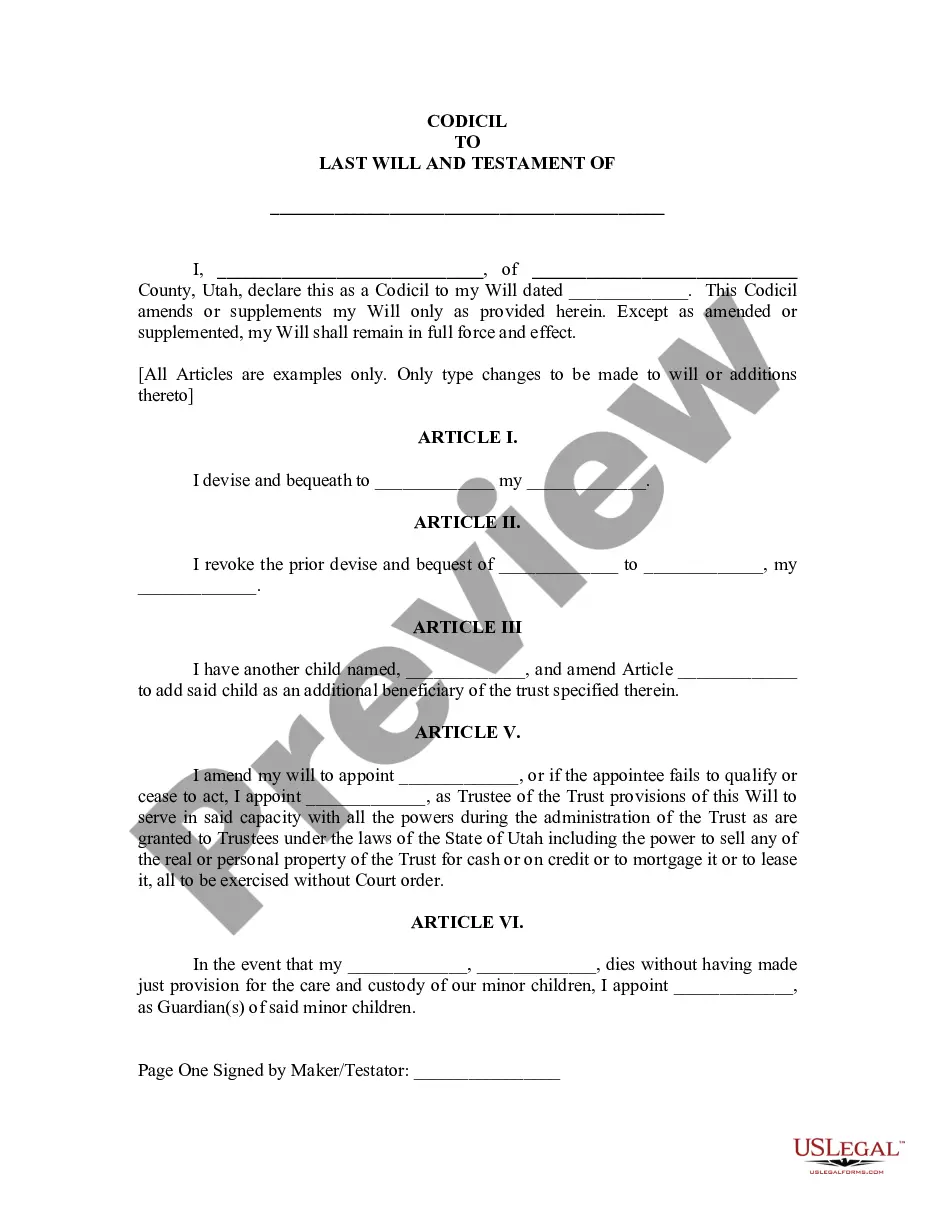

This form is used when a Trust has terminated by the terms of the Agreement creating the Trust and pursuant to the terms of the Agreement creating the Trust, upon its termination, the then acting Trustee is to distribute all of the Properties in the Trust to the beneficiaries named in the Trust Agreement.

Harris Texas Trustee's Deed and Assignment for Distributing Properties Out of Trust

Description

How to fill out Trustee's Deed And Assignment For Distributing Properties Out Of Trust?

A documentation procedure consistently accompanies any legal action you undertake.

Launching a business, applying for or accepting a job proposition, transferring ownership, and numerous other life circumstances necessitate that you prepare official paperwork that differs across the nation.

That’s why having everything organized in one location is incredibly advantageous.

US Legal Forms is the most comprehensive online repository of current federal and state-specific legal documents.

This is the most straightforward and reliable means to secure legal documentation. All templates offered by our library are professionally crafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal affairs effectively with US Legal Forms!

- On this platform, you can conveniently locate and download a document for any personal or business need relevant to your area, including the Harris Trustee's Deed and Assignment for Distributing Properties Out of Trust.

- Finding templates on the platform is surprisingly straightforward.

- If you already possess a subscription to our library, Log In to your account, use the search bar to locate the sample, and click Download to save it on your device.

- Subsequently, the Harris Trustee's Deed and Assignment for Distributing Properties Out of Trust will be available for further use in the My documents section of your profile.

- If you are utilizing US Legal Forms for the first time, follow this straightforward guide to acquire the Harris Trustee's Deed and Assignment for Distributing Properties Out of Trust.

- Make sure you have accessed the correct page with your localized form.

- Employ the Preview mode (if available) to review the template.

Form popularity

FAQ

Appointor is the term used in modern discretionary trust deeds to describe the person who has the power to appoint and remove the trustee. The appointor is also commonly referred to as a guardian, protector or principal.

Even if there are assets, such as homes, to be sold, the Trust should be wrapped up and distributed within eighteen months.

If your trustee fails to provide you with a statutory trust accounting within 90 days after the date that he, she or it receives your demand, then you can file an action in court to compel him to comply with your demand.

Distribution of trust funds after death The Trustee simply transfers all assets to the beneficiary. Distribution is also fairly easy if the trust document identifies all assets and specific amounts to be paid to each beneficiary.

Assets will not be distributed until certain administrative tasks are carried out, including filing of tax returns, drafting of an accounting, and providing notice to all beneficiaries. Some or all of the assets will often not be distributed until expenses of the trust are paid.

The state of California has an anti-lapse law that is put in place in the event that a beneficiary passes away before the decedent. With this statute, the beneficiary's share of the estate will pass down to the beneficiary's heirs or issue, rather than reverting back to the decedent's estate.

Yes, a trustee can be one of the beneficiaries of a trust. For example, an individual could set up a trust, appoint themselves as trustee and distribute income to their family. However, a trustee cannot be the sole beneficiary of a trust.

A revocable trust may be created to distribute assets after the grantor's death (and close shortly after), while an irrevocable trust can continue to exist for years, even decades.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

A trustee cannot distribute the income or assets of a deceased estate until the debts of the deceased person, including any outstanding tax liabilities, are determined. For taxation purposes, this requires a notice of assessment.