Tarrant Texas Gift Deed

Description

How to fill out Texas Gift Deed?

We consistently aim to reduce or avert legal harm when engaging with subtle legal or fiscal issues.

To achieve this, we enlist the services of attorneys, which are typically quite costly.

Nonetheless, not all legal matters are this intricate. Many can be managed by ourselves.

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it from within the My documents tab. The process is equally straightforward if you’re new to the platform! You can set up your account in minutes. Ensure that the Tarrant Texas Gift Deed conforms to the laws and regulations of your state and locality. It’s also essential that you review the form’s outline (if available), and if you notice any inconsistencies with your initial expectations, look for a different template. Once you’ve confirmed that the Tarrant Texas Gift Deed is suitable for your situation, select the subscription option and proceed to payment. Then, you can download the document in any available file format. With over 24 years in the industry, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Make the most of US Legal Forms now to save time and resources!

- Our platform empowers you to handle your affairs independently without relying on legal counsel.

- We provide access to legal form templates that are not always readily accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Take advantage of US Legal Forms whenever you need to locate and download the Tarrant Texas Gift Deed or any other form securely and easily.

Form popularity

FAQ

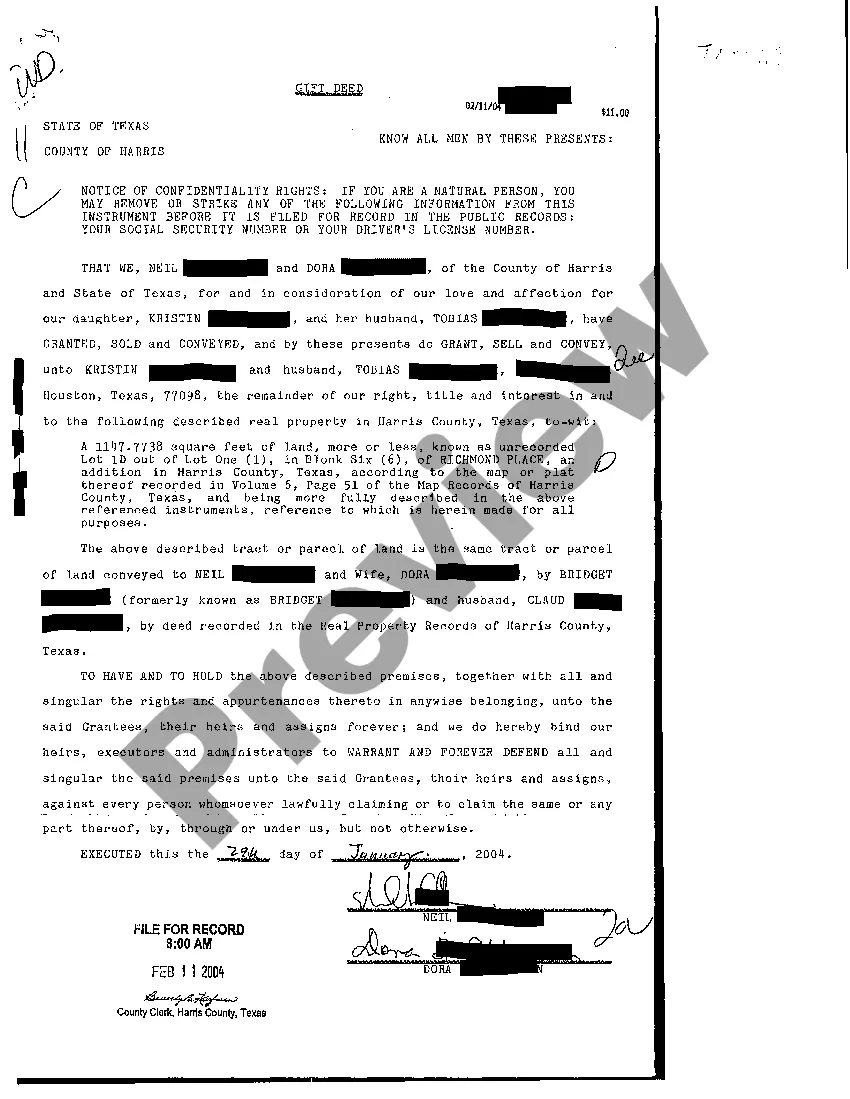

Writing a gift deed in Texas involves creating a document that clearly states the intent to transfer property as a gift. First, include the names of the grantor and grantee, along with a detailed description of the property. Then, incorporate the language that specifies the transfer does not involve any monetary exchange. Consider using the US Legal Forms platform for guided templates that simplify this process and ensure compliance with Texas laws.

To transfer ownership of a house to a family member in Texas, you can use a Tarrant Texas Gift Deed. This legal document allows the current owner to gift their property, transferring it to the family member without requiring payment. Ensure you properly fill out the deed, including details like the property description and the names of both parties. Once completed, you must file the deed with the local county clerk to complete the transfer.

A quitclaim deed transfers whatever interest the grantor has in the property without ensuring that the title is clear, while a Tarrant Texas Gift Deed specifically conveys ownership as a gift. This means that with a gift deed, the recipient obtains a clear title as long as the deed complies with Texas law. Moreover, gift deeds do not require consideration, making them more straightforward for transferring property as a gift. Understanding these differences can help you choose the right deed for your needs.

In Texas, a gift deed allows one person to transfer property to another without receiving any payment in return. To create a valid Tarrant Texas Gift Deed, the donor must have the legal capacity to give the property, and both parties must sign the deed. Additionally, the deed must be notarized and recorded with the county clerk's office where the property is located to ensure its effectiveness. By understanding these rules, you can accurately execute a gift deed in Tarrant, Texas.

To create a valid Tarrant Texas Gift Deed, the donor must be of sound mind and must express the intention to make a gift without any expectation of return. The deed must be in writing and signed by the donor. Moreover, it is crucial that the property description is clear and that the deed is delivered to the recipient to finalize the transfer.

While a Tarrant Texas Gift Deed can be a straightforward way to transfer property, it does come with a few disadvantages. For instance, once you give a gift deed, you relinquish any claim to that property, which means you cannot change your mind later. Additionally, this type of deed may have tax implications for both the giver and the recipient, potentially affecting your financial situation.

??A Texas Gift Deed is the document you will need to have in order to give real estate to another person. You can give Texas real estate to anyone, or to any entity, including a church or charity.

All property deeds ? $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas. Board-certified in residential real estate law.

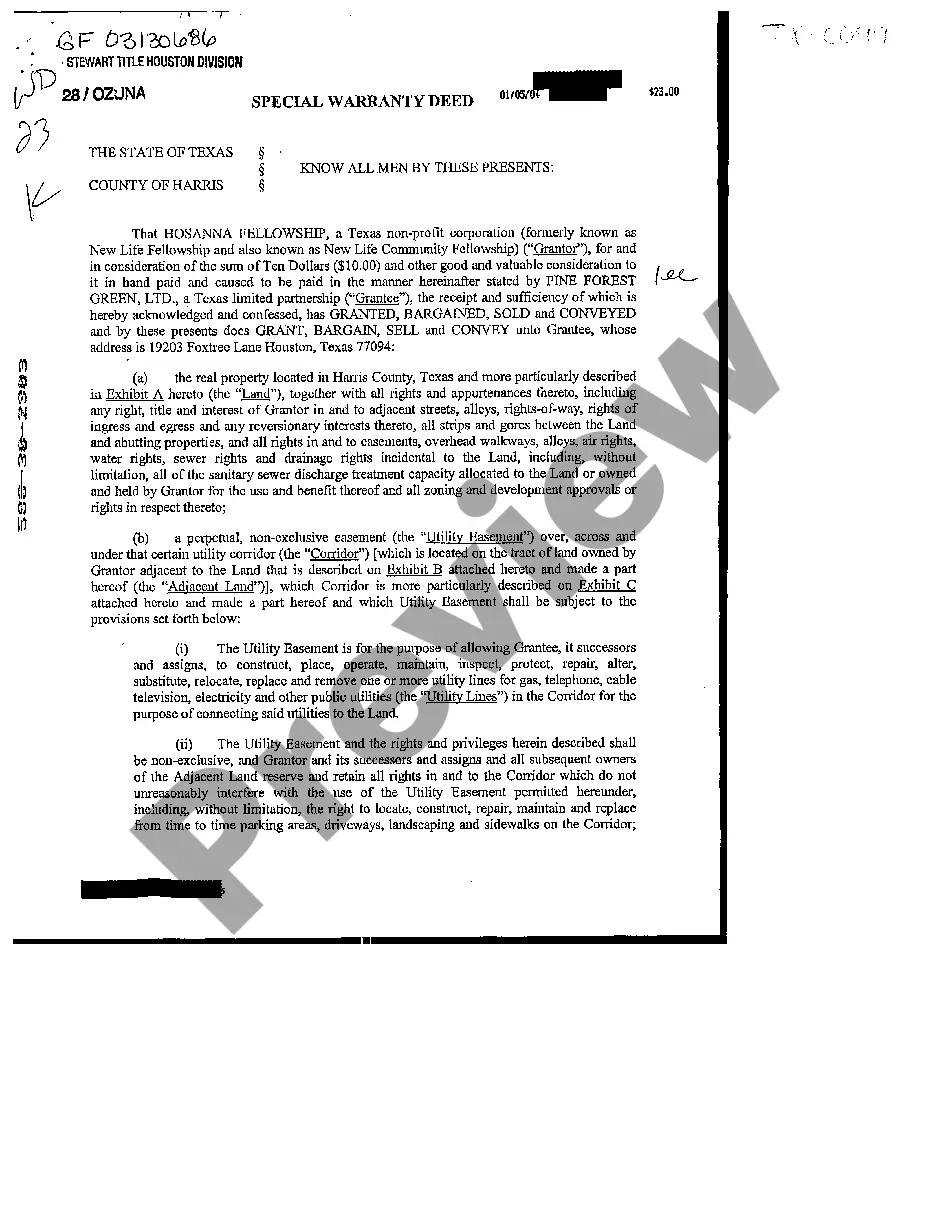

Gift deeds in Texas are valid, but there are requirements above and beyond those of a regular deed. A gift deed is a document that transfers title to land. It can be informal, but the grantor's intent must be to immediately divest himself of the property where he no longer has control over the land.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.