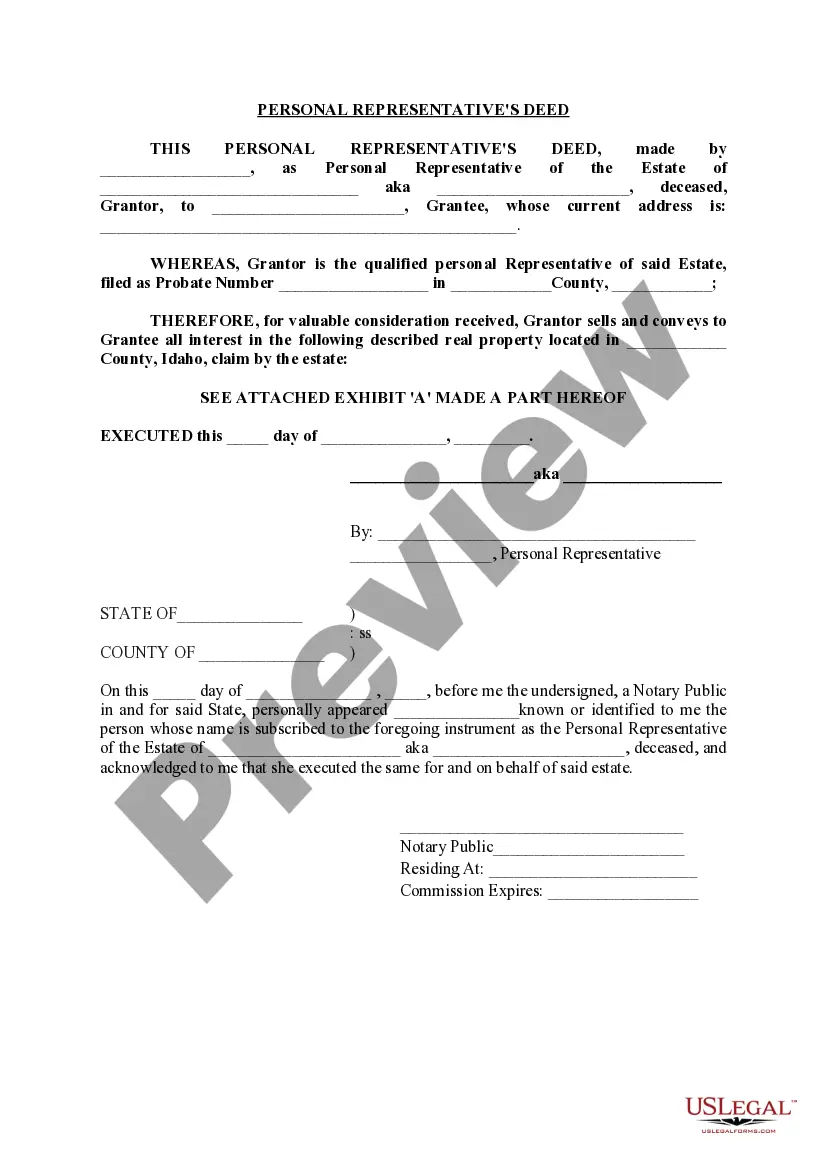

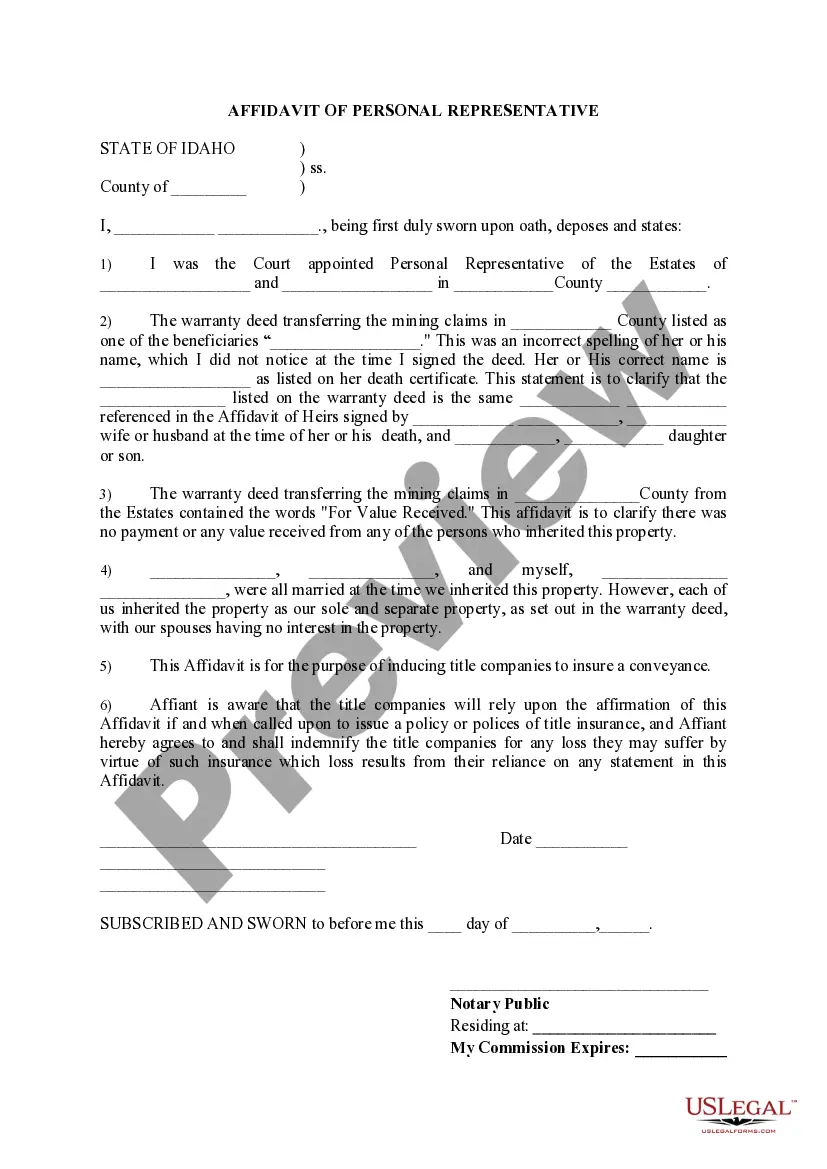

Idaho Affidavit of Personal Representative

Description

How to fill out Idaho Affidavit Of Personal Representative?

Utilize US Legal Forms to acquire a printable Idaho Affidavit of Personal Representative.

Our court-accepted documents are composed and frequently refreshed by experienced attorneys.

Ours is the most extensive Forms collection available online and provides cost-effective and precise examples for individuals, legal practitioners, and small to medium-sized businesses.

Select Buy Now if it’s the document you require. Create your account and pay via PayPal or with a credit card. Download the form to your device and feel free to reuse it multiple times. Utilize the Search field if you're looking for another document template. US Legal Forms offers a vast array of legal and tax templates and packages for business and personal requirements, including the Idaho Affidavit of Personal Representative. Over three million users have successfully used our platform. Choose your subscription plan and obtain high-quality forms in just a few clicks.

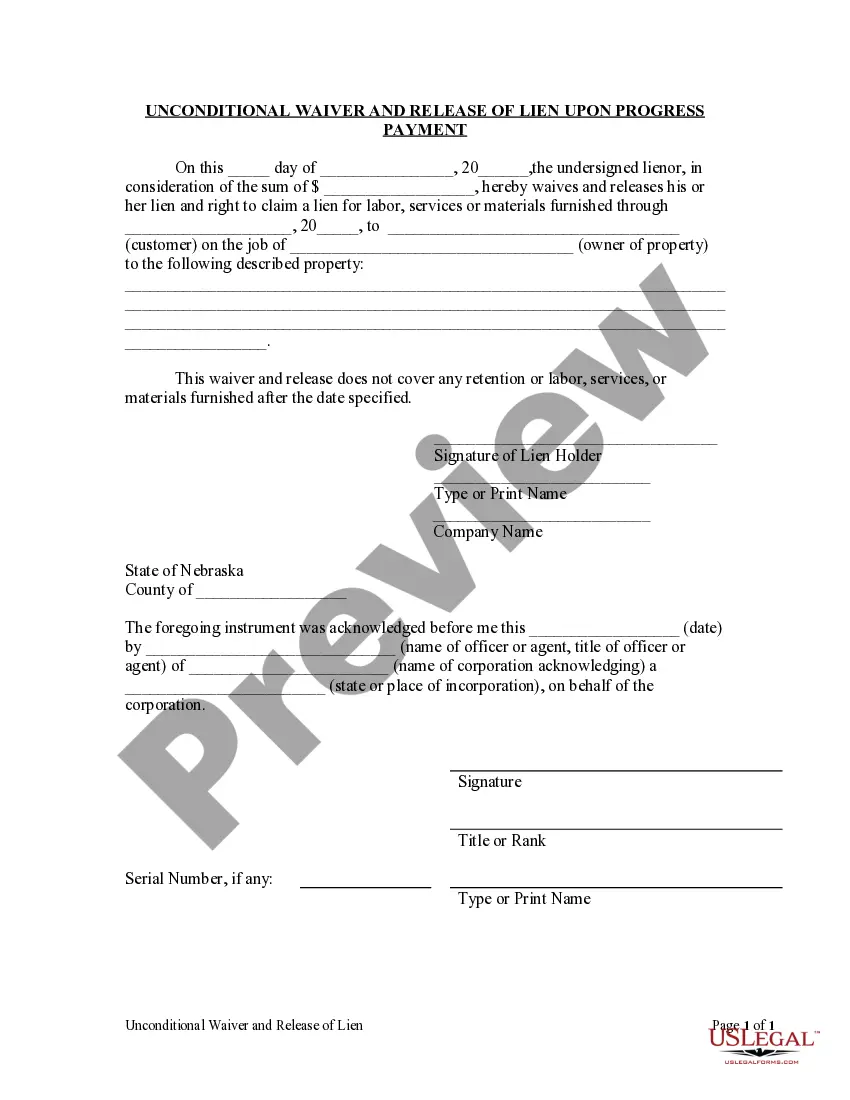

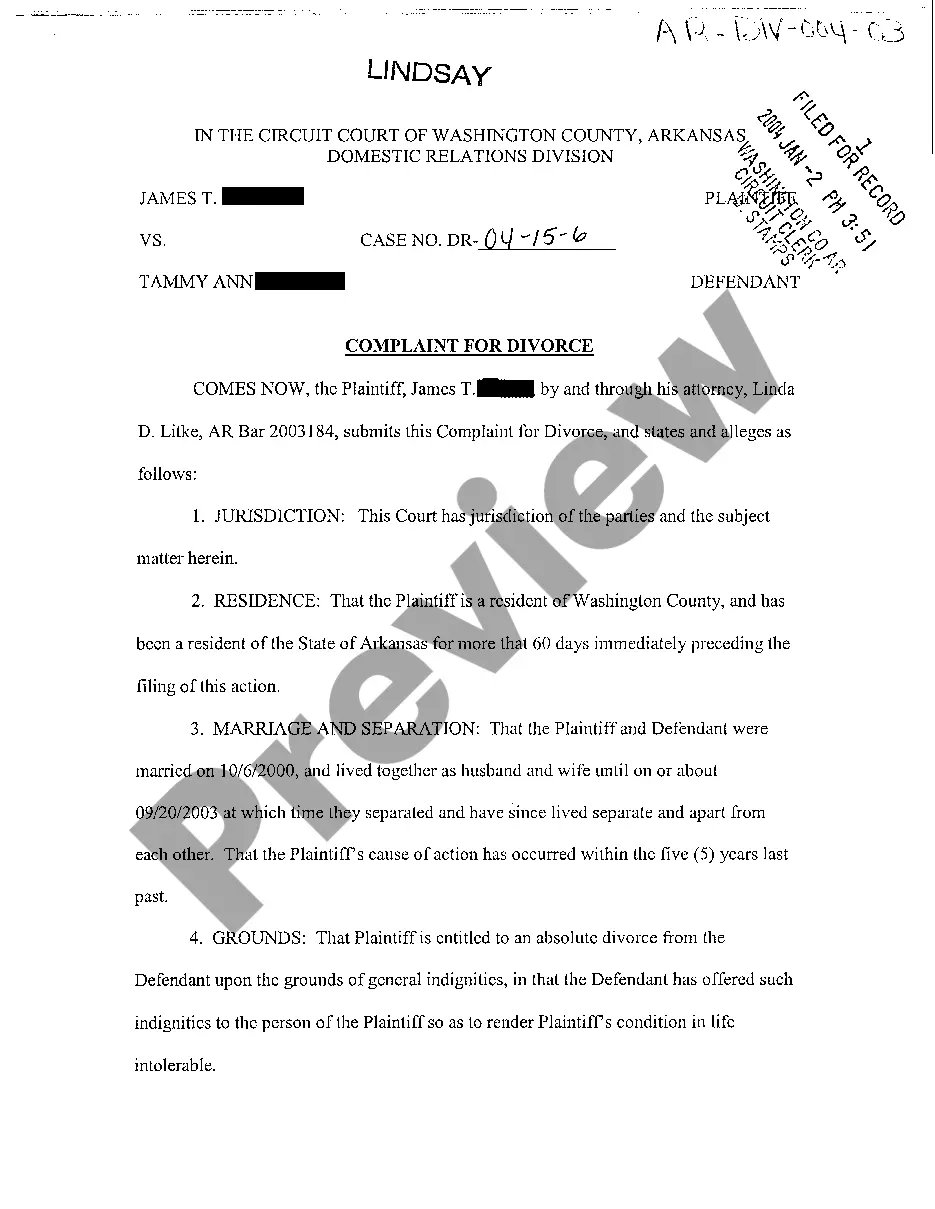

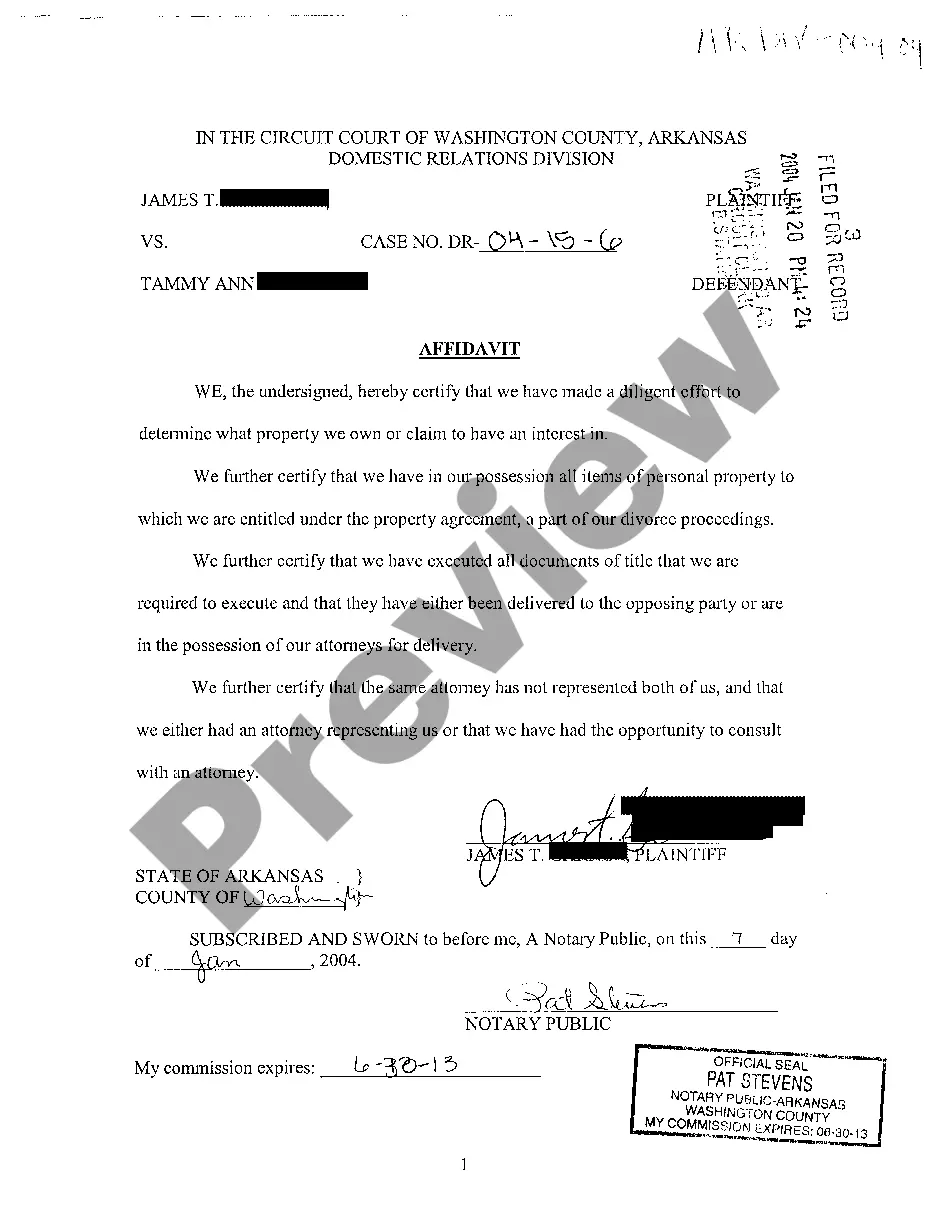

- The papers are organized into state-specific categories, and many can be previewed before downloading.

- To retrieve templates, users need to possess a subscription and must Log In to their account.

- Click Download next to any template you desire and locate it in My documents.

- For those lacking a subscription, follow these instructions to swiftly locate and download the Idaho Affidavit of Personal Representative.

- Verify that you have the correct form pertinent to the state it is required in.

- Examine the document by perusing the description and utilizing the Preview function.

Form popularity

FAQ

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

According to California statutes, a personal representative must use ordinary care and diligence and act reasonably and in good faith in administering the estate. The personal representative has a fiduciary duty toward the estate and interested parties like heirs, will beneficiaries and estate creditors.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).