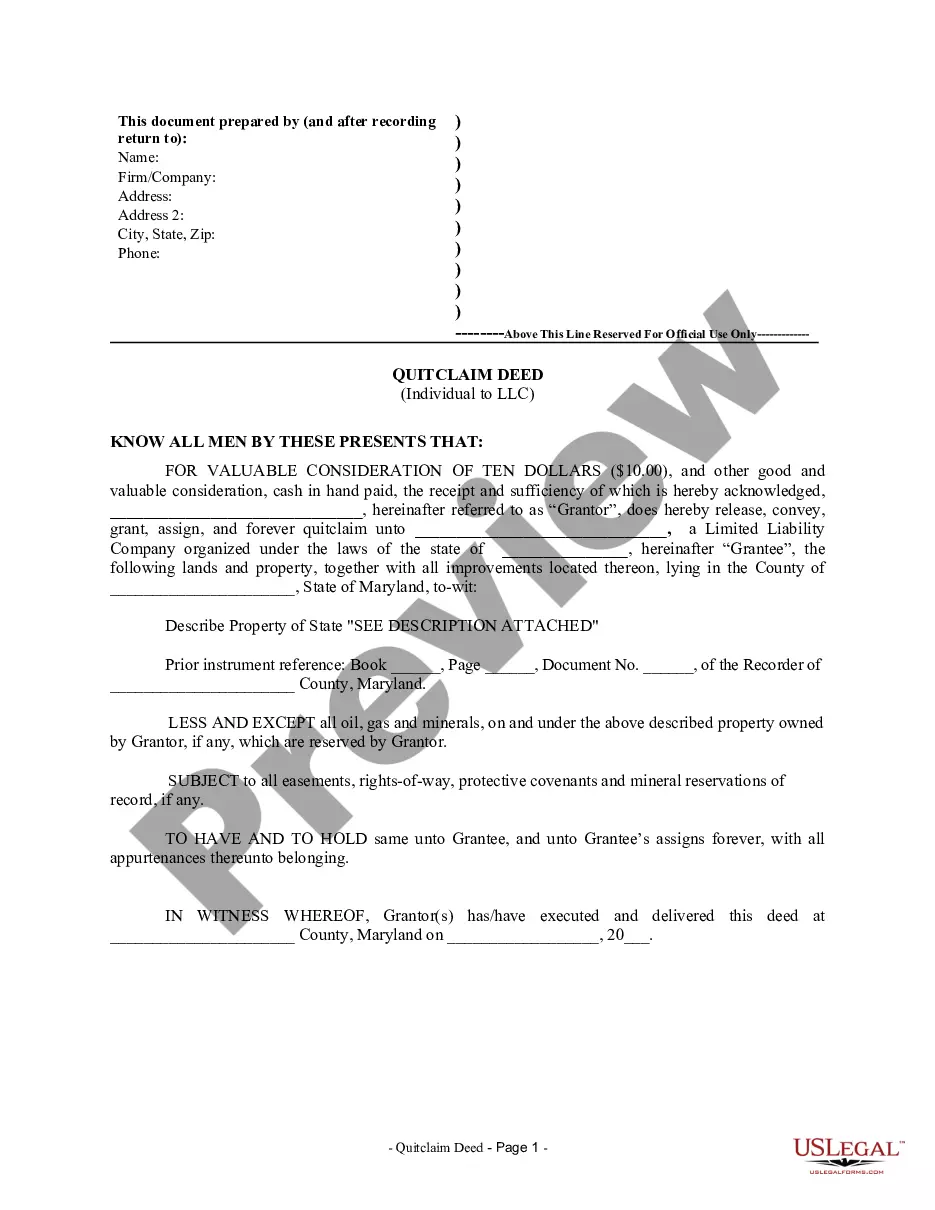

Maryland Quitclaim Deed from Individual to LLC

Description

How to fill out Maryland Quitclaim Deed From Individual To LLC?

You are invited to the most extensive legal documents repository, US Legal Forms.

Here, you can obtain any example including Maryland Quitclaim Deed from Individual to LLC templates and save them (as many as you wish/require).

Prepare official documents in mere hours, rather than days or weeks, without needing to pay a fortune to an attorney.

If the document meets all your requirements, click Buy Now. To create an account, select a pricing plan. Register using a card or PayPal account. Download the file in your desired format (Word or PDF). Print the document and complete it with your/your business’s details. Once you’ve filled out the Maryland Quitclaim Deed from Individual to LLC, present it to your attorney for validation. This additional step is important to ensure you are fully protected. Join US Legal Forms today and gain access to numerous reusable templates.

- Acquire the state-specific template with just a few clicks and feel confident knowing it was created by our state-licensed legal experts.

- If you are already a subscribed client, just sign in to your account and select Download next to the Maryland Quitclaim Deed from Individual to LLC that you need.

- Since US Legal Forms operates online, you’ll always have access to your downloaded documents, regardless of the device you’re using.

- Locate them within the My documents section.

- If you don’t have an account yet, what are you waiting for.

- Follow our instructions below to get started.

- If this is a state-specific template, verify its relevance in your state.

- Examine the description (if available) to determine if it’s the correct template.

Form popularity

FAQ

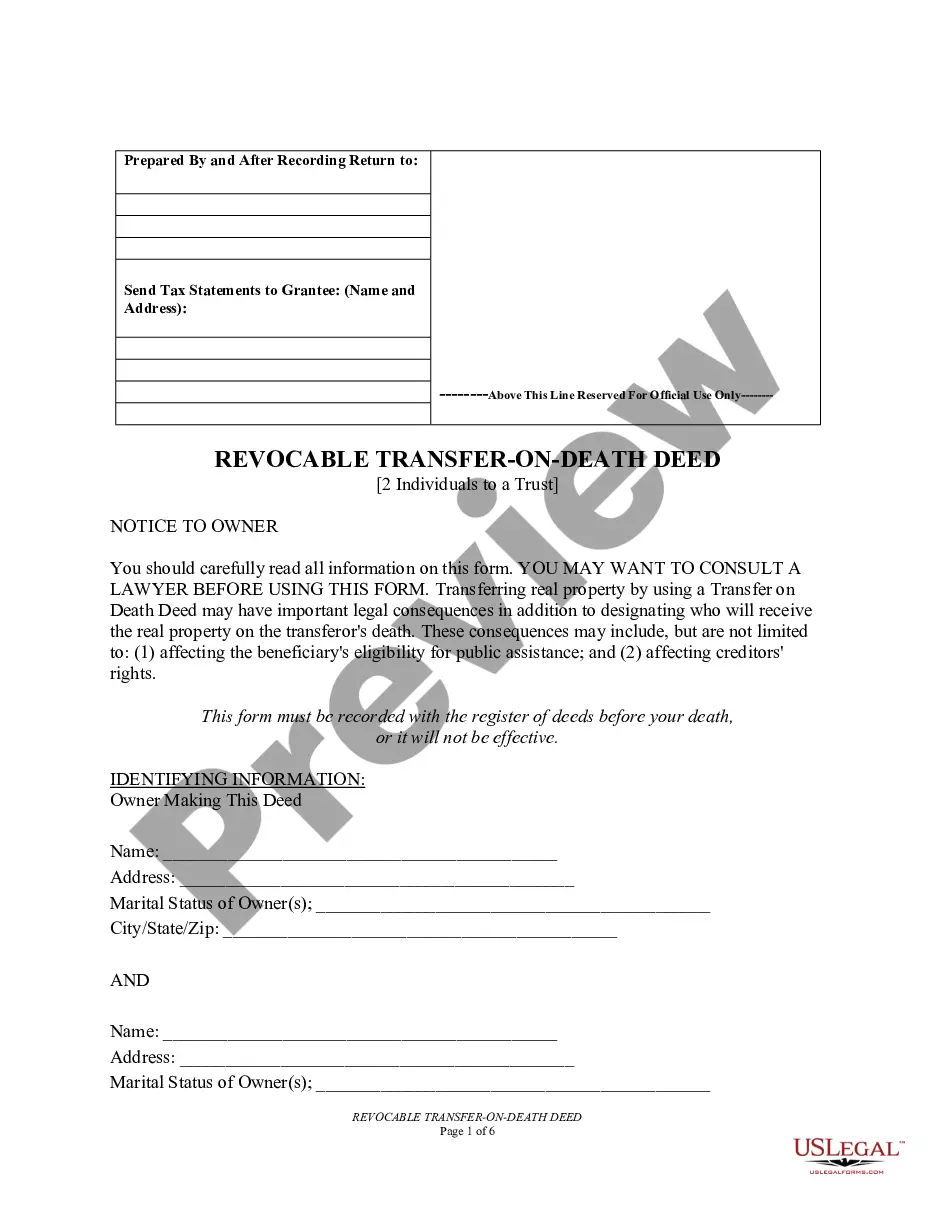

They are commonly used to add/remove someone to/from real estate title or deed (divorce, name changes, family and trust transfers). The quitclaim deed is a legal document (deed) used to transfer interest in real estate from one person or entity (grantor) to another (grantee).

When done properly, a deed is recorded anywhere from two weeks to three months after closing. However, there are many instances where deeds are not properly recorded. Title agents commit errors, lose deeds, and even go out of business. Even county offices sometimes fail to record deeds that were properly submitted.

Instead of transferring assets as a capital contribution, you can also sell assets directly to your LLC. The most significant difference between a contribution and a sale is that the sale creates no equity in the company.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Does LLC ownership count as time used as a primary residence? For a single-member LLC, the answer is typically yes. For example, if the house is owned by an LLC. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

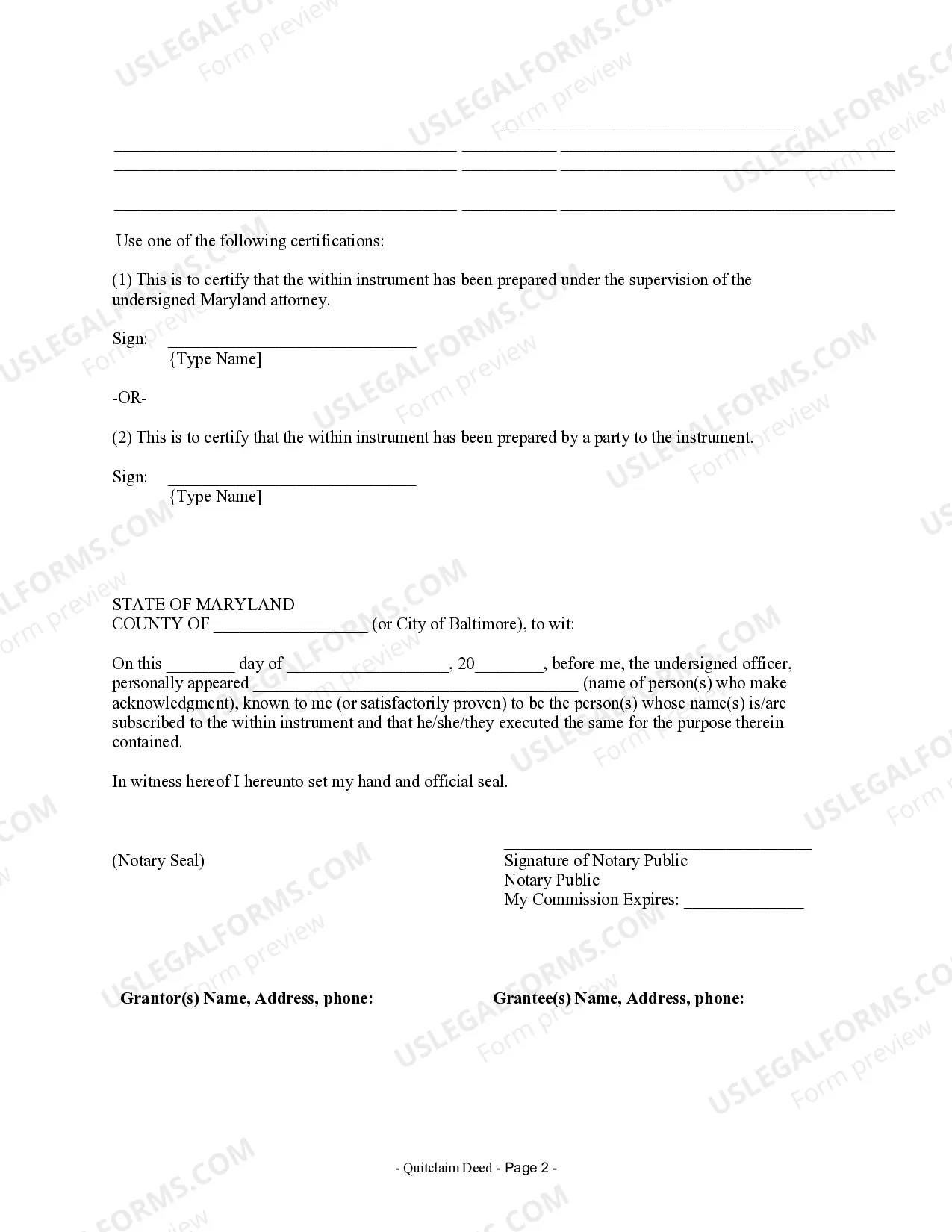

Documents: To submit the quitclaim deed to the Clerk of the Circuit Court, you must have a Land Intake Sheet with the deed. Filing: Quitclaim deeds in Maryland are filed with the Clerk of the Circuit Court in the county where the property is located. Each county has its own filing fee.

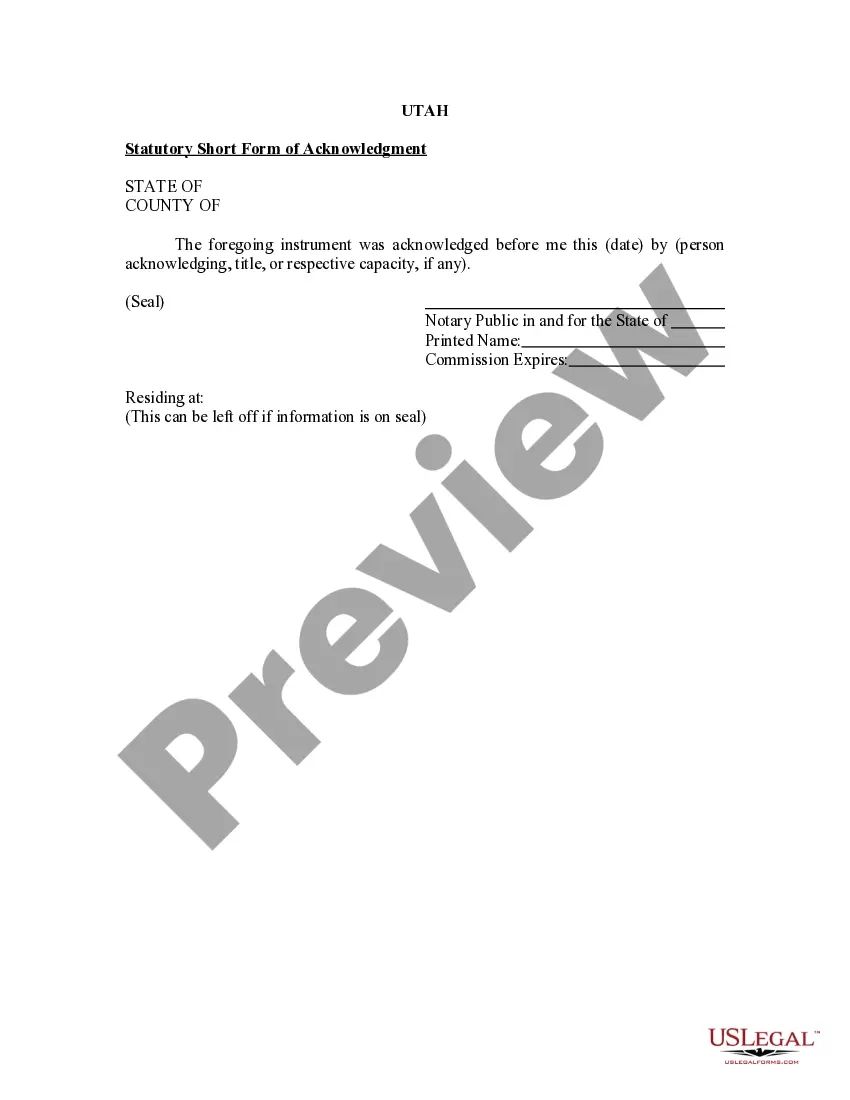

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.