Invoice 9 is a document used for billing purposes. It is an itemized list of products or services rendered along with a total amount due for payment. Invoice 9 typically includes the date of purchase, the quantity and description of items, the unit price, and any applicable taxes. It may also include the terms of payment, such as the due date and payment method. Depending on the type of business, Invoice 9 can also include discounts, shipping costs, and additional fees. There are several types of Invoice 9, including sales invoices, purchase invoices, and credit invoices. Sales invoices are used for billing customers for goods or services, and they usually include the customer's name and address, invoice number, item description, and payment terms. Purchase invoices are used by businesses to document the purchase of goods or services, and they typically include the supplier's name and address, invoice number, item description, and payment terms. Credit invoices are used when a customer returns an item and is issued a credit for the purchase price of the item. They typically include the customer's name and address, invoice number, item description, and payment terms.

Invoice 9

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Invoice 9?

If you’re searching for a way to appropriately prepare the Invoice 9 without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business situation. Every piece of paperwork you find on our online service is designed in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Invoice 9:

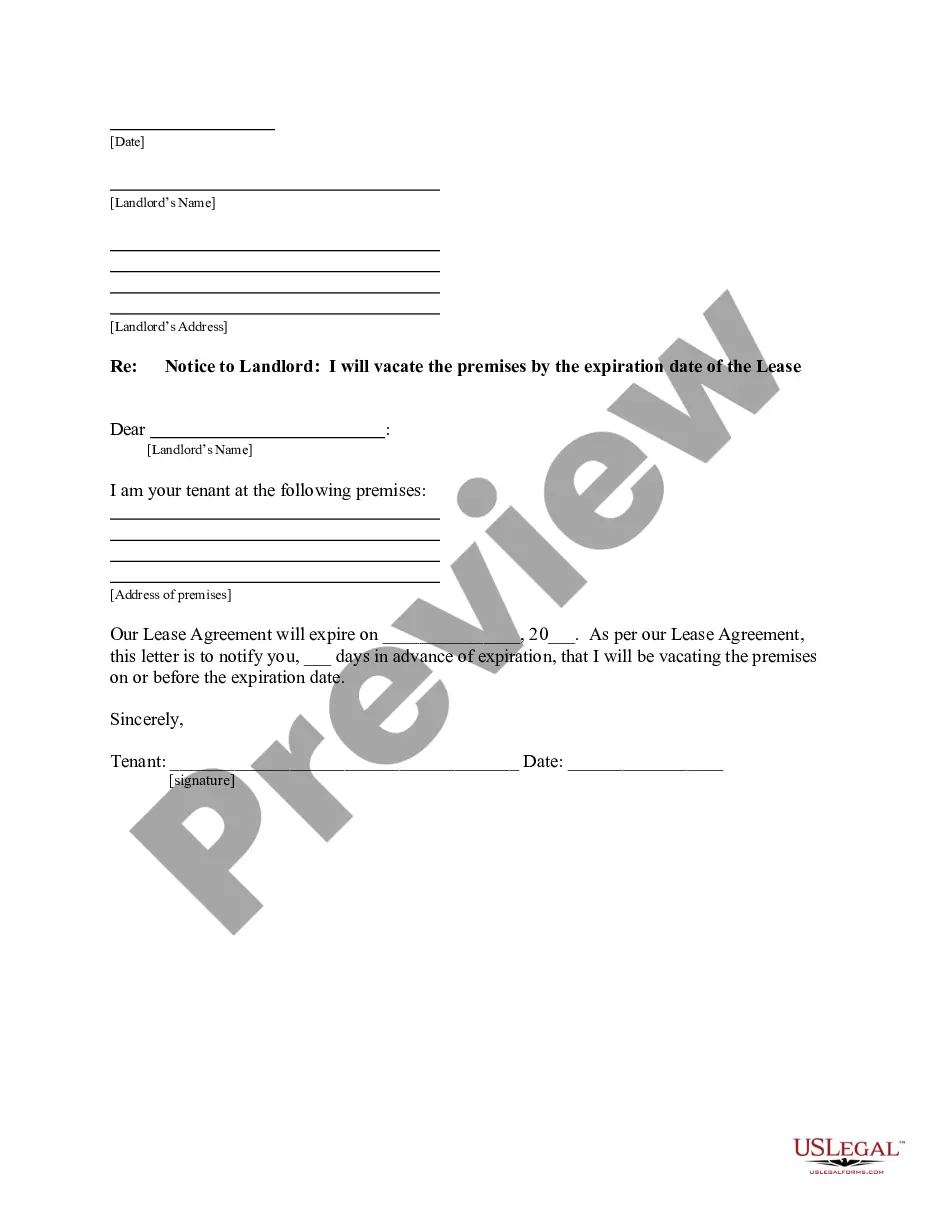

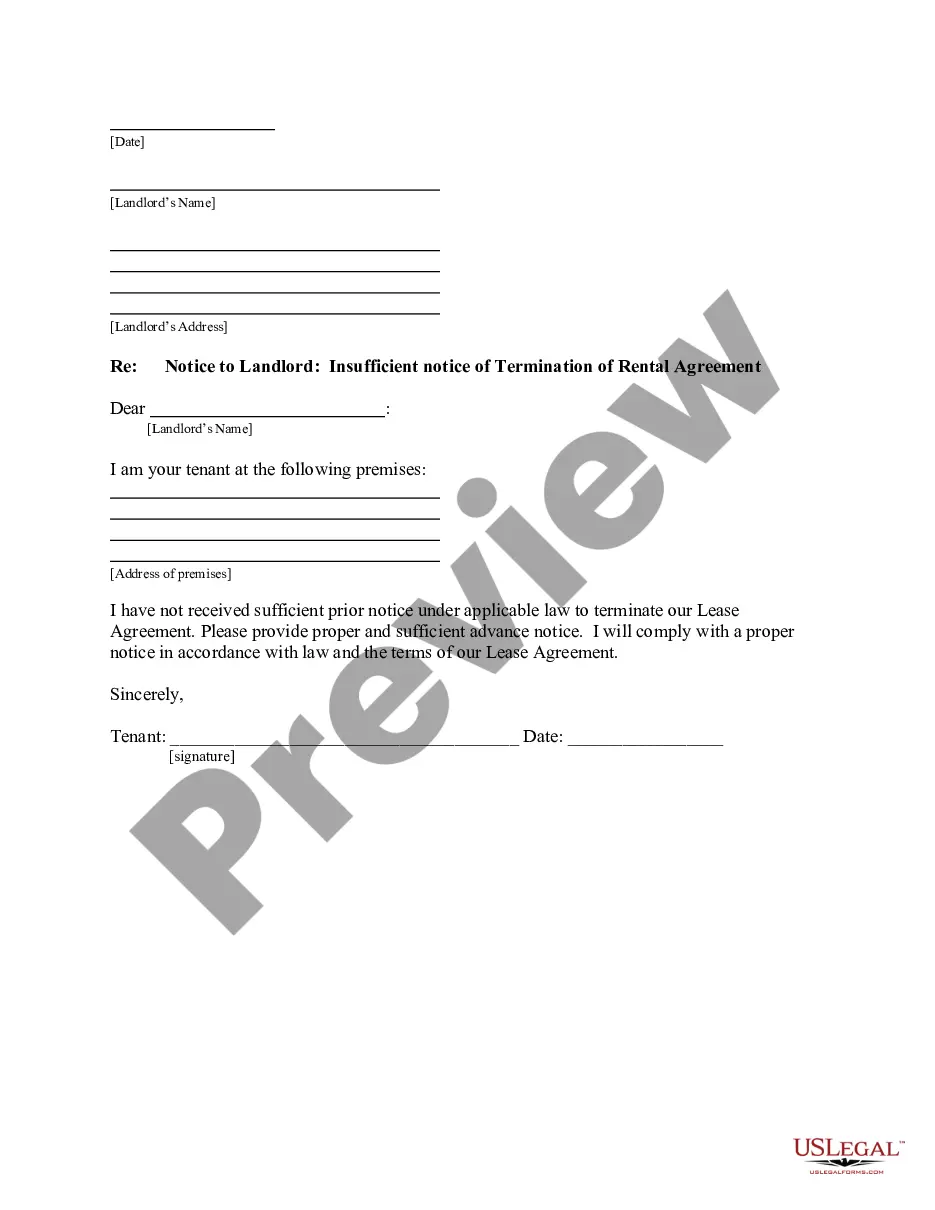

- Make sure the document you see on the page corresponds with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and select your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Invoice 9 and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

A typical invoice number will have 3 to 5 digits, and it is often alphanumeric, meaning it contains both numbers and letters with no special characters. Invoice numbering follows a specific system that assigns a unique invoice number to each invoice you generate.

An invoice is an itemized commercial document that records the products or services delivered to the customer, the total amount due, and the preferred payment method. The seller can send either paper or electronic invoices to the customer.

Items sold by Amazon and most sellers come with a downloadable invoice. The items have some text that reads: GST invoice on their product detail page. You can identify items that come with a downloadable invoice to ensure you always get one.

An invoice number can be any string of numbers and letters. You can use different approaches to create an invoice number, such as: numbering your invoices sequentially, for example, INV00001, INV00002. starting with a unique customer code, for example, XER00001.

How to create an invoice number numbering your invoices sequentially, for example, INV00001, INV00002. starting with a unique customer code, for example, XER00001. including the date at the start of your invoice number, for example, 2023-01-001. combining the customer code and date, for example, XER-2023-01-001.

An invoice number is a unique, sequential code that is systematically assigned to invoices. Invoice numbers are one of the most important aspects of invoicing as they ensure that income is properly documented for tax and accounting purposes. They also make it easier to track payments and manage overdue invoices.