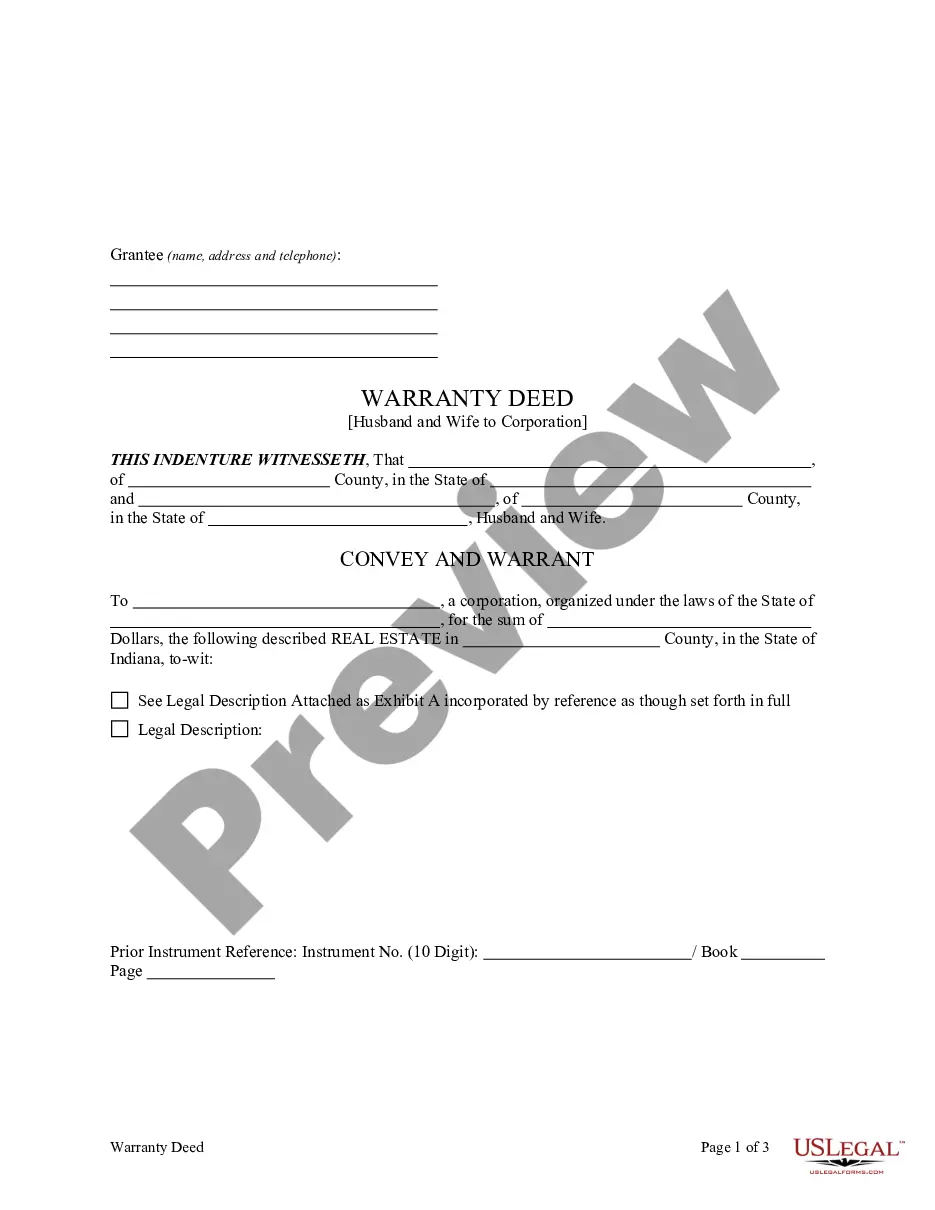

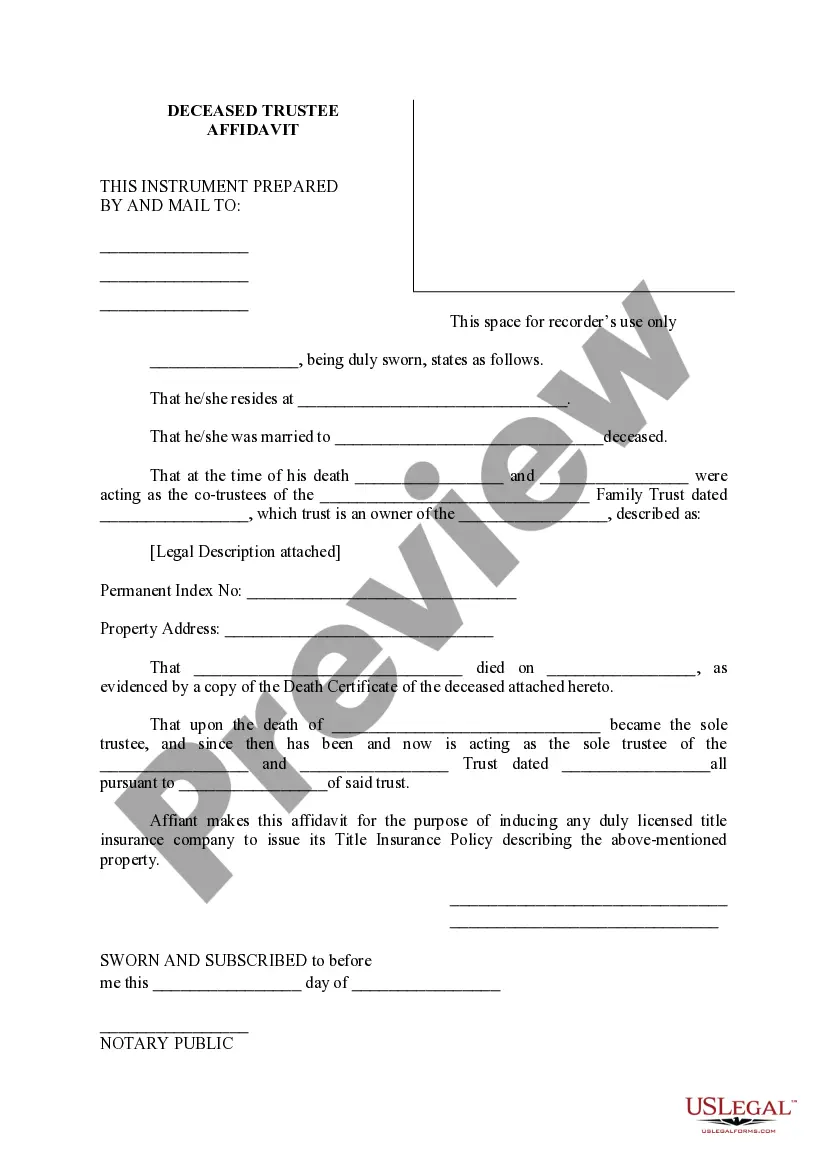

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indiana Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Indiana Warranty Deed From Husband And Wife To Corporation?

Attempting to locate a sample Indiana Warranty Deed from Spouse to Company can be quite challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template tailored to your state in just a few clicks.

Our attorneys prepare each document, so you only need to complete them. It is genuinely that simple.

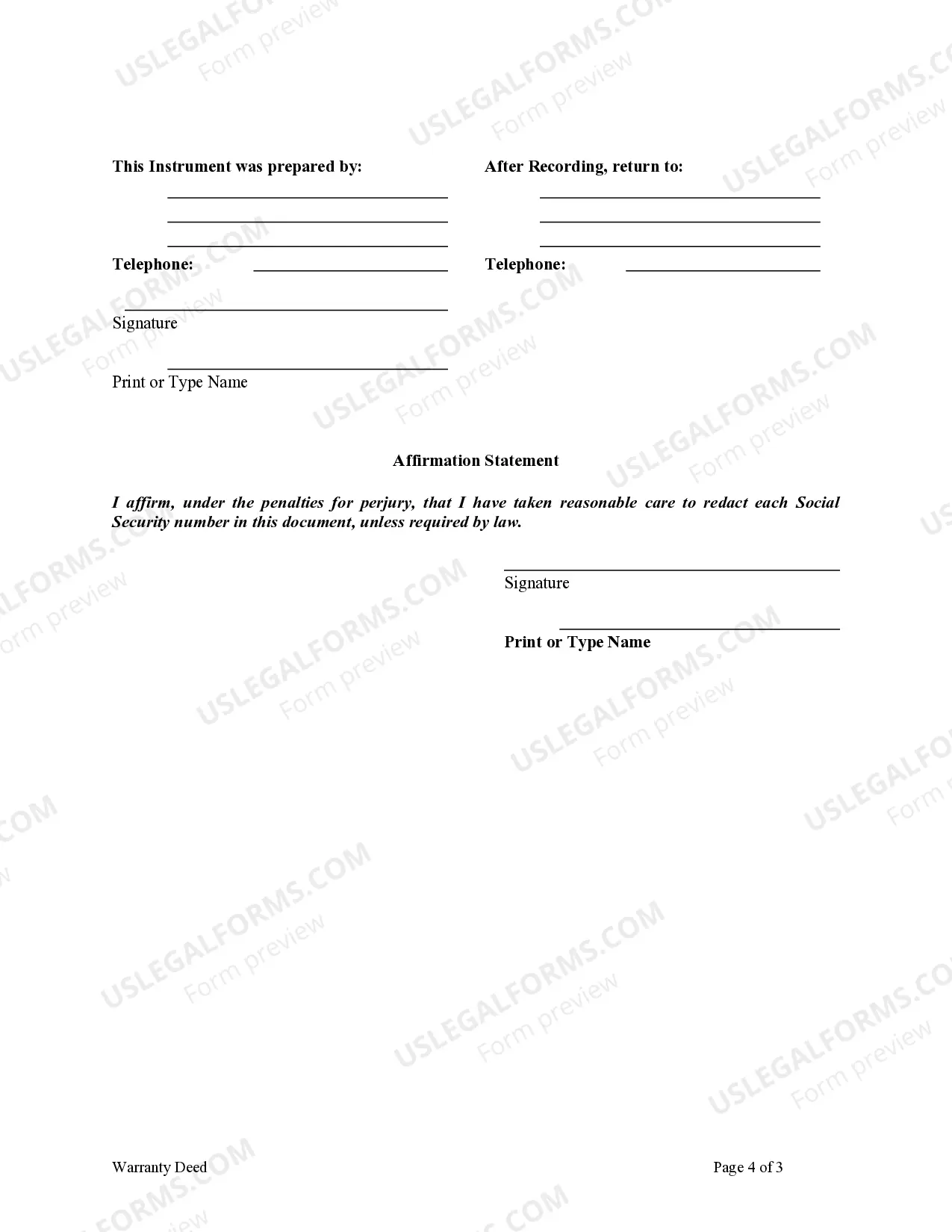

Select your pricing plan on the payment page and create your account. Choose your preferred payment method via card or PayPal. Save the sample in your desired format. You may print the Indiana Warranty Deed from Husband and Wife to Corporation template or fill it out using any online editor. Don't stress about errors since your template can be used and submitted, and printed as many times as necessary. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Access your account via Log In and return to the form's page to download the document.

- Your stored templates can be found in My documents and are available anytime for later use.

- If you haven’t registered yet, you will need to sign up.

- Follow our comprehensive instructions on how to obtain the Indiana Warranty Deed from Husband and Wife to Corporation form in just a few minutes.

- To acquire a valid example, verify its legitimacy for your state.

- Examine the sample using the Preview feature (if available).

- If there is a description, read it to understand the critical details.

- Click Buy Now if you have found what you need.

Form popularity

FAQ

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

Locate the prior deed to the property. Create the new deed. Sign the new deed. Record the original deed.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

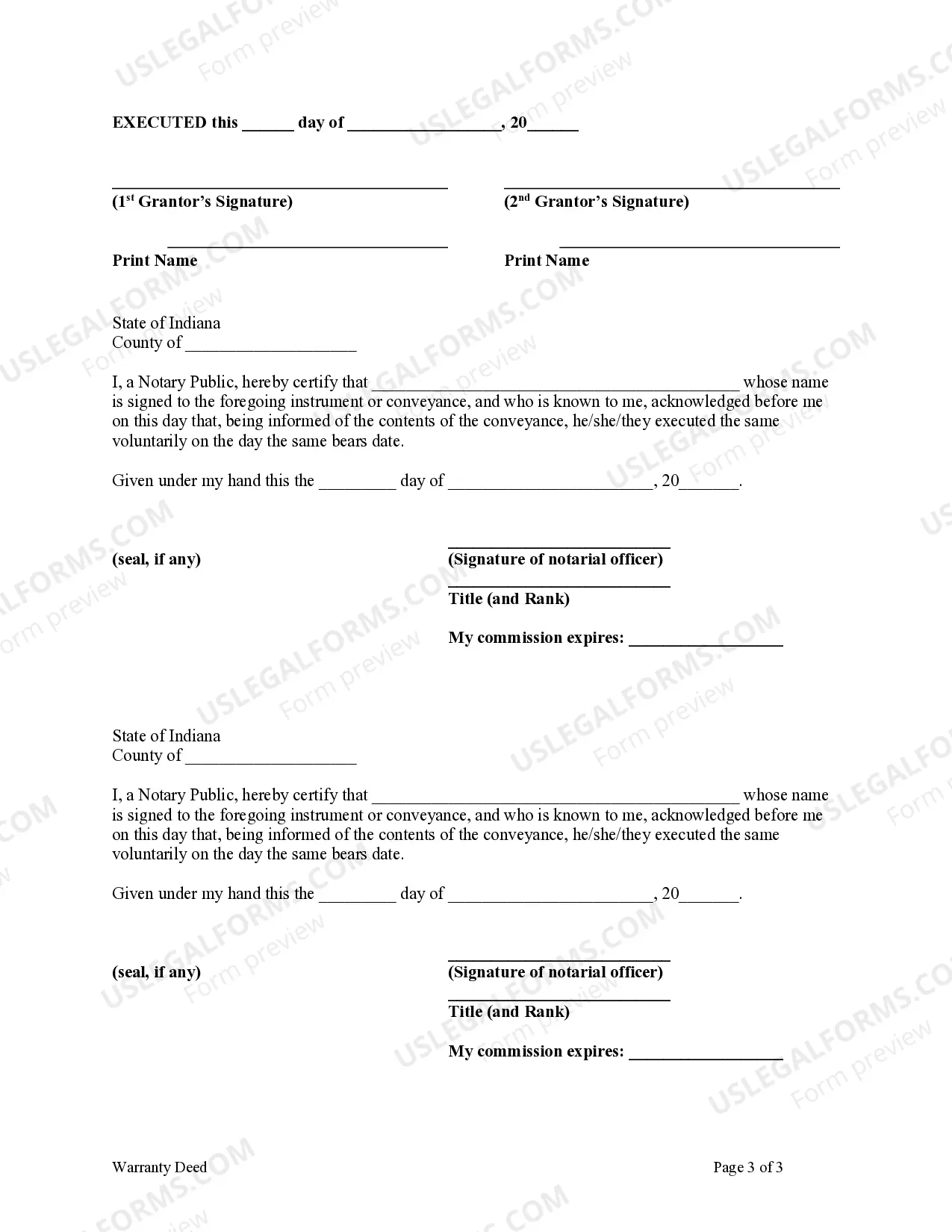

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.