What is Probate?

Probate is the legal process involving the distribution of a deceased person's assets. It includes validating wills and settling debts. Explore templates specific to Idaho for a smoother experience.

Probate involves managing a deceased person's estate. Attorney-drafted templates make the process fast and straightforward.

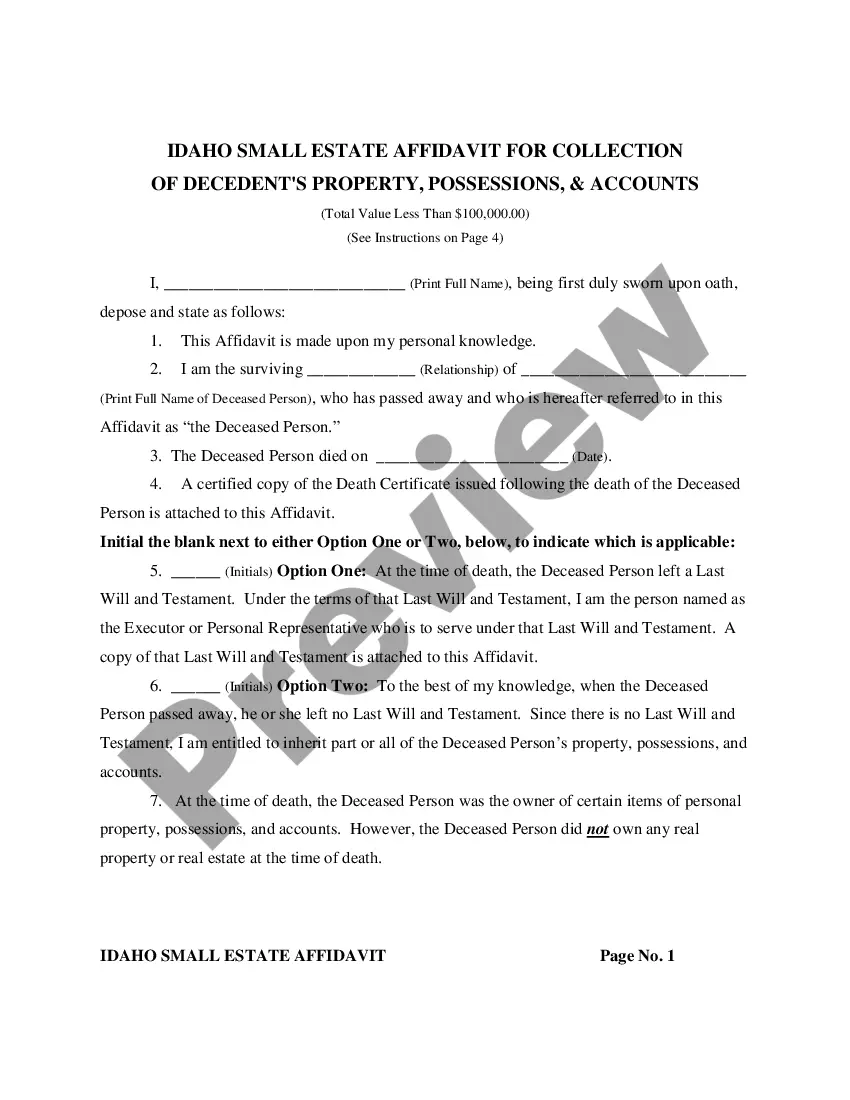

Use this affidavit to collect property from a deceased loved one without going through probate if their total assets are under $100,000.

Use this package to manage small estates efficiently without formal probate, saving time and simplifying the process.

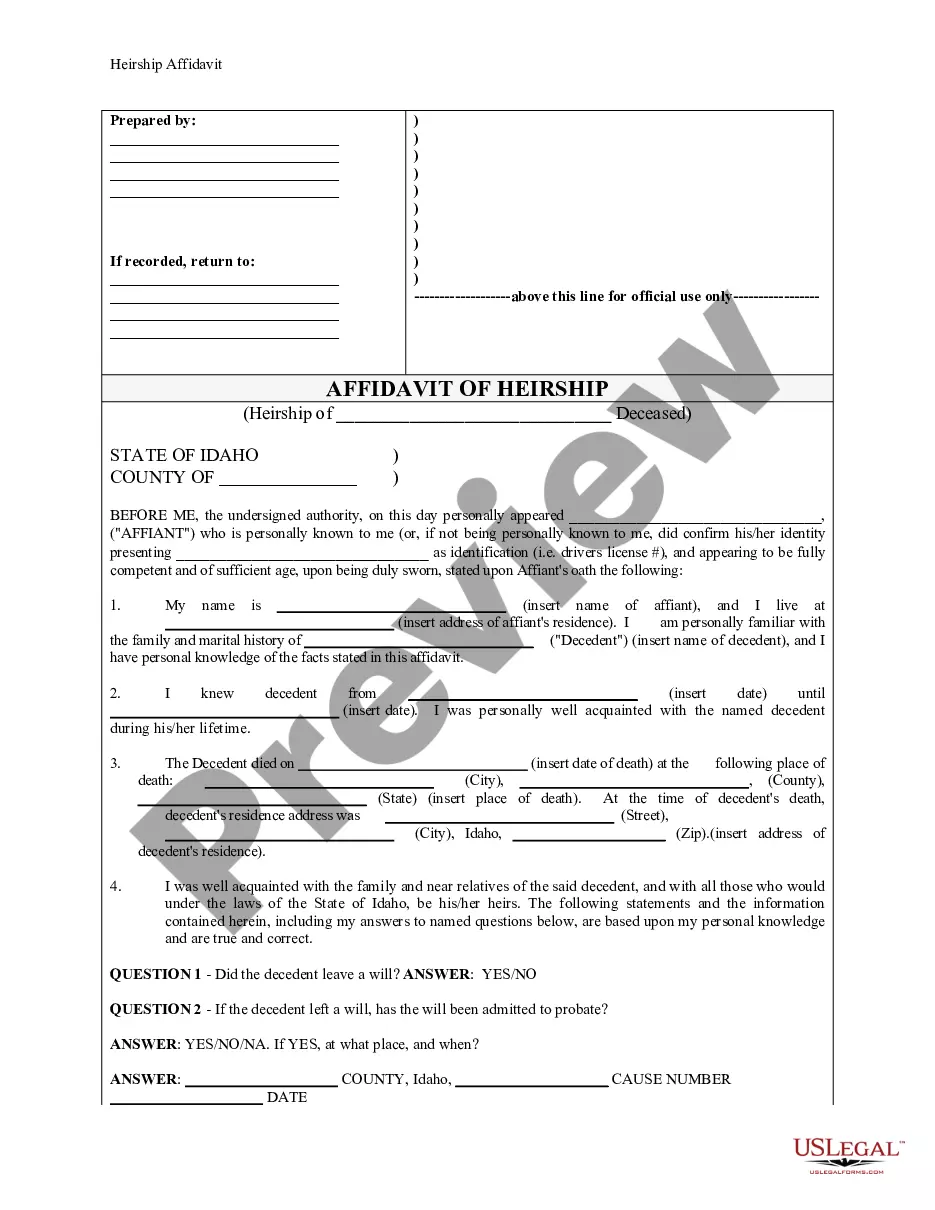

Establish rightful heirs for a deceased person without a will, crucial for transferring assets smoothly.

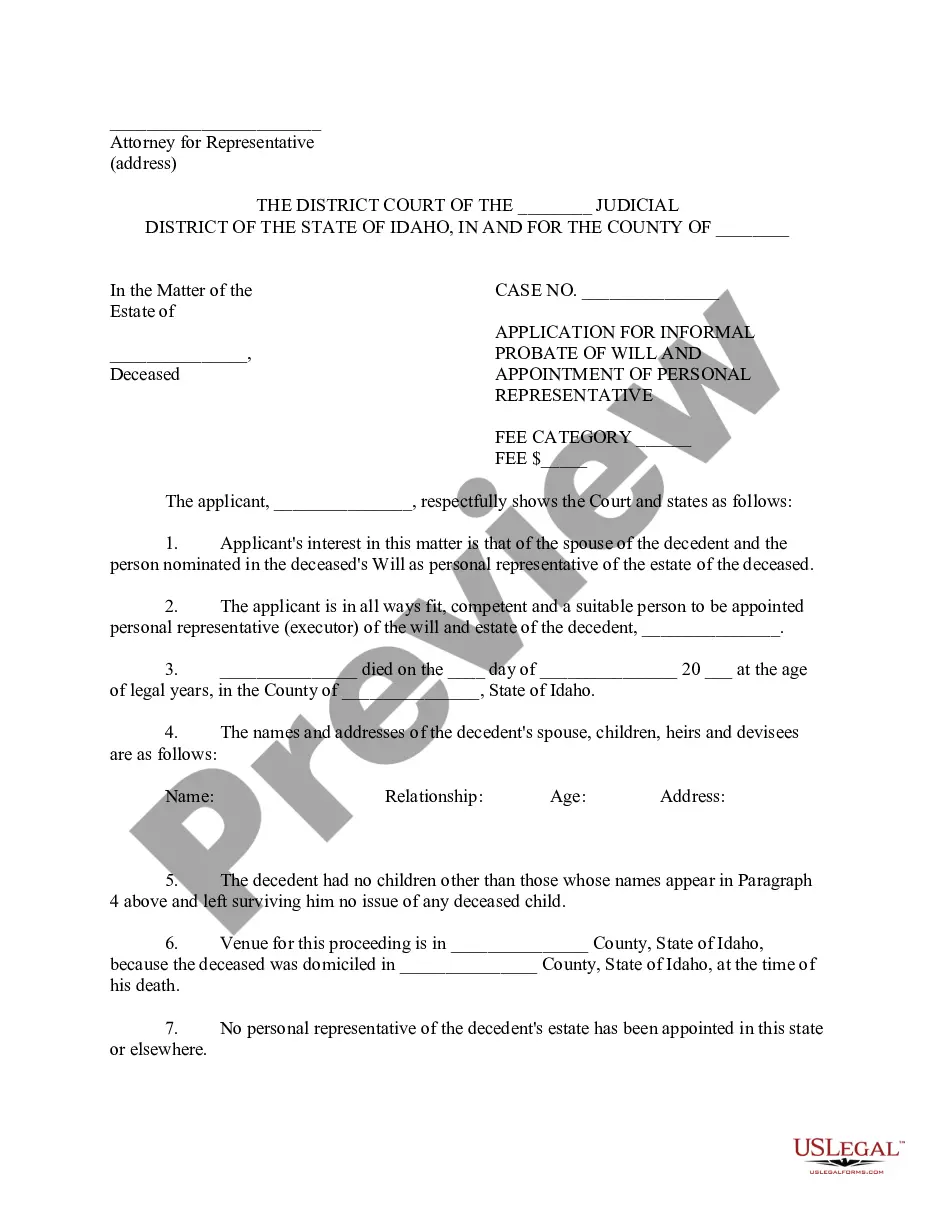

Secure informal probate and appoint a personal representative for an estate with this essential application, simplifying the process for surviving spouses.

Request a copy of a deceased person's will to ensure your rights are protected, especially as a close relative.

Use this form to informally probate a will and appoint a personal representative without the complexities of formal proceedings.

Secure your role as the personal representative of an estate after a will is probated, providing legal authority to manage the deceased's affairs.

File when you're ready to finalize the distribution of a deceased person's estate after debts are settled and legal requirements are met.

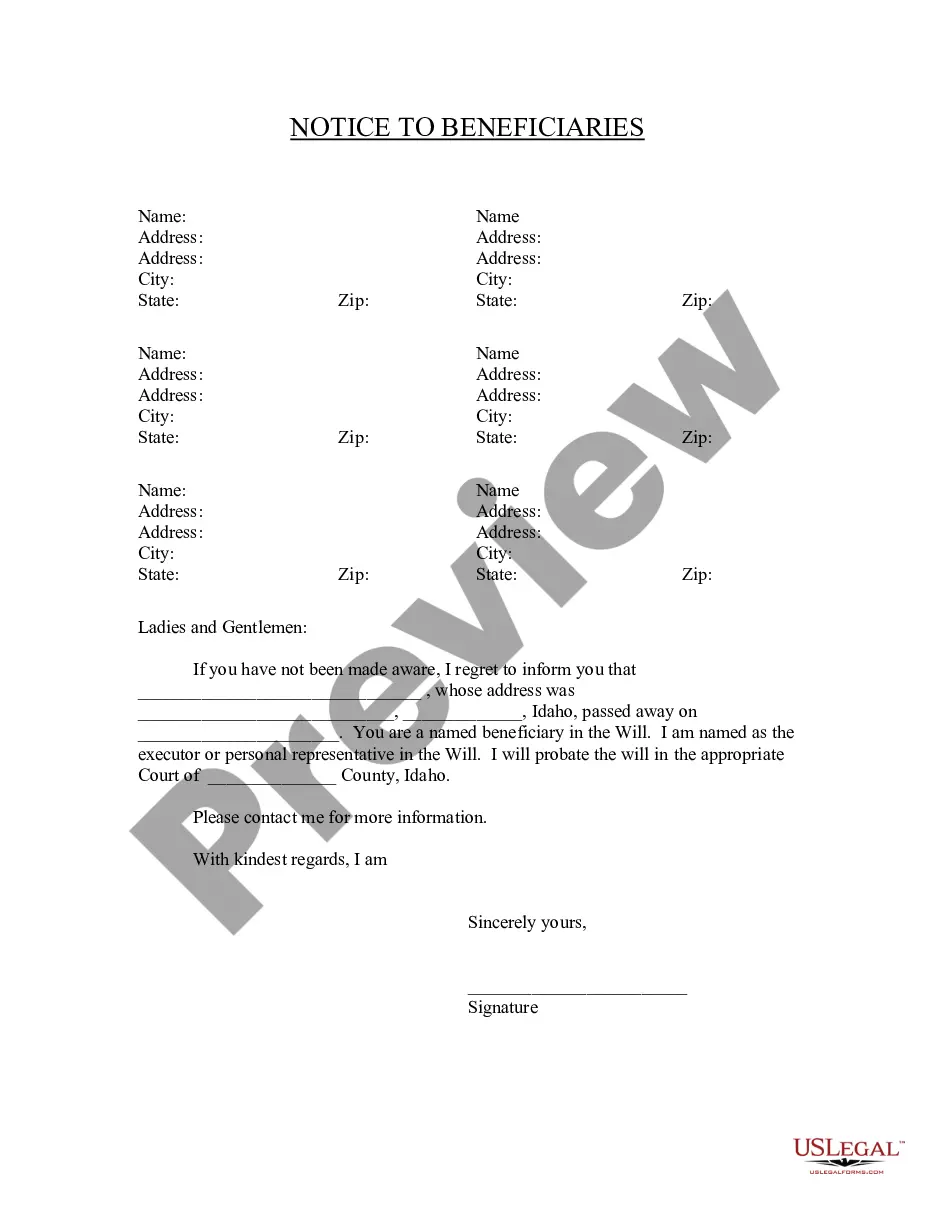

Inform heirs about their status in a deceased person's will and next steps for probate.

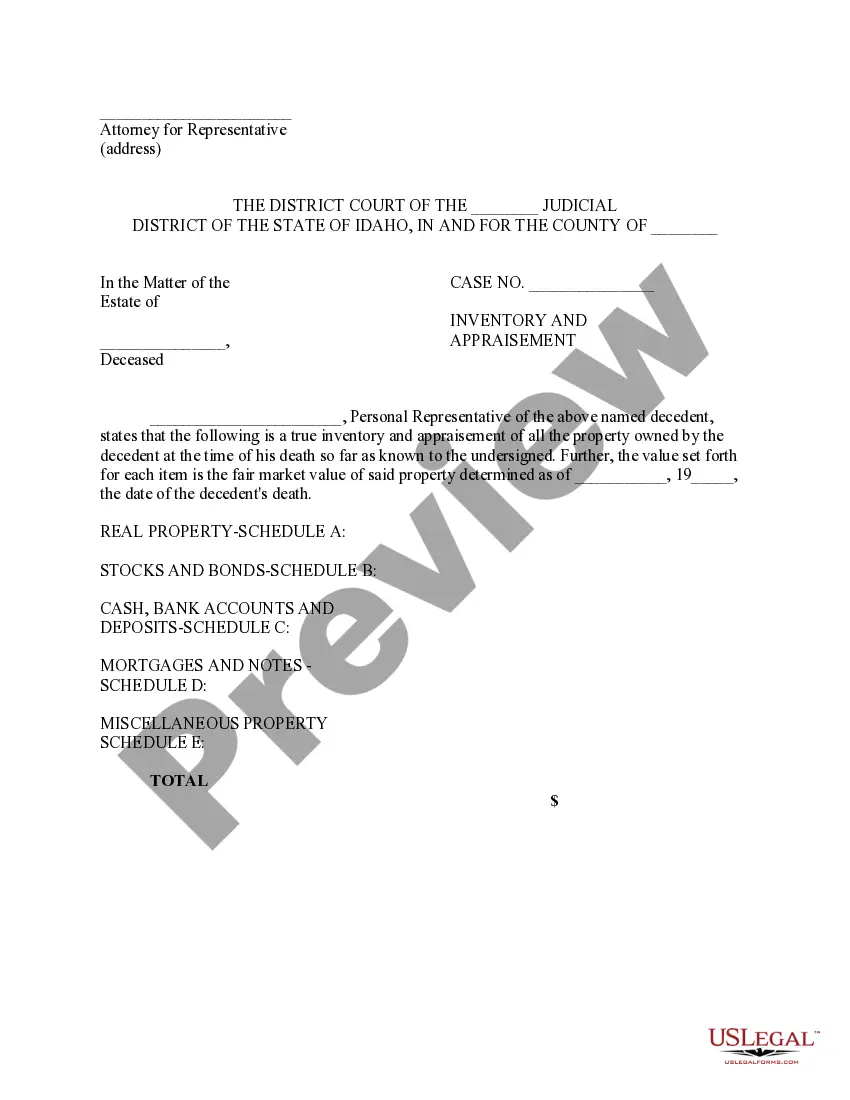

Essential for documenting a deceased person's assets and their value, this form ensures proper estate management during probate proceedings.

Probate is necessary for distributing assets and settling debts.

Wills must be validated in probate court.

Not all assets go through probate, such as those in trusts.

Probate can take several months to complete.

Heirs may contest a will during probate.

Begin your probate process with these simple steps.

A trust can help avoid probate and manage assets during your lifetime.

Without a plan, state laws dictate how your assets will be distributed.

It's wise to review your estate plan every few years or after major life events.

Beneficiary designations can override your will, directing assets outside of probate.

Yes, you can designate separate agents for financial and healthcare decisions.