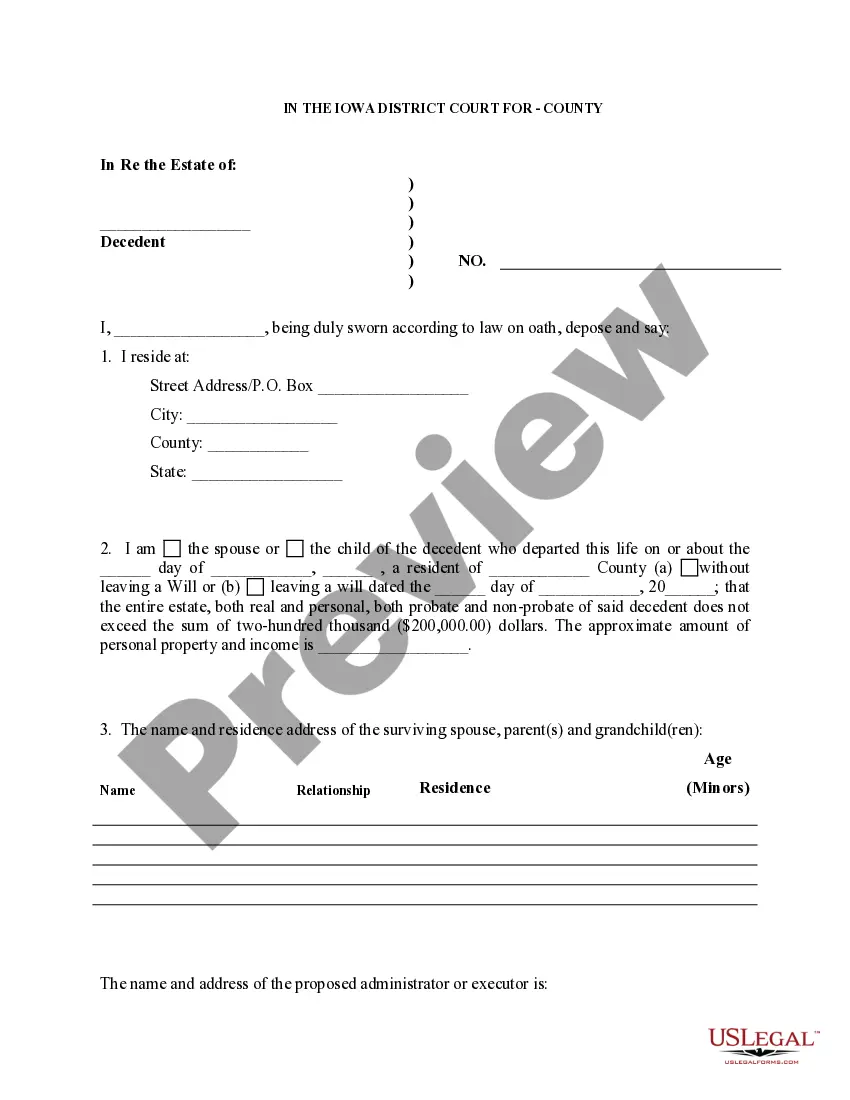

Small Estate Affidavit for Estates Not More Than $200,000

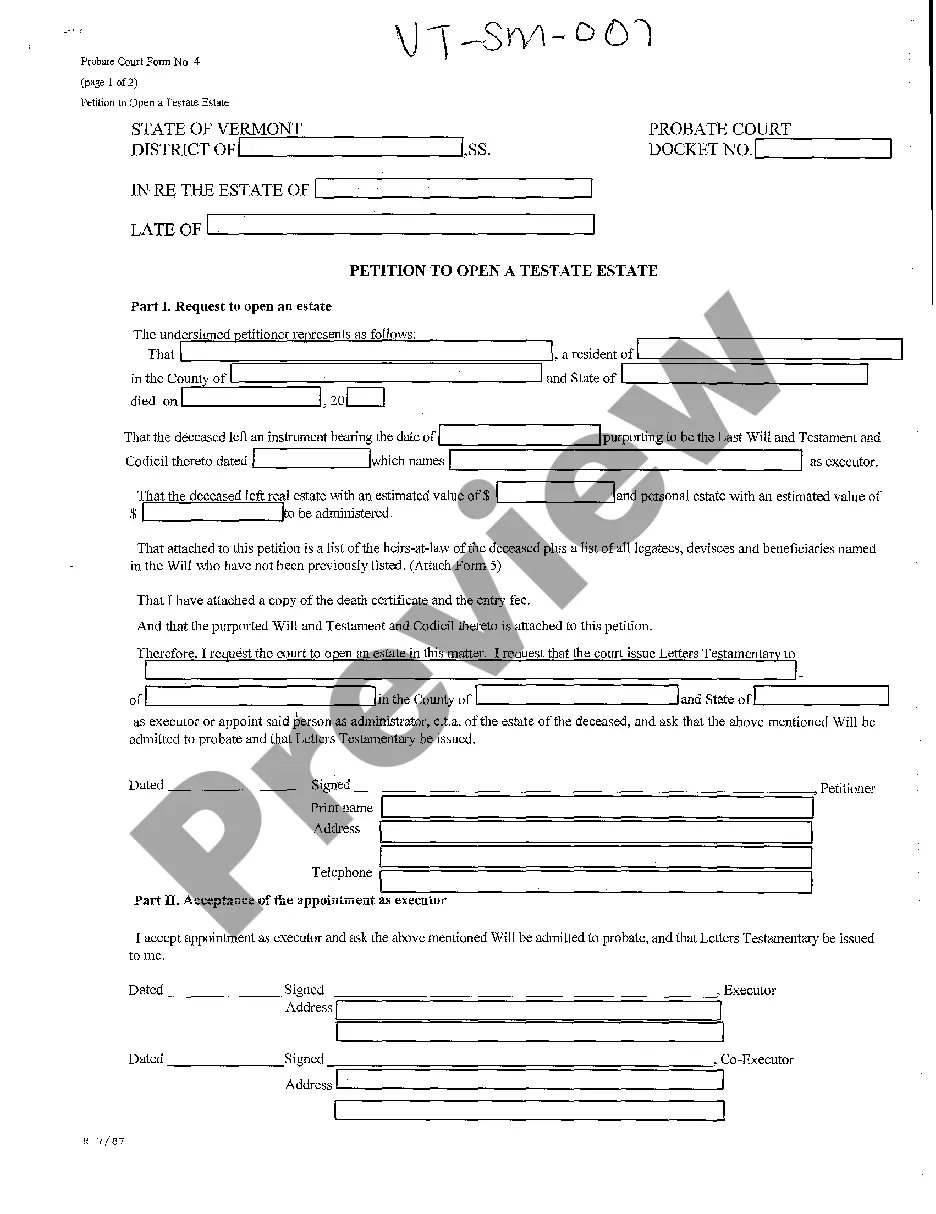

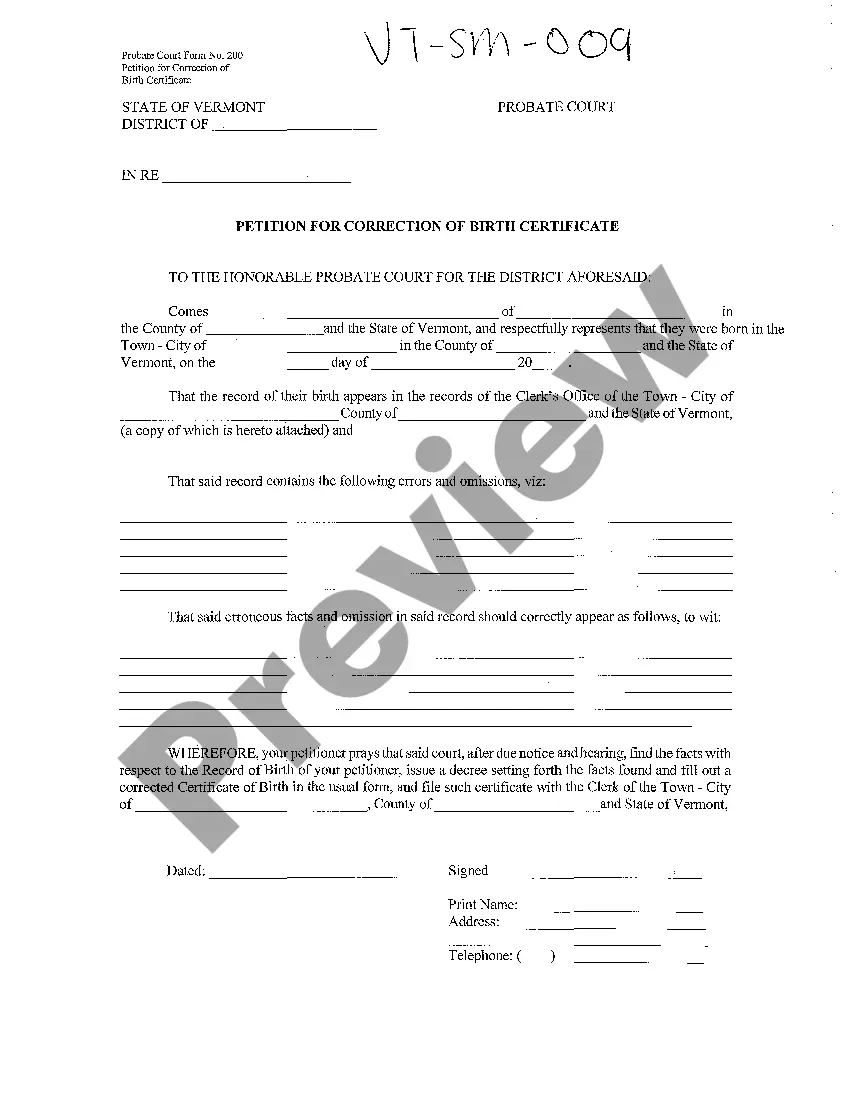

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

1. Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Iowa Summary:

Under Iowa statute, where as estate is valued at no more than $100,000, an interested party may issue a small estate affidavit to collect any debts owed to the decedent.

Iowa Requirements:

Iowa requirements are set forth in the statutes below.

635.1 When applicable.

When the gross value of the probate assets of a decedent subject to the jurisdiction of this state does not exceed one hundred thousand dollars, and upon a petition as provided in section 635.2 of an authorized petitioner in accordance with section 633.227, 633.228, or 633.290, the clerk shall issue letters of appointment for administration to the proposed personal representative named in the petition, if qualified to serve. Unless otherwise provided in this chapter, the provisions of chapter 633 apply to an estate probated pursuant to this chapter.

635.2 Petition requirements.

The petition for administration of a small estate must contain the following:

1. The name, domicile, and date of death of the decedent.

2. The name and address of the surviving spouse, if any.

3. Whether the decedent died intestate or testate, and, if testate, the date the will was executed.

4. A statement that the probate property of the decedent subject to the jurisdiction of this state does not have an aggregate gross value of more than the amount permitted under the provisions of section 635.1 and the approximate amount of personal property and income for the purposes of setting a bond.

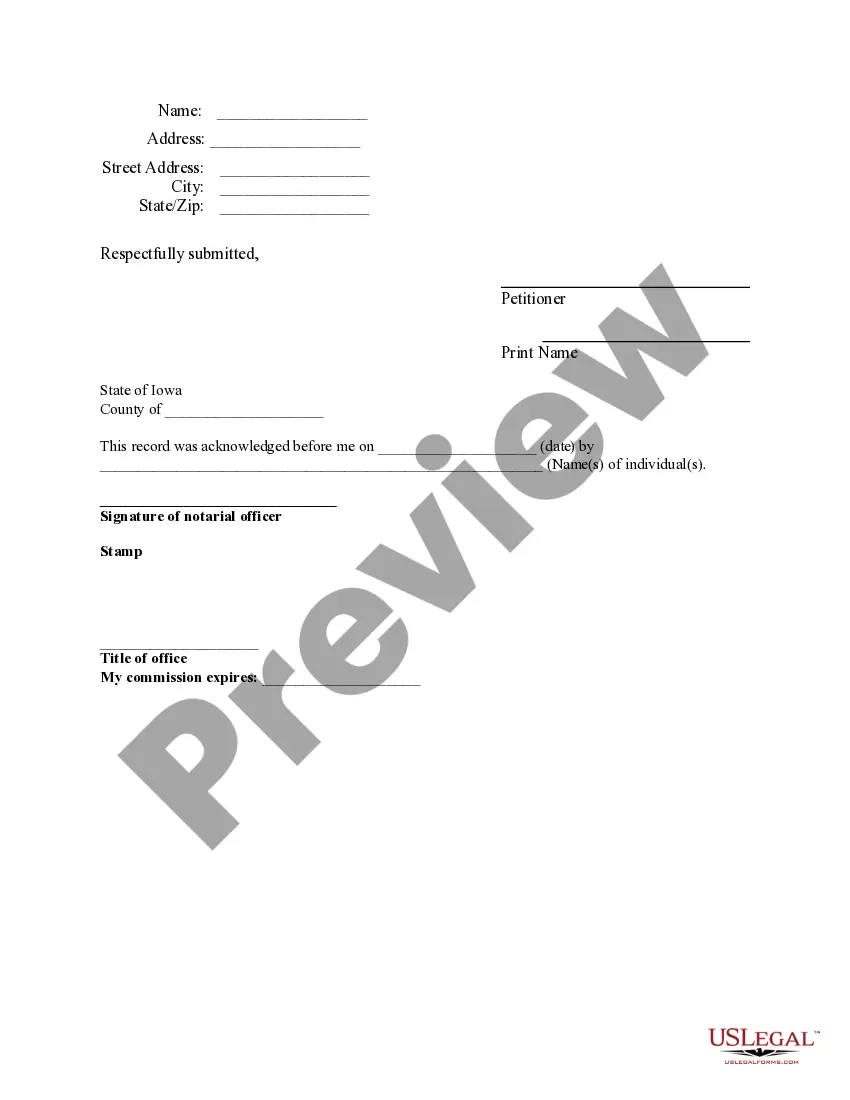

5. The name and address of the proposed personal representative.

635.7 Report and inventory value and conversion.

1. The personal representative is required to file the report and inventory for which provision is made in section 633.361, including all probate and nonprobate assets. This chapter does not exempt the personal representative from complying with the requirements of section 422.27, 450.22, 450.58, 633.480, or 633.481, and the administration of an estate whether converted to or from a small estate shall be considered one proceeding pursuant to section 633.330.

2. The report and inventory shall show the gross value of probate assets subject to the jurisdiction of this state.

3. If the gross value of probate assets subject to the jurisdiction of this state exceeds the amount permitted for a small estate under section 635.1, the estate shall be administered as provided in chapter 633.

4. If the report and inventory in an estate probated pursuant to chapter 633 shows the gross value of the probate assets subject to the jurisdiction of this state does not exceed the amount permitted under section 635.1, the estate shall be administered as a small estate upon the filing of a statement by the personal representative that the estate is a small estate.

5. Other interested parties may convert proceedings from a small estate to a regular estate or from a regular estate to a small estate only upon good cause shown with approval from the court.

[C75, 77, 79, 81, 635.7

81 Acts, ch 199, 8

635.8 Closing by sworn statement

1. The personal representative shall file with the court a closing statement and proof of service thereof within a reasonable time from the date of issuance of the letters of appointment. The closing statement shall be verified or affirmed under penalty of perjury stating all of the following:

a. To the best knowledge of the personal representative, the gross value of the probate assets subject to the jurisdiction of this state does not exceed the amount permitted under section 635.1.

b. The estate has been fully administered and will be distributed to persons entitled thereto if no objection is filed to the closing statement and the accounting and proposed distribution within thirty days after service thereof.

c. An accounting and proposed distribution of the estate including an accurate description of all the real estate of which the decedent died seized, stating the nature and extent of the interest in the real estate and its disposition.

d. A copy of the closing statement and a notice of an opportunity to object to and request a hearing has been sent, as provided in section 633.40, to all interested parties.

e. A statement as to whether or not all statutory requirements pertaining to taxes have been complied with, including whether federal estate tax due has been paid, whether a lien continues to exist for any federal estate tax, and whether inheritance tax was paid or a tax return was filed in this state.

f. The amount of fees to be paid to the personal representative and the personal representative's attorney with the appropriate documentation showing compliance with subsection 4.

2. If no actions or proceedings involving the estate are pending in the court thirty days after service of the closing statement, the estate shall be distributed according to the closing statement.

3. The estate shall close and the personal representative shall be discharged upon the earlier of either of the following:

a. The filing of an affidavit of mailing or other proof of service of the closing statement and a statement of asset distribution by the personal representative.

b. Sixty days after the filing of the closing statement and an affidavit of mailing or other proof of service thereof.

4. The fees for the personal representative shall not exceed three percent of the gross value of the probate assets of the estate, unless the personal representative itemizes the personal representative's services to the estate. The personal representative's attorney shall be paid reasonable fees as approved by the court or as agreed to in writing by the personal representative and such writing shall be executed by the time of filing the probate inventory. All interested parties shall have the opportunity to object and request a hearing as to all fees reported in the closing statement.

5. If a closing statement is not filed within twelve months of the date of issuance of a letter of appointment, an interlocutory report shall be filed within such time period. Such report shall be provided to all interested parties at least once every six months until the closing statement has been filed unless excused by the court for good cause shown. The provisions of section 633.473 requiring final settlement within three years shall apply to an estate probated pursuant to this chapter. A closing statement filed under this section has the same effect as final settlement of the estate under chapter 633.

[C75, 77, 79, 81, 635.8; 81 Acts, ch 199, 9] 89 Acts, ch 25, 4; 2007 Acts, ch 134, 24, 28; 2008 Acts, ch 1119, 36; 2009 Acts, ch 52, 11, 14; 2012 Acts, ch 1123, 31

635.13 Notice claims.

If a petition for administration of a small estate is granted, the notice as provided in section 633.237, and either sections 633.230 and 633.231 or sections 633.304 and 633.304A shall be given. Creditors having claims against the estate must file them with the clerk within the applicable time periods provided in such notices. The notice has the same force and effect as in chapter 633. Claimants of the estate shall be interested parties of the estate as long as the claims are pending in the estate.

[81 Acts, ch 199, 12] 84 Acts, ch 1080, 15; 89 Acts, ch 25, 6; 2007 Acts, ch 134, 25, 28