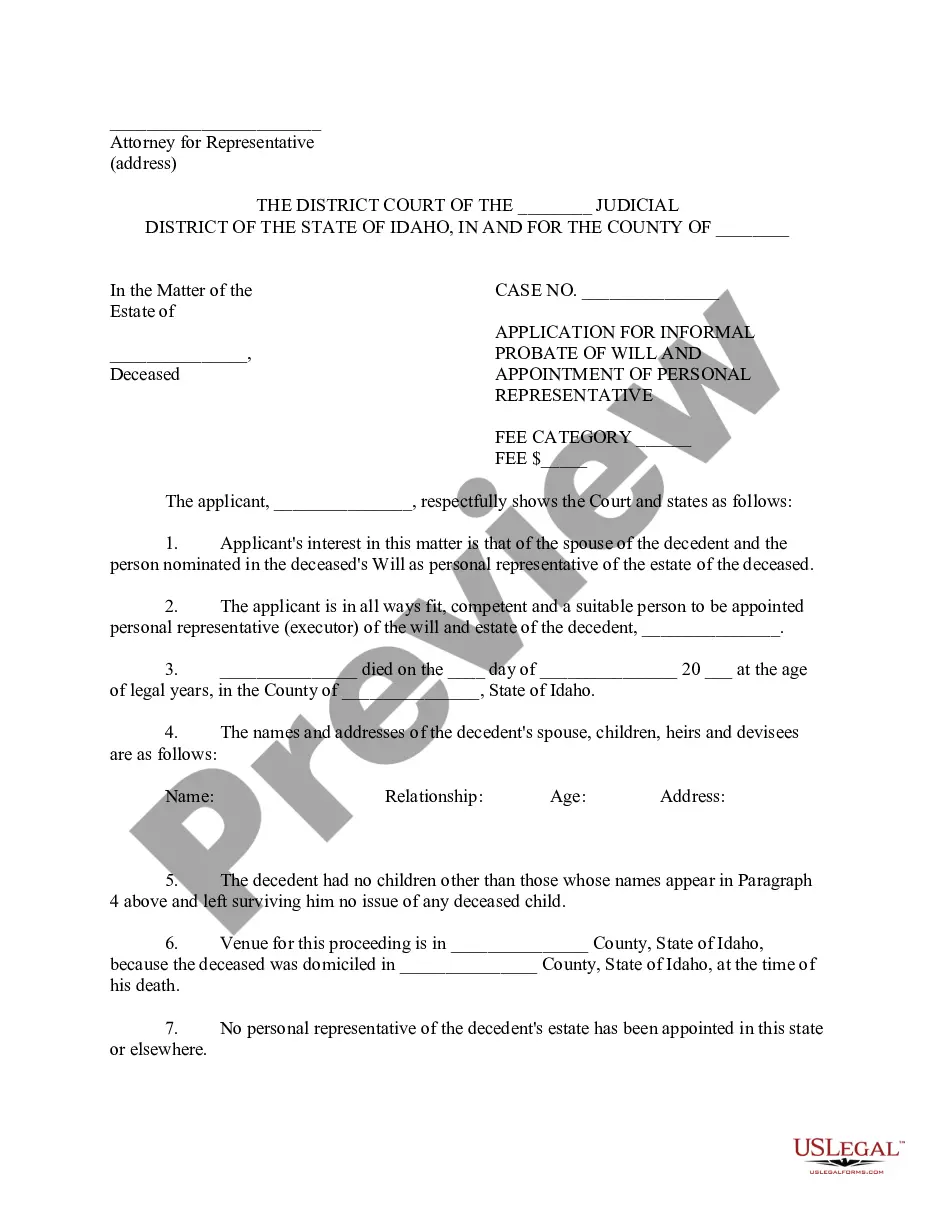

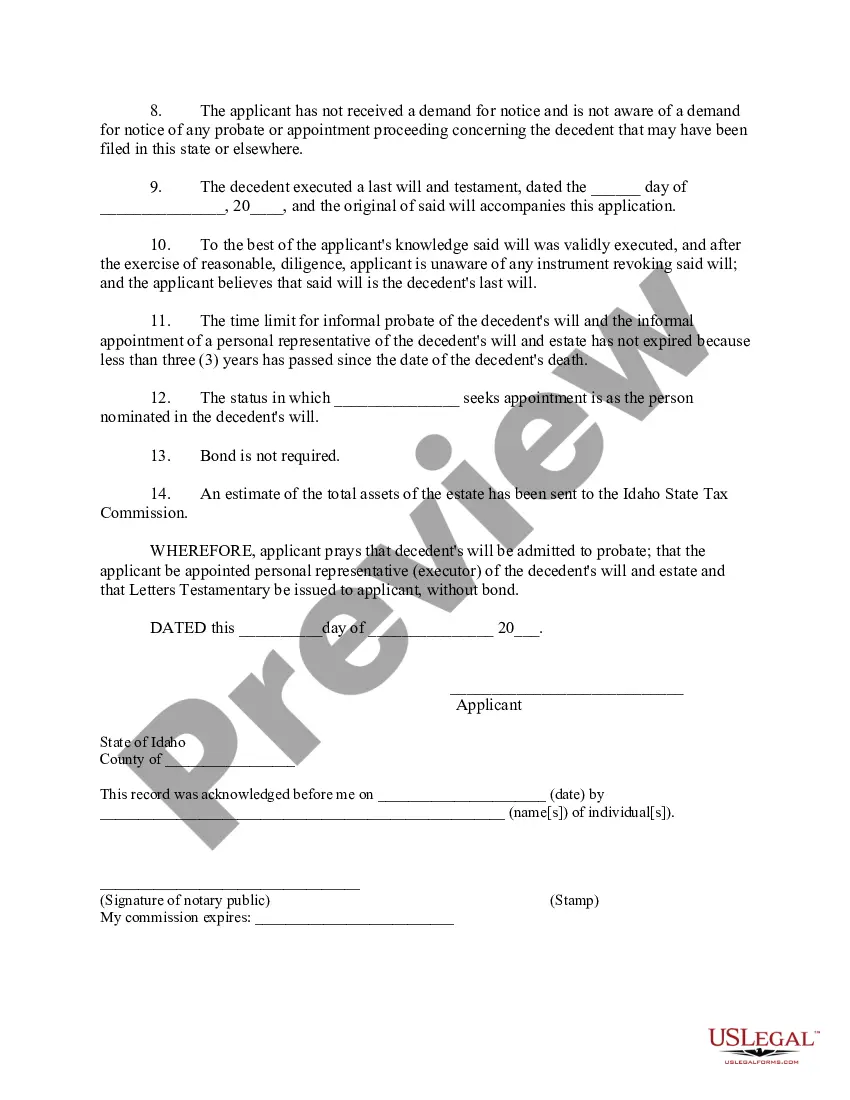

Idaho Application for Informal Probate of Will and Appointment of Personal Representative

About this form

The Application for Informal Probate of Will and Appointment of Personal Representative is a legal document that initiates probate proceedings on a deceased person's will, which the court possesses. This form is specifically designed for situations where the estate's personal representative needs to be appointed. Unlike other probate forms, this application allows for an informal process, streamlining the legal procedures necessary to manage the deceased's estate.

Main sections of this form

- Identification of the applicant and their relationship to the deceased.

- Details regarding the deceased, including name, date of death, and domicile.

- List of heirs and beneficiaries entitled to the estate.

- Confirmation that no previous personal representative has been appointed.

- Statement about the validity of the will and whether it has been revoked.

- Request for the court to admit the will to probate and grant letters testamentary.

When to use this document

This form is essential when a loved one has passed away, and you need to start the probate process for their estate. Use this application if you are named as the personal representative in the deceased's will and wish to manage the estate without going through a full judicial probate process. This form is particularly helpful for small estates or when there is no dispute over the will.

Who needs this form

Eligible users of this form include:

- Spouses of the deceased who are named in the will.

- Children or other individuals listed as beneficiaries in the will.

- Anyone who believes they have a legal right to administer the estate.

Steps to complete this form

- Provide your contact information and that of the deceased.

- List the names and addresses of all heirs and beneficiaries.

- Indicate the date of death and confirm the domicile of the deceased.

- Attach the original will to the application and indicate its execution date.

- Complete the affirmation and sign the document in front of a notary.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Common mistakes

- Failing to include all required signatures, especially from witnesses or notaries.

- Not listing all heirs or beneficiaries, which can lead to delays.

- Error in the dates mentioned, which may affect the validity of the probate process.

- Providing incomplete or incorrect information regarding the deceased's domicile.

Why use this form online

- Convenient access to the form at any time, allowing for easy completion from home.

- Editable formats (Word and Rich Text) facilitate customization and accuracy.

- Ensures compliance with legal standards, as the documents are prepared by licensed attorneys.

Summary of main points

- The Application for Informal Probate of Will facilitates the quick initiation of probate proceedings for a deceased's estate.

- Proper completion and notarization of the form are crucial for its acceptance by the court.

- This form is primarily used by individuals designated as personal representatives in a will.

Form popularity

FAQ

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

The Costs to Probate in Idaho In Idaho the filing fee for doing a probate is $166. After that the total costs and fees for most average estates that we complete for our clients is somewhere between $2,000 to $2,500.

Idaho has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).