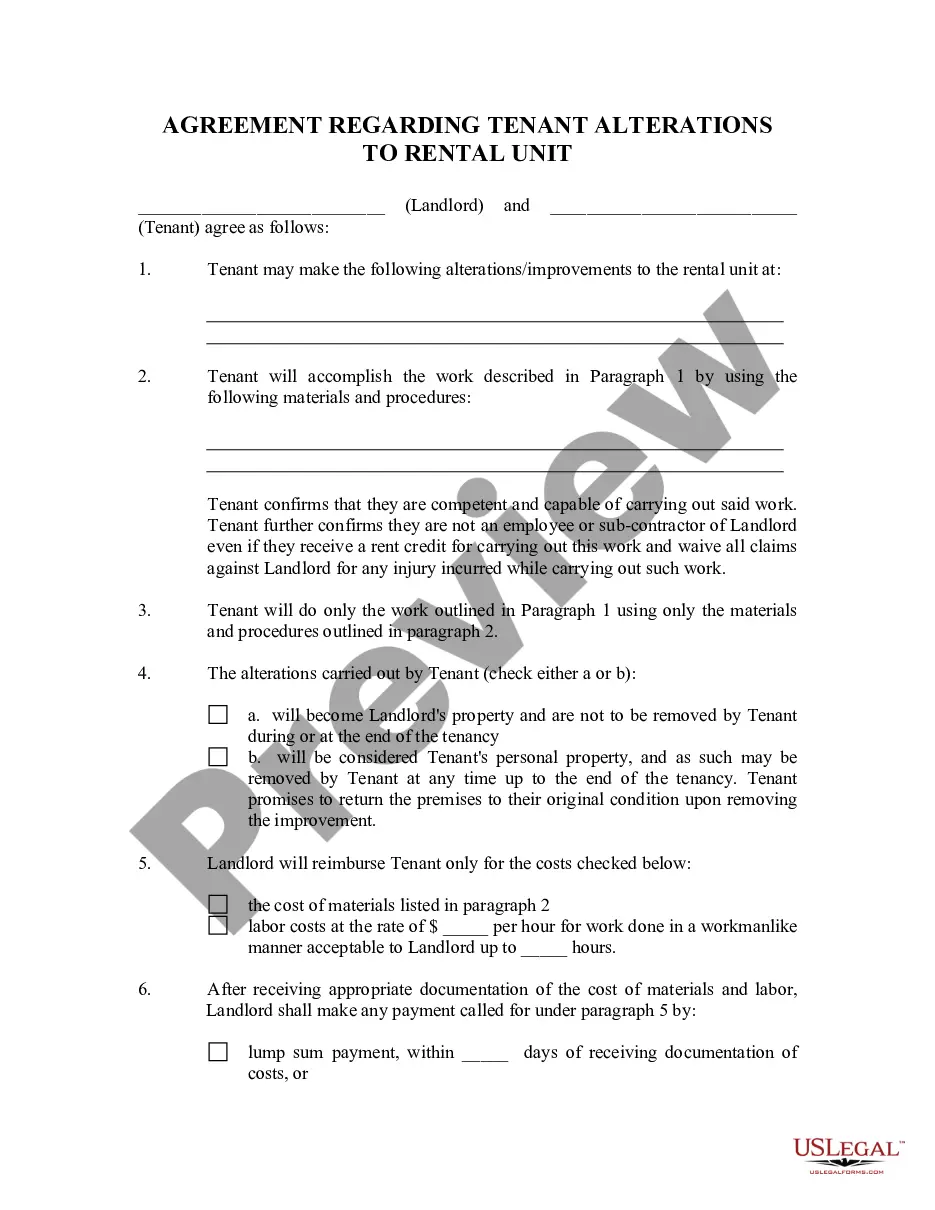

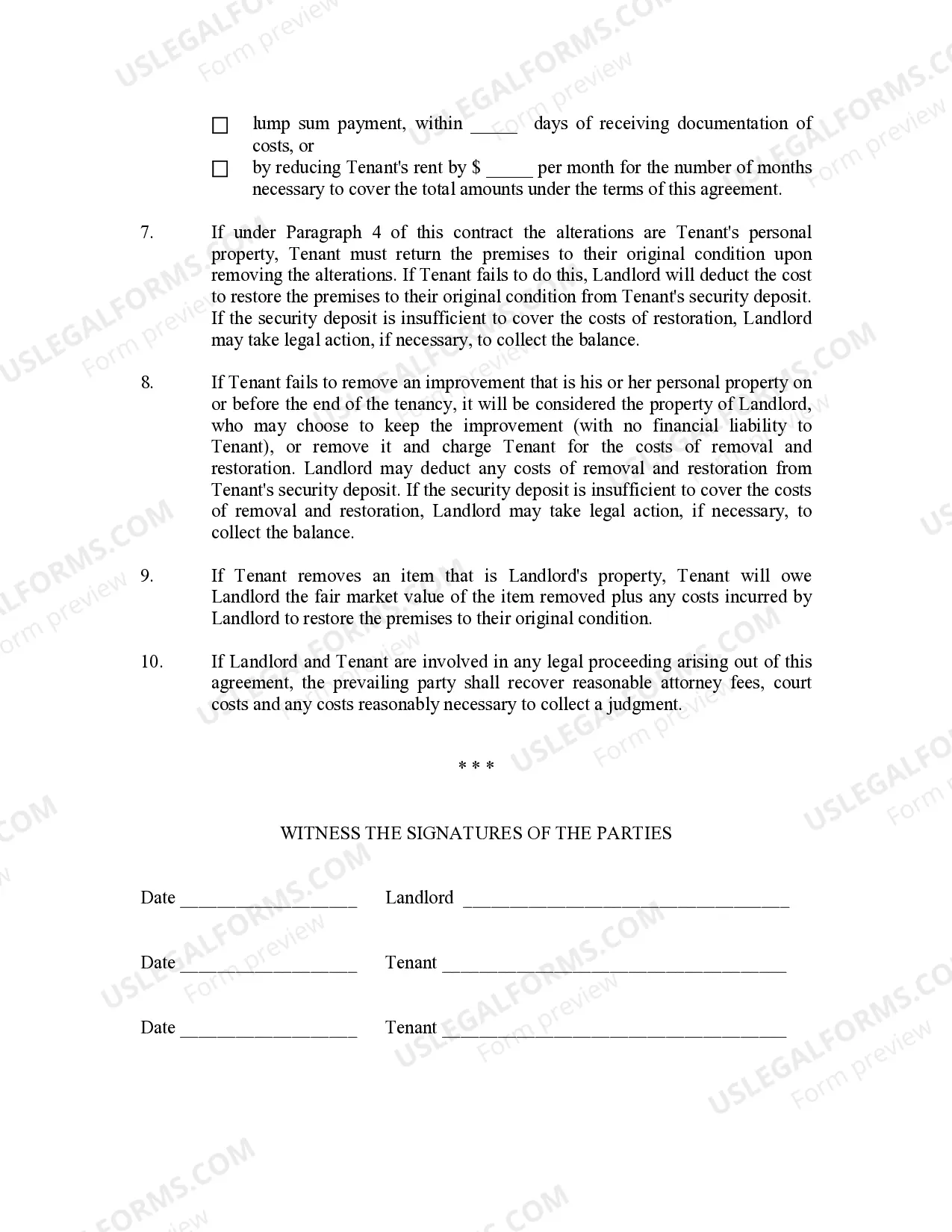

Pennsylvania Landlord Agreement to allow Tenant Alterations to Premises

Description

How to fill out Pennsylvania Landlord Agreement To Allow Tenant Alterations To Premises?

The work with documents isn't the most uncomplicated task, especially for people who almost never deal with legal papers. That's why we recommend using accurate Pennsylvania Landlord Agreement to allow Tenant Alterations to Premises templates made by skilled lawyers. It allows you to stay away from difficulties when in court or working with official organizations. Find the samples you need on our site for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template page. Right after downloading the sample, it’ll be saved in the My Forms menu.

Users with no an activated subscription can quickly get an account. Follow this simple step-by-step help guide to get your Pennsylvania Landlord Agreement to allow Tenant Alterations to Premises:

- Ensure that the document you found is eligible for use in the state it’s needed in.

- Verify the document. Use the Preview feature or read its description (if offered).

- Buy Now if this form is the thing you need or return to the Search field to get a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these straightforward steps, you are able to complete the sample in an appropriate editor. Double-check filled in data and consider asking a lawyer to review your Pennsylvania Landlord Agreement to allow Tenant Alterations to Premises for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

Tenant Rights to Withhold Rent in PennsylvaniaTenants may withhold rent or exercise the right to repair and deduct if a landlord fails to take care of important repairs, such as a broken heater. For specifics, see Pennsylvania Tenant Rights to Withhold Rent or Repair and Deduct.

Can a tenant claim for improvements made during the lease? The position differs in the case of immovable and movable property. Tenant can claim for:The claim arises only once the lease is terminated and lessee vacated the property.

Pennsylvania's Landlord and Tenant law says that you can be evicted if: You don't pay rent; You don't live up to your end of the written or oral lease agreement; or. The time for which you rented your dwelling is up, and the landlord wants you to move.

Tenants also have certain rights under federal, state, and some local laws. These include the right to not be discriminated against, the right to a habitable home, and the right to not be charged more for a security deposit than is allowed by state law, to name just a few.

The Landlord/Tenant Act requires your landlord to give you a written eviction notice. This notice must be a 10-day notice if he/she is evicting you for nonpayment of rent, or 15 days if the eviction is for breach of the lease or end of lease term.

Often, landlords will provide a 'leasehold improvement allowance' for their tenants which is merely a set amount they agree to pay for. If the improvements you want cost more than the allowance, you will be responsible for those extra costs.

If the tenant pays for leasehold improvements, the capital expenditure is recorded as an asset on the tenant's balance sheet. Then the expense is recorded on income statements as amortization over either the life of the lease or the useful life of the asset, whichever is shorter.

Leasehold improvements are any changes made to a rental property in order to customize it for the particular needs of a tenant. These can include alterations such as painting, installing partitions, changing the flooring, or putting in customized light fixtures.

In cases like this, landlords are entitled to deduct the remaining tax basis in capitalized leasehold improvements made for a particular tenant upon termination of the lease if such improvements are irrevocably disposed of or abandoned and won't be used by a subsequent tenant.