This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

District of Columbia Accounting

Description

How to fill out District Of Columbia Accounting?

The larger amount of documentation you need to complete - the more anxious you become.

You can discover countless District of Columbia Accounting forms online, but you're uncertain which ones are reliable.

Eliminate the complexity and make finding samples much more straightforward with US Legal Forms. Acquire expertly crafted documents that are designed to comply with state regulations.

Provide the necessary details to create your account and pay for your order via PayPal or credit card. Select a convenient document format and obtain your sample. Access every document you acquire in the My documents section. Simply navigate there to fill out a new copy of the District of Columbia Accounting. Even when using expertly designed templates, it remains crucial to consider consulting a local attorney to double-check the completed form to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms account, Log In to your account, and you'll see the Download option on the District of Columbia Accounting page.

- If you’ve never used our website before, follow these steps to complete the registration process.

- Confirm that the District of Columbia Accounting is applicable in your state.

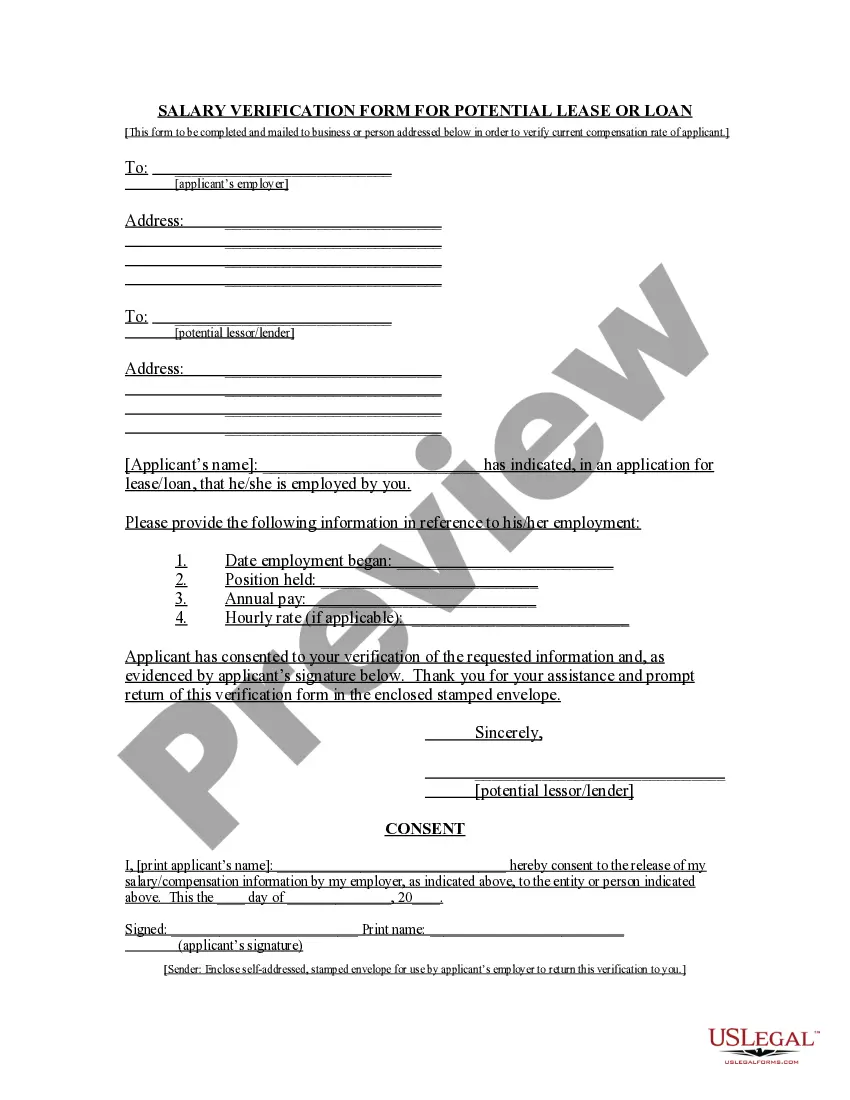

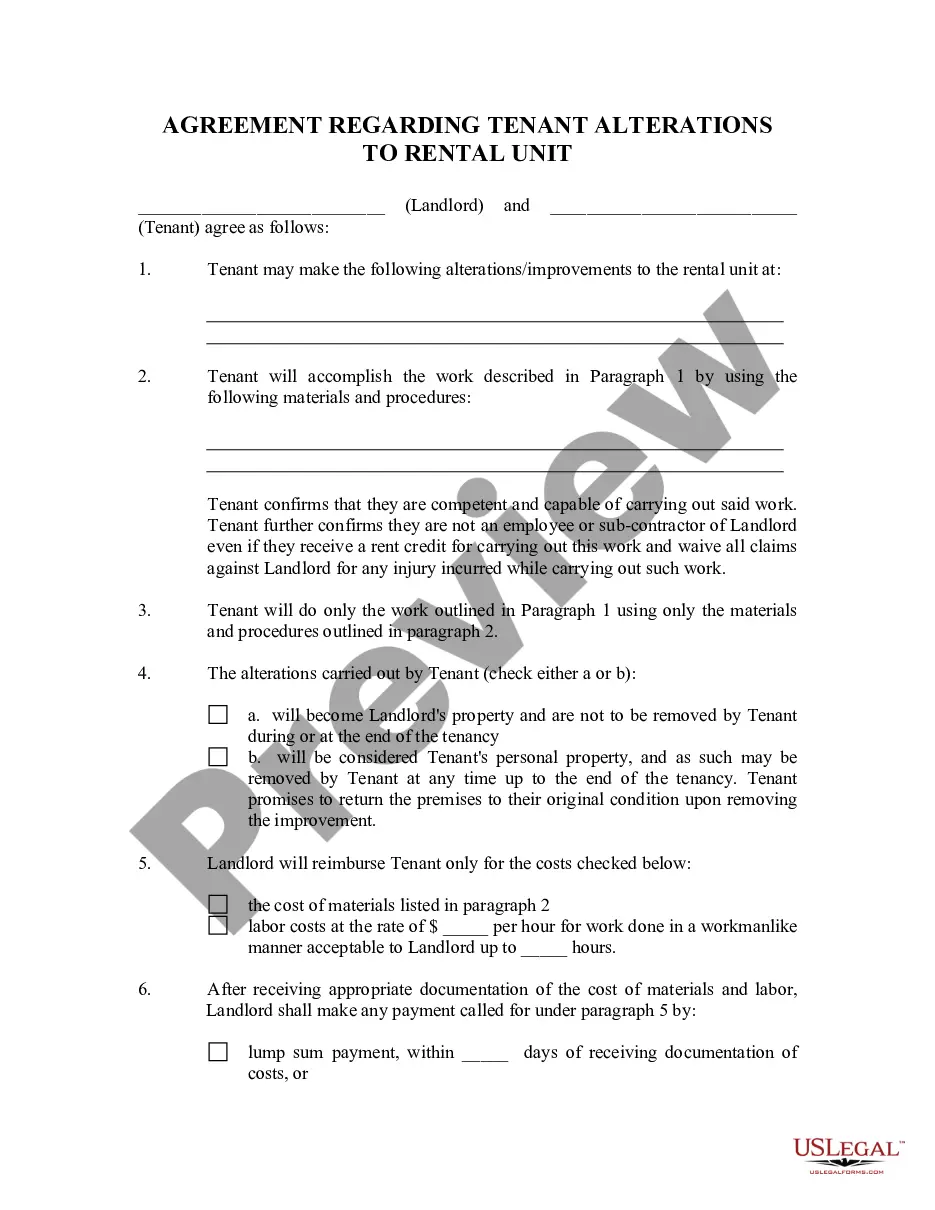

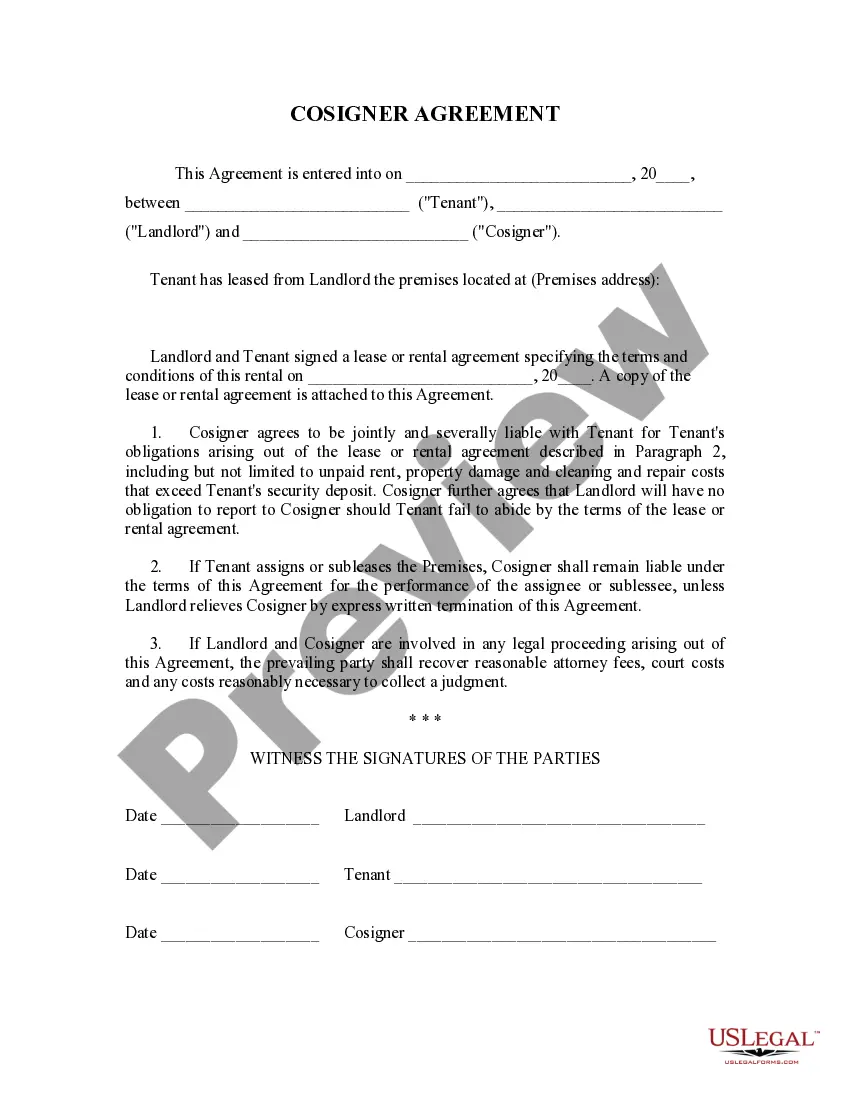

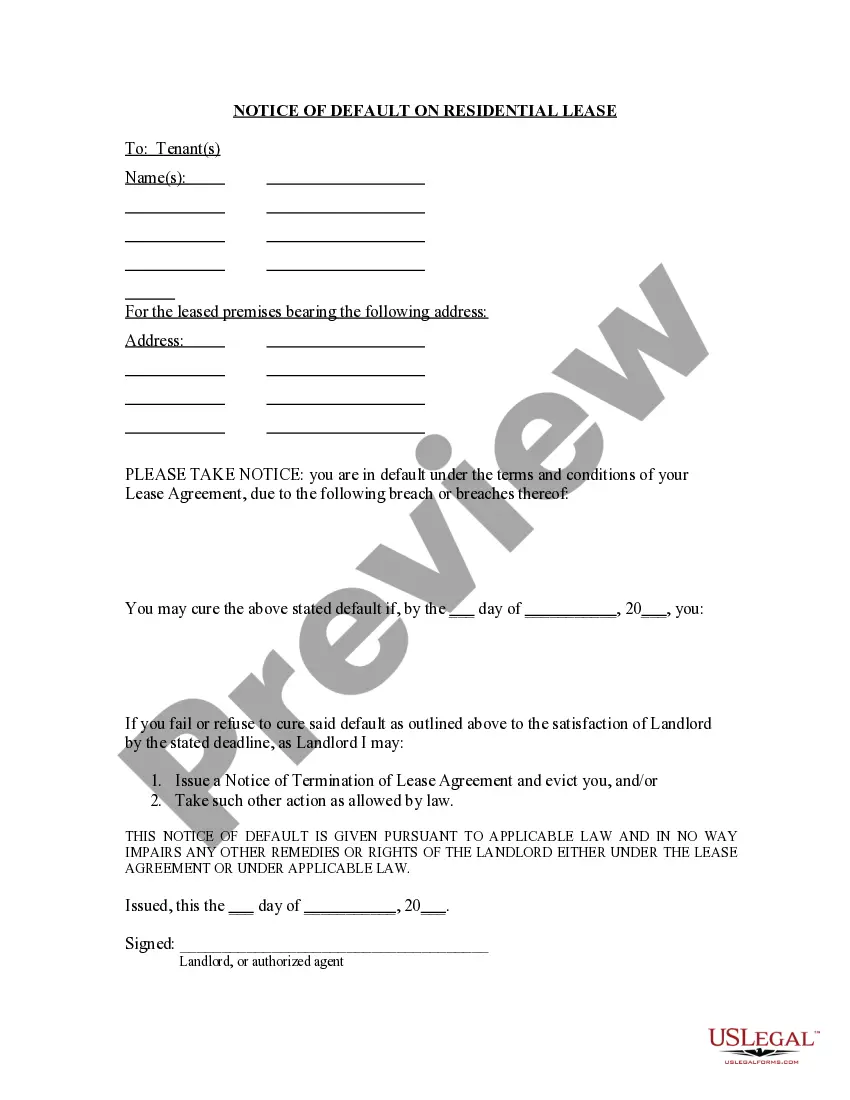

- Verify your choice by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

The District of Columbia receives funding from various sources, including federal funding, local taxes, and grants. Federal contributions play a central role in supporting essential services and infrastructure. Local taxes, derived from property and sales, also bolster the District's financial needs. Understanding these funding streams is crucial for professionals in District of Columbia accounting, especially when advising city agencies or businesses on financial planning.

Becoming a CPA in the District of Columbia involves several steps. First, you need to complete the required educational background, typically a degree in accounting. Next, you must pass the CPA exam and fulfill the necessary work experience requirements. Utilizing resources like USLegalForms can help streamline your application process, providing the essential documents and guidance as you navigate through the requirements for District of Columbia accounting.

No, 40 is not too late to pursue a CPA designation. Many individuals successfully obtain their CPA licenses later in life and bring valuable experience to the table. The world of District of Columbia accounting welcomes diverse backgrounds and life experiences, enhancing the profession. Therefore, if you are considering this path, take confidence in your decision and explore the necessary steps to becoming a CPA.

Yes, the District of Columbia serves as the capital of the United States. It is home to significant governmental institutions, including the White House and the Capitol building. This central role emphasizes the importance of governance and finance within the realm of District of Columbia accounting. Understanding the capital's structure can be beneficial for accounting professionals as it offers unique opportunities in government-related financial services.

Yes, the District of Columbia requires most businesses to obtain a license to operate legally. The specific type of license you need depends on the nature of your business activities. Ensuring compliance with these regulations is crucial for your District of Columbia accounting, and our platform can assist you in understanding the licensing requirements.

District of Columbia tax includes various forms of taxation such as income taxes, sales taxes, and property taxes. Each tax category has its own rules and rates, impacting residents and businesses differently. Staying updated on these taxes is essential for effective District of Columbia accounting, and using our resources can help you navigate the complexities.

Filing requirements in the District of Columbia vary based on your income, residency status, and specific business activities. Typically, you need to submit a tax return if you earn income or meet other conditions set by the DC Office of Tax and Revenue. For further clarity, seeking assistance from our platform can guide you through the District of Columbia accounting processes.

Yes, you can file your District of Columbia taxes online. The DC Office of Tax and Revenue provides an online portal specifically for tax filing. This option not only simplifies the process but also helps you stay organized in your District of Columbia accounting endeavors.

The 183 day rule refers to the guideline that determines whether you are considered a resident for tax purposes in the District of Columbia. If you spend 183 days or more within the district in a given tax year, you may owe taxes as a resident. Understanding this rule is crucial in the realm of District of Columbia accounting to ensure proper tax filings and obligations.

The District of Columbia has specific size limits regarding the space needed for various business types. Generally, these limits depend on the nature of your business and its operational needs. For accurate guidance on size limits and compliance in District of Columbia accounting, you may want to consult with a local expert or utilize the resources available on our platform.