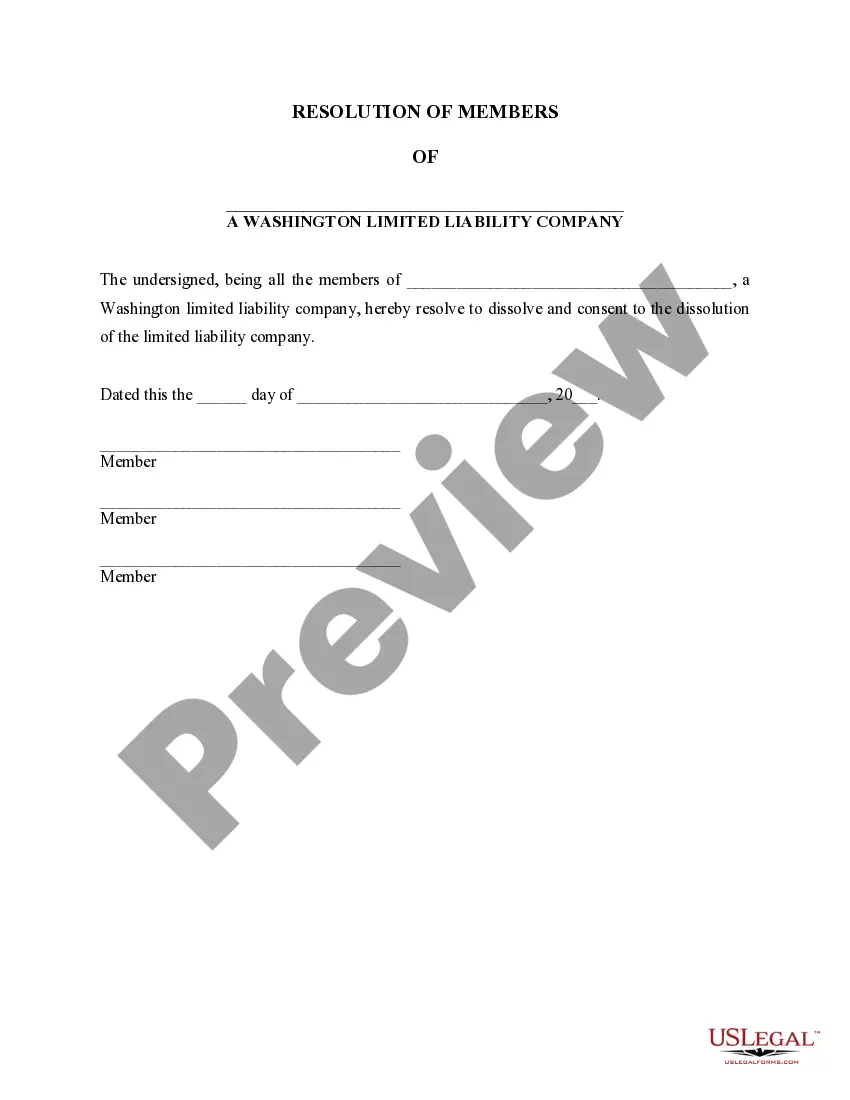

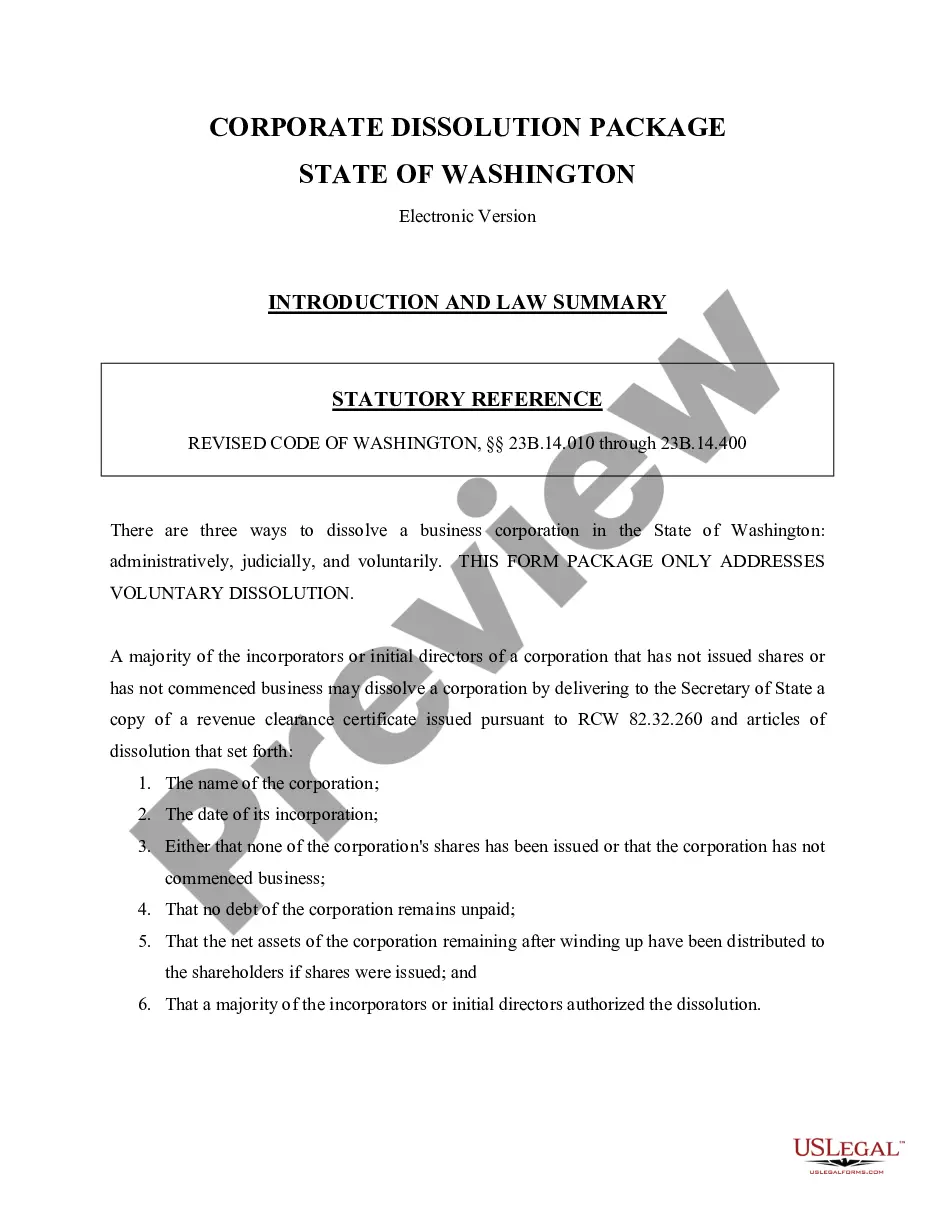

The dissolution package contains all forms to dissolve a LLC or PLLC in Washington, step by step instructions, addresses, transmittal letters, and other information.

Seattle Washington Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Washington Dissolution Package To Dissolve Limited Liability Company LLC?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our advantageous platform with a vast array of document templates simplifies the process of locating and acquiring almost any document sample you require.

You can save, complete, and sign the Seattle Washington Dissolution Package to Dissolve Limited Liability Company LLC in just a few minutes instead of spending hours searching online for an appropriate template.

Using our catalog is a smart approach to enhance the security of your form submissions.

If you haven't created a profile yet, follow the steps outlined below.

Access the page with the form you need. Ensure that it is the template you intended to find: verify its title and description, and use the Preview feature if available. If not, use the Search box to locate the correct one.

- Our knowledgeable attorneys consistently review all documents to ensure that the forms are suitable for a specific state and comply with current laws and regulations.

- How can you acquire the Seattle Washington Dissolution Package to Dissolve Limited Liability Company LLC.

- If you already have an account, simply Log In.

- The Download button will be activated for all samples you view.

- Furthermore, you can retrieve all previously saved documents from the My documents section.

Form popularity

FAQ

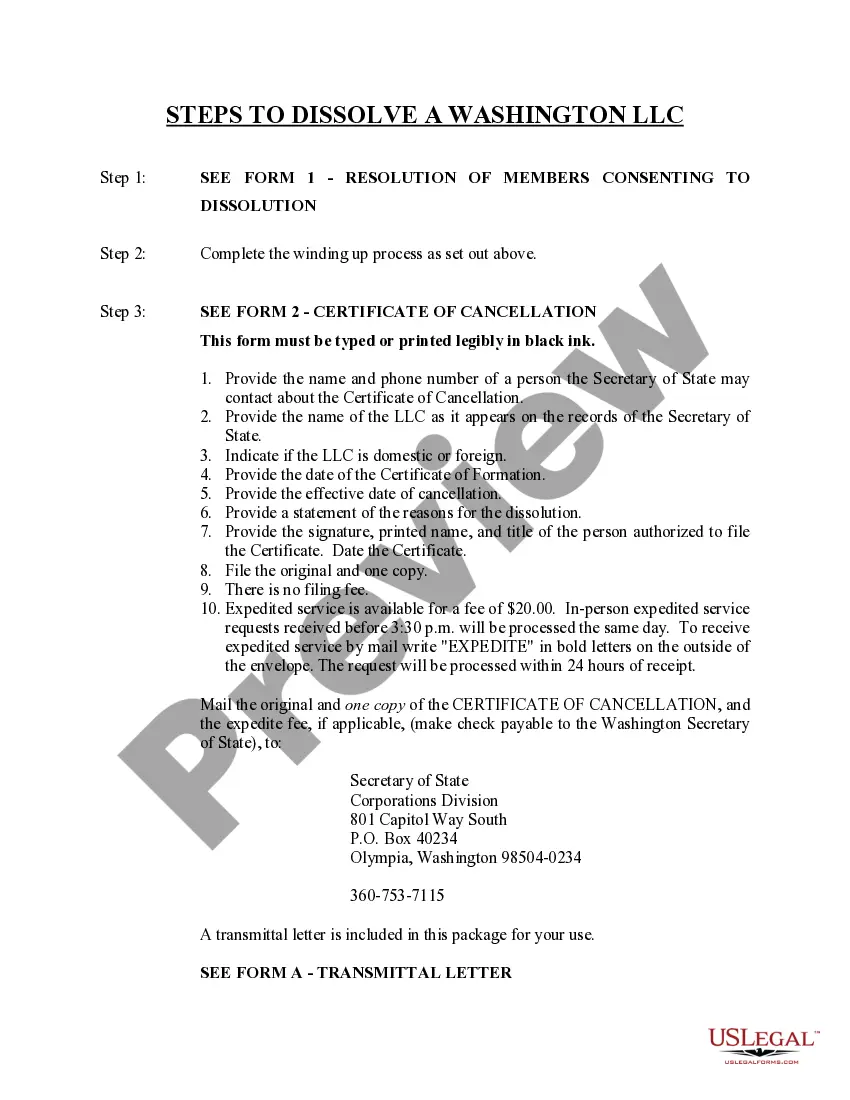

How to Dissolve a Washington Corporation or LLC Submit a Revenue Clearance Certificate Application.Wait for processing.Fill out Articles of Dissolution.Attach the certificate.Submit Articles of Dissolution.Wait for processing.Inform your registered agent.

How to Dissolve a Washington Corporation or LLC Submit a Revenue Clearance Certificate Application.Wait for processing.Fill out Articles of Dissolution.Attach the certificate.Submit Articles of Dissolution.Wait for processing.Inform your registered agent.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

FEES: There is no filing fee for standard service. If expedited service is requested, include an additional $50.00 and write ?EXPEDITE? on the outside of the envelope.

FEES: There is no filing fee for standard service. If expedited service is requested, include an additional $50.00 and write ?EXPEDITE? on the outside of the envelope.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Dissolution: The beginning of the end, not the end itself. What it is and what it isn't. Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence.

Yes, a Department of Revenue Clearance Certificate is required for dissolution of a Washington Corporation. You will need to complete the Revenue Clearance Certificate Application and mail it to Washington State Department of Revenue, Audit Division, PO Box 47474, Olympia, WA 98504-7474, or fax it to (360) 586-7603.

To dissolve your domestic corporation in Washington State, you submit the completed Articles of Dissolution form to the Secretary of State by mail, fax or in person. You will need to attach a Department of Revenue Clearance Certificate to your completed Articles of Dissolution.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.