What is Probate?

Probate is the legal process of administering a deceased person's estate. It ensures debts are paid and assets are distributed according to the will. Select Indiana-specific templates to simplify the process.

Probate involves managing an estate after someone passes away. Our attorney-drafted templates are quick and user-friendly.

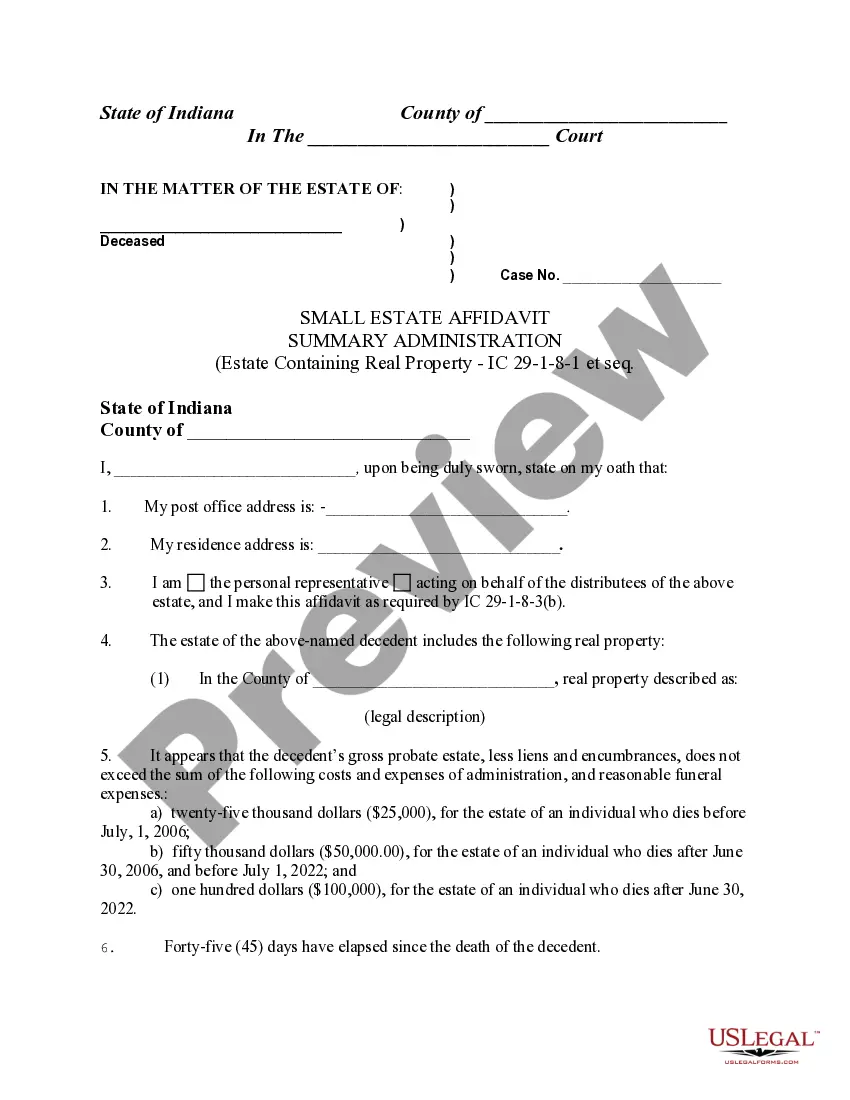

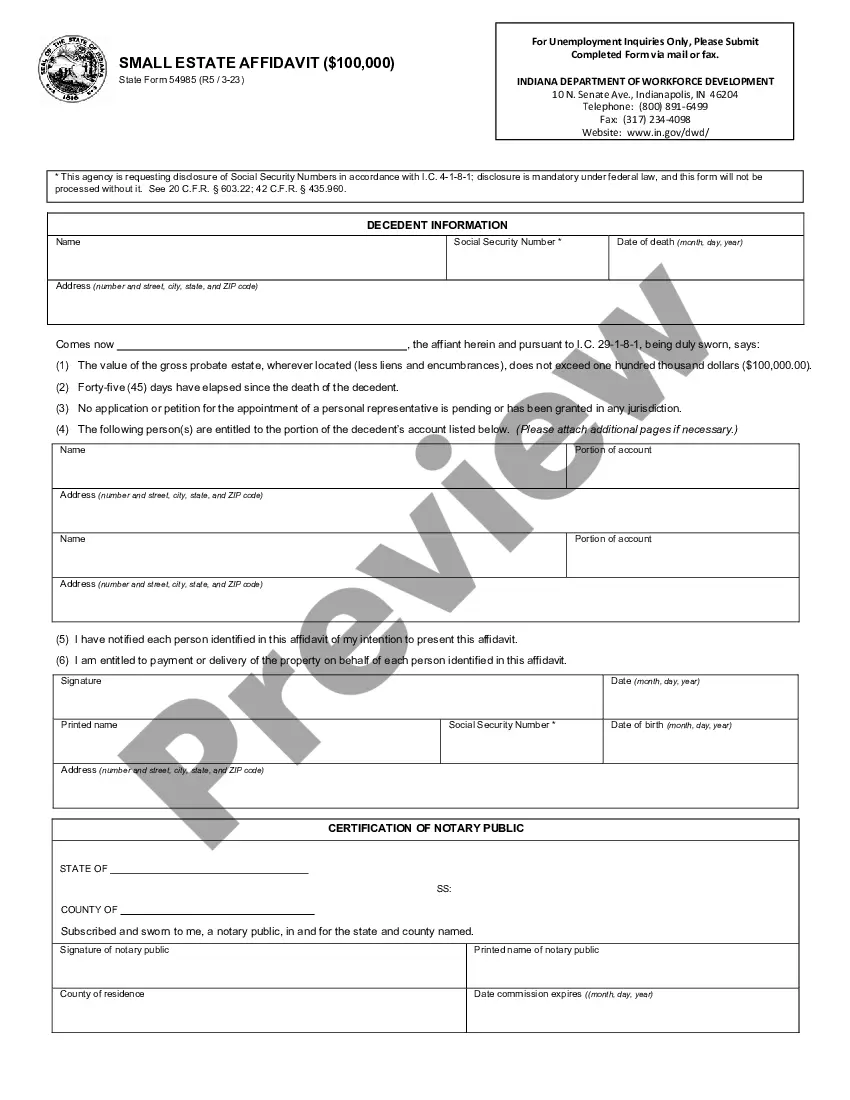

Handle small estate matters efficiently without a lengthy probate process, ideal for estates under $100,000.

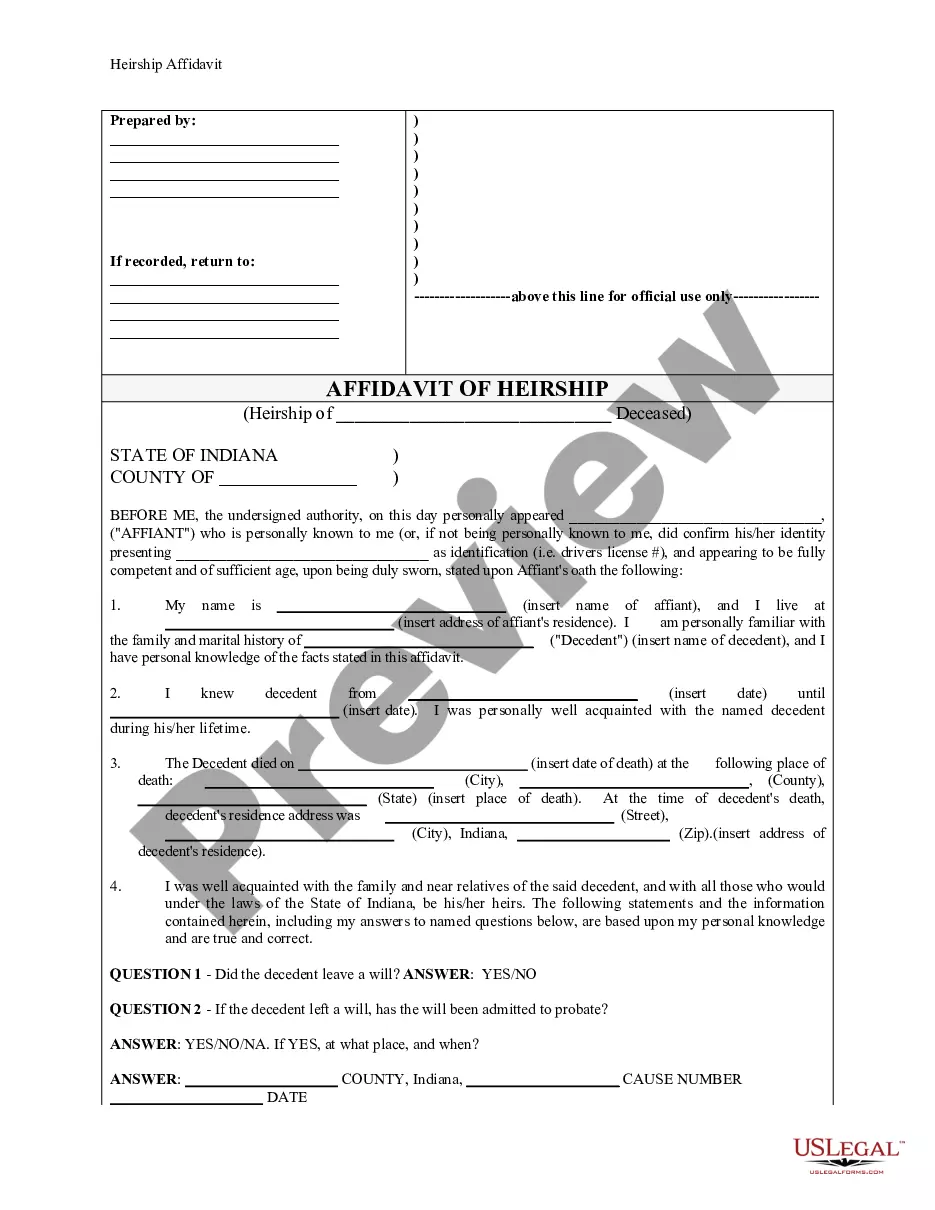

Use this affidavit to declare heirs of a deceased person when settling an estate without a will.

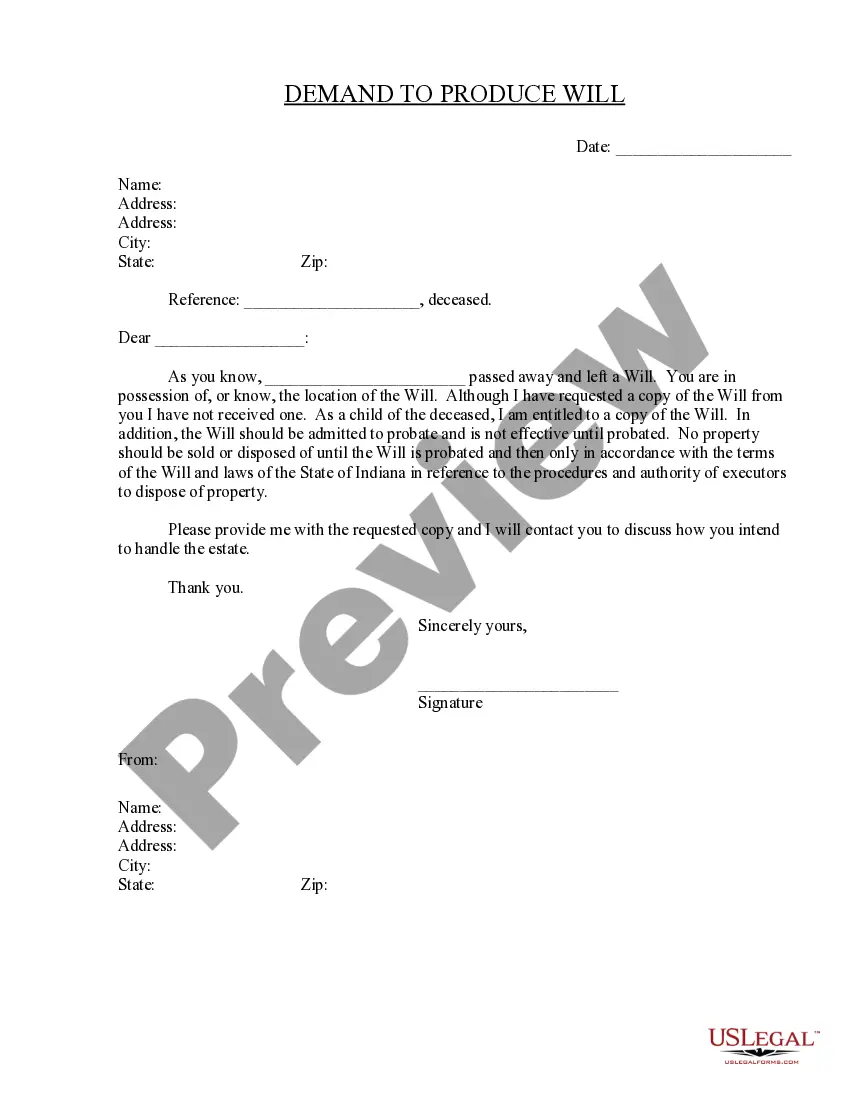

Requesting a copy of a deceased person's Will is essential to understanding their wishes and managing the estate properly.

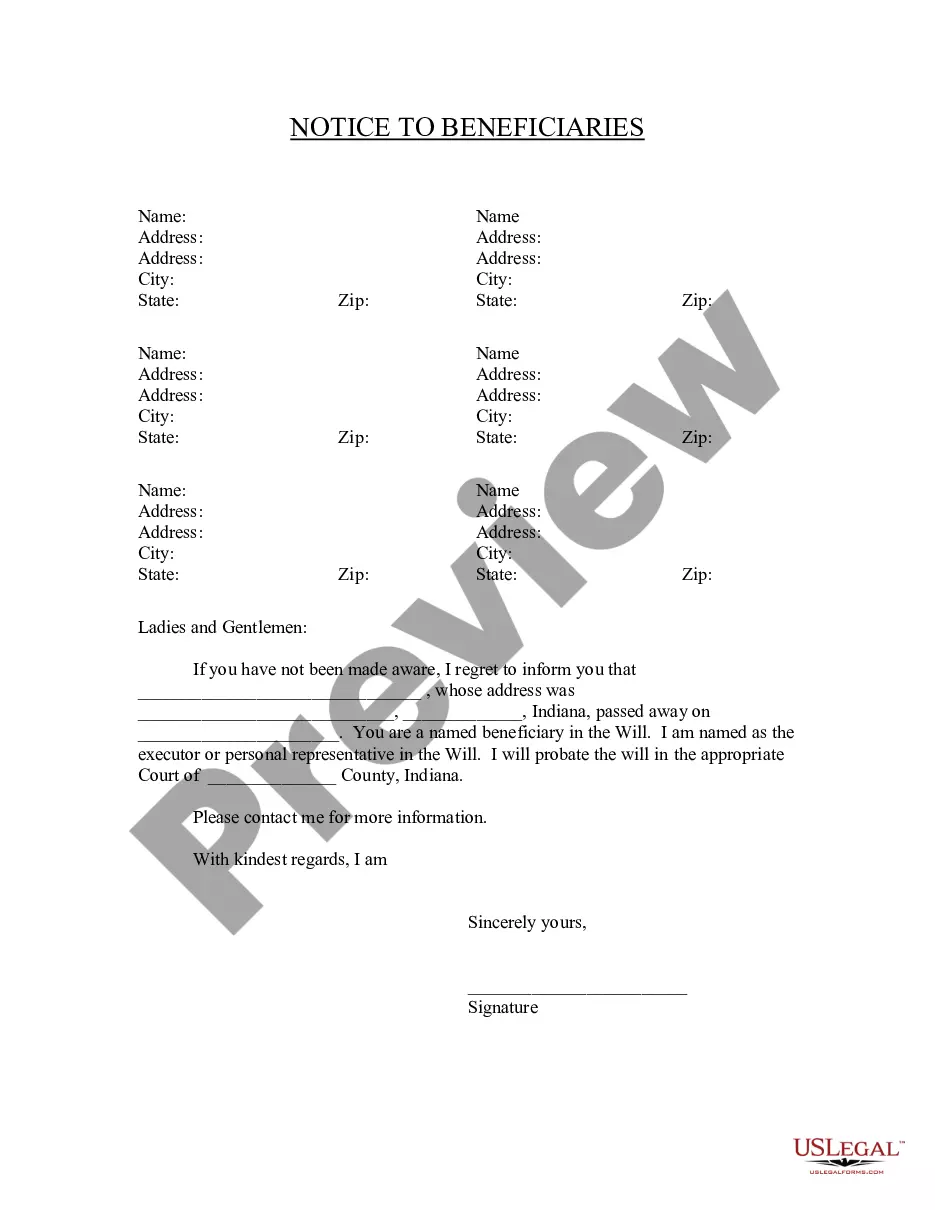

Inform beneficiaries about their status in a deceased person's will and how to proceed with the probate process.

Use this guide to understand your responsibilities as a personal representative in a supervised estate, ensuring proper management and distribution of assets.

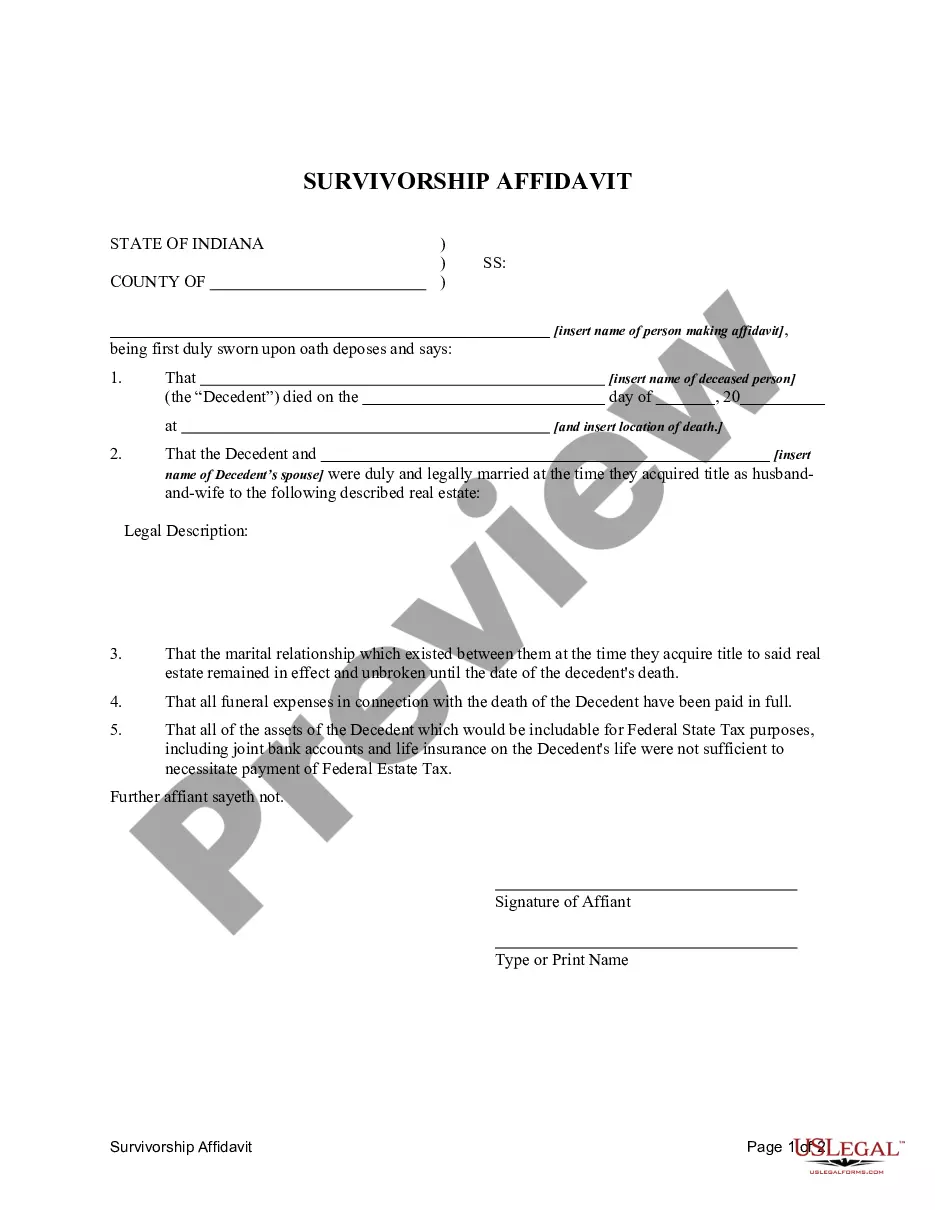

Use this affidavit to confirm payment of all funeral expenses and assert that the deceased's assets do not require estate tax.

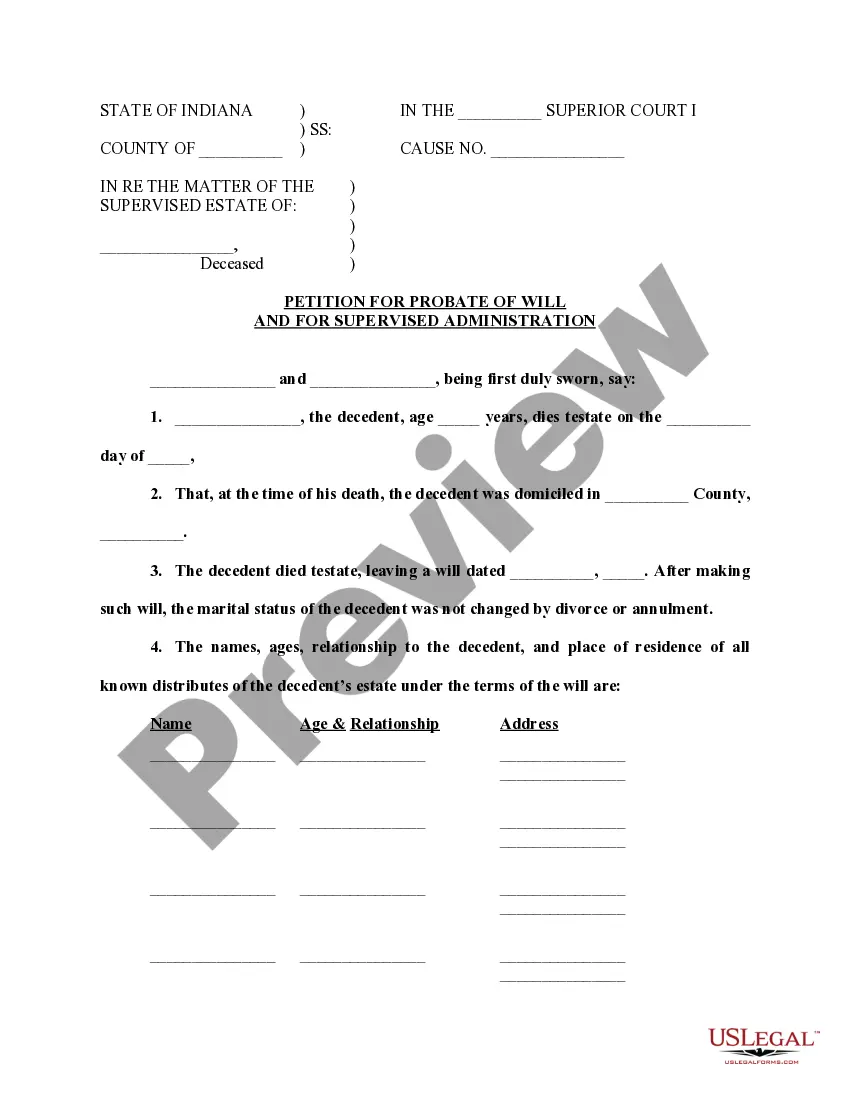

Use this form to initiate probate proceedings for a decedent's will while ensuring supervised administration of the estate's assets.

Use this form to formally request the allowance of a claim, ensuring your rights are recognized during a legal process.

Obtain official recognition of an executor's authority to administer an estate. This document is essential for handling estate matters after someone's death.

Probate is necessary for distributing a deceased person's assets.

Every estate goes through probate unless it is exempt.

Probate can involve various forms depending on the estate's complexity.

Debts of the deceased must be settled during the probate process.

Probate can take several months to years, depending on the estate's size.

Begin your probate journey in just a few simple steps.

A trust can provide additional benefits, such as avoiding probate, but it is not always necessary.

If no action is taken, the state may determine how your estate is distributed.

It's wise to review your estate plan every few years or after major life changes.

Beneficiary designations typically take precedence over will instructions for certain assets.

Yes, you can designate separate individuals for financial and healthcare decisions.