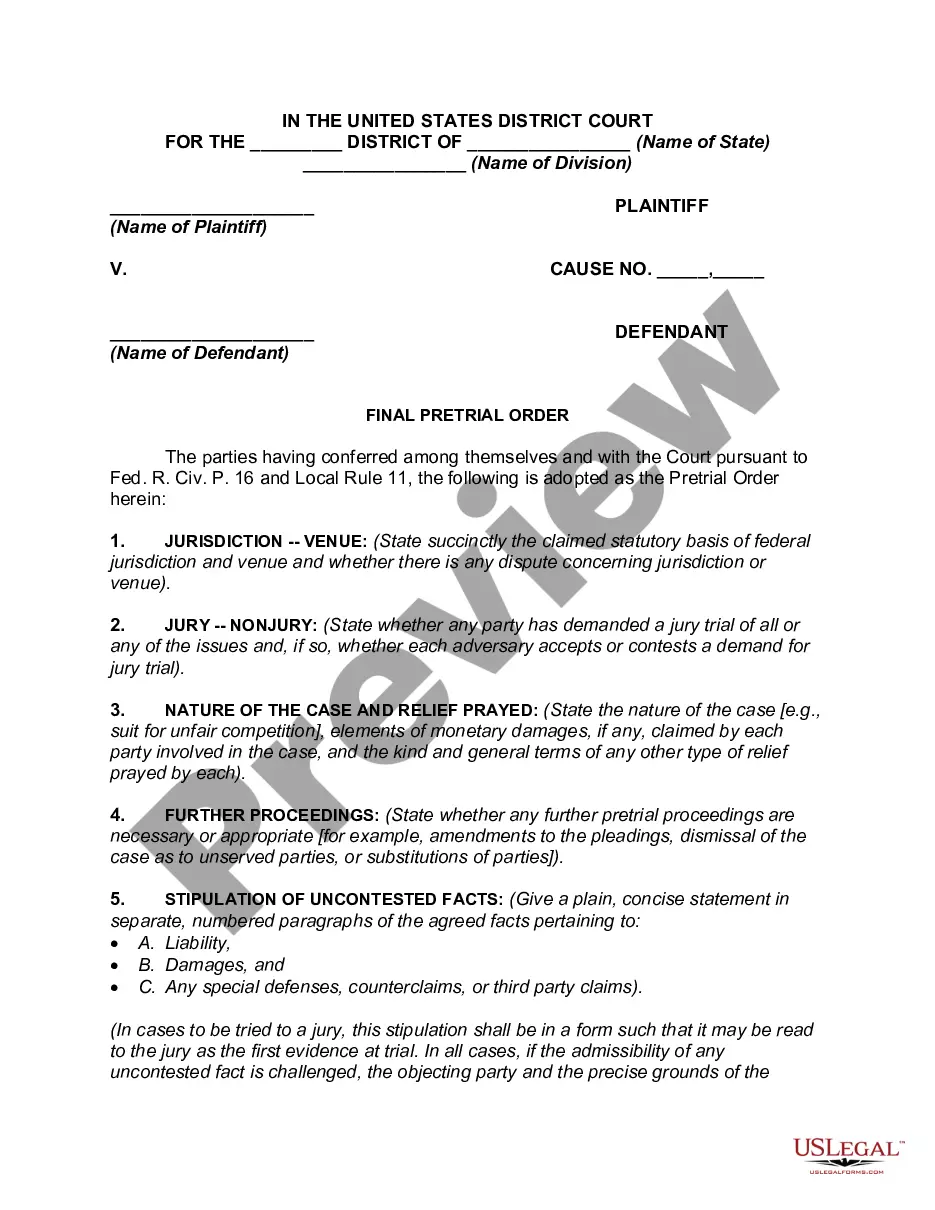

Validate Debt Owed With Interest

Description

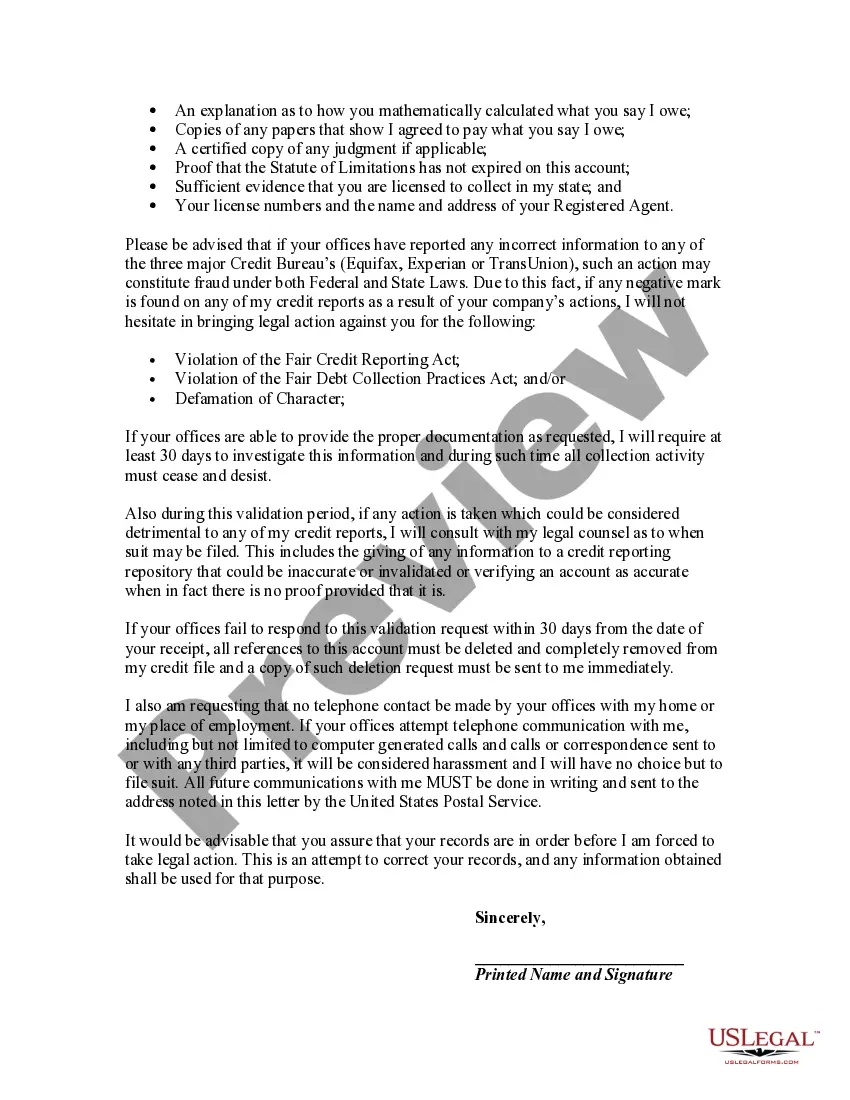

How to fill out Letter Requesting A Collection Agency To Validate A Debt That You Allegedly Owe A Creditor?

Acquiring legal documents that adhere to federal and regional regulations is a necessity, and the internet provides numerous choices available.

However, what is the use of squandering time searching for the appropriate Validate Debt Owed With Interest template online when the US Legal Forms digital library already hosts such documents consolidated in one location.

US Legal Forms is the most extensive online legal repository comprising over 85,000 editable templates crafted by attorneys for any professional or personal situation. They are easy to navigate with all documents categorized by state and intended use. Our specialists stay updated with legislative modifications, ensuring your documents are current and compliant when securing a Validate Debt Owed With Interest from our portal.

- If you possess an account with an active subscription, Log In and download the document sample you need in your preferred format.

- If you are new to our platform, follow these steps.

- Review the template using the Preview option or via the text description to ensure it meets your requirements.

- If necessary, find another sample using the search feature located at the top of the page.

- Click Buy Now once you've identified the correct form and choose a subscription plan.

Form popularity

FAQ

You'll need to collect sales tax in South Dakota if you have nexus there. There are two ways that sellers can be tied to a state when it comes to nexus: physical or economic. Physical nexus means having enough tangible presence or activity in a state to merit paying sales tax in that state.

To be considered a nexus, a business must have ?sufficient presence? in the state and be ?engaged in business? in the state. The requirement of sufficient presence is satisfied by the brief physical presence of someone at a trade show to something more permanent, such as a warehouse.

Prior to the bill's enactment, South Dakota's economic nexus threshold was gross revenue of $100,000 or 200 or more separate transactions in the previous or current calendar year. The economic nexus threshold will now be gross revenue of $100,000 in the previous or current calendar year, effective July 1, 2023.

Like many states with no income tax, South Dakota rakes in revenue through other forms of taxation, including taxes on cigarettes and alcohol.18 The home of the Lakota Sioux and the Black Hills has one of the highest sales tax rates in the country and above-average property tax rates.51920 South Dakota's position as ...

In South Dakota, the standard parenting guidelines will set out the custody arrangement to be followed by the parents. You can object to the standard guidelines and the judge will order a hearing within thirty days.

If you are conducting business in South Dakota you need a license even if you do not have a physical location. If you have nexus then all your sales in South Dakota are taxable (including online and catalog sales) and you must be licensed with the Department of Revenue.

What is economic nexus? The term economic nexus refers to a business presence in a US state that makes an out-of-state seller liable to collect sales tax there once a set level of transactions or sales activity is met.

A limited liability company (LLC) offers liability protection and tax advantages, among other benefits for small businesses. LLC formation in South Dakota is easy.