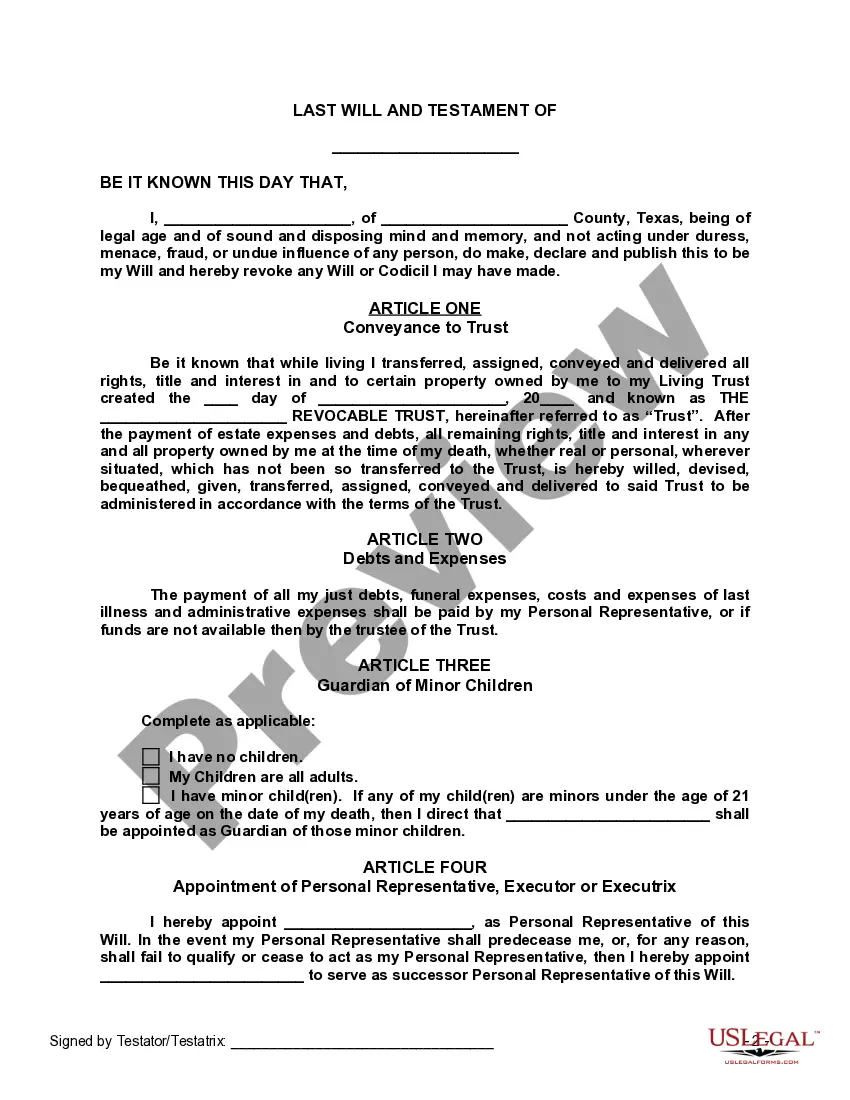

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

San Antonio Texas Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Texas Last Will And Testament With All Property To Trust Called A Pour Over Will?

We consistently aim to reduce or avert legal complications when engaged with intricate legal or financial matters.

To achieve this, we seek legal remedies that are typically quite costly.

Nevertheless, not every legal issue is that intricate; many can be handled independently.

US Legal Forms is an online repository of current DIY legal documents that range from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can effortlessly download it again from the My documents tab.

- Our platform allows you to manage your matters without needing to consult an attorney.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to obtain and download the San Antonio Texas Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will, or any other document quickly and securely.

Form popularity

FAQ

Generally speaking, there are three kinds of Wills: (1) holographic?written entirely in the handwriting of the person writing the Will; (2) standard, formal typewritten?printed or typed; and (3) partially handwritten and partially typed. The requirements for a valid Will are different for each type of Will.

Deciding between a Will and a Trust depends on your circumstances; there are pros and cons of each. For example, a Trust can be used to avoid probate and reduce Estate Taxes, whereas a Will cannot.

Drafting a Pour-Over Will in Texas A pour-over will is a safety net. It is a legal document that transfers (or ?pours?) assets into your trust at death if you have not transferred all of them to your trust during your lifetime. Living trusts and pour-over wills should be executed simultaneously.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

A simple/basic Will in Texas averages between $250 to $2,500+. The price depends on the experience of the attorney drafting the Will. Reputable attorneys will charge a minimum of $500+, since a Will is only valid if it is properly drafted and executed.

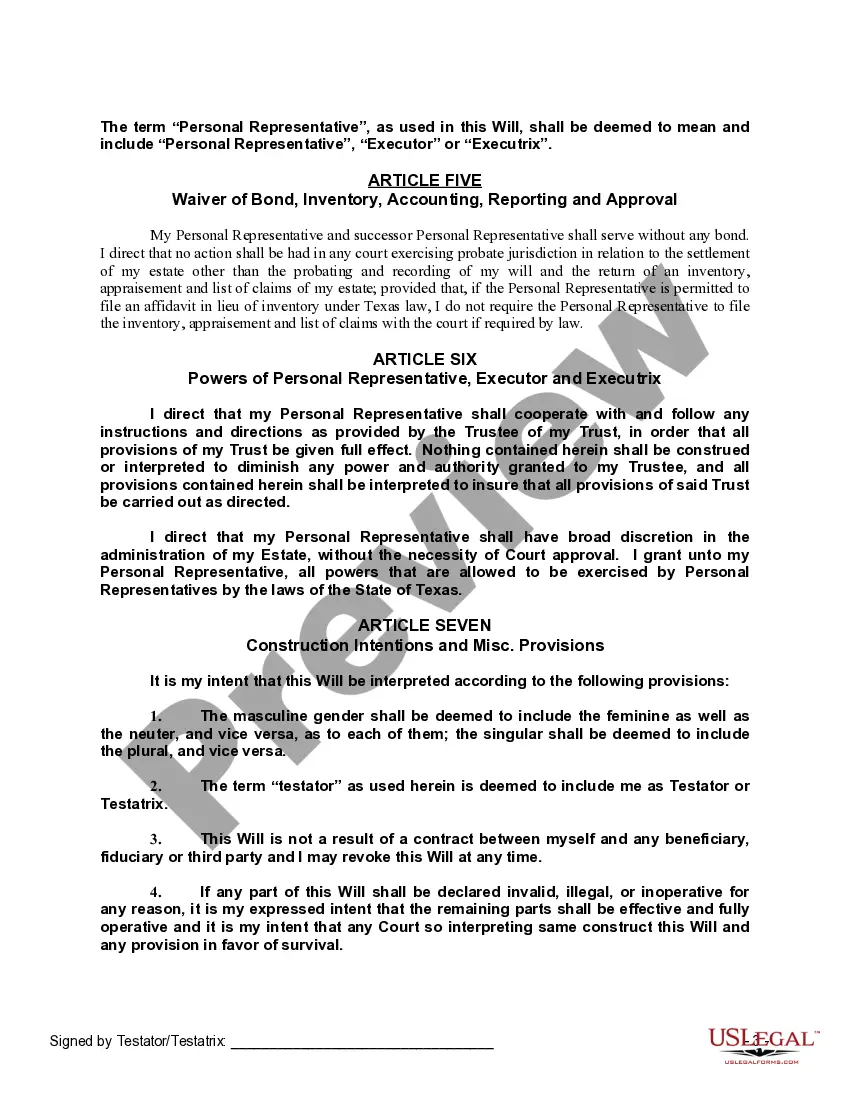

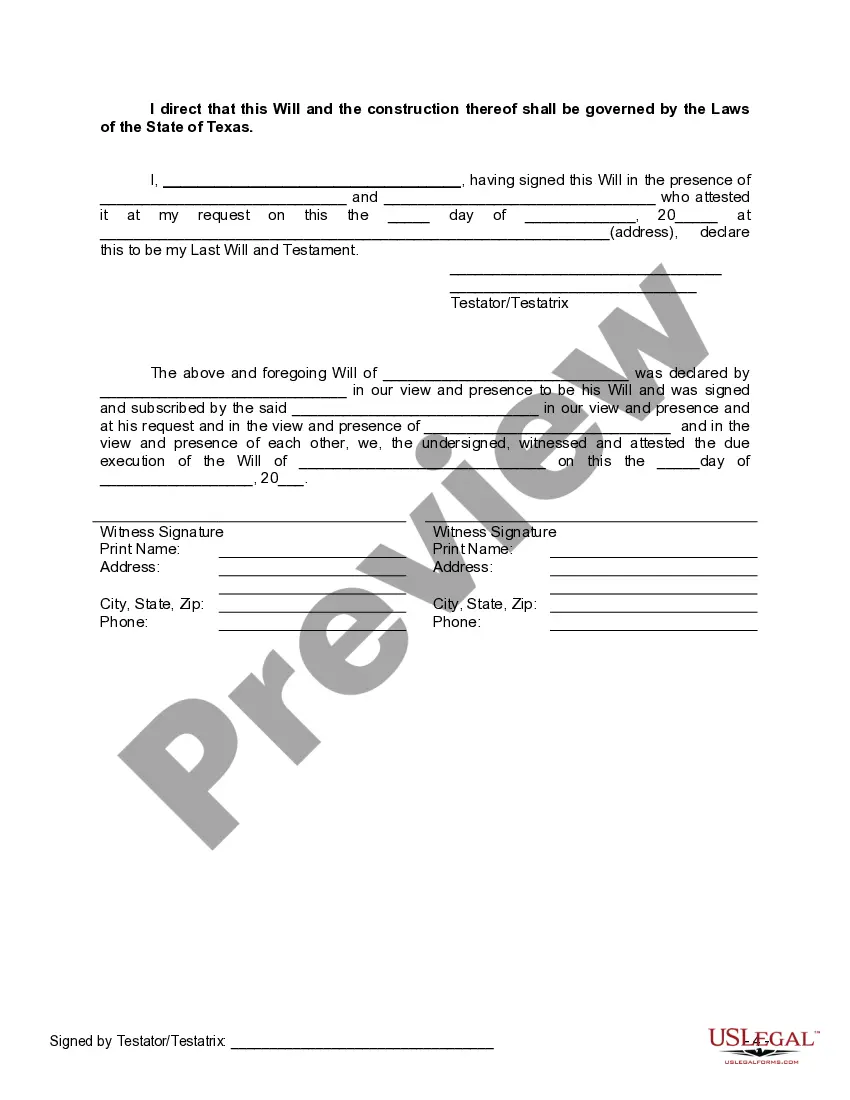

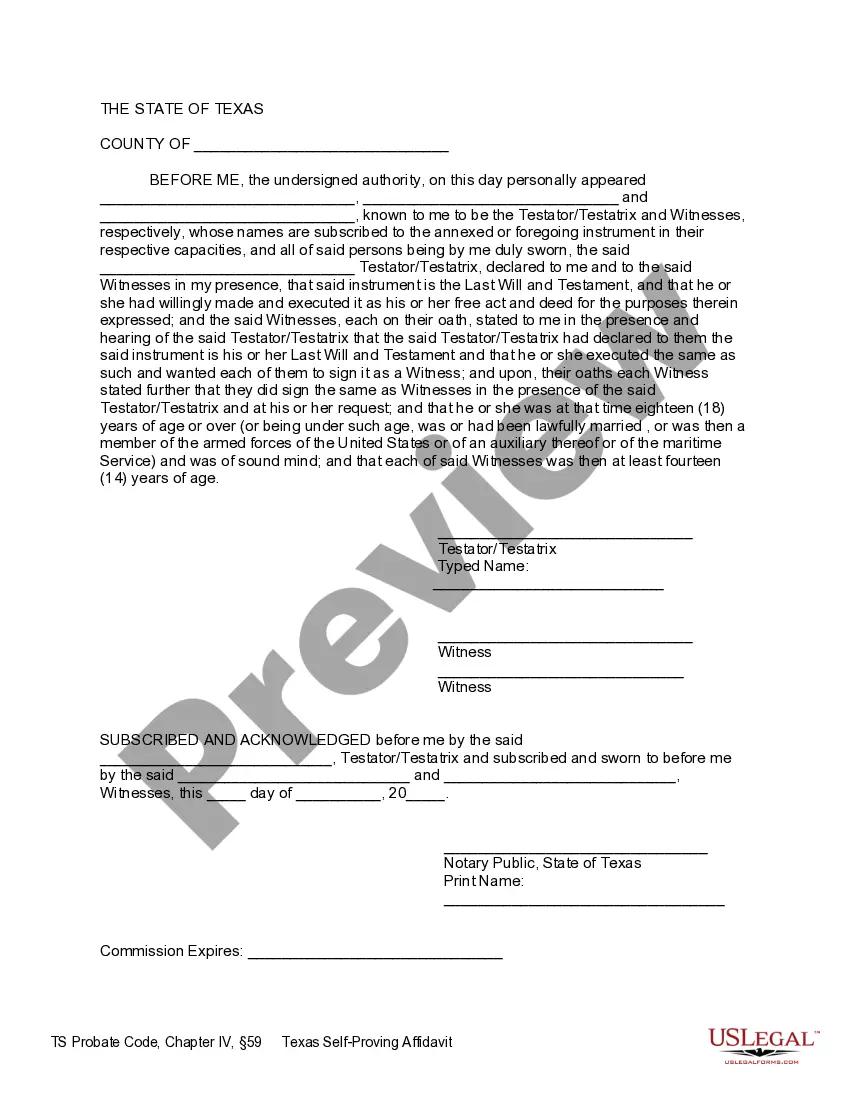

Two types of wills are recognized in Texas: formal and holographic. A formal will requires that at least two people over the age of 14 witness the signing of the document. An attorney should draft your formal will.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

If you die without either a will or a living trust, Texas controls the disposition of your property. And settling your estate likely will be more troublesome ? and more costly. The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death.

Two types of wills are recognized in Texas: formal and holographic. A formal will requires that at least two people over the age of 14 witness the signing of the document. An attorney should draft your formal will.

A will does not go into effect until after you die, whereas a living trust is active once it is created and funded. This means that a trust can provide protection and direct your assets if you become mentally incapacitated, something a will is unable to do.