Idaho Summary Administration Package for Small Estates

Overview of this form

The Summary Administration Package for Small Estates is a legal document set designed for administrators managing small estates in Idaho. This package allows the personal representative to expedite the distribution of assets without the needs for a formal court filing or extensive notice requirements. Under Idaho statutes, if the estate meets specific criteria, the assets can be distributed immediately, simplifying the probate process for smaller estates.

Key parts of this document

- Petition for Informal Appointment of Personal Representative

- Notice of Petition

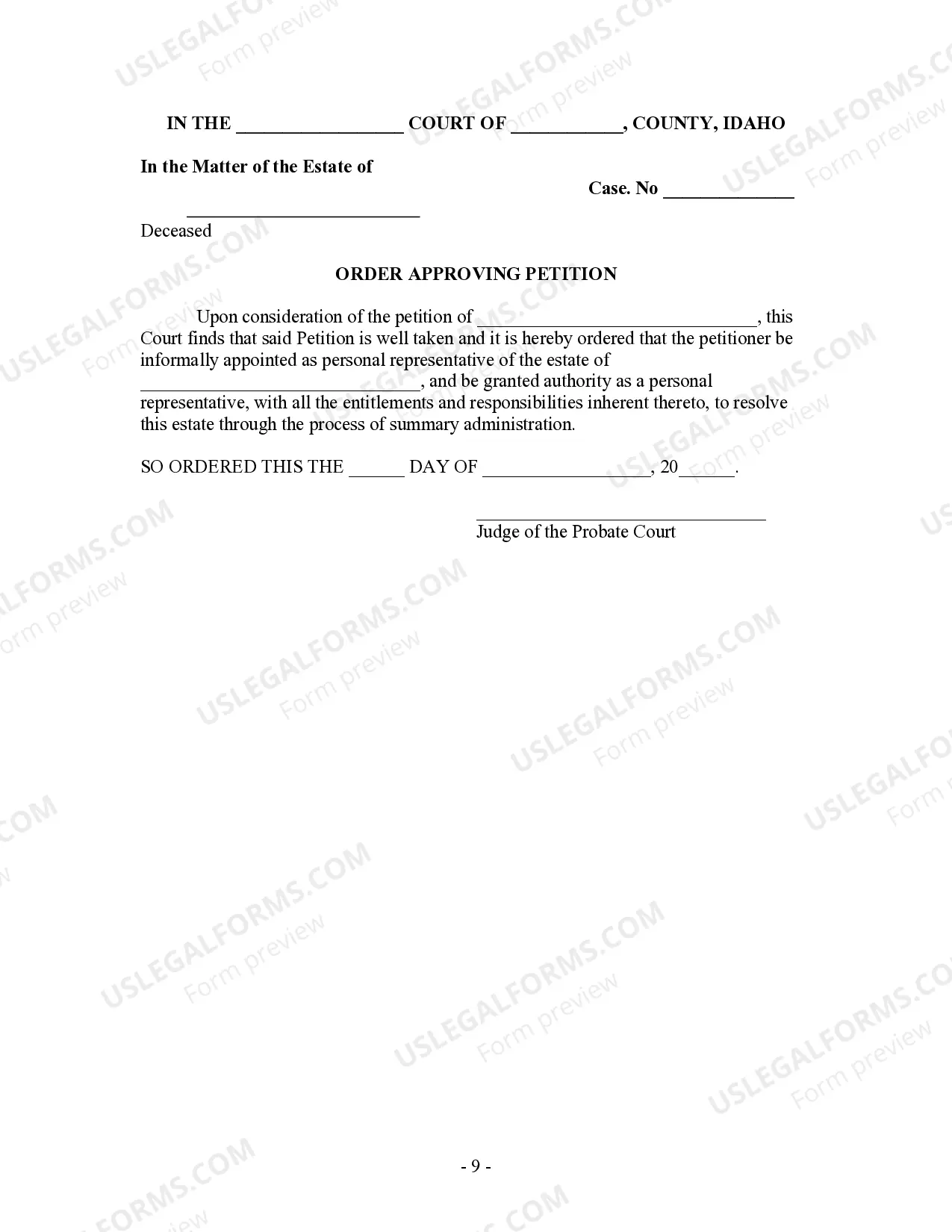

- Proposed Order Approving Petition

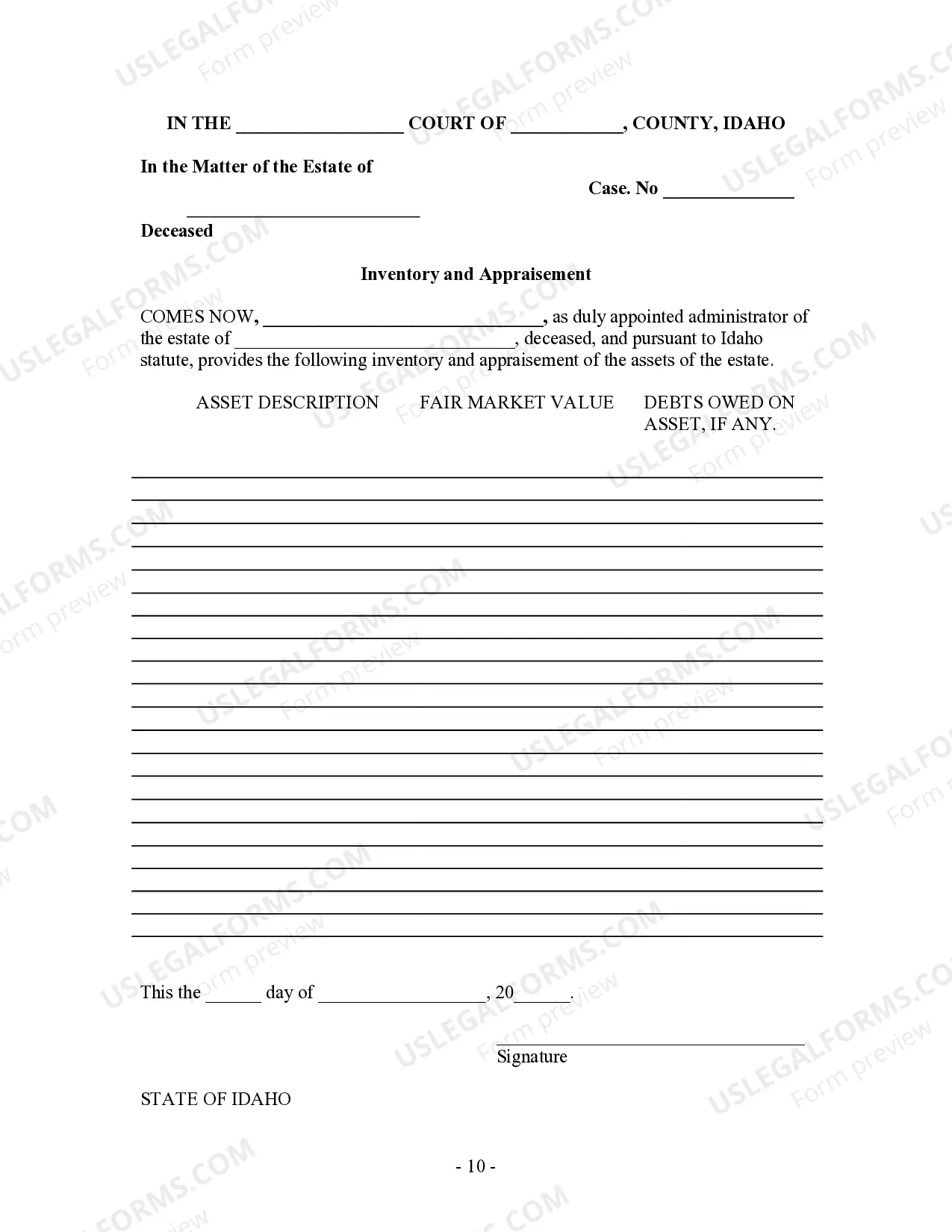

- Inventory and Appraisement

- Closing Statement

Common use cases

This form is essential when managing a decedent's estate in Idaho that qualifies as a small estate, as defined by state law. If the total value of the estate is below the threshold specified under Idaho Code, this package allows for a more straightforward and quicker distribution of the decedent's assets to the rightful heirs without extensive court involvement.

Who needs this form

- Personal representatives of decedents who have passed away with a small estate in Idaho.

- Individuals who have been designated as heirs or beneficiaries of such estates.

- Surviving spouses who are the sole beneficiaries of the decedent's estate.

How to prepare this document

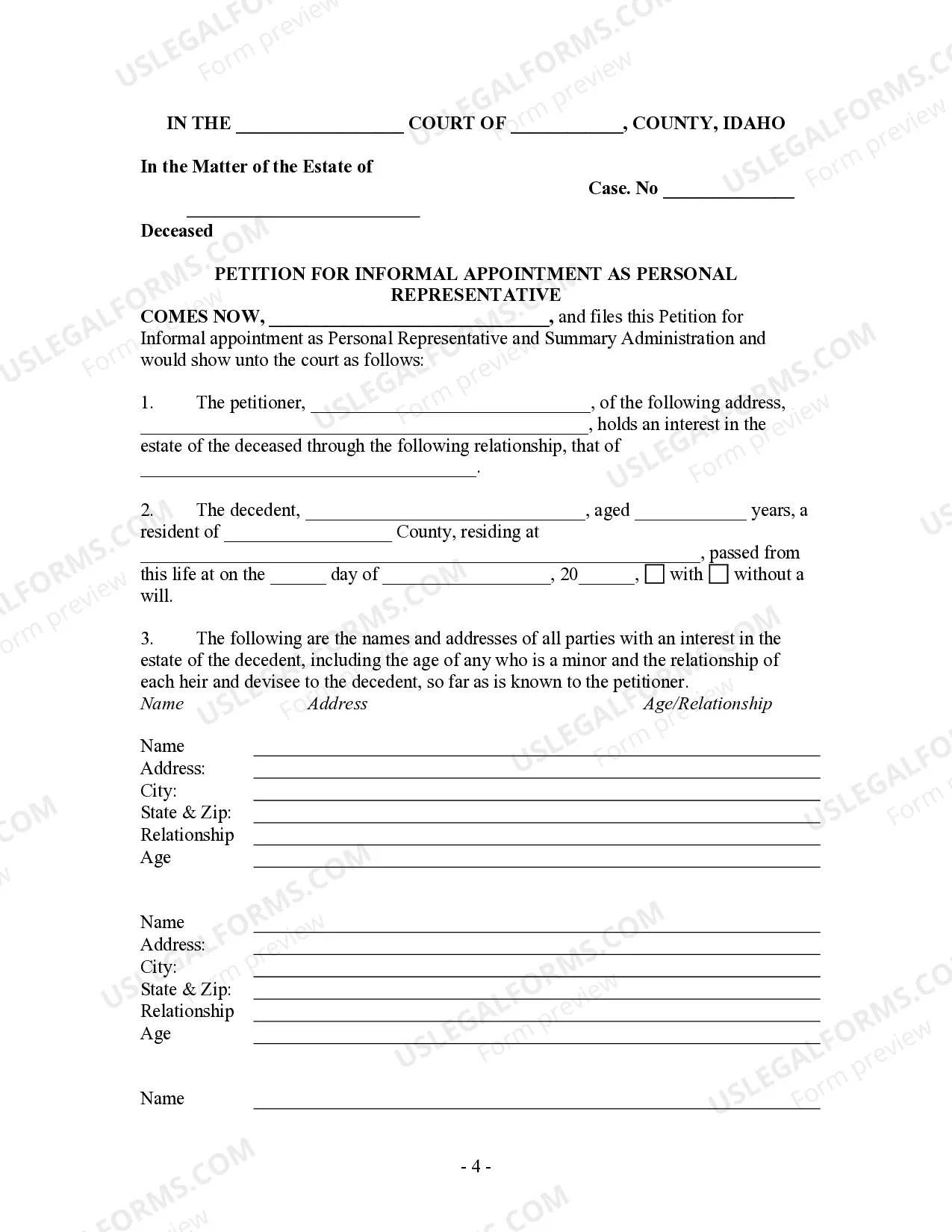

- Identify the parties involved, including the personal representative and decedent.

- Complete the Petition for Informal Appointment of Personal Representative with necessary details.

- Provide a Notice of Petition to interested parties as required.

- Prepare an Inventory and Appraisement of the estate's assets.

- File the Closing Statement after the assets have been distributed to the beneficiaries.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to accurately assess the total value of the estate assets.

- Not providing proper notice to all interested parties.

- Omitting necessary signatures from documents.

- Submitting incomplete forms, which can delay the administration process.

Benefits of using this form online

- Convenient access to legal forms that can be completed at your own pace.

- Editable formatting allows for easy updates before finalizing your document.

- Reliable support from U.S. Legal Forms ensures that the documents meet legal standards.

Looking for another form?

Form popularity

FAQ

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

But generally if the total value of the Estate is less than £15,000 then usually Probate will not be required. But if the deceased owned assets worth more than the threshold, you'll need to go through the Probate process.

The threshold for Probate can range from £5,000 to A£50,000, depending on which banks and financial institutions are holding the deceased person's assets.

In Idaho, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

The Costs to Probate in Idaho In Idaho the filing fee for doing a probate is $166. After that the total costs and fees for most average estates that we complete for our clients is somewhere between $2,000 to $2,500.