Appraisal Contingency Clauses: Contract for Real Property are clauses included in real estate contracts that state that the buyer has the right to back out of the contract if the property's appraised value is less than the purchase price. This clause gives the buyer protection in case the property is overpriced. There are two types of Appraisal Contingency Clauses: Contract for Real Property: 1. Contingent on Appraisal Clause: This clause states that the buyer has the right to terminate the contract if the appraised value of the property is lower than the purchase price. 2. Financing Contingency Clause: This clause states that the buyer has the right to terminate the contract if the buyer is unable to obtain financing for the purchase of the property.

Appraisal Contingency Clauses: Contract for Real Property

Description

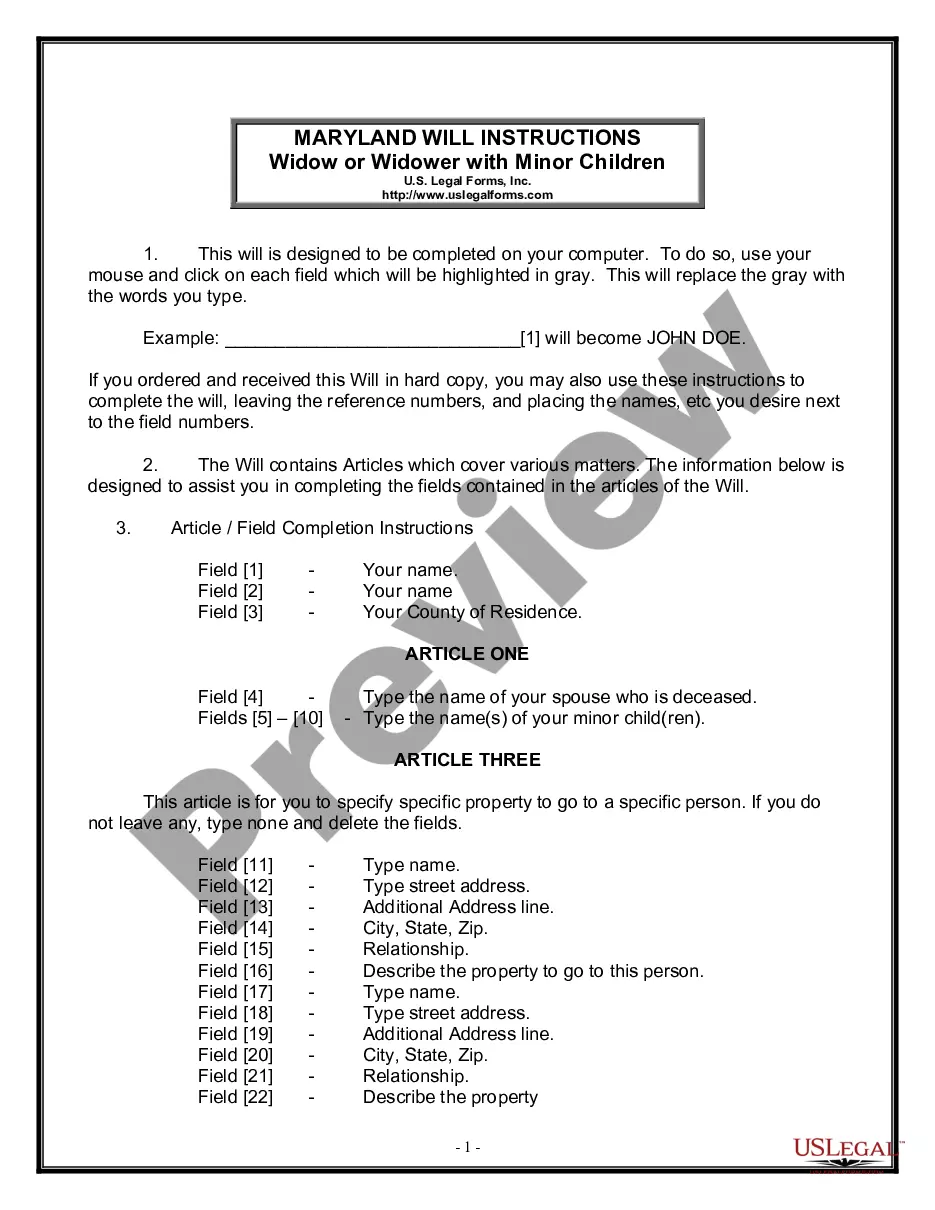

How to fill out Appraisal Contingency Clauses: Contract For Real Property?

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are verified by our experts. So if you need to prepare Appraisal Contingency Clauses: Contract for Real Property, our service is the perfect place to download it.

Getting your Appraisal Contingency Clauses: Contract for Real Property from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button after they locate the proper template. Afterwards, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

- Document compliance verification. You should attentively review the content of the form you want and make sure whether it suits your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Appraisal Contingency Clauses: Contract for Real Property and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

As an appraisal contingency example, if you agree to buy a home for $200,000, but the appraised value comes in at only $190,000, the lender will not give you a loan for the property unless you cover the difference.

Options that could make an offer more attractive include offering more than the asking price, offering a larger Earnest Money Deposit than requested, letting the sellers choose the closing date, picking up the sellers closing costs and limiting the time period for your house to sell.

CONTINGENCY: This offer is accepted contingent upon BUYER selling their real property located at (Address) (City) , with in days (contingency period) from acceptance of this offer, or any written extensions thereof signed by BUYER and SELLER.

A contingency is a condition that needs to be met before an offer can proceed. In other words, it's kind of like a safety net. Therefore, an appraisal contingency means that if your home doesn't appraise for the amount you've agreed to pay, you can walk away from the deal with your deposit.

Contingency contracts target undesirable behaviors and conditions while helping a person achieve better outcomes. For instance, a parent can enter a contingency contract with a child that does not finish his or her homework on time. The child can agree to finish his or her homework before supper.

An appraisal contingency clause is a provision included in purchase contracts that allows homebuyers to back out of their contract if a home is appraised for less than the purchase price included in the contract.

A contingency clause should clearly outline what the condition is, how the condition is to be fulfilled, and which party is responsible for fulfilling it. The clause should also provide a timeframe and what happens if the condition is not met.

Contingencies can include details such as the time frame (for example, ?the buyer has 14 days to inspect the property?) and specific terms (such as, ?the buyer has 21 days to secure a 30-year conventional loan for 80% of the purchase price at an interest rate no higher than 4.5%?).