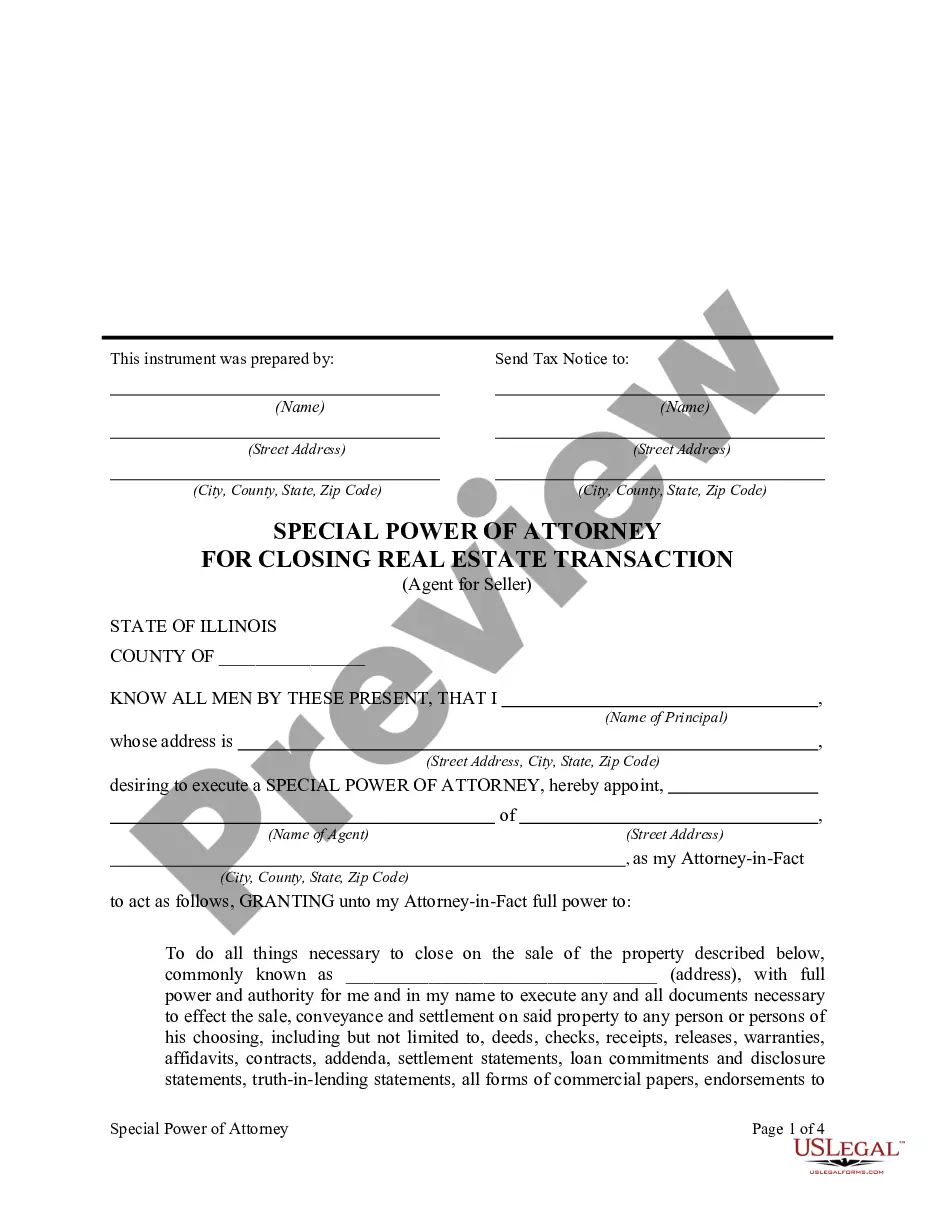

Power Of Attorney Illinois

Description Attorney In Fact Real Estate

How to fill out Illinois Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

Looking for Illinois Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller sample and completing them could be a problem. In order to save time, costs and effort, use US Legal Forms and choose the right example specifically for your state in a couple of clicks. Our attorneys draw up all documents, so you just have to fill them out. It really is so simple.

Log in to your account and return to the form's web page and save the sample. Your downloaded templates are saved in My Forms and therefore are accessible always for further use later. If you haven’t subscribed yet, you need to register.

Have a look at our comprehensive recommendations regarding how to get your Illinois Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller form in a few minutes:

- To get an entitled form, check out its validity for your state.

- Take a look at the example making use of the Preview option (if it’s accessible).

- If there's a description, read it to know the specifics.

- Click on Buy Now button if you identified what you're trying to find.

- Pick your plan on the pricing page and create an account.

- Pick how you wish to pay out by a card or by PayPal.

- Download the sample in the preferred format.

Now you can print the Illinois Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller form or fill it out making use of any web-based editor. Don’t worry about making typos because your template may be used and sent, and printed as many times as you want. Try out US Legal Forms and access to above 85,000 state-specific legal and tax files.