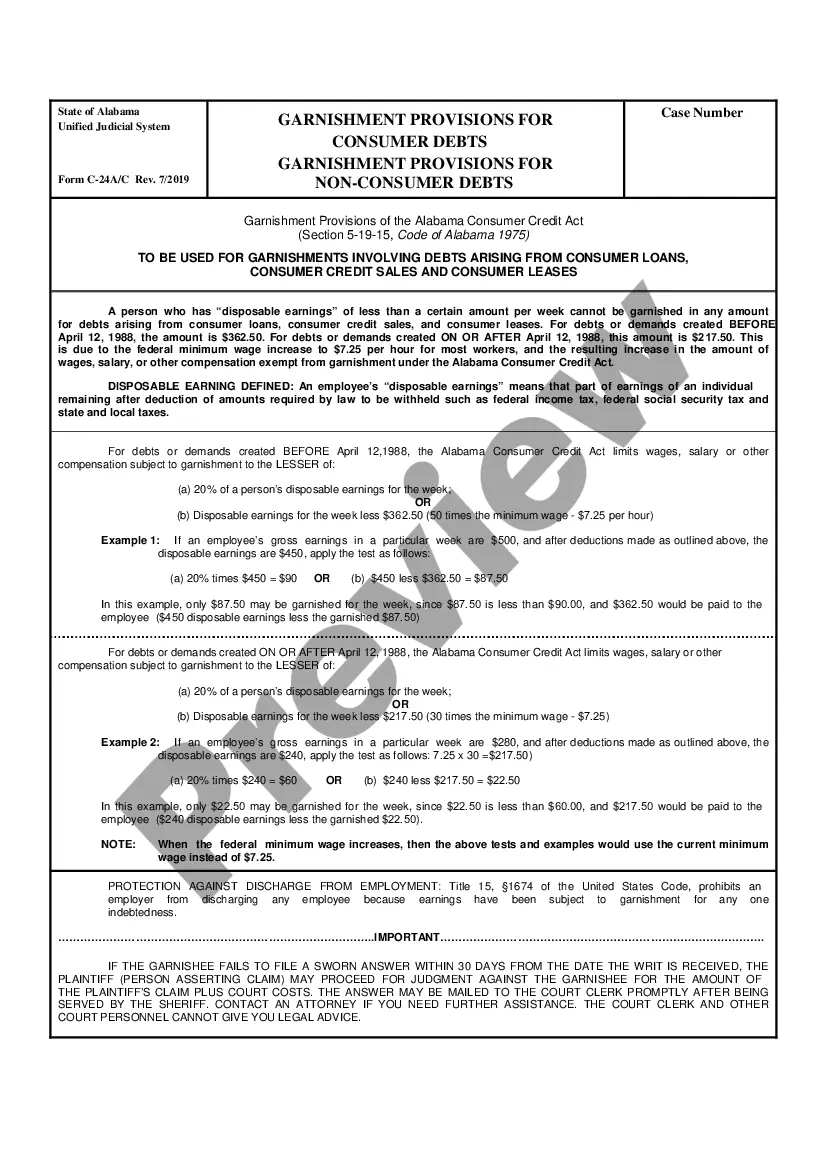

Alabama Official Form - Garnishment Provision for Consumer Debts, Garnishment Provisions for Non-Consumer Debts pursuant to the Alabama Consumer Credit Act.

Alabama Garnishment Provision for Consumer Debts Garnishment Provisions for Non-Consumer Debts

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Garnishment Provision For Consumer Debts Garnishment Provisions For Non-Consumer Debts?

Utilizing the Alabama Garnishment Provision for Consumer Debts and Garnishment Provisions for Non-Consumer Debts templates crafted by proficient attorneys helps you to avert stress when filing documents.

Merely download the form from our site, complete it, and have legal counsel review it.

This approach can save you significantly more time and expenses than having a lawyer draft a document entirely from the beginning to accommodate your requirements.

Once you've completed all the steps above, you will have the ability to fill out, print, and sign the Alabama Garnishment Provision for Consumer Debts and Garnishment Provisions for Non-Consumer Debts template. Be sure to verify all entered information for accuracy before submitting it or dispatching it. Reduce the time spent on document creation with US Legal Forms!

- If you possess a US Legal Forms subscription, simply Log In to your account and navigate back to the form webpage.

- Locate the Download button near the template you are reviewing.

- After downloading a file, you can find your saved samples in the My documents tab.

- In the absence of a subscription, there's no need to worry.

- Follow the step-by-step instructions below to register for your account online, obtain, and complete your Alabama Garnishment Provision for Consumer Debts and Garnishment Provisions for Non-Consumer Debts template.

- Double-check to ensure that you are downloading the correct state-specific form.

Form popularity

FAQ

To stop wage garnishment in Alabama, you may need to file a motion with the court that issued the garnishment order. This motion can request a review of your financial situation based on Alabama Garnishment Provisions for Consumer Debts and other applicable laws. Consider utilizing services like USLegalForms for guidance and templates to effectively communicate your situation to the court.

To claim an exemption from wage garnishment in Alabama, you must file a claim with the court that issued the garnishment order. Detail your financial circumstances and provide evidence of income and expenses that qualify you for an exemption under the Alabama Garnishment Provision for Consumer Debts. It is often helpful to consult legal resources or services like USLegalForms to ensure accuracy in your claim.

When writing an objection letter for wage garnishment, begin by including your name, address, and case details. Clearly outline your objections and the specific reasons you believe the garnishment is unjust, referencing relevant Alabama Garnishment Provisions for Consumer Debts or Non-Consumer Debts. Submit your letter promptly to ensure it reaches the court before the garnishment begins.

Yes, a debt collector can garnish your wages without prior notification, but they must follow legal procedures. They usually need to obtain a court order to initiate garnishment under the Alabama Garnishment Provision for Consumer Debts. It's essential to stay informed about your rights to contest any improper garnishment and seek advice on how to effectively respond.

To write a letter to stop wage garnishment, begin by addressing the debt collector with your information and the details of the garnishment. Clearly state your intention to object to the garnishment and provide reasoned arguments based on the Alabama Garnishment Provision for Consumer Debts and Garnishment Provisions for Non-Consumer Debts. Lastly, include any supporting documentation, such as proof of financial hardship, to strengthen your case.

In Alabama, creditors cannot garnish more than 25% of your disposable earnings for consumer debts. For non-consumer debts, different limits may apply based on the nature of the debt. It's vital to understand these limits under the Alabama Garnishment Provision for Consumer Debts to avoid excessive deductions from your paycheck.

To claim an exemption from wage garnishment in Alabama, you need to file a claim with the court stating your reasons. Valid exemptions may include essential expenses and income below a certain threshold. The Alabama Garnishment Provision for Consumer Debts provides guidelines on what qualifies, so it's critical to gather necessary documentation and consult legal resources to ensure your claim is successful.

If you are facing wage garnishment, some options may help alleviate this burden. Engaging with your creditor directly to negotiate a payment plan can be beneficial. Additionally, exploring legal avenues like exemptions under the Alabama Garnishment Provision for Consumer Debts may provide relief. US Legal Forms can help you understand and navigate these processes effectively.

In Alabama, garnishments must follow specific legal procedures to protect consumer rights. The Alabama Garnishment Provision for Consumer Debts outlines the maximum amounts creditors can garnish from your wages, typically limited to 25% of your disposable earnings. Non-consumer debts have different regulations, so understanding these rules is crucial.

While it may be challenging to fully avoid wage garnishment, you can consider options such as negotiating with creditors or filing for bankruptcy. These actions can sometimes halt garnishment processes under the Alabama Garnishment Provision for Consumer Debts and Garnishment Provisions for Non-Consumer Debts. It is essential to understand your circumstances and seek legal advice to explore your options.