Agreement to Make Improvements to Leased Property

Description

How to fill out Agreement To Make Improvements To Leased Property?

Make use of the most complete legal catalogue of forms. US Legal Forms is the best platform for finding up-to-date Agreement to Make Improvements to Leased Property templates. Our service provides 1000s of legal forms drafted by licensed legal professionals and sorted by state.

To download a sample from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and choose the document you are looking for and buy it. After purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Check if the Form name you have found is state-specific and suits your needs.

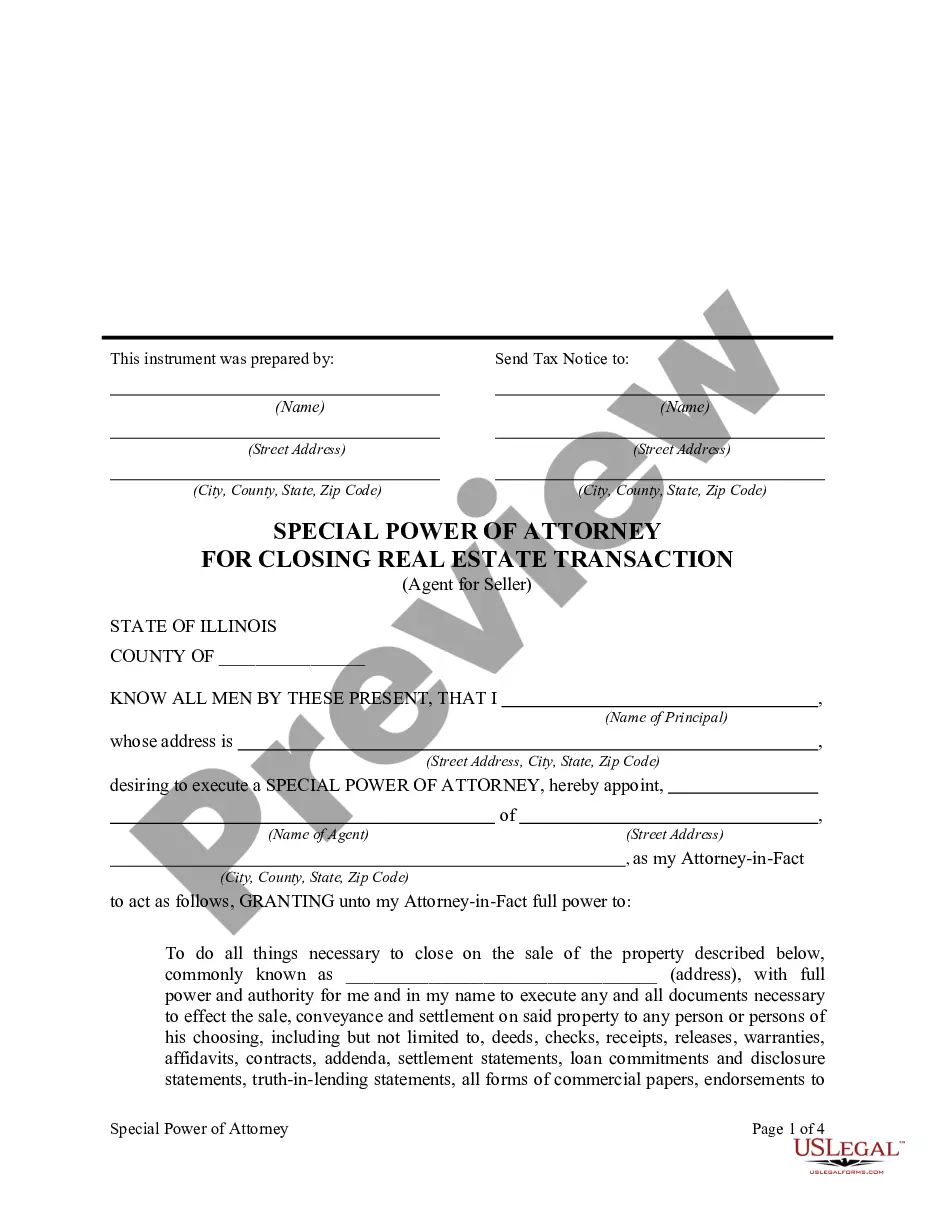

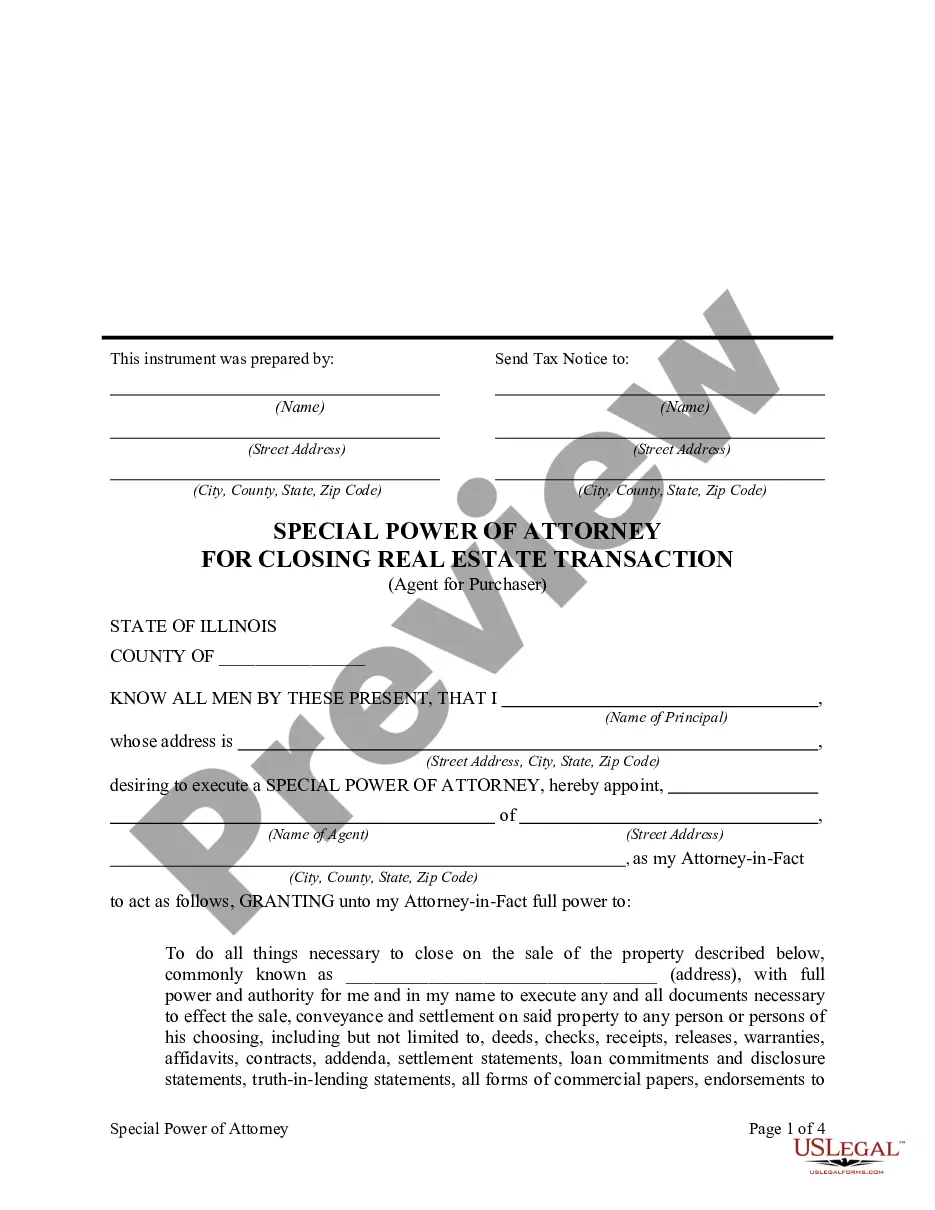

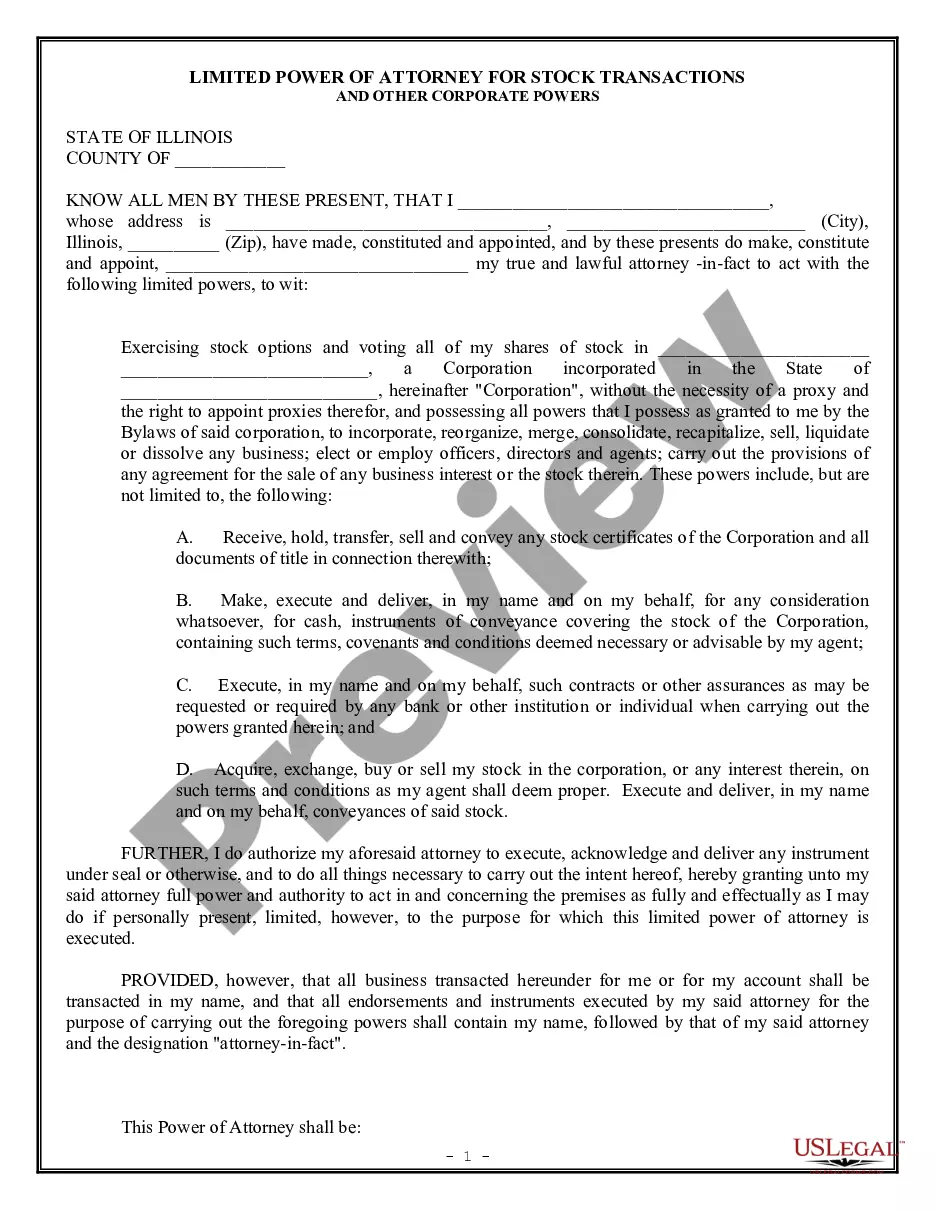

- If the template has a Preview option, use it to check the sample.

- If the sample does not suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your expections.

- Select a pricing plan.

- Create an account.

- Pay via PayPal or with yourr credit/credit card.

- Choose a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and fill out the Form name. Join thousands of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

The immediate deduction is available for both new and second-hand assets. However, certain assets are specifically excluded, such as: buildings and leasehold improvements that fall under the capital works deduction regime; software allocated to a software development pool (but not other software);

A leasehold improvement is a change made to a rental property to customize it for the particular needs of a tenant. The IRS does not allow deductions for leasehold improvements. But because improvements are considered part of the building, they are subject to depreciation.

The Lease Must be in Writing It does not matter if the lease is handwritten or typed. If the lease is for more than one year, it must be in written form and contain the following terms.

In cases like this, landlords are entitled to deduct the remaining tax basis in capitalized leasehold improvements made for a particular tenant upon termination of the lease if such improvements are irrevocably disposed of or abandoned and won't be used by a subsequent tenant.

When you pay for leasehold improvements, capitalize them if they exceed the corporate capitalization limit. If not, charge them to expense in the period incurred. If you capitalize these expenditures, then amortize them over the shorter of their useful life or the remaining term of the lease.

Can a tenant claim for improvements made during the lease? The position differs in the case of immovable and movable property. Tenant can claim for:The claim arises only once the lease is terminated and lessee vacated the property.

Qualified Improvement Property (QIP) is a term found in the Internal Revenue Code, Section 168, and encompasses any improvements made to the interior of a commercial real property.

Regardless of whether they are used for repairs, maintenance or improvements, materials used in leasehold construction upgrades are subject to sales tax.

Most leases and rental agreements contain a provision that prevents a tenant from making improvements or alterations to a rental unit without getting the written consent of the landlord. If you make an improvement or alteration without consent, it generally becomes the property of the landlord if you leave.