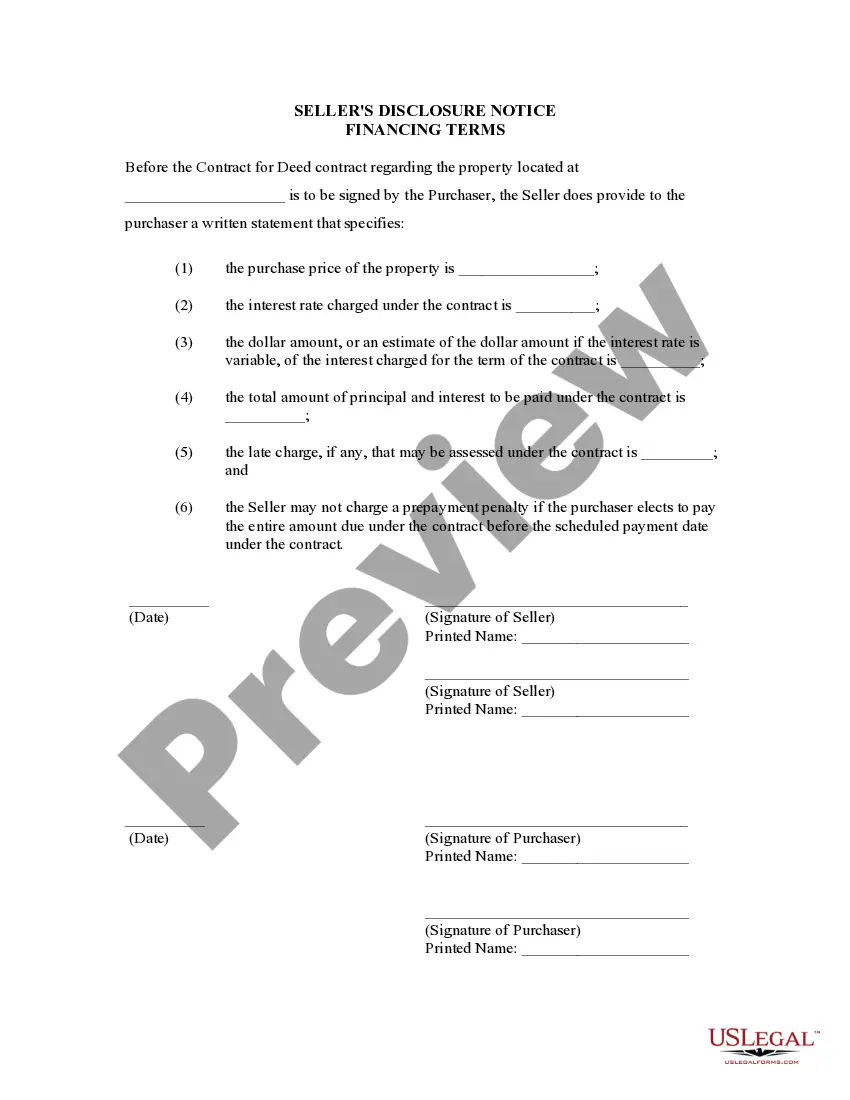

This document serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. It should be completed by Seller of property and provided to Purchaser at or before the signing of the contract for deed.

Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Indiana Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Utilize US Legal Forms to obtain a downloadable Indiana Seller's Disclosure of Financing Terms for Residential Property associated with a Contract or Agreement for Deed also known as a Land Contract.

Our legally acceptable forms are created and consistently updated by experienced attorneys.

We possess the most extensive library of forms available online, providing affordable and precise samples for consumers, lawyers, and small to medium-sized businesses.

Examine the document by reviewing the description and using the Preview option. Click Buy Now if you require that template. Set up your account and make the payment via PayPal or by credit card. Download the template to your device for repeated use. Utilize the search function if you need to find another document template. US Legal Forms provides a vast array of legal and tax templates and packages for both business and individual requirements, including the Indiana Seller's Disclosure of Financing Terms for Residential Property regarding a Contract or Agreement for Deed aka Land Contract. Over three million users have successfully taken advantage of our services. Choose your subscription plan and access high-quality forms in just a few clicks.

- The documents are organized into state-specific categories.

- Some documents can be viewed prior to downloading.

- To obtain templates, users must hold a subscription and need to sign in to their account.

- Click Download next to any desired form and locate it in My documents.

- For users without a subscription, follow these instructions to quickly find and download the Indiana Seller's Disclosure of Financing Terms for Residential Property related to a Contract or Agreement for Deed commonly referred to as a Land Contract.

- Ensure you have the correct template for the relevant state.

Form popularity

FAQ

With seller-financing, often the insurance and tax payments are paid directly to the owner, who is expected to make the annual payment personally. If, for some reason these payments aren't made, both parties can be put at risk of either a tax foreclosure, or a cancellation of the home owner's insurance.

_________/- (Rupees ____________________________), will be received by the FIRST PARTY from the SECOND PARTY, at the time of registration of the Sale Deed, the FIRST PARTY doth hereby agree to grant, convey, sell, transfer and assign all his rights, titles and interests in the said portion of the said property, fully

In seller financing, the seller takes on the role of the lender. Instead of giving cash to the buyer, the seller extends enough credit to the buyer for the purchase price of the home, minus any down payment.Then the buyer pays back the loan over time, typically with interest.

Owner Financing Example Over the course of the loan, the buyer makes monthly payments of $426 and is responsible for property tax and insurance payments. At closing, the buyer receives title to the home that is subject to a mortgage held by the seller.

Complete the addendum, including your name, the purchaser's name and a description of the property. Include the type of financing that you are providing, such as first mortgage, second mortgage or deed of trust. List the terms of the loan.

The seller financing addendum outlines the terms at which the seller of the property agrees to loan the money to the buyer in order to purchase their property.Once complete, this addendum should be signed and attached to the purchase agreement made between the parties.

Taxes need not be paid on the portion of the payments representing return of basis--the amount the seller originally paid for the property. Tax must be paid on the portion representing the gain from the sale; this is paid at capital gains rates, which are usually lower than ordinary income tax rates.

In a contract for deed, often done with seller finance deals, the answer is a little complicated. The buyer holds "equitable" title, while the seller holds legal title.