Kings New York Right of First Refusal to Purchase Real Estate

Description

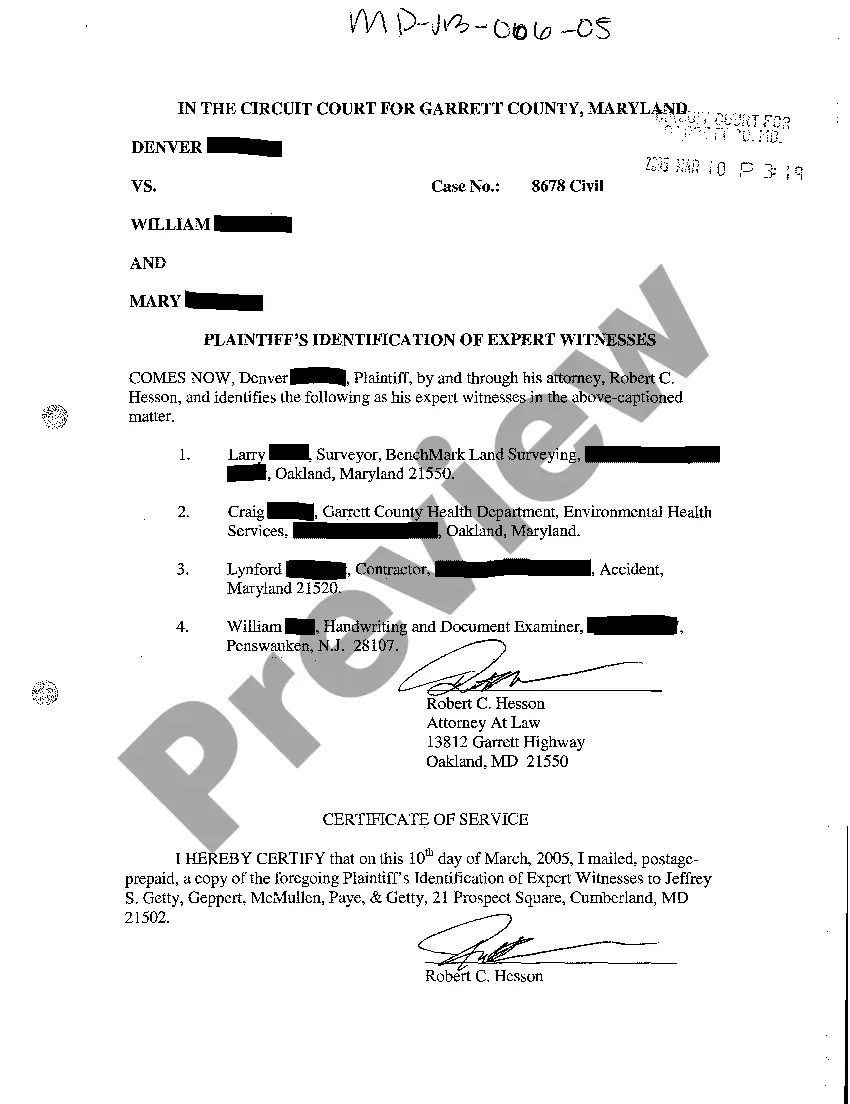

How to fill out Right Of First Refusal To Purchase Real Estate?

If you require a reliable legal document provider to acquire the King's Right of First Refusal for Real Estate Purchase, think about US Legal Forms. Whether you are looking to launch your LLC enterprise or manage your asset distribution, we’ve got you covered.

US Legal Forms is a dependable service providing legal forms to millions since 1997.

Simply type to search for or browse the King's Right of First Refusal for Real Estate Purchase, either by keyword or according to the state/county the form pertains to.

After finding the required form, you can Log In and download it or save it under the My documents section.

Don’t have an account? It’s simple to get started! Just find the King's Right of First Refusal for Real Estate Purchase template and review the form's preview and a brief introduction (if available). If you’re comfortable with the template’s language, feel free to click Buy now. Create an account and select a subscription plan. The template will be available for download as soon as the payment is processed. Now you can execute the form.

- You don't have to be well-versed in law to search for and download the necessary form.

- You can choose from over 85,000 forms organized by state/county and case.

- The user-friendly interface, range of educational resources, and committed support make it easy to obtain and manage various documents.

Form popularity

FAQ

Once that is done the ROFR holder has the option of purchasing the property instead or waiving their ROFR and allowing another sale to go through. To get to closing, a title company has to have a signed Waiver of Right of First Refusal document in the file before funding can occur.

A right of last refusal is a right granted to a tenant to match an offer made by a third party to purchase or lease property from a property owner, which offer the property owner intends to accept if the right of last refusal is not exercised. A right of last refusal is often referred to as a matching right.

The right of first refusal (ROFR) is a contractual right that can impact your business and future opportunities. Simply put, the ROFR gives the holder of the right the option to enter into a transaction before anyone else.

The first right of refusal is a contractual right that ensures businesses have access to certain commercial opportunities before others. It is similar to an options clause because the holder has the right, but not the obligation, to enter into a transaction.

The right of first refusal is usually triggered when a third party offers to buy or lease the property owner's asset. Before the property owner accepts this offer, the property holder (the person with the right of first refusal) must be allowed to buy or lease the asset under the same terms offered by the third party.

The right of first refusal granted herein shall terminate (i)with respect to any particular First Refusal Space upon the failure by Tenant to exercise its right of first refusal with respect to the First Refusal Space so offered by Landlord pursuant to the terms of this Section1.

ROFR is a contractual obligation that binds both a prospective real estate buyer for example, a potential homeowner looking for an apartment, condo, or single-family residence and real estate seller.

The seller will keep the property on the market but accept a contingent offer, providing buyers with a 72-hour (negotiable) first-right-of-refusal notice to perform in the event seller receives a better offer. 2. The seller will take the property off the market and wait for the buyer to sell the buyer's existing home.

There's a time limit built into the typical ROFR agreement, so when the seller does decide to put the property up for sale, the potential buyer needs to be ready to make a quick decision and know whether they can line up the financing. They should be ready to enter into a purchase agreement within a matter of days.