What is Deed?

Deeds are legal documents that transfer ownership of real estate. They are used during sales, gifts, or inheritance. Explore our state-specific templates for your needs.

Deeds are essential documents for transferring property ownership. Attorney-drafted templates are simple and quick to complete.

Access everything needed for an owner-financed real estate transaction with a collection of essential legal forms.

Get everything needed for mortgage satisfaction and release in one convenient package of related legal forms.

Access everything needed for an owner-financed real estate transaction with a collection of essential legal forms.

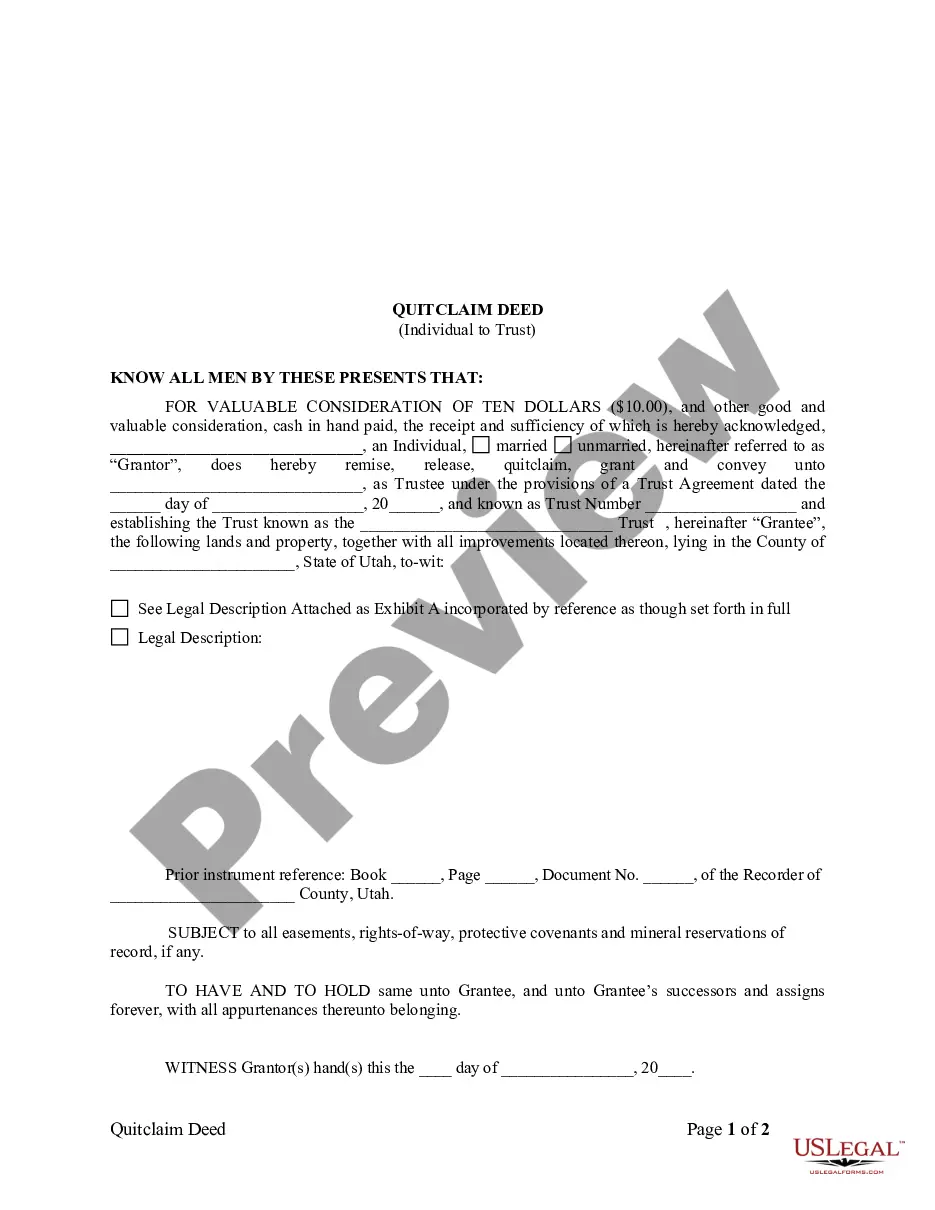

Transfer property ownership from an individual to a trust efficiently, ensuring future control and management of the asset.

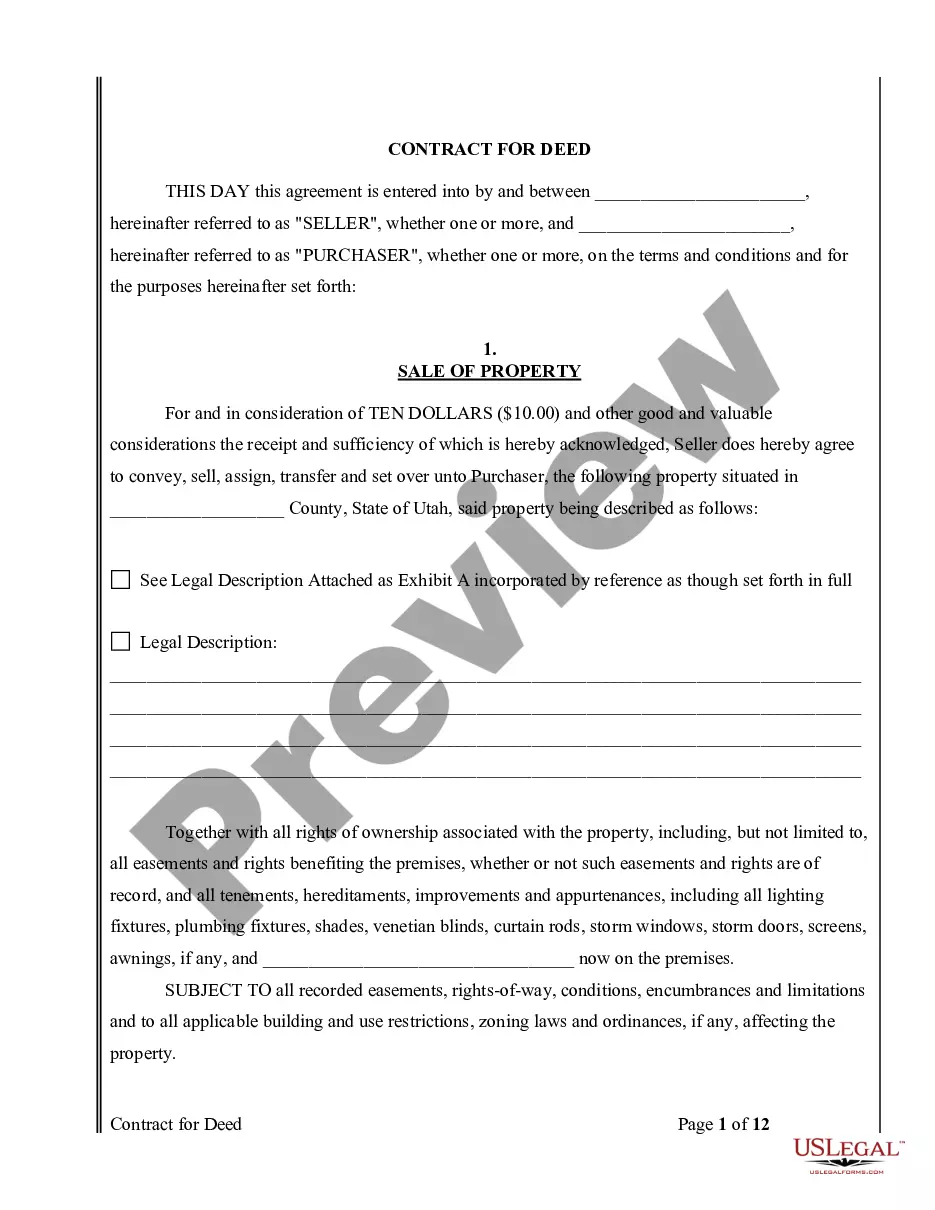

Ideal for buyers and sellers, this agreement facilitates a sale with payment terms over time, securing the transaction without immediate full payment.

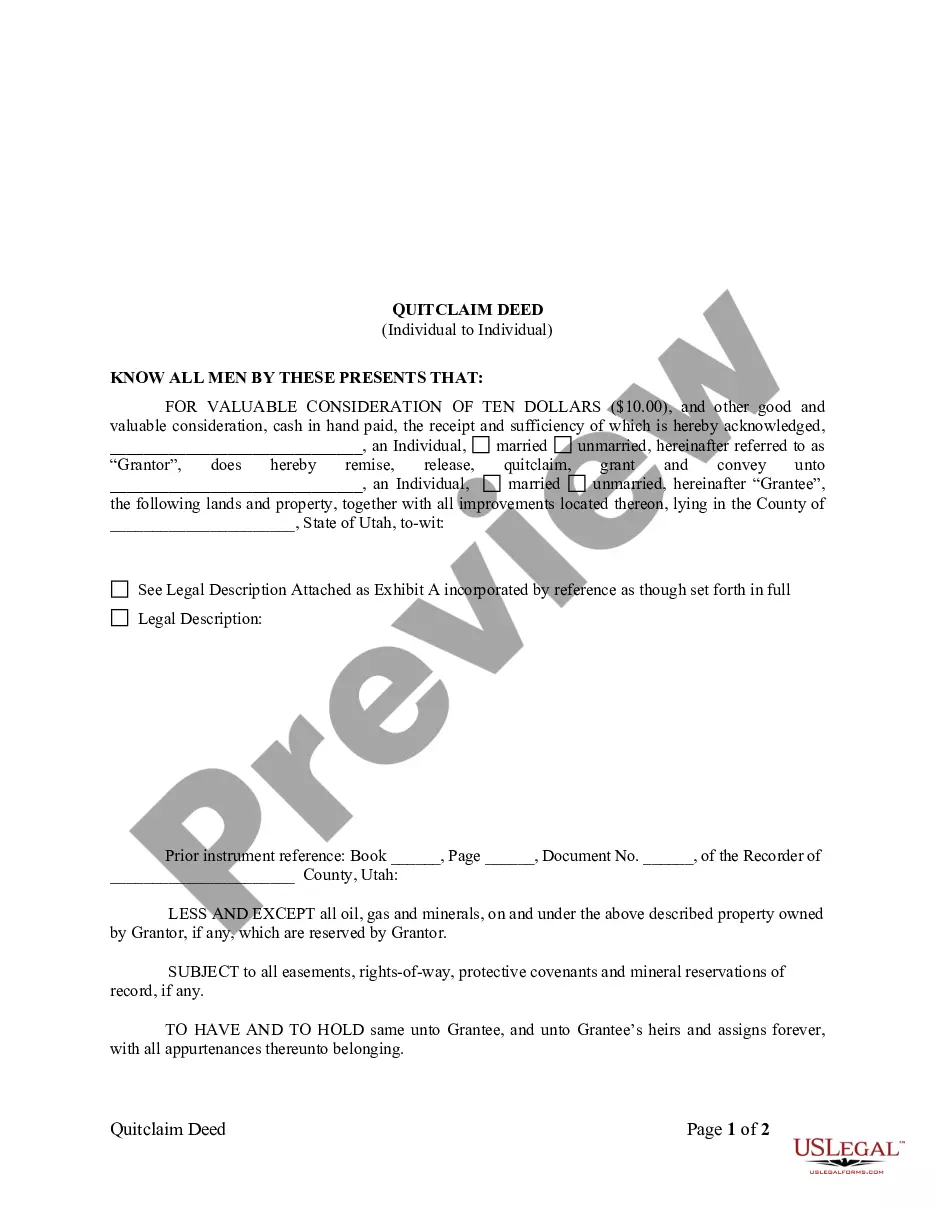

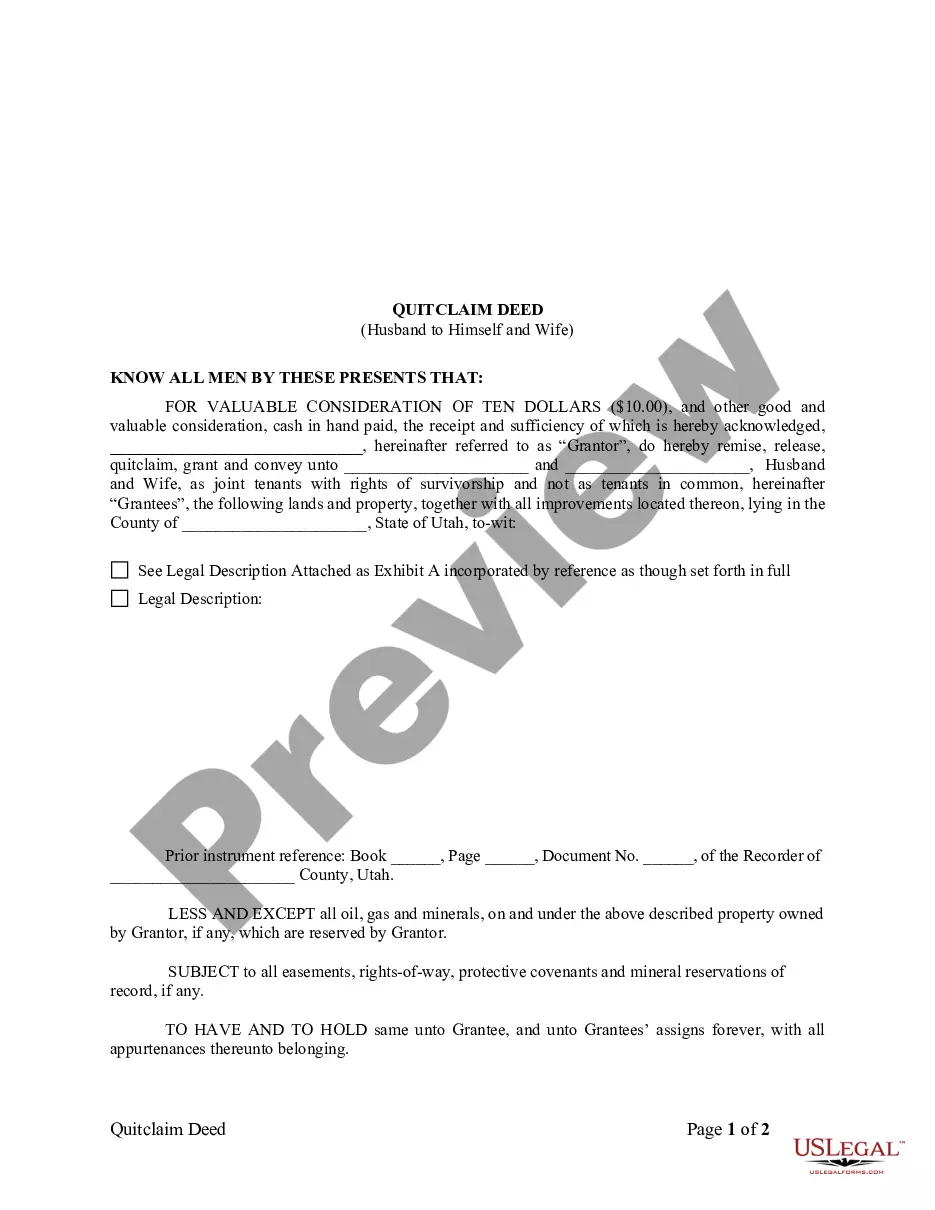

Transfer property rights easily with this form, which allows individuals to relinquish their claim to a property without warranties.

Transfer property from a trust to a married couple, detailing ownership type for legal clarity.

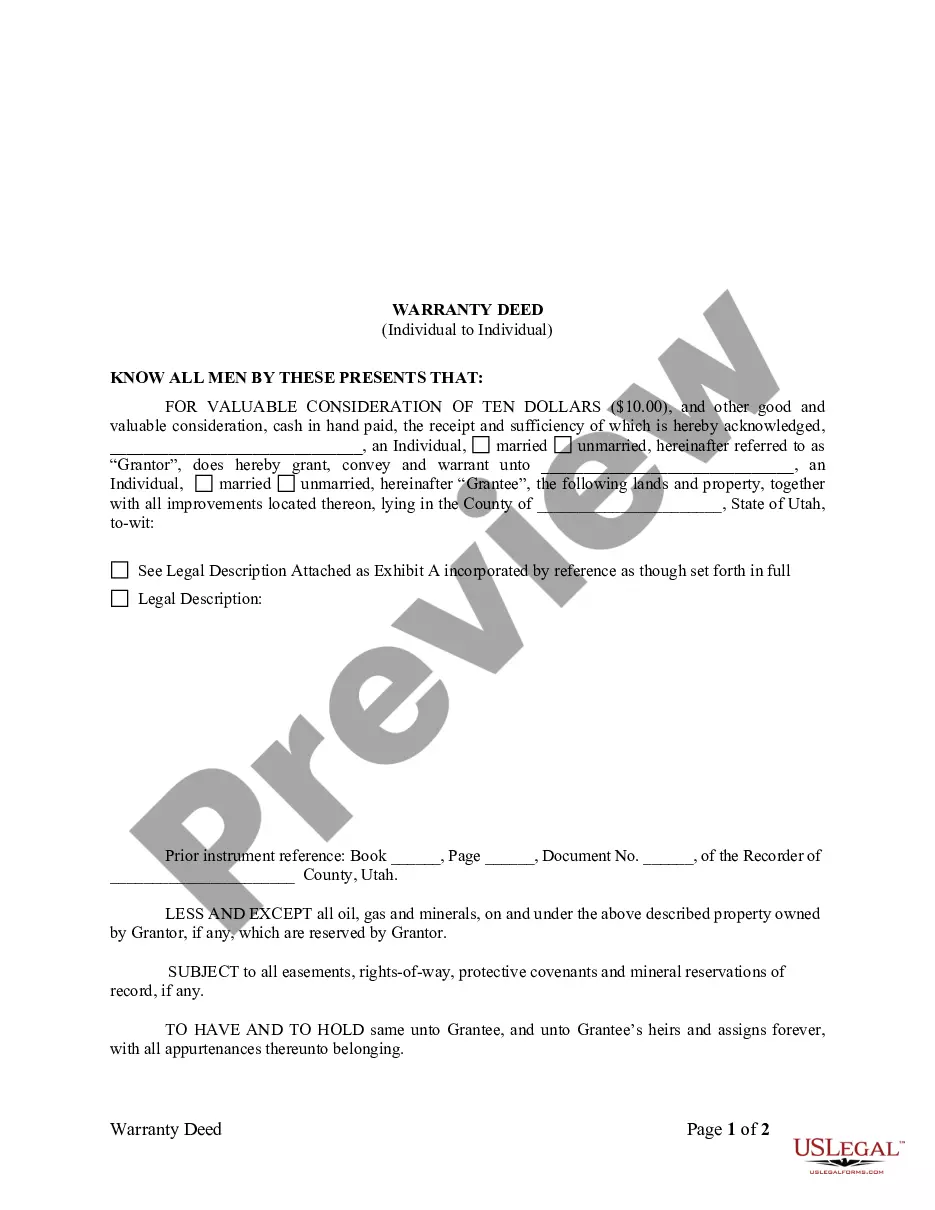

Securely transfer property ownership between individuals, ensuring clear title and legal protection against future claims.

Transfer property ownership from one spouse to both spouses, ensuring joint tenancy and survivorship rights.

Use this legal document to transfer property ownership from a limited liability company to a trust, ensuring clarity and protection in asset transfers.

Transfer property to a child while retaining a life estate, ensuring you maintain rights until you're no longer able.

Transfer property from a corporation to an individual, ensuring ownership rights and legal protection.

Deeds are critical for establishing ownership of real property.

Most deeds require notarization to be legally effective.

Different types of deeds serve various purposes and levels of protection.

Deeds must be recorded to protect against future claims.

Transferring property through a deed can have tax implications.

Begin your process easily with these steps.

A trust can help manage assets during your lifetime and avoid probate.

Failing to plan can lead to complications in asset distribution.

Review your estate plan regularly, especially after major life events.

Beneficiary designations can supersede your will, so keep them updated.

Yes, you can designate different agents for financial and health matters.