Indiana Survivorship Affidavit

Overview of this form

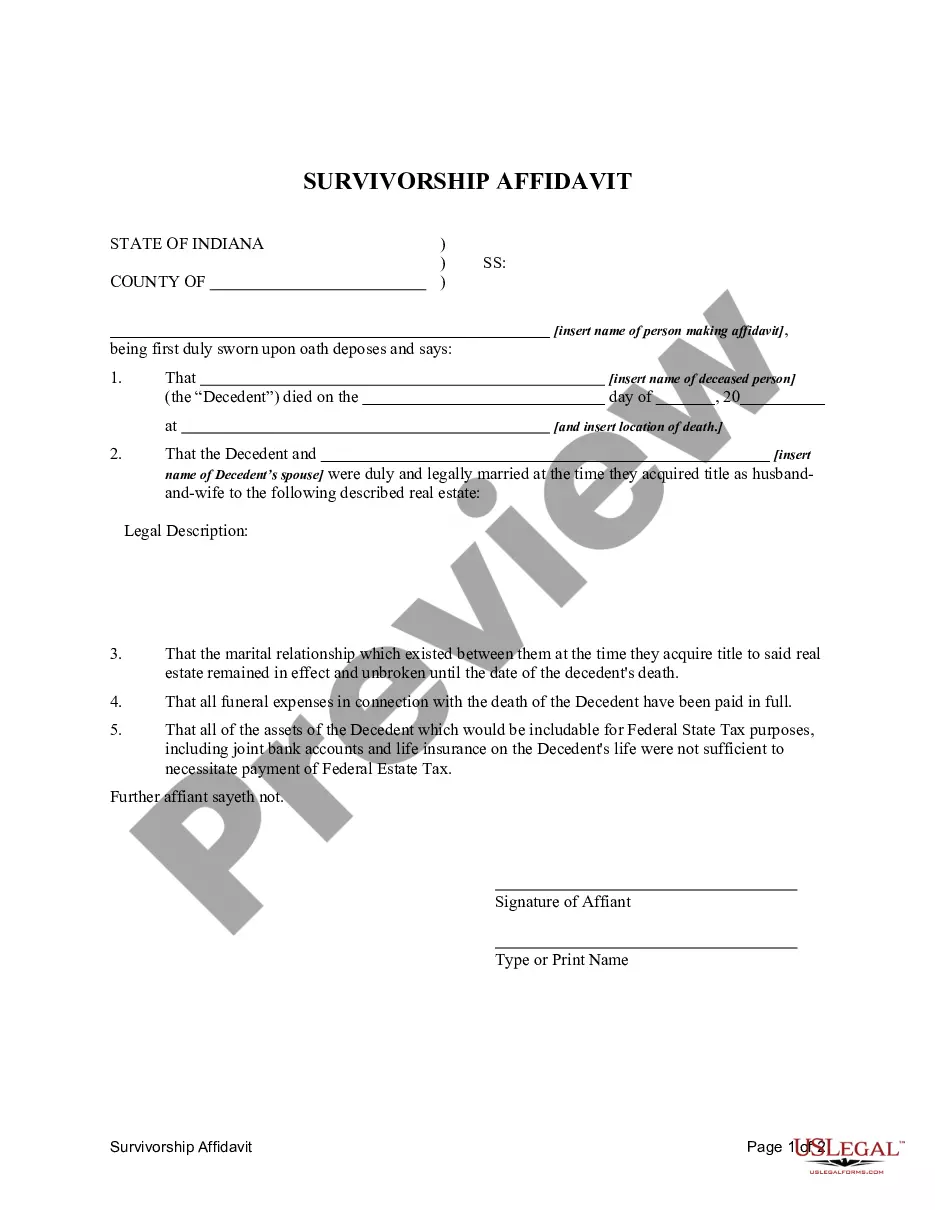

The Survivorship Affidavit is a legal document used to verify the identity of a survivor in a joint tenancy or other property ownership arrangement. This form is essential for establishing the right of a surviving co-owner to inherit property upon the death of the other co-owner, distinguishing it from other forms such as wills or estate declarations.

Key parts of this document

- Verification of the decedent's death and identity of the survivor.

- Statement confirming that all funeral expenses have been paid in full.

- Assertion regarding the decedent's assets in relation to federal estate tax requirements.

- Affiantâs declaration that no other matters necessitate further legal action.

When this form is needed

This form is typically used when a co-owner of property passes away, leaving the other owner as the survivor. It is necessary to assert the survivor's right to the property and to facilitate the transfer of ownership without requiring probate proceedings, especially when the decedentâs assets do not exceed certain tax thresholds.

Who can use this document

This form is intended for:

- Individuals who jointly own property with a deceased partner.

- Survivors seeking to secure their rights to inherited property.

- Anyone needing to clarify property rights in the absence of a will.

Steps to complete this form

- Identify the parties involved, including the decedent and the survivor.

- Provide the date and details of the decedentâs passing.

- Confirm that funeral expenses have been settled.

- Detail the decedentâs financial assets as related to federal estate tax implications.

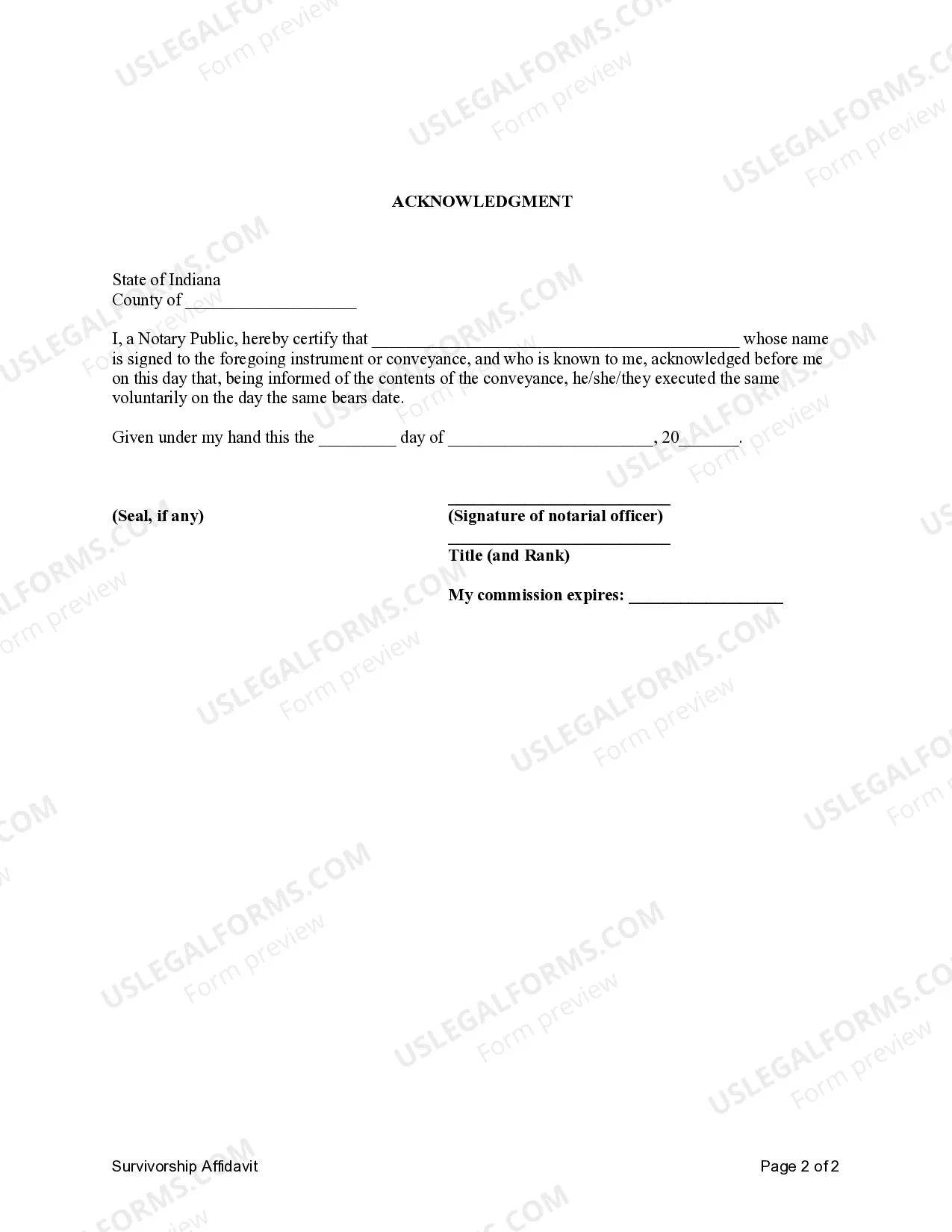

- Sign and date the affidavit before notary public, if required.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes to avoid

- Failing to complete all required fields accurately.

- Not gathering necessary documentation to prove payment of funeral expenses.

- Overlooking notarization requirements or signature verification.

Why complete this form online

- Convenient access to legal forms that can be downloaded and completed at your own pace.

- Editability to ensure all details are correct before submission.

- Reliability of being drafted by licensed attorneys, ensuring legal compliance.

Main things to remember

- The Survivorship Affidavit is crucial for confirming a survivor's rights to jointly owned assets after the death of a co-owner.

- It simplifies the transfer of ownership and can prevent lengthy probate processes.

- Accurate completion and attention to detail are essential to ensure validity and avoid common mistakes.

Form popularity

FAQ

The right of survivorship is an attribute of several types of joint ownership of property, most notably joint tenancy and tenancy in common. When jointly owned property includes a right of survivorship, the surviving owner automatically absorbs a dying owner's share of the property.

Documents must be notarized. Documents executed or acknowledged in Indiana must include a statement that includes: The names of all those signing or serving as a witness on the document must be identical throughout the document and must be printed or typewritten under each signature.

A Survivorship Deed transfers residential or commercial property from one property owner (the grantor) to another (the grantee) while allowing them to avoid going through probate when they (the grantor) passes away. The parties transferring property in a Survivorship Deed must have full ownership of the property.

Locate the prior deed to the property. Create the new deed. Sign the new deed. Record the original deed.

The way that the right of survivorship works is that if a property is purchased and owned by two or more individuals and the right of survivorship has been included in the title to the property, then if one of the owners dies, the surviving owner or owners will absorb the share for the deceased's share of the property

1 : the legal right of the survivor of persons having joint interests in property to take the interest of the person who has died. 2 : the state of being a survivor : survival.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Can I contest a house deed with right of survivorship? Yes. However as stated above, it is very difficult to challenge the right of survivorship.

Survivorship rights take precedence over any contrary terms in a person's will because property subject to rights of survivorship is not legally part of their estate at death and so cannot be distributed through a will.