Irrevocable Trust Template With Formulas

Description

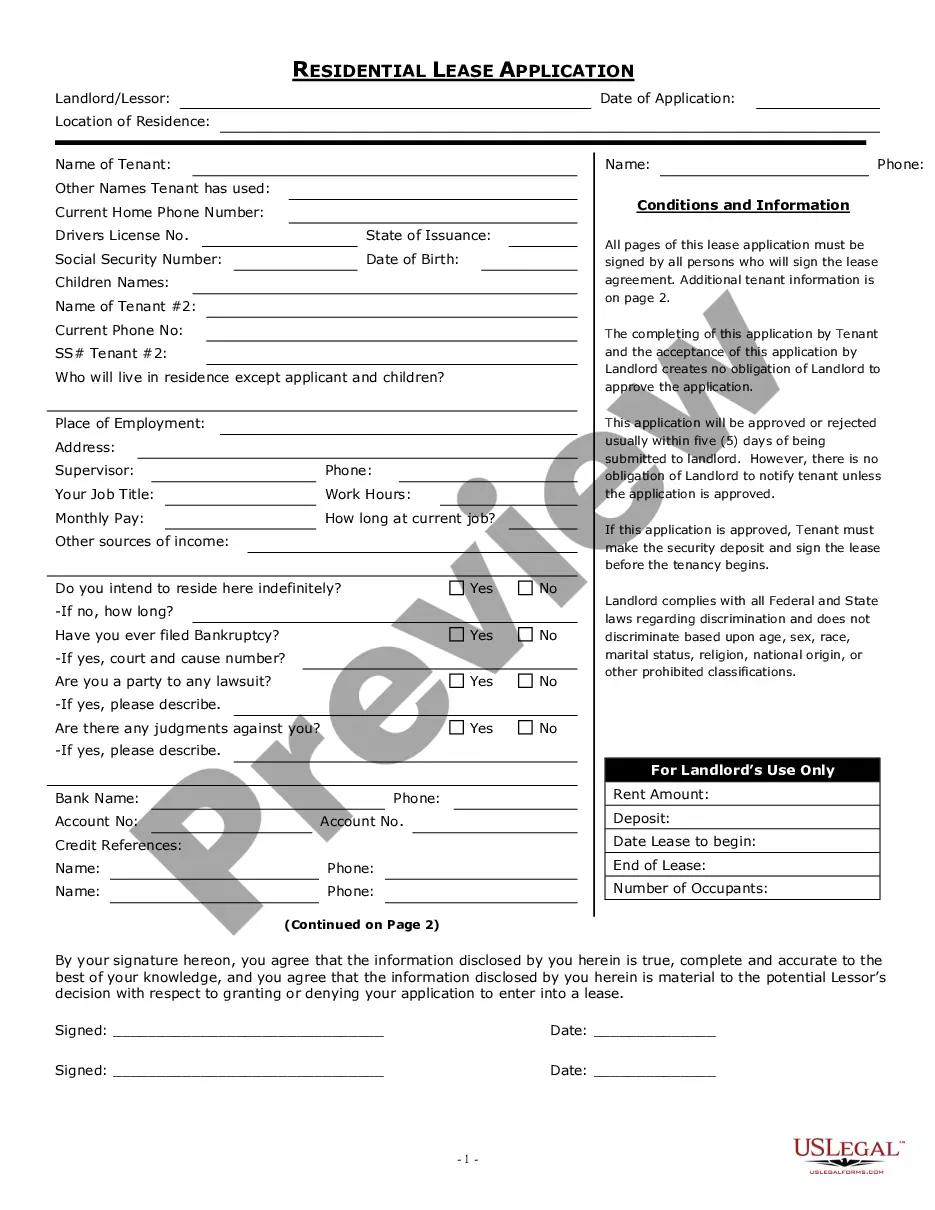

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active; if not, renew it based on your payment plan.

- For first-time users, begin by examining the Preview mode and description of the irrevocable trust template. Ensure it fulfills your specific legal needs and conforms with local regulations.

- If necessary, utilize the Search tab to locate a more suitable template. Ensure that it aligns with your requirements before proceeding.

- Make a purchase by clicking the Buy Now button. Select your preferred subscription plan and create an account to access the forms library.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Download your chosen template directly to your device and store it in the My Forms section of your profile for future access.

By using US Legal Forms, you gain access to a vast collection of legal forms—over 85,000 in total—far surpassing competitors' offerings at a similar cost. This platform not only provides templates but also connects you with premium experts to ensure your documents are both accurate and legally binding.

Start your legal journey today with US Legal Forms and experience the ease of creating essential documents. Don’t hesitate—visit the website to get started!

Form popularity

FAQ

Yes, you can set up an irrevocable trust on your own, but it may require careful consideration and planning. An irrevocable trust template with formulas provides a structured approach that can assist you in navigating the setup process. While you can handle this independently, consulting with legal experts can provide further clarity and help avoid potential pitfalls. Resources like uSlegalforms can offer valuable templates and insights tailored to your needs.

One notable downside of an irrevocable trust is the loss of control over the assets once the trust is established. Unlike revocable trusts, you cannot modify or revoke this type of trust easily. Additionally, transferring assets to an irrevocable trust may have tax implications that you should consider. Using an irrevocable trust template with formulas can help outline these factors, guiding you through the potential drawbacks.

Creating an irrevocable trust yourself is possible, especially if you have a clear understanding of the requirements involved. However, using an irrevocable trust template with formulas can simplify the process and ensure you meet all legal standards. It helps to have a solid framework to work from, reducing the risk of mistakes. If you seek guidance or support, consider visiting uSlegalforms as a resource to assist you.

The structure of an irrevocable trust generally includes a grantor, trustee, and beneficiaries. The grantor creates the trust and transfers assets into it, while the trustee manages those assets according to the trust's terms. An irrevocable trust template with formulas often outlines these roles, ensuring clarity in how the trust functions. This structure protects assets from creditors and may provide tax benefits, making it an essential estate planning tool.

To fill out an irrevocable trust, start by gathering the necessary information about the grantor, beneficiaries, and assets. Use an irrevocable trust template with formulas, which provides clear fields to input data accurately. Ensure that you describe each asset clearly and specify how you want them distributed. Lastly, review the completed document for any errors and consult a legal professional to finalize it.

Yes, you can create an irrevocable trust without an attorney by using an irrevocable trust template with formulas. This template can guide you in drafting a legal document that meets your needs while ensuring you understand each component. However, while this approach can save costs, seeking professional help can provide peace of mind and ensure compliance with legal standards. Evaluate your comfort level when deciding.

Writing an irrevocable trust document starts with defining the grantor, trustee, and beneficiaries clearly. Use an irrevocable trust template with formulas to assist in organizing your thoughts and structure. Include details about the trust's assets, management, and distribution to beneficiaries. Double-check that you abide by state-specific regulations to enhance the document's validity.

To write your own irrevocable trust, start by gathering necessary information about your assets and beneficiaries. Follow an irrevocable trust template with formulas to draft the document, addressing all the required sections, such as trust purpose and asset distribution. Ensure your trust complies with state laws, and consider having it reviewed for accuracy. Taking these steps will lead to a well-structured trust.

One of the biggest mistakes parents make is not clearly outlining their intentions and expectations. They may fail to communicate how they want the trust to be utilized, leading to misunderstandings among beneficiaries. Utilizing an irrevocable trust template with formulas ensures that you can specify the terms clearly. Transparency can foster family harmony and understanding.

Avoid placing assets that you wish to retain control over in an irrevocable trust, such as your primary residence. Additionally, you should refrain from including personal property that you may need access to later. Using an irrevocable trust template with formulas helps clarify what types of assets are appropriate for inclusion. Carefully evaluate your assets before making decisions.