Agreement by Lessee to Make Leasehold Improvements

Description

Key Concepts & Definitions

Leasehold Improvements: Modifications made to a rental space by a tenant, also known as tenant improvements or leasehold improvements. These include changes like installing walls, floors, ceilings, and plumbing to enhance the space for the tenant's specific needs. Improvement Allowance: A contribution given by the landlord to the tenant to cover the cost of improvements. The Work Letter is a detailed agreement that outlines the specific improvements the landlord will make as part of the lease agreement. Common terms include tenant shall and landlord shall, which define the responsibilities each party has regarding improvements.

Step-by-Step Guide

- Review the Lease Agreement: Identify and understand terms related to improvements, such as 'improvement allowance' and 'tenant shall'.

- Plan the Improvements: Decide on the modifications needed for your business and whether it aligns with the 'work letter' and landlord's policies.

- Negotiate Improvement Terms: Discuss the improvement specifics and financial responsibilities with the landlord. This may involve negotiation on the improvement allowance or other terms.

- Permitting and Approvals: Ensure all necessary permissions are acquired before starting any work, particularly if the changes impact structural or utility components.

- Complete the Improvements: Work should be completed within the scope and timeline specified in the lease agreement and work letter.

- Final Inspection and Reconciliation: Have the improvements inspected and ensure compliance with lease terms. Reconcile any financial credit or discrepancies in improvement allowances.

Risk Analysis

- Financial Overruns: Tenant improvements can exceed initial budgets, especially if unforeseen challenges arise during construction.

- Legal and Compliance Issues: Failure to align improvements with local building codes or the lease agreement can result in legal penalties.

- Impact on Lease Conditions: Unauthorized or unapproved leasehold improvements might breach lease conditions, potentially leading to conflicts or even eviction.

- Tax Implications: Improvements might affect the depreciation schedules and income tax calculations for the business.

- Amortization of Leasehold Improvements: If not properly negotiated, the cost of improvements could be ineffectively amortized over the lease period, affecting financial statements.

Best Practices

- Clear Agreements: Ensure all improvement terms are clearly outlined in the lease documents to avoid future disputes.

- Document Everything: Keep records of all communications and approvals related to leasehold improvements.

- Use Professional Help: Engage with architects, designers, and contractors who understand the regulatory and compliance aspects of tenant improvements.

- Consider Future Needs: Design improvements that not only meet current needs but are adaptable for future business changes or expansions.

- Assess Financial Implications: Determine how improvements will affect your finances, including cash flow and tax obligations.

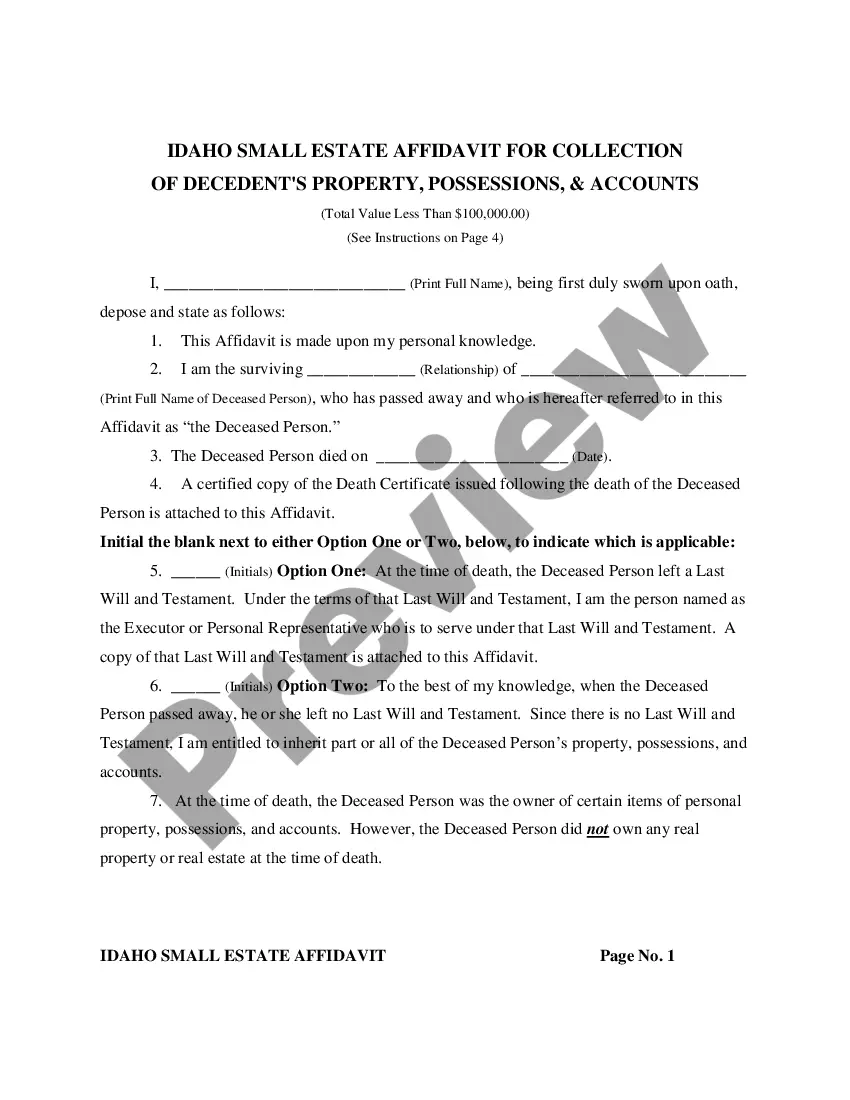

How to fill out Agreement By Lessee To Make Leasehold Improvements?

Make use of the most extensive legal catalogue of forms. US Legal Forms is the perfect platform for finding up-to-date Agreement by Lessee to Make Leasehold Improvements templates. Our platform provides thousands of legal forms drafted by licensed legal professionals and grouped by state.

To get a template from US Legal Forms, users simply need to sign up for a free account first. If you are already registered on our platform, log in and select the template you are looking for and purchase it. Right after buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps below:

- Check if the Form name you have found is state-specific and suits your requirements.

- In case the template features a Preview function, utilize it to review the sample.

- If the template doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with yourr credit/credit card.

- Select a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and complete the Form name. Join a large number of pleased customers who’re already using US Legal Forms!

Form popularity

FAQ

When you pay for leasehold improvements, capitalize them if they exceed the corporate capitalization limit. If not, charge them to expense in the period incurred. If you capitalize these expenditures, then amortize them over the shorter of their useful life or the remaining term of the lease.

Generally, the party who pays for and owns the improvements may take the depreciation deductions.When landlords construct and pay for improvements, they own and depreciate the improvements, and there are no tax consequences to the tenant.

A leasehold improvement is a change made to a rental property to customize it for the particular needs of a tenant. The IRS does not allow deductions for leasehold improvements. But because improvements are considered part of the building, they are subject to depreciation.

If the tenant pays for leasehold improvements, the capital expenditure is recorded as an asset on the tenant's balance sheet. Then the expense is recorded on income statements as amortization over either the life of the lease or the useful life of the asset, whichever is shorter.

In cases like this, landlords are entitled to deduct the remaining tax basis in capitalized leasehold improvements made for a particular tenant upon termination of the lease if such improvements are irrevocably disposed of or abandoned and won't be used by a subsequent tenant.

Can a tenant claim for improvements made during the lease? The position differs in the case of immovable and movable property. Tenant can claim for:The claim arises only once the lease is terminated and lessee vacated the property.

As discussed above, a tenant improvement allowance is recorded as a liability which is amortized (as a reduction to rent expense) over the life of the lease.

Often, landlords will provide a 'leasehold improvement allowance' for their tenants which is merely a set amount they agree to pay for. If the improvements you want cost more than the allowance, you will be responsible for those extra costs.

The options are: Lessee owns the improvements. If the lessee owns the improvements, then the lessee initially records the allowance as an incentive (which is a deferred credit), and amortizes it over the lesser of either the term of the lease or the useful life of the improvements, with no residual value.