Access an online library of 85,000+ state-specific legal forms

Looking for a specific legal form?

Find a legal form for any use case

Personal Planning package

- Will templates

- Power of Attorney blanks

- Personal Life Planning form

- Estate Planning worksheet

Easy Order of special offers

Register your business

online in a few steps

Notarize documents

US Legal Forms allows you to get your documents securely notarized online in a matter of minutes. Documents notarized online carry the same legal standing as documents notarized in person. There is no need to waste time looking for a notary. All you need is an internet connection and a camera.

Upload a PDF, edit it using a powerful online PDF editor, and fill it out. A digital notary will do the rest. Once your document is notarized, you can download and share it with another party.

Legal resources

US Legal Forms provides access to legal resources that help you get accurate information about a specific legal topic. The resources include definitions for legal terms, articles on a variety of legal topics supported by real-life examples, and answers to frequently asked questions.

With a US Legal Forms subscription, you can search for information straight from your account. With our legal resources, you will get a deeper understanding of a specific legal issue and as a result, resolve your legal dispute faster.

Completion services

Try US Legal Forms completion services to get a legally-binding Last Will and statement online. Reduce confusion and protect your family by clearly outlining what should be done with your property and other affairs.

Learn moreIndustry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

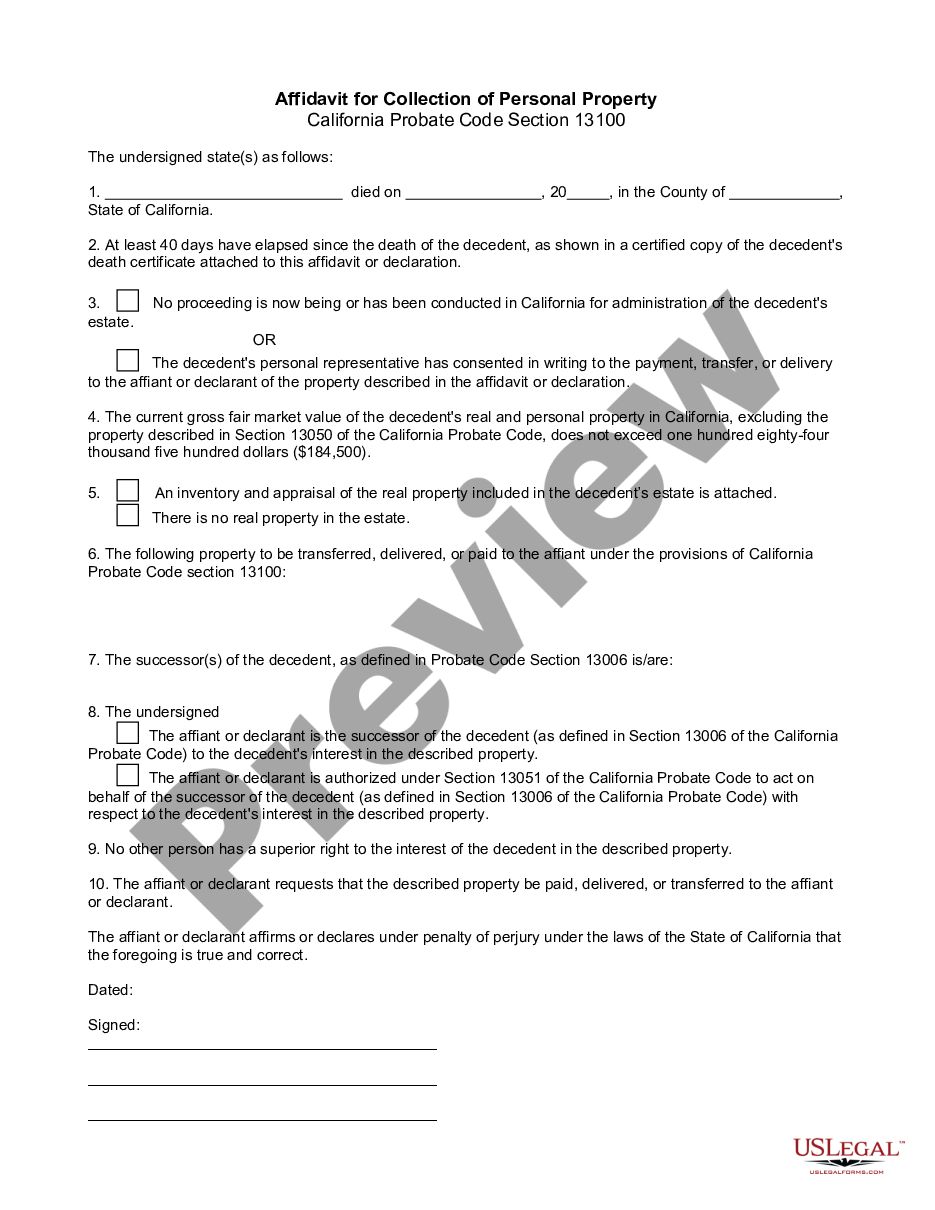

US Legal Forms is the largest online library of more than 85,000 national and state-specific legal documents. It allows individual consumers, small businesses, and attorneys to find ready-to-use legal forms and form packages for any use case. From contracts and agreements to documents for personal needs with real-life examples, you can do it yourself without paying for a lawyer's services. US Legal Forms also includes eSignature and editing capabilities, so you can edit, eSign, and notarize documents online using any device and without having to switch between apps.

Get legal documents online within a single secure solution

Find legal document templates that match your use case and get assistance completing legal paperwork with US Legal Forms. With over 25 years of experience in the market of legal documents, we've built an online library of over 85,000 state-specific forms to help you resolve any case. During that time, we've been recognized as a leading form publisher with expertise that helped us earn the trust of more than 3 million users worldwide.

We strive to provide qualified guidance to help you execute law documents online. Our collection includes documents that you won't find in any other resources. All legal templates are sourced by experts and supported with detailed instructions, simple descriptions, and previews so you can easily complete them online using any device. There is no need to buy legal forms separately. In US Legal Forms, you can get any documents with a single pricing plan.

Our online legal forms cover a range of use cases, including:

-

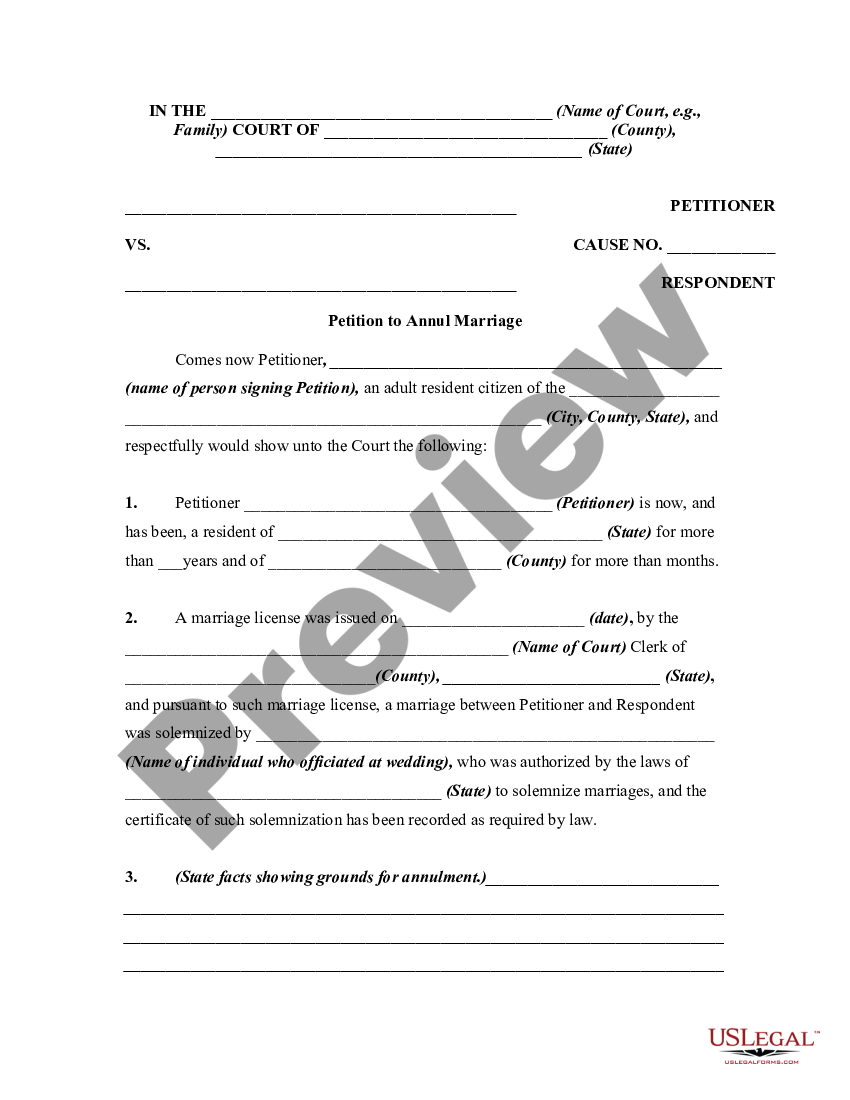

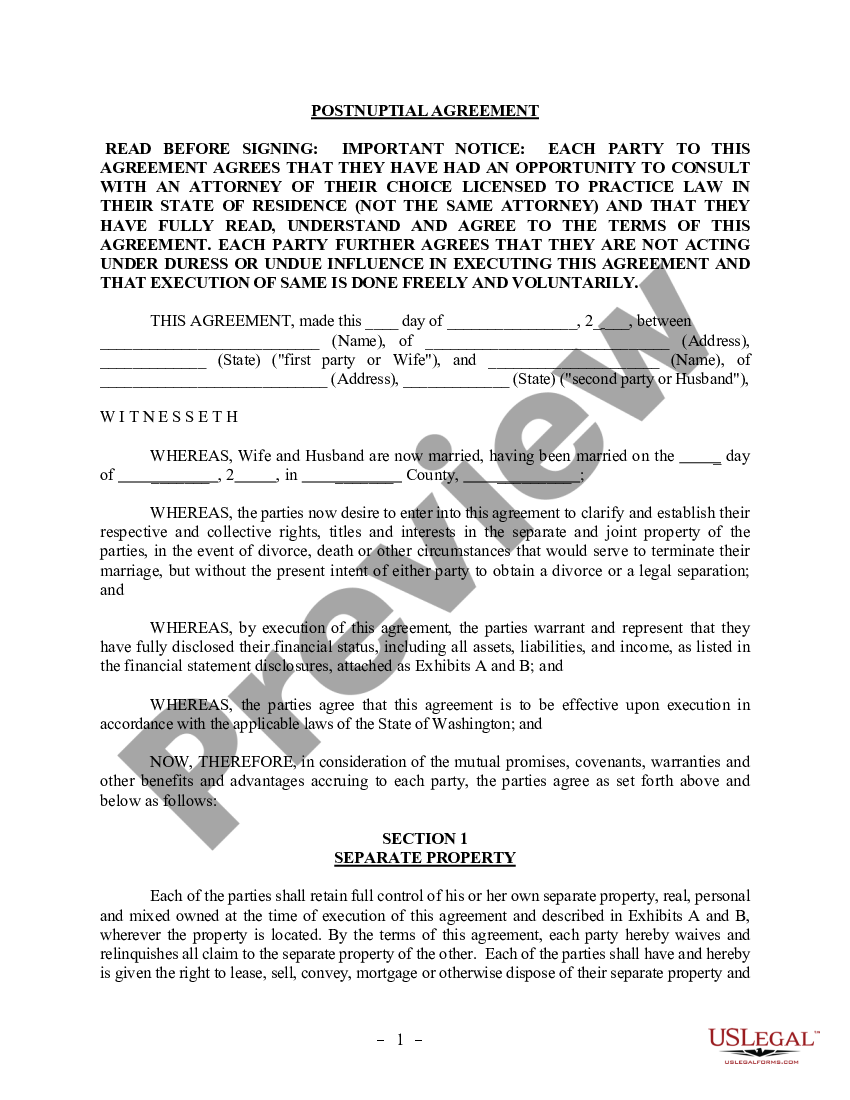

Family law such as marriage, adoption, divorce, name change, etc.

-

Estate planning e.g., last will and testament

-

Real estate operations such as sales and leases

-

Business-related cases such as legal agreements templates, licenses, and more

Besides ready-made forms that you can fill out yourself, we provide completion services where our experts will prepare entire document packages tailored to your specific case. All you need to do is complete a brief questionnaire and our experts will do the rest. You can then save your completed forms and reuse them at any time.

Find documents and form packages for your specific case

US Legal Forms makes it easy to find legal forms. To help you increase efficiency and minimize time spent on papers, we've organized every document by category. Each category contains a collection of documents arranged by a specific use case, including real estate, employment, internet technology, divorce, and more. The categories in the form library are organized in alphabetical order which simplifies navigation. If you'd like, you can browse popular forms by category and find the template you need.

Each state has its own legal guidelines that can affect the validity of documents prepared in another state. With this fact in mind, we’ve created legal templates in accordance with the laws of specific states so that you can ensure your documents are up-to-date, no matter your location.

How to get legal documents for a particular state?

First, select a form category. Then, pick the state you need from the list. You will be redirected to the subcategory page where you can find the relevant forms.

As an alternative, you can use the search bar to quickly locate your form. Simply enter a form name and get it in seconds. It is that easy. Whether you have some personal legal issues, are planning to relocate, looking for a job, thinking about starting a business, or simply want to take care of your loved ones — US Legal Forms is here to assist you every step of the way. And if you just need a reliable source of information or examples of legal documents, US Legal Forms is your one-stop shop.

Edit, share, and save forms online in minutes

US Legal Forms is more than just a library with the best online legal forms. With a powerful all-in-one online PDF editor and award-winning legally-binding eSignature solution included in our premium subscription, you can complete your forms without any back-and-forth or costly applications.

Here is how to execute your online legal document:

-

Find a form in our library

-

Customize it in the online document editor — add text, drawings or images, highlight important information, or blackout confidential details

-

Add a signature using your preferred method — you can type, draw, or upload its picture from your device

-

Send your document to others so they can sign and fill it out. When your document is completed, you will get an instant email notification so you won't miss a beat

-

If you wish, you can download and print out your form

-

Securely store documents directly in your account and reuse your legal forms example as many times as you need

With a US Legal Forms premium subscription, starting and running a business has never been easier. Find out what business structure is right for you, answer a few questions, and our experts will file all the necessary papers for you. From LLCs and corporations to non-profit organizations, US Legal Forms can help you set up any business structure. Once your business is up and running, we'll provide you with the online legal contracts and forms required to keep your organization growing.