What is Deed?

Deeds are legal instruments used to transfer ownership of property. They are commonly utilized during real estate transactions. Explore our templates tailored for Indiana.

Deeds are essential legal documents for property transactions in Indiana. Attorney-drafted templates are efficient and easy to fill out.

Gather all necessary documents for owner-financed real estate transactions in one convenient package.

Gather all necessary documents for owner-financed real estate transactions in one convenient package.

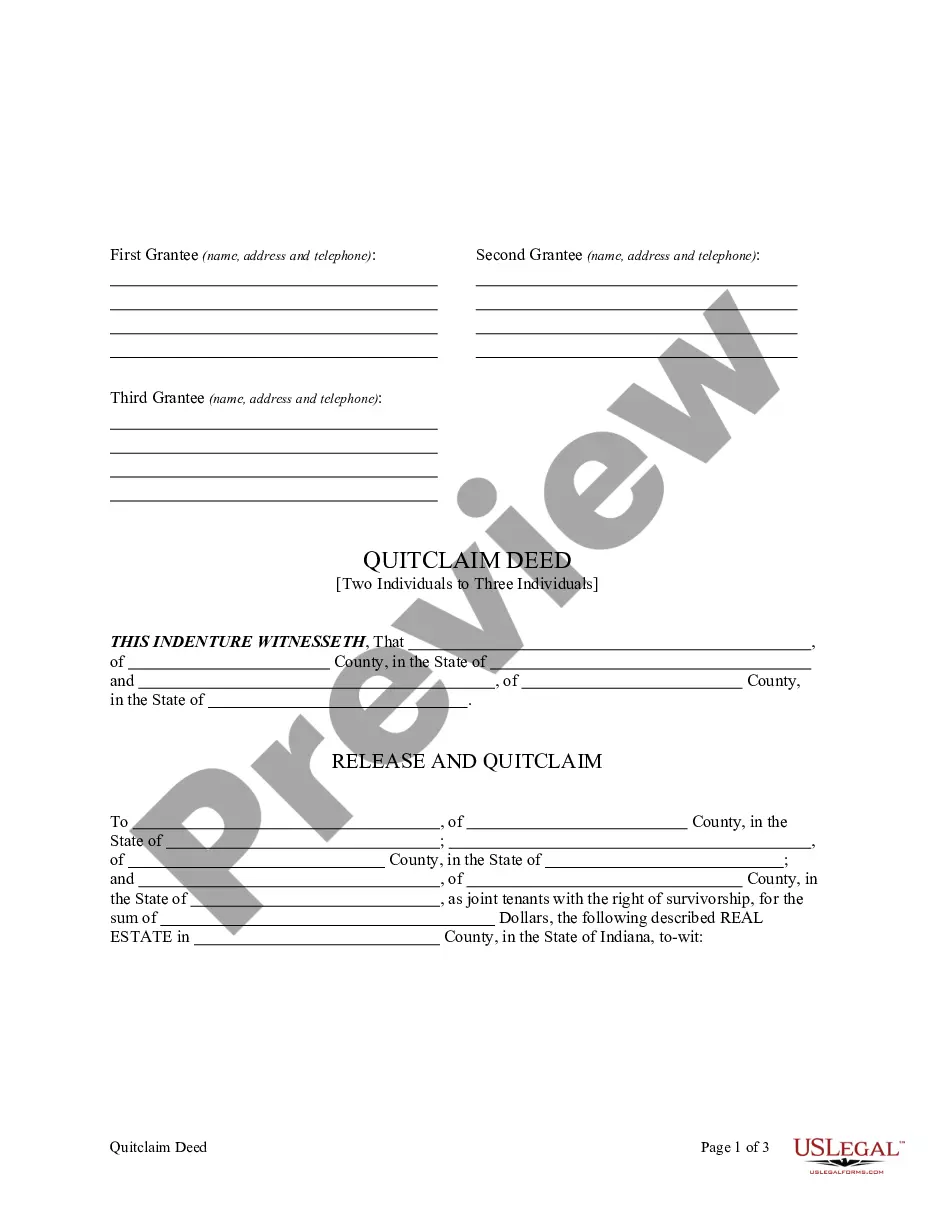

Transfer ownership of property from two individuals to three. Ideal for adjusting property interests among family members or business partners.

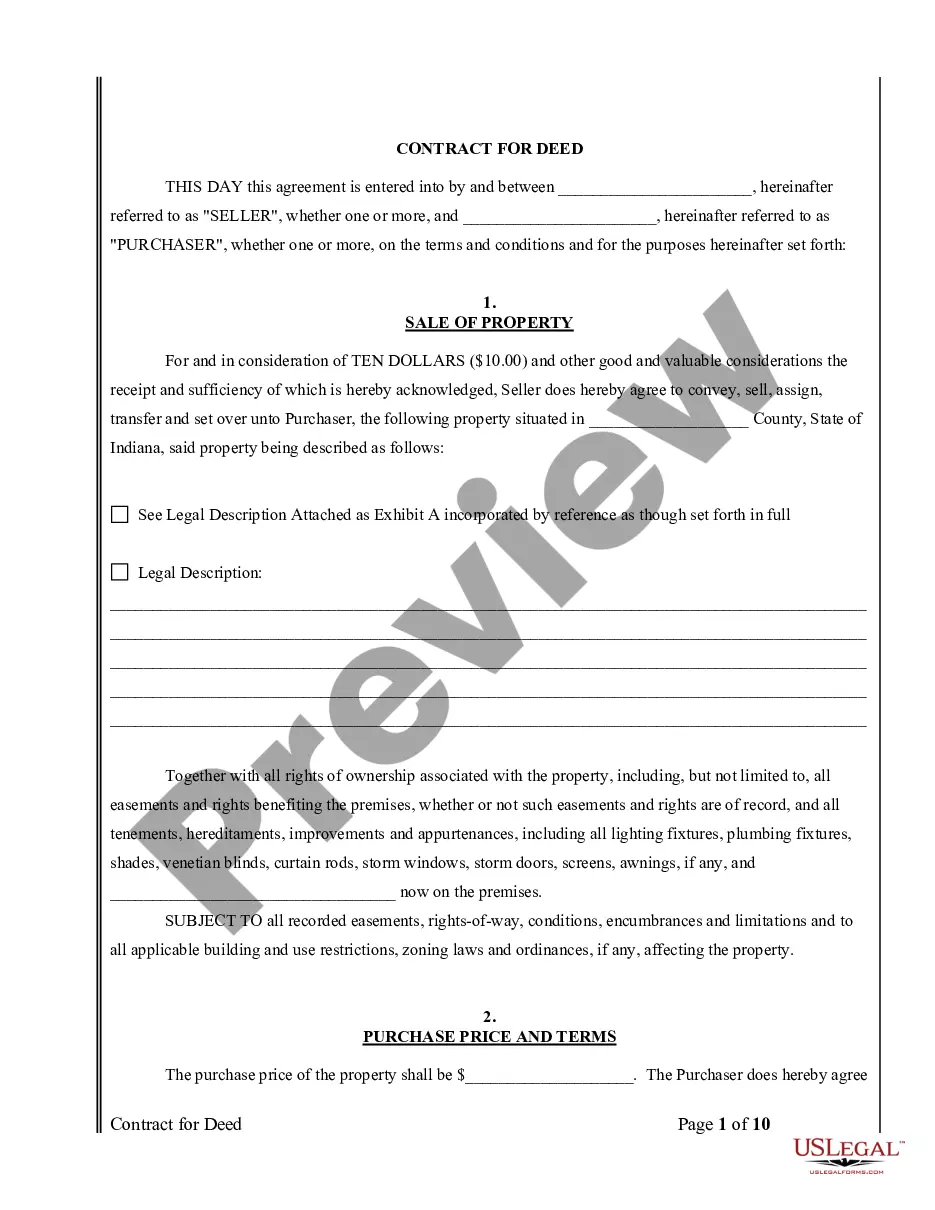

Secure a property sale with flexible payment terms for buyers and sellers, especially useful when traditional financing isn't ideal.

Easily transfer property ownership between individuals, ensuring that rights are clear and documented.

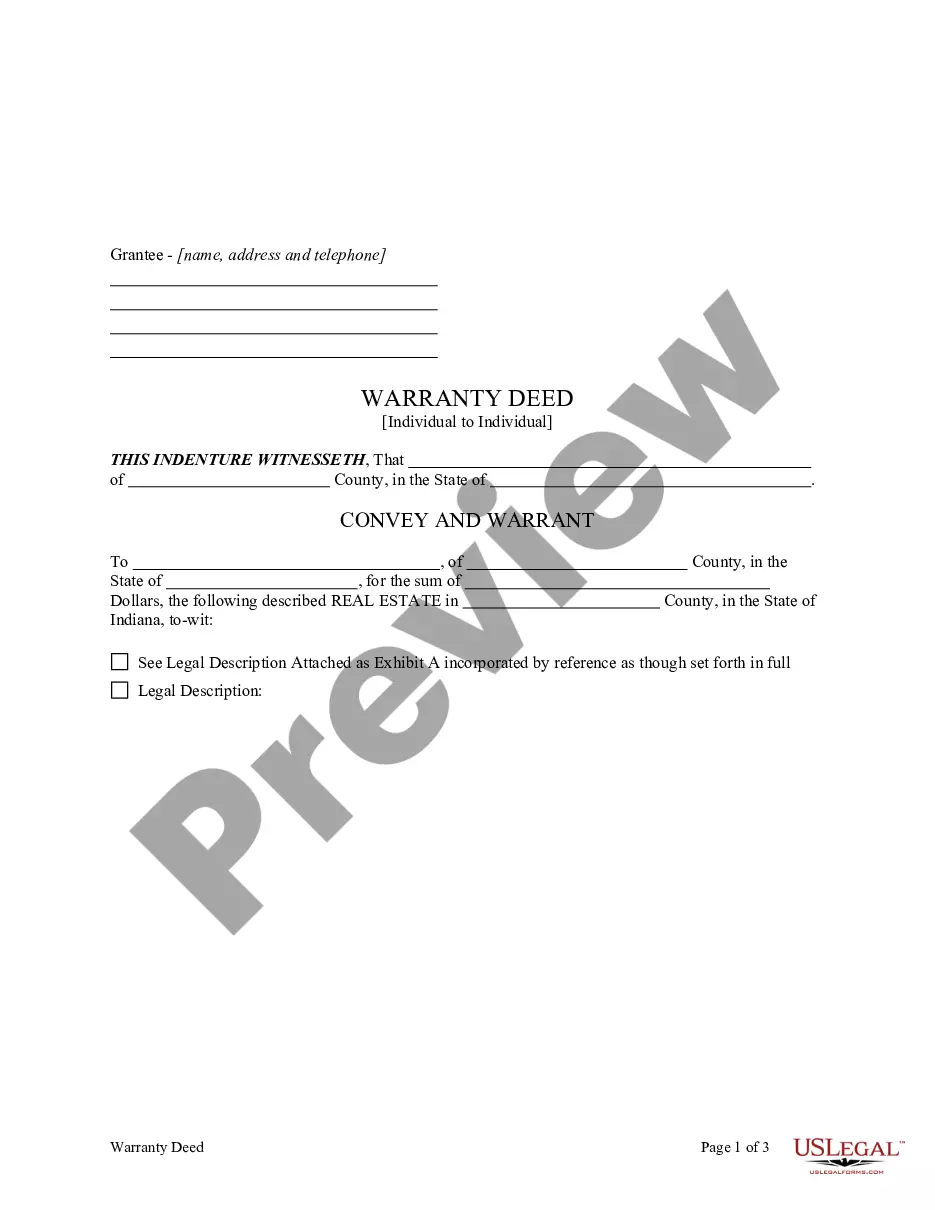

Transfer your property ownership smoothly and securely between individuals with this essential legal document.

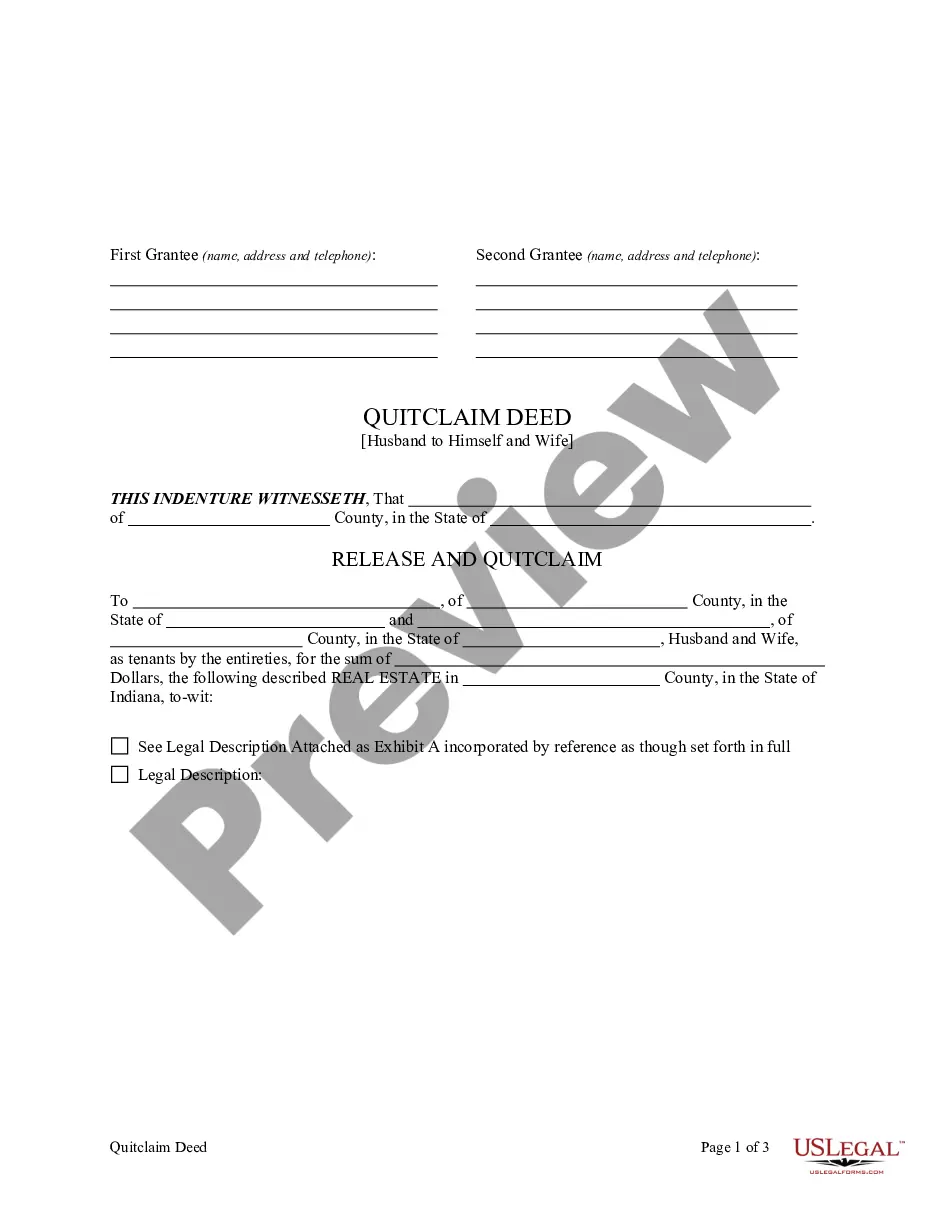

Transfer property ownership between partners, allowing clear title and rights. Useful in divorce or joint ownership situations.

Transfer property ownership to a beneficiary upon death without going through probate, ensuring a smooth transition of assets.

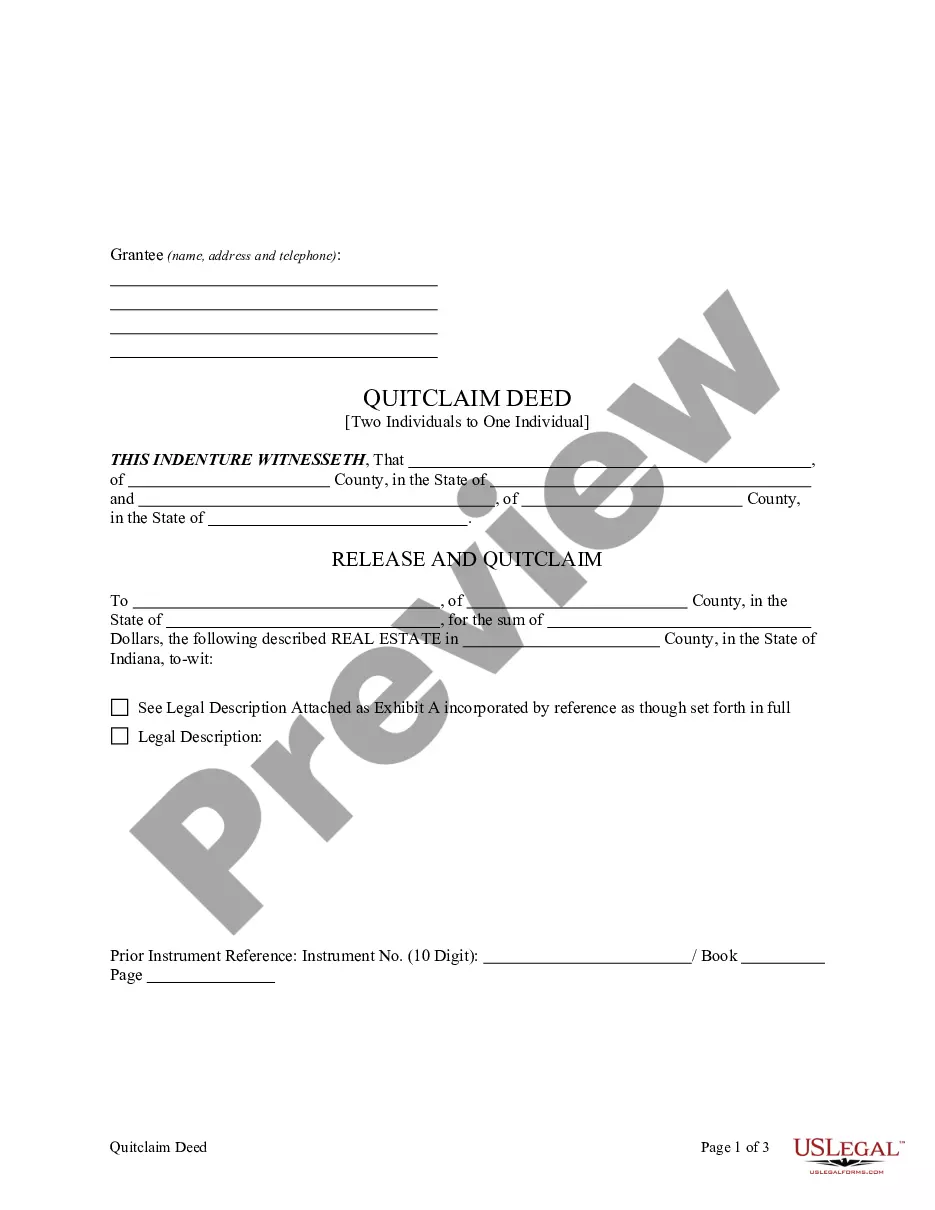

Transfer property rights from two owners to a single individual, ensuring clarity in ownership and simplifying future transactions.

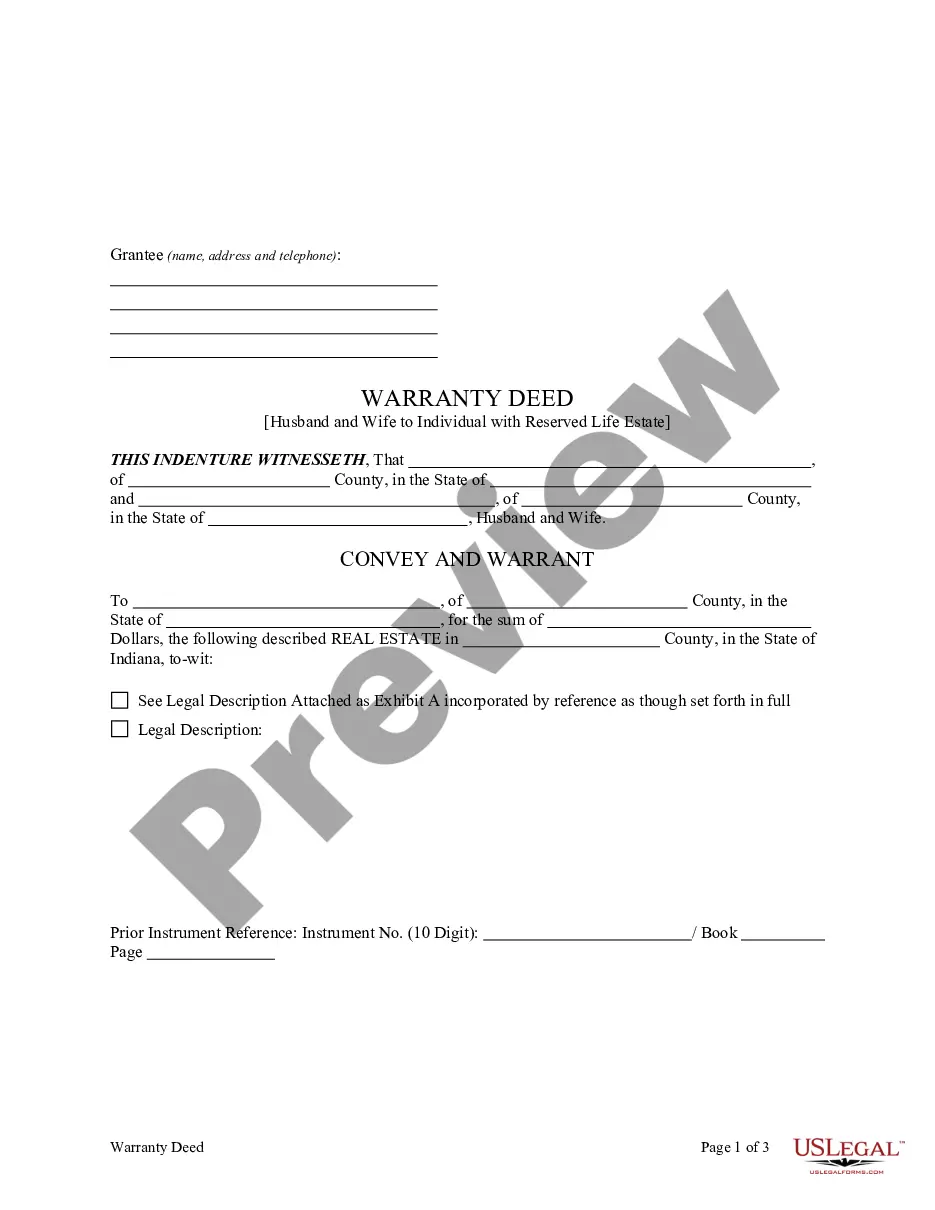

Easily transfer property to a child while retaining the right to live there, ensuring your family home stays in the family for future generations.

Transfer property ownership to a family limited partnership with this essential legal document, ensuring proper legal structure and asset protection.

Many deeds must be notarized or witnessed.

Deeds typically include a legal description of the property.

The type of deed affects the rights transferred.

Property can be transferred through various deed types.

Not all deeds guarantee clear title.

Deeds can involve complex legal terms.

Reviewing the deed is crucial before signing.

Begin in moments with these simple steps.

Do I need a trust if I have a will?

What happens if I do nothing?

How often should I update my plan?

How do beneficiary designations interact with my plan?

Can different people handle finances and health decisions?