What is Probate?

Probate is the legal process of settling an estate after someone passes away. It includes validating wills and distributing assets. Explore our state-specific templates for your needs.

Probate involves managing a deceased person's estate. Our attorney-drafted templates are quick and easy to complete.

Use this affidavit to settle estates valued at up to $200,000 without the formalities of probate court.

Use this affidavit to claim personal property from an estate valued at $50,000 or less, without going through probate.

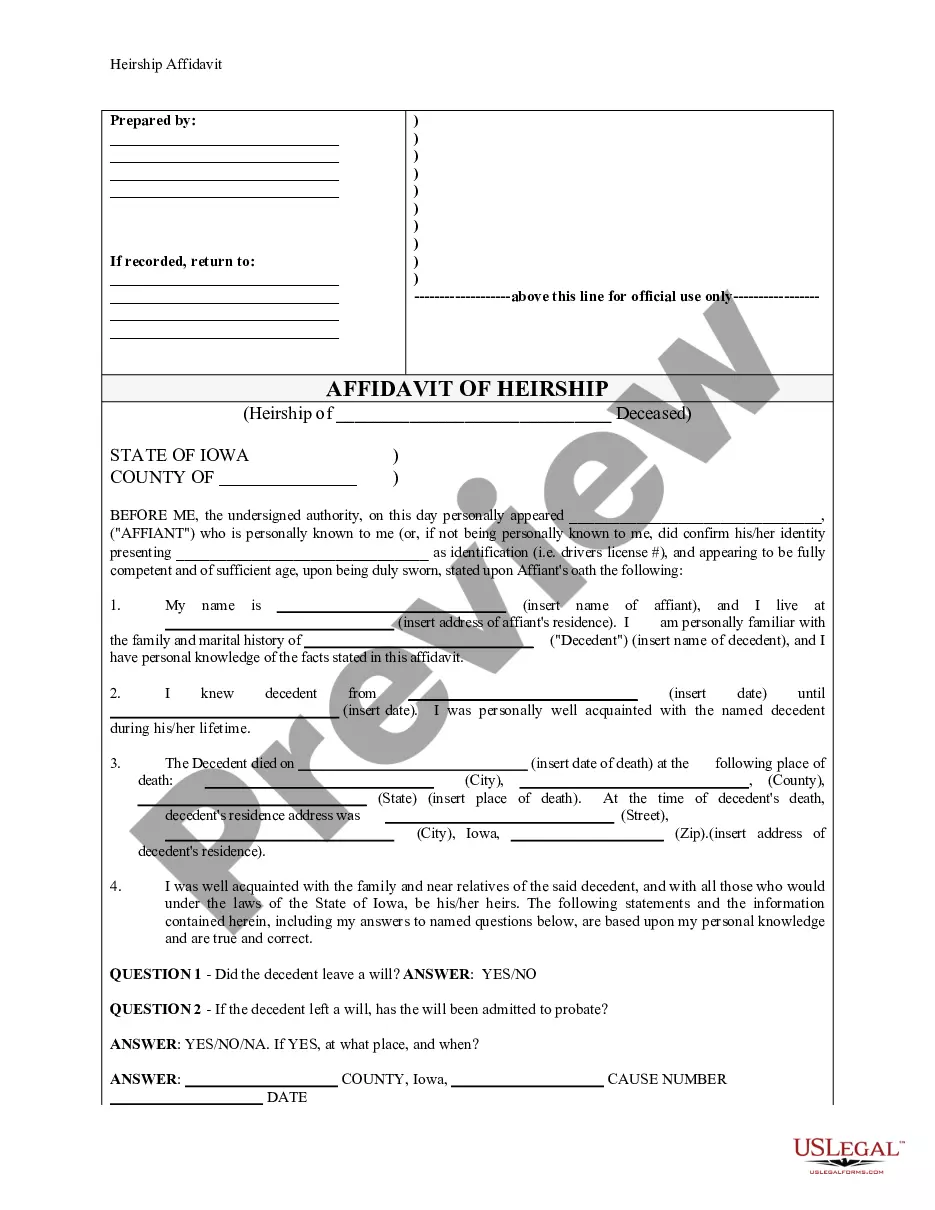

Use this affidavit to establish the heirs of a deceased individual for legal purposes in Iowa.

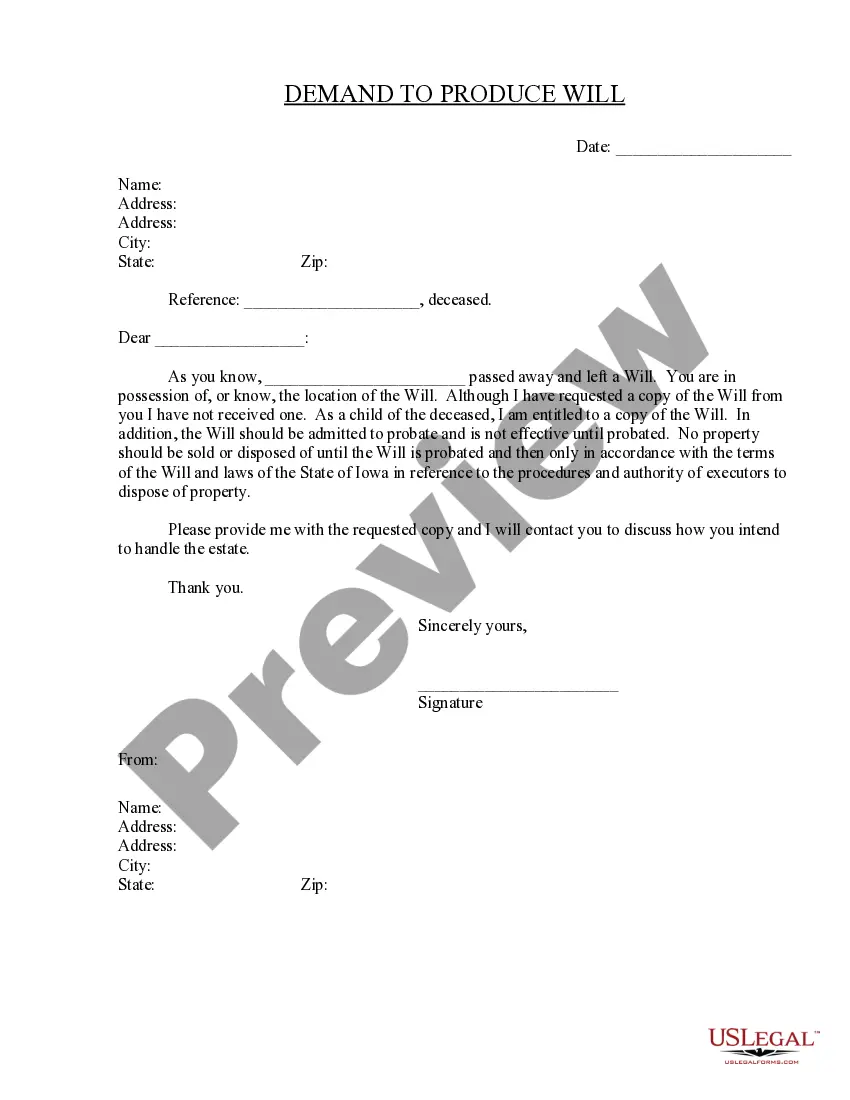

Request a copy of a deceased's Will when it's not voluntarily provided, ensuring legal rights and clarity in estate matters.

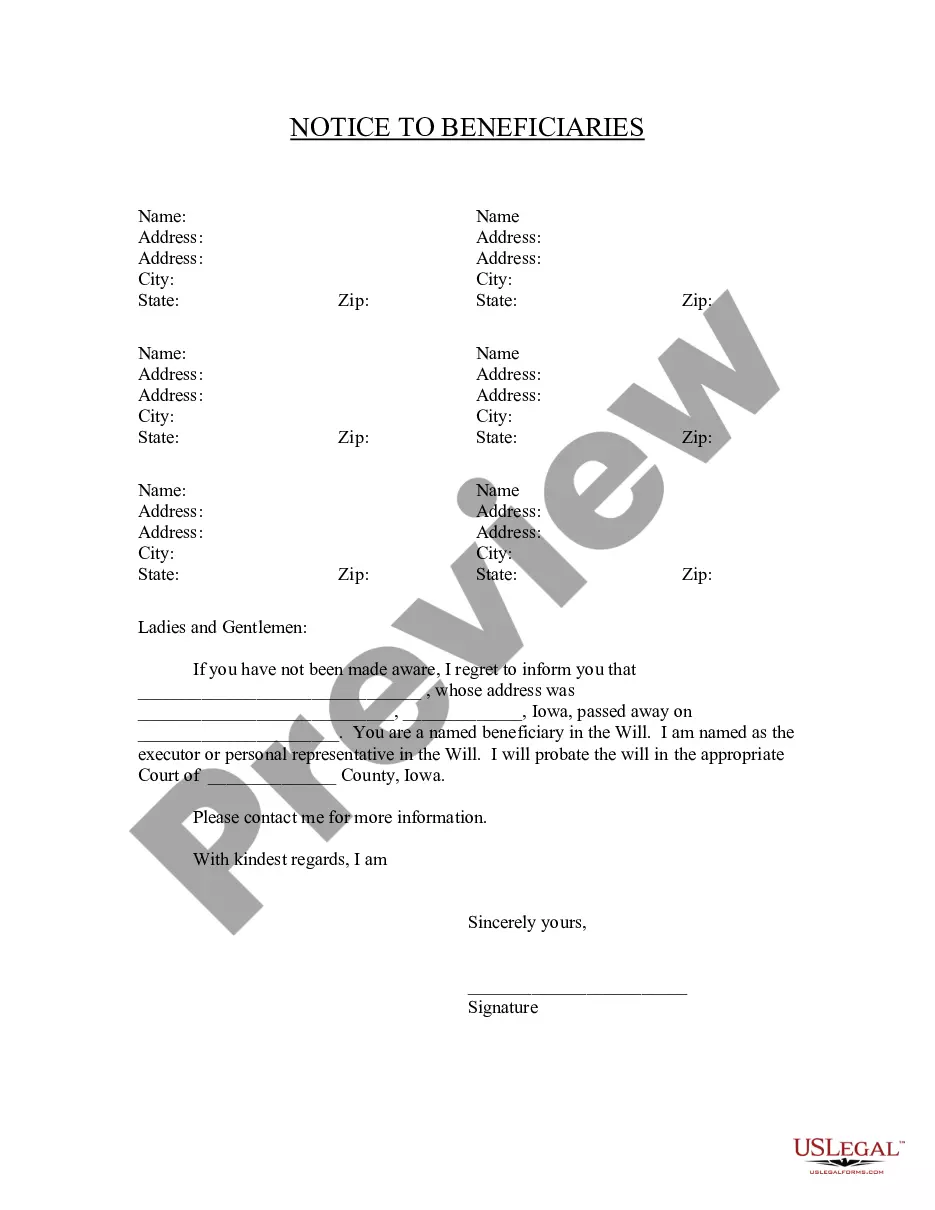

Notify beneficiaries of their status in a will and provide essential details about the deceased and the probate process.

Disclaim any rights to inherit property from an estate or trust, allowing for clear distribution according to your wishes.

Clarify estate divisions among heirs to avoid disputes over inheritance.

Clarify joint ownership of property, addressing common misconceptions and explaining rights and responsibilities in shared ownership scenarios.

Renounce your right to inherit property, allowing it to pass to others according to state law, without claiming your share.

Streamline the probate process by formally renouncing executorship, ensuring legal compliance and efficient estate management.

Probate is necessary for asset distribution in most estates.

Not all assets require probate to transfer ownership.

Wills must be validated by a probate court.

Probate proceedings can take several months to complete.

Estate debts must be settled before distribution to heirs.

Begin your probate journey in a few easy steps.

A trust can help avoid probate and manage assets during life, while a will only takes effect after death.

If no estate plan exists, state law will determine how assets are distributed.

Review your estate plan every few years or after significant life changes.

Beneficiary designations on accounts usually override instructions in a will or trust.

Yes, you can appoint separate individuals for financial and healthcare decisions.