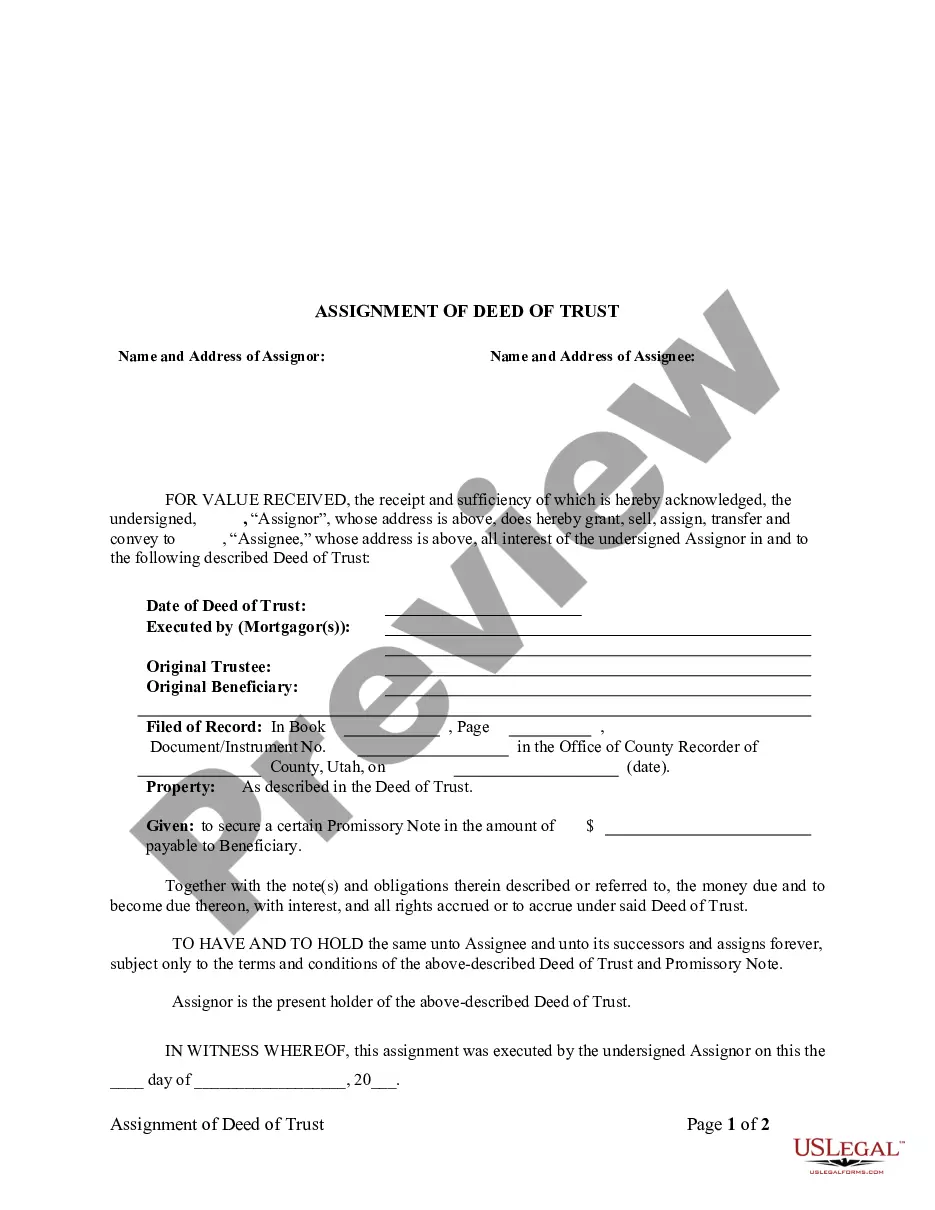

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Utah Assignment of Deed of Trust by Individual Mortgage Holder

Description

How to fill out Utah Assignment Of Deed Of Trust By Individual Mortgage Holder?

Searching for a Utah Assignment of Deed of Trust by Individual Mortgage Holder online might be stressful. All too often, you find files that you just think are alright to use, but find out afterwards they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional legal professionals according to state requirements. Have any document you’re searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be added to the My Forms section. If you don’t have an account, you should register and pick a subscription plan first.

Follow the step-by-step recommendations listed below to download Utah Assignment of Deed of Trust by Individual Mortgage Holder from our website:

- See the document description and hit Preview (if available) to check whether the template meets your requirements or not.

- In case the document is not what you need, find others with the help of Search engine or the provided recommendations.

- If it is appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Get access to 85,000 legal forms from our US Legal Forms library. Besides professionally drafted templates, users may also be supported with step-by-step instructions concerning how to find, download, and complete templates.

Form popularity

FAQ

You may be able to transfer your interest in the property through a quitclaim deed, where you relinquish all ownership of the property to someone else. Your lender may also agree to add another name to the mortgage. In this case, someone else would be able to legally make payments on the mortgage.

An assignment of trust deed is a document that lenders use when they sell loans secured by trust deeds. While they can freely sell the promissory notes between themselves, the trust deeds that give them the right to foreclose have to be assigned with a legal document.

No law forbids adding someone to your mortgaged home's deed or in signing your home over to others through one. Mortgage lenders understand deeds, though, and use loan due-on-sale clauses to prevent unauthorized property sales or transfers.

The law doesn't forbid adding people to a deed on a home with an outstanding mortgage. Mortgage lenders are familiar and frequently work with deed changes and transfers.When you "deed" your home to someone, you've effectively transferred part ownership, which could activate the "due-on-sale" clause.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

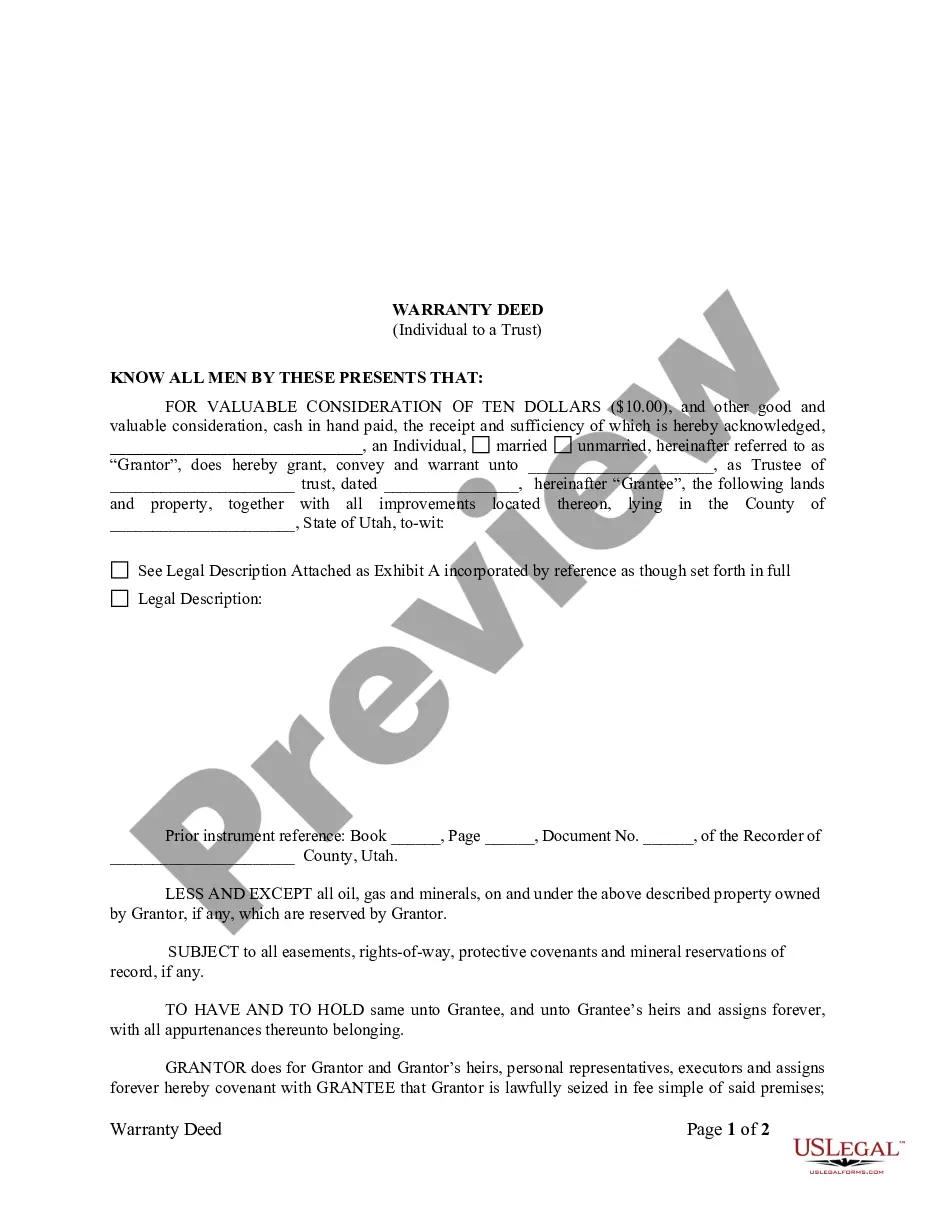

They serve different purposes and are signed by different parties. The warranty deed transfers the property's ownership from the current owner to the new buyer, while the deed of trust ensures the lender has interest in the property in the event a buyer defaults on the loan.

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,

If you or another party to the deed of trust already own the property and you enter into a deed of trust to regulate an arrangement there is usually no reason to inform your mortgage lender.Therefore the mortgage company's position is secure and they need not be concerned with a deed of trust.