The Wyoming Request for a Previously Filed Annual Report (AR) Worksheet(s) is an online form that a corporation must complete when filing its annual report to the Secretary of State. The form is required for all Wyoming corporations, limited liability companies, and partnerships to file an annual report. The Wyoming AR Worksheet includes the following information: • Entity name and ID • Entity type • Registered agent • Principal office address • Entity formation date • Last annual report filing date • Annual report fee • List of Officers, Directors, and/or Managers • List of MembersforcesCs) or Partners (for Partnerships) • List of Authorized Signatures • List of Authorized Representatives • Contact information The Wyoming AR Worksheet must be signed and submitted along with the annual report fee to the Secretary of State. Upon submission, the Secretary of State will provide the corporation with a confirmation of receipt. There are three types of Wyoming Request for a Previously Filed Annual Report (AR) Worksheet(s): Wyoming LLC AR Worksheet, Wyoming Corporation AR Worksheet, and Wyoming Partnership AR Worksheet.

Wyoming Request for a Previously Filed Annual Report (AR) Worksheet(s)

Description

How to fill out Wyoming Request For A Previously Filed Annual Report (AR) Worksheet(s)?

How much time and resources do you usually spend on composing official documentation? There’s a greater option to get such forms than hiring legal experts or spending hours browsing the web for a proper template. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Wyoming Request for a Previously Filed Annual Report (AR) Worksheet(s).

To obtain and complete a suitable Wyoming Request for a Previously Filed Annual Report (AR) Worksheet(s) template, follow these simple steps:

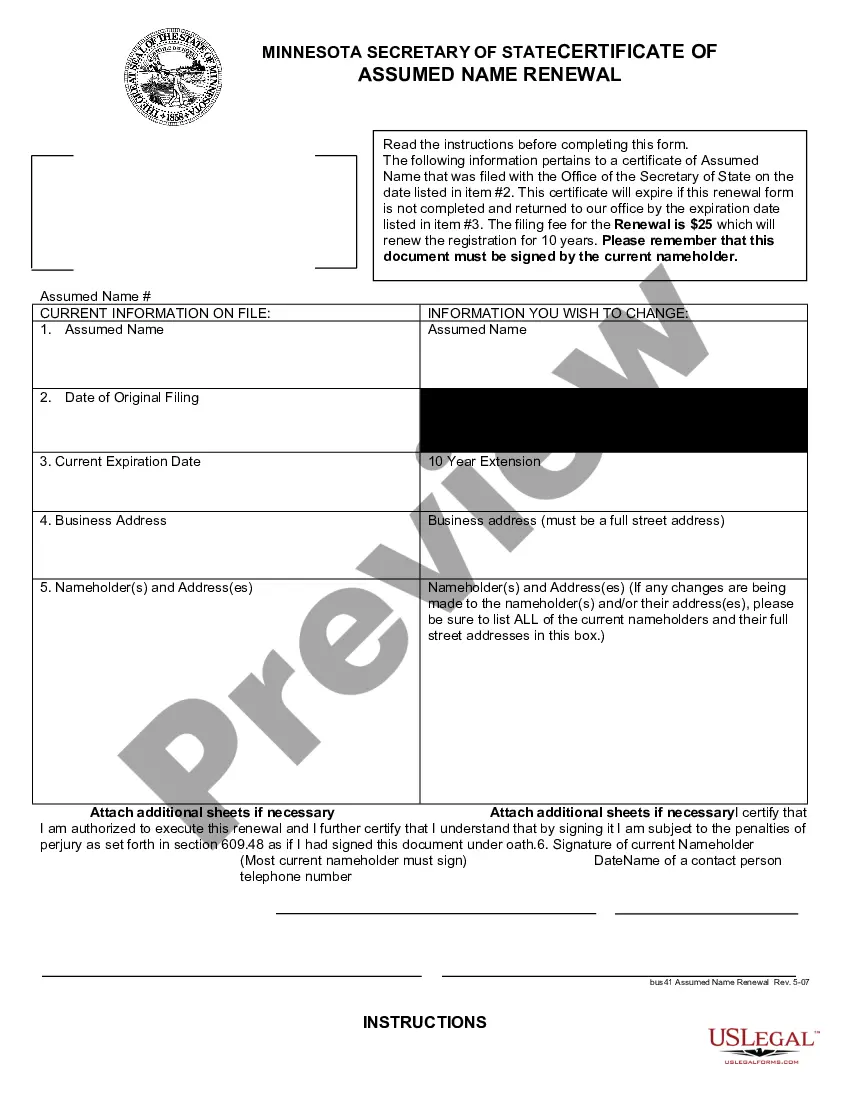

- Examine the form content to make sure it complies with your state requirements. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Wyoming Request for a Previously Filed Annual Report (AR) Worksheet(s). If not, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally safe for that.

- Download your Wyoming Request for a Previously Filed Annual Report (AR) Worksheet(s) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web services. Join us now!

Form popularity

FAQ

Registered Limited Liability Partnerships: Annual Report License tax is $60 or two-tenths of one mill on the dollar ($. 0002) whichever is greater based on the company's assets located and employed in the state of Wyoming.

How much does an LLC in Wyoming cost per year? All Wyoming LLCs need to pay $60 per year for the Annual Report (aka Wyoming Annual License Tax). These Wyoming LLC fees are paid to the Secretary of State. And this is the only state-required annual fee.

The process is free if done online at the Secretary of State website. By mail, the processing fee is $10. Additionally, online processing provides immediate processing, while a mail-in application will take approximately two days to complete.

All Wyoming corporations, nonprofits, LLCs, and LPs need to file a Wyoming Annual Report each year. These reports must be submitted to the Wyoming Secretary of State, Business Division.

Filing ID refers to the identification number assigned to the filing by the Secretary of State's Office. Filings include business entities, trademarks and trade names.

Annual Report License tax is $60 or two-tenths of one mill on the dollar ($. 0002) whichever is greater based on the company's assets located and employed in the state of Wyoming.

Does Wyoming Annual Reports Have Late Fees? No, there is no late fee for Wyoming annual reports not filed on time. However, the Wyoming Secretary of State will administratively dissolve your business if the report is filed more than 60 days late.