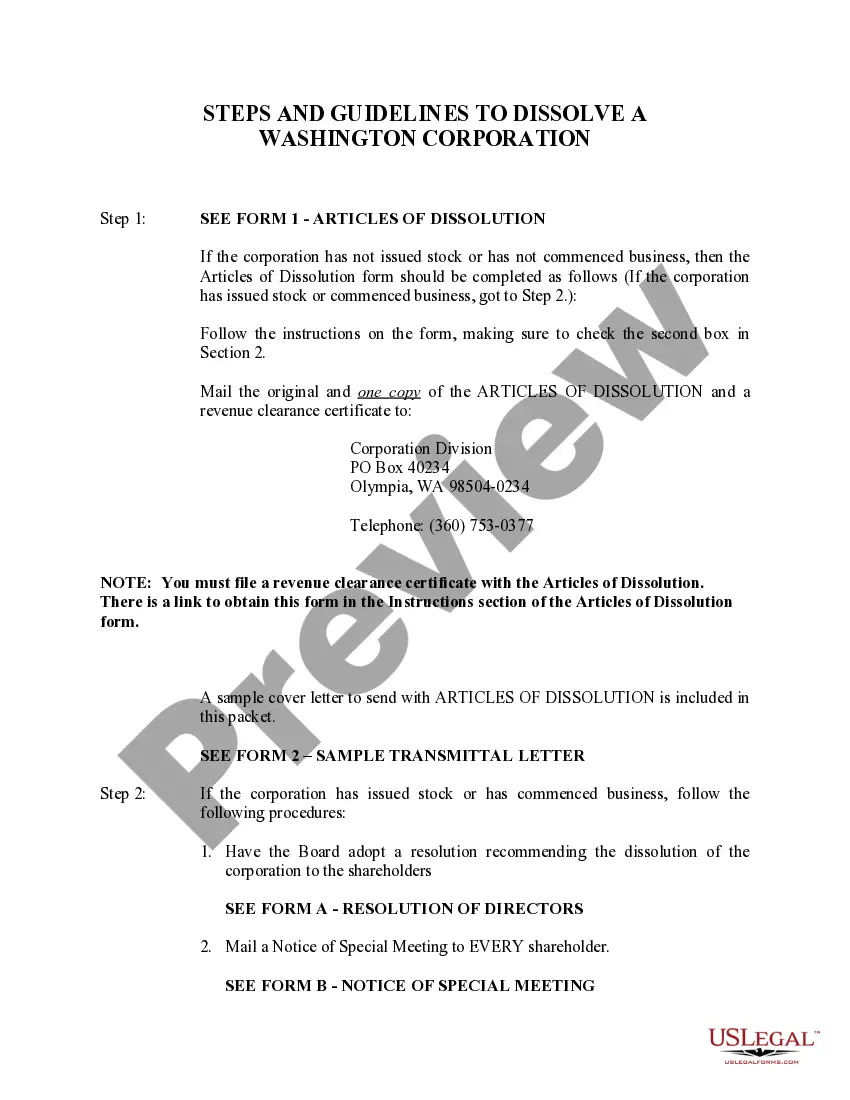

The dissolution of a corporation package contains all forms to dissolve a corporation in Washington, step by step instructions, addresses, transmittal letters, and other information.

Seattle Washington Dissolution Package to Dissolve Corporation

Description

How to fill out Washington Dissolution Package To Dissolve Corporation?

We consistently endeavor to lessen or avert legal concerns when managing intricate legal or financial matters.

To achieve this, we enlist legal services that are generally quite expensive.

However, not every legal issue is equally complicated.

Most can be handled independently.

Utilize US Legal Forms whenever you need to obtain and download the Seattle Washington Dissolution Package to Dissolve Corporation or any other document quickly and securely.

- US Legal Forms is a digital repository of current DIY legal documents that encompass everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection enables you to manage your affairs autonomously, without relying on legal advisors.

- We provide access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, making the search process considerably easier.

Form popularity

FAQ

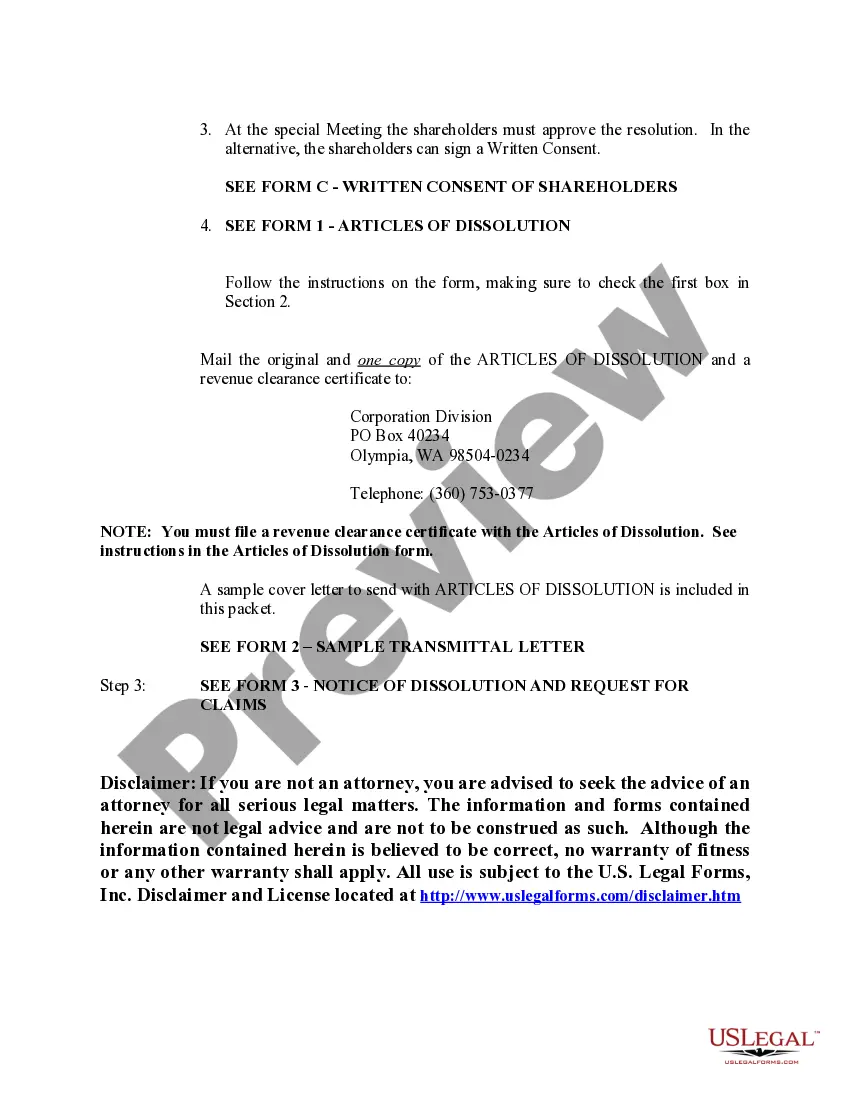

The first is voluntary dissolution, which is an elective decision to dissolve the entity. A second is involuntary dissolution, which occurs upon the happening of statute-specific events such as a failure to pay taxes. Last, a corporation may be dissolved judicially, either by shareholder or creditor lawsuit.

Dissolution of a Corporation is the termination of a corporation, either a) voluntarily by resolution, paying debts, distributing assets, and filing dissolution documents with the Secretary of State; or b) by state suspension for not paying corporate taxes or some other action of the government.

Voluntary dissolution is generally a two-step process: Obtaining written consent from the Tax Department1 (which will check to see if the corporation owes back taxes and if it has filed all its returns)2; and. Filing paperwork with the New York Department of State, including a Certificate of Dissolution.

A corporation seeking voluntary dissolution shall submit a verified request signed by its duly authorized representatives containing the corporate name, SEC registration number, principal office, a statement requesting for the dissolution, and reason for the dissolution.

Yes, a Department of Revenue Clearance Certificate is required for dissolution of a Washington Corporation. You will need to complete the Revenue Clearance Certificate Application and mail it to Washington State Department of Revenue, Audit Division, PO Box 47474, Olympia, WA 98504-7474, or fax it to (360) 586-7603.

Dissolution of corporation refers to the closing of a corporate entity which can be a complex process. Ending a corporation becomes more complex with more owners and more assets.

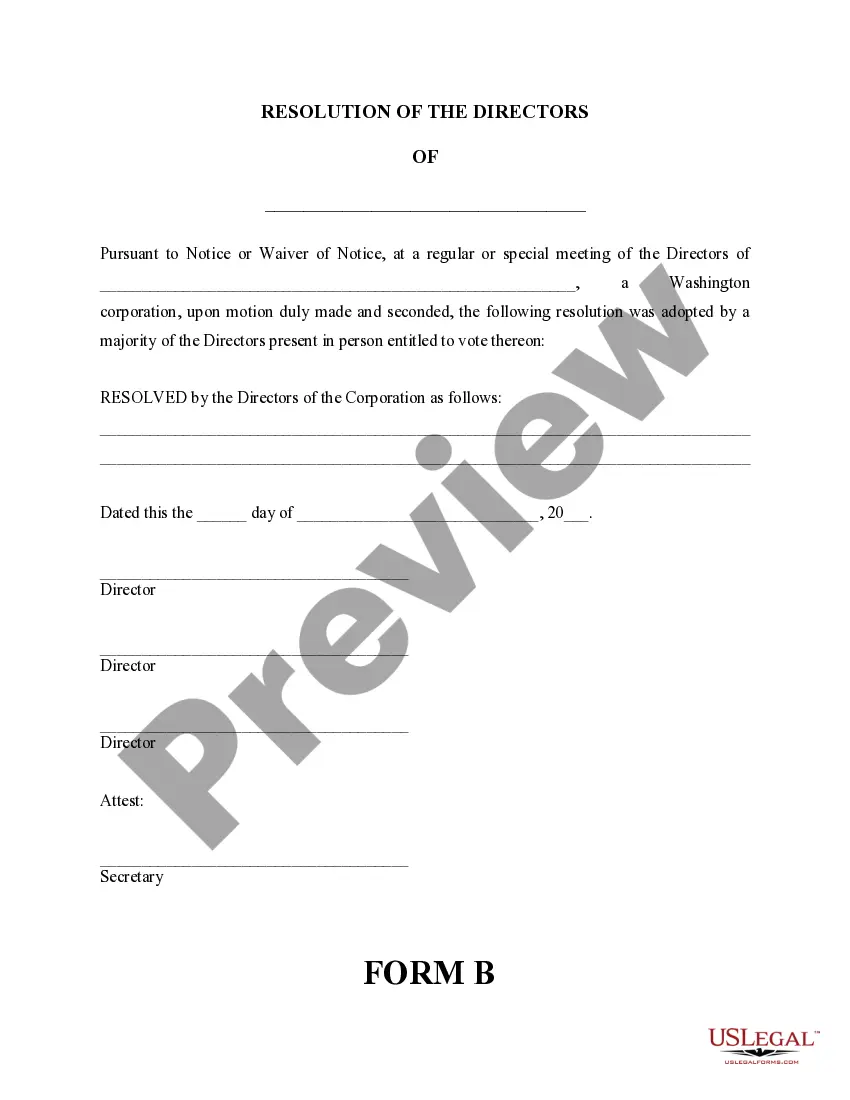

Depending upon the circumstances or the corporate bylaws, voluntary dissolution can be initiated by shareholder action, by action initiated by the board of directors, or where no directors are in place by the incorporators. Generally, the decision to dissolve a corporation rests with the corporation's shareholders.

How to dissolve a business in 7 steps Step 1: Get approval of the owners of the corporation or LLC.Step 2: File the Certificate of Dissolution with the state.Step 3: File federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notify creditors your business is closing.Step 6: Settle creditors' claims.

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).