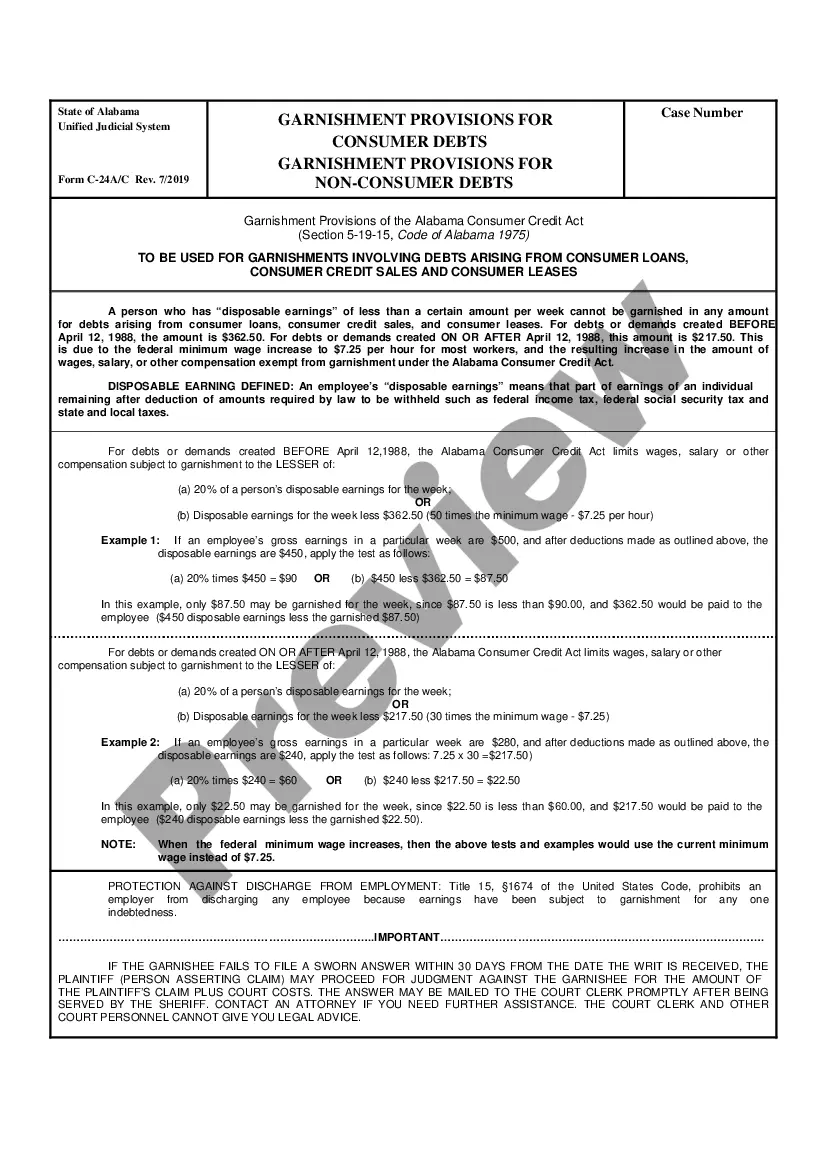

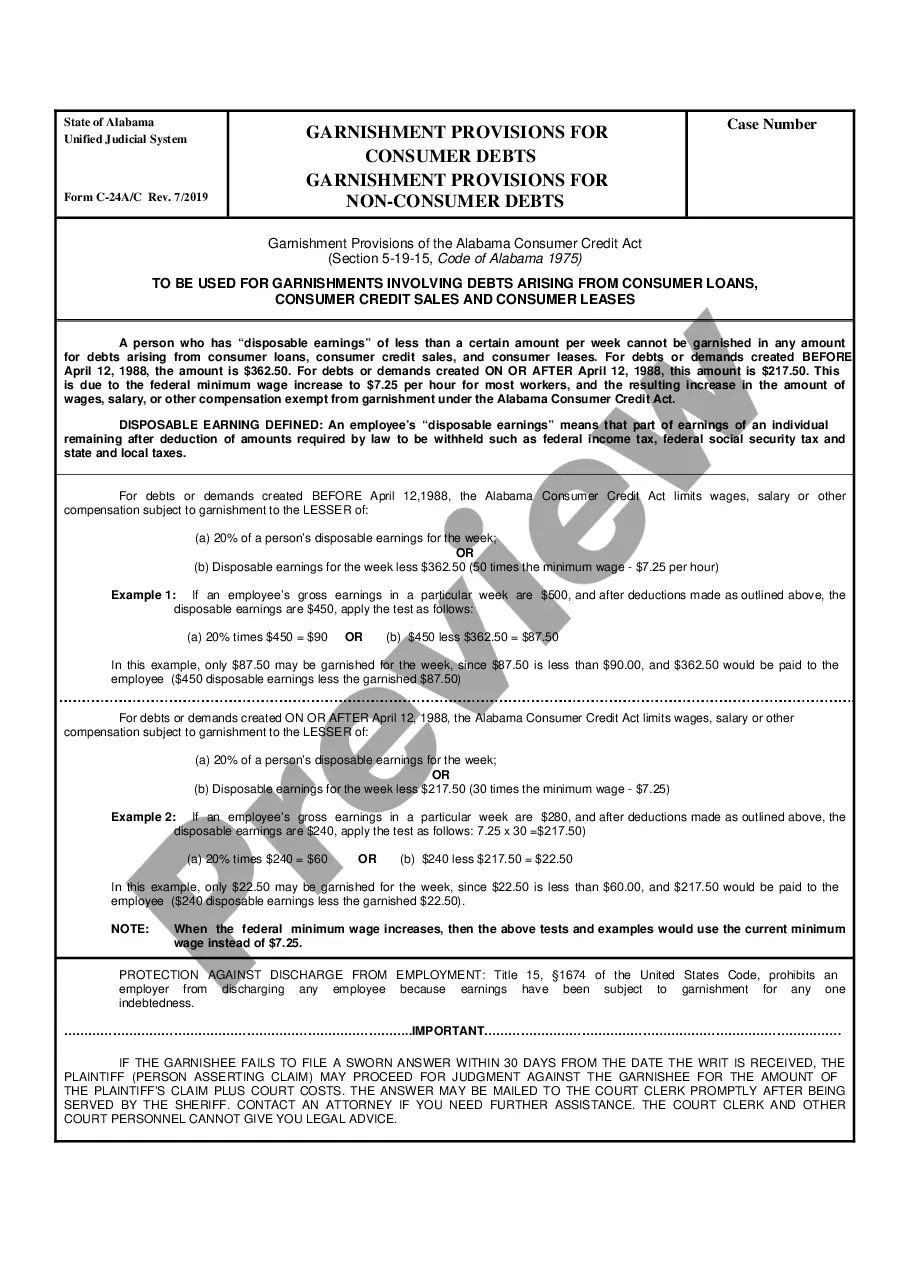

Garnishment Provisions for Consumer Debts and Non Consumer Debts, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama st

Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts

Description

How to fill out Alabama Garnishment Provisions For Consumer Debts And Non Consumer Debts?

Utilizing Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts templates crafted by professional attorneys helps you avoid stress when completing forms. Simply download the template from our site, fill it in, and ask a lawyer to review it. By doing so, you can save considerably more time and effort than having an attorney draft a document tailored to your specifications.

If you possess a US Legal Forms subscription, just Log In to your account and navigate back to the form page. Locate the Download button next to the template you're examining. After downloading a template, you will see all your saved documents in the My documents section.

If you lack a subscription, that's not a significant issue. Just follow the simple guide below to register for your online account, obtain, and fill out your Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts template.

Once you have completed all the steps mentioned above, you will be able to fill out, print, and sign the Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts template. Ensure to verify all entered information for accuracy before submission or dispatch. Minimize the time spent on document creation with US Legal Forms!

- Verify that you are downloading the correct state-specific document.

- Use the Preview feature and examine the description (if present) to determine if you require this particular template; if you do, just click Buy Now.

- Search for another document using the Search field if needed.

- Choose a subscription that fits your requirements.

- Proceed with your credit card or PayPal account.

- Select a file format and download your document.

Form popularity

FAQ

Alabama has specific rules governing garnishment that dictate the percentage of wages subject to garnishment and procedures for notification. These rules differ based on whether the debt is classified as consumer or non-consumer. Understanding the Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts helps ensure you are aware of your rights and responsibilities as a debtor. Consulting with legal experts or resources like uslegalforms may provide the guidance you need.

To stop a wage garnishment immediately in Alabama, you need to act promptly and often involve the court system. You may file for an exemption if you qualify, which can halt the garnishment process. Familiarity with the Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts streamlines this process for you. Consider using platforms like uslegalforms to help you with the necessary paperwork.

The garnishment rule in Alabama dictates how much of your wages can be taken for debt repayment. This rule varies for consumer debts and non-consumer debts, making it essential to understand these Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts. By being aware of these regulations, you can better manage your financial situation and avoid misunderstandings. Knowing your rights can empower you during a garnishment process.

In Alabama, wages can typically be garnished immediately after a default judgment is entered. This means creditors may take action without further notice to you. Understanding the Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts can prepare you for this reality. It's crucial to act quickly if you want to explore options that may prevent garnishment.

You can stop a garnishment in Alabama, but it usually requires a legal process. You may need to file a motion with the court, claiming an exemption or disputing the validity of the garnishment. Understanding the Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts helps you navigate this process more effectively. Legal assistance can be invaluable in pursuing this option.

In Alabama, the maximum garnishment amount for consumer debts typically limits to 25% of your disposable earnings. However, for non-consumer debts, different rules may apply. It's important to understand these Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts to manage your financial obligations effectively. Consulting an expert can help clarify specific situations.

To claim an exemption from wage garnishment in Alabama, you must file a claim with the court. Familiarize yourself with the applicable Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts to understand what exemptions may apply to you. Generally, exemptions can vary based on income level, type of debt, and specific circumstances. It is advisable to seek legal assistance or use resources like US Legal Forms to access necessary documentation and guidance.

To write a hardship letter that aims to stop a garnishment, begin by explaining your current financial situation in a straightforward manner. Cite the Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts to strengthen your request. Clearly state how the garnishment impacts your ability to cover essential expenses, such as rent and utilities. Remember to offer possible alternatives, such as a reduced payment plan.

When writing a letter to stop wage garnishment, start by clearly stating your intent to dispute the garnishment. Include your personal information, such as your name and address, and reference the Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts. Be sure to outline your reasons for stopping the garnishment, and provide any supporting documentation that can bolster your case. It’s best to send this letter via certified mail for record keeping.

To stop wage garnishment in Alabama, you can take several steps. First, you may need to challenge the garnishment in court, based on Alabama Garnishment Provisions for Consumer Debts and Non Consumer Debts. Additionally, you can file for bankruptcy, which could halt the garnishment temporarily. Lastly, consider negotiating a payment plan with your creditor to avoid further legal actions.