Iowa Small Estate Affidavit for Estates Not More Than $200,000

About this form

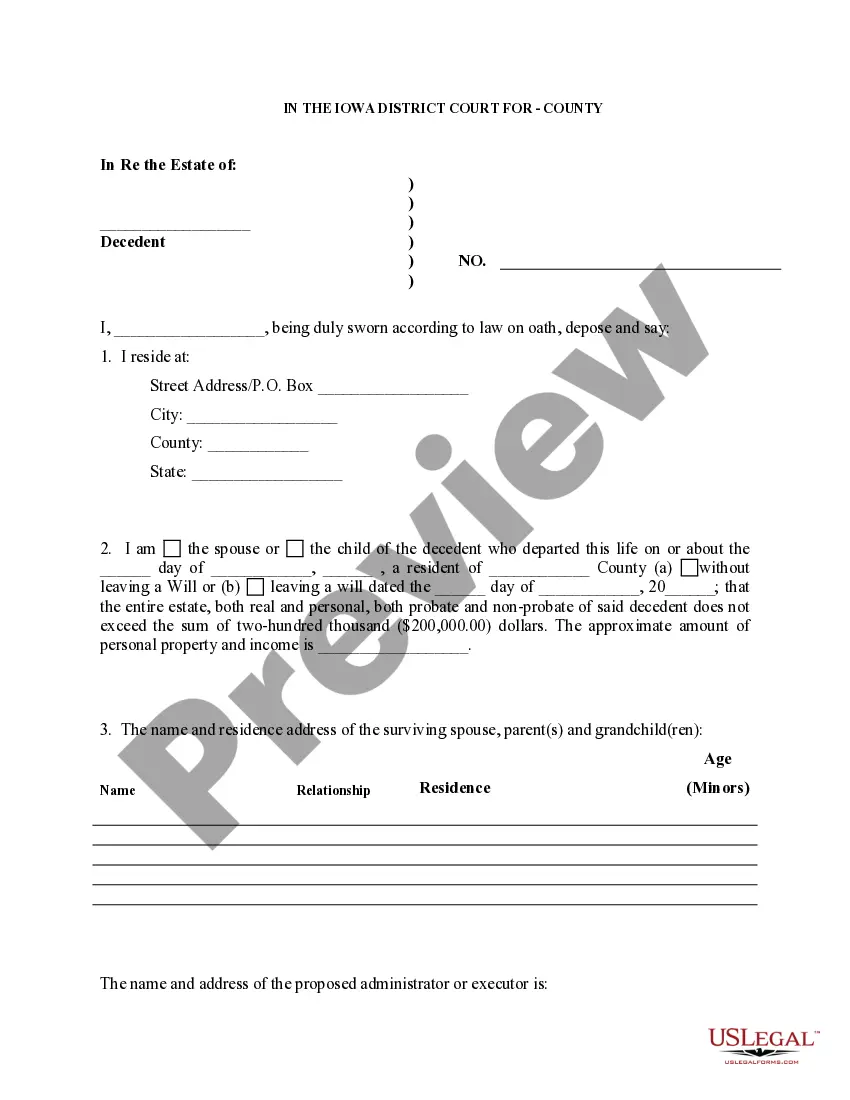

The Small Estate Affidavit for Estates Not More Than $200,000 is a legal document used to simplify the transfer of assets from a deceased person's estate when the total value is less than $200,000. This form is typically utilized by a spouse, heir, or creditor of the decedent and serves as a formal declaration stating the estate's value and the claimant's right to the property. It differs from other probate forms as it avoids the lengthy probate process for smaller estates.

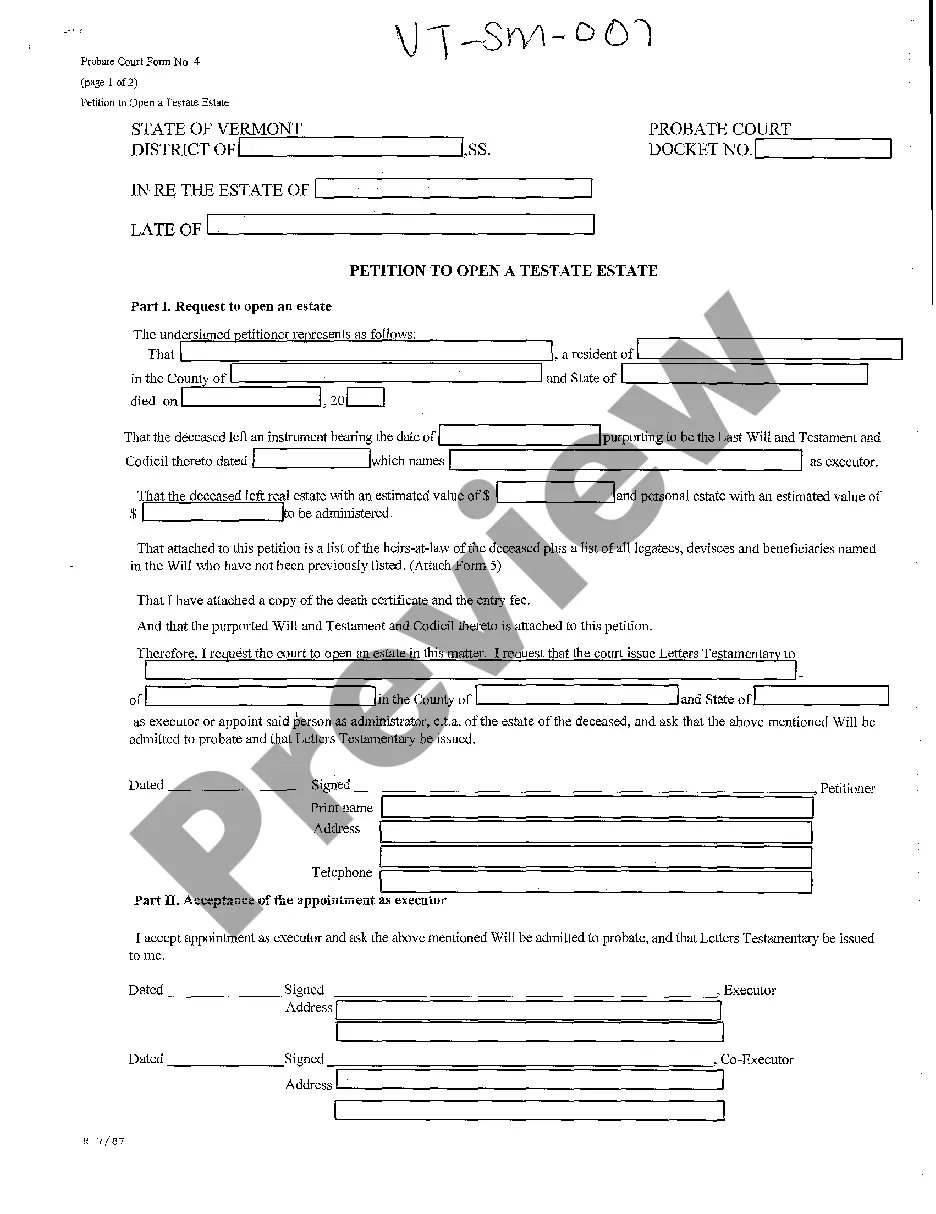

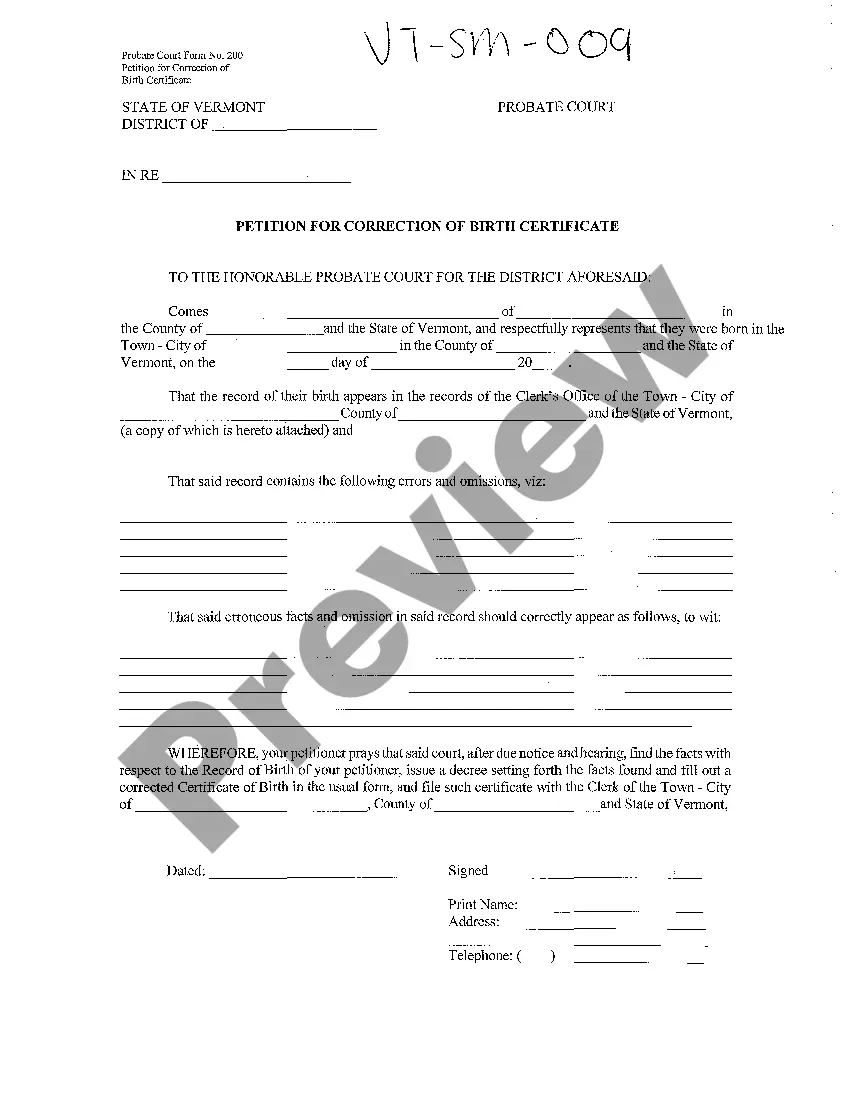

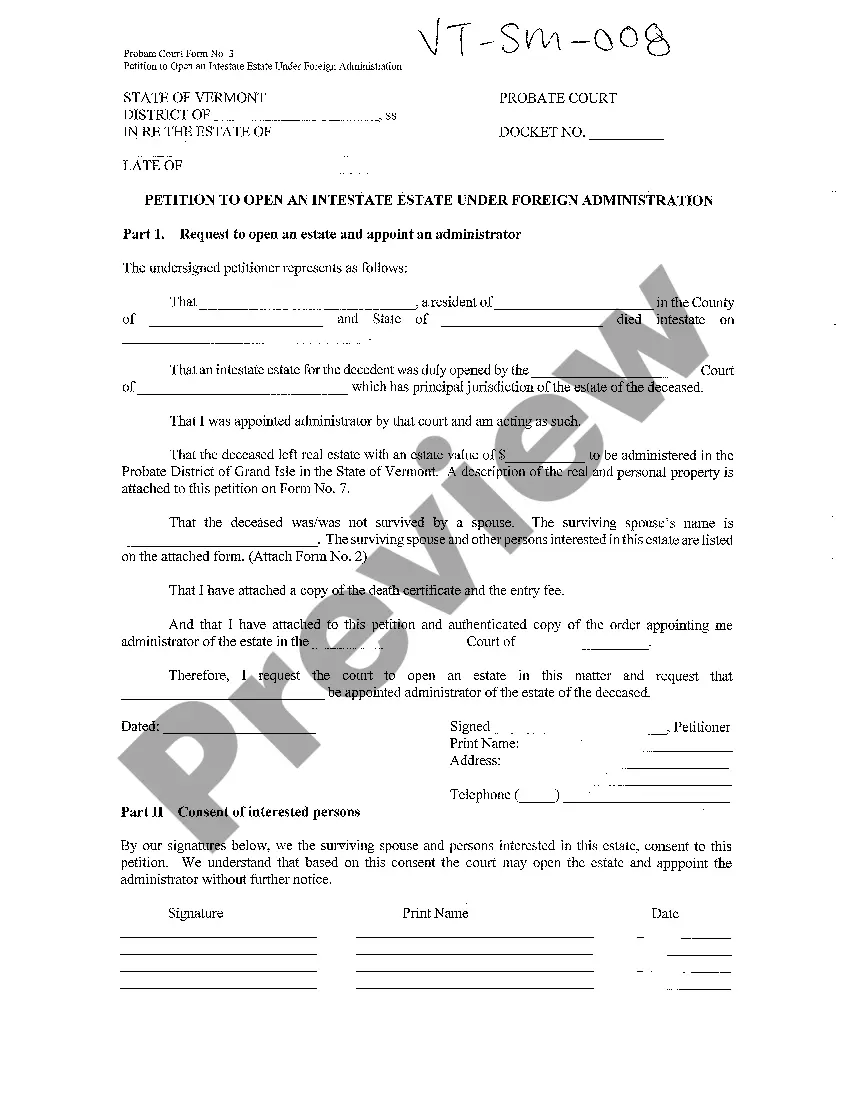

Form components explained

- Identification of the decedent, including date of death and residency details

- Affirmation of the estate's total gross value not exceeding $200,000

- Details about surviving family members, including spouse and children

- Signature and seal requirements for notarization

Situations where this form applies

This form should be used when the estate of a deceased individual has a gross value of no more than $200,000. It is ideal for scenarios where the decedent did not leave behind a will or where the will's assets are under the jurisdiction of a small estate procedure, allowing heirs or creditors to claim the estate's assets without going through formal probate.

Who this form is for

- Surviving spouses of the decedent

- Children or descendants of the decedent

- Creditors who have claims against the decedentâs estate

Steps to complete this form

- Enter the name and address of the decedent, along with the date of death.

- State your relationship to the decedent (e.g., spouse, child).

- Indicate whether there was a will and provide its details if applicable.

- Fill in the estimated value of the decedent's assets, ensuring it does not exceed $200,000.

- List names and addresses of surviving family members, such as spouses and children.

- Have the completed affidavit notarized to ensure it is legally valid.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide accurate asset values that exceed $200,000.

- Omitting necessary signatures, especially from a notary.

- Incorrectly stating the relationship to the decedent.

- Not listing all surviving family members as required.

Benefits of completing this form online

- Convenient access to legal forms from anywhere, at any time.

- Editable form fields make it easy to provide accurate information.

- Reliable templates drafted by licensed attorneys ensure legal compliance.

Looking for another form?

Form popularity

FAQ

Filling out a lack of probate affidavit in Iowa requires specific information about the decedent and the estate. You need to provide details such as the estate value, the names of heirs, and the list of assets. For assistance, consider using platforms like USLegalForms, which offer guided templates and resources to simplify completing the Iowa Small Estate Affidavit for Estates Not More Than $200,000.

Yes, the minimum amount for probate in Iowa is generally $50,000. If an estate's assets exceed this amount and do not qualify as a small estate, it must go through probate. Conversely, those managing estates worth $200,000 or less can use the Iowa Small Estate Affidavit for Estates Not More Than $200,000 to bypass probate procedures, expediting the distribution process.

The small estate limit in Iowa is $200,000, making this figure pivotal for estate planning. If the estate value falls within this limit, heirs can opt for the Iowa Small Estate Affidavit for Estates Not More Than $200,000. This choice simplifies the distribution of assets, avoiding the complexities of traditional probate.

The minimum amount for probate in Iowa is generally $50,000, but this does not apply to all estates. Estates valued at $200,000 or below can utilize the Iowa Small Estate Affidavit for Estates Not More Than $200,000, offering a more efficient alternative to the full probate process. This option helps reduce wait times for inheritors, making it easier to settle estates.

Not all wills are subject to probate in Iowa. If an estate's total value is $200,000 or less, beneficiaries may use the Iowa Small Estate Affidavit for Estates Not More Than $200,000 to transfer assets without the probate court's involvement. This streamlined process provides a quicker resolution, allowing heirs to access their inheritance sooner.

Yes, there is a minimum estate threshold for probate in Iowa, which is typically set at $50,000. If an estate's value exceeds this amount, it usually must go through the probate process. On the other hand, if you are dealing with an estate valued at $200,000 or less, you can take advantage of the Iowa Small Estate Affidavit for Estates Not More Than $200,000 to avoid probate.

In Iowa, an estate must generally be worth more than $50,000 to require probate, excluding certain assets like joint accounts. However, if the estate is valued at $200,000 or less, you may be able to utilize the Iowa Small Estate Affidavit for Estates Not More Than $200,000. This alternative provides a simplified process, allowing heirs to distribute assets without lengthy court procedures.