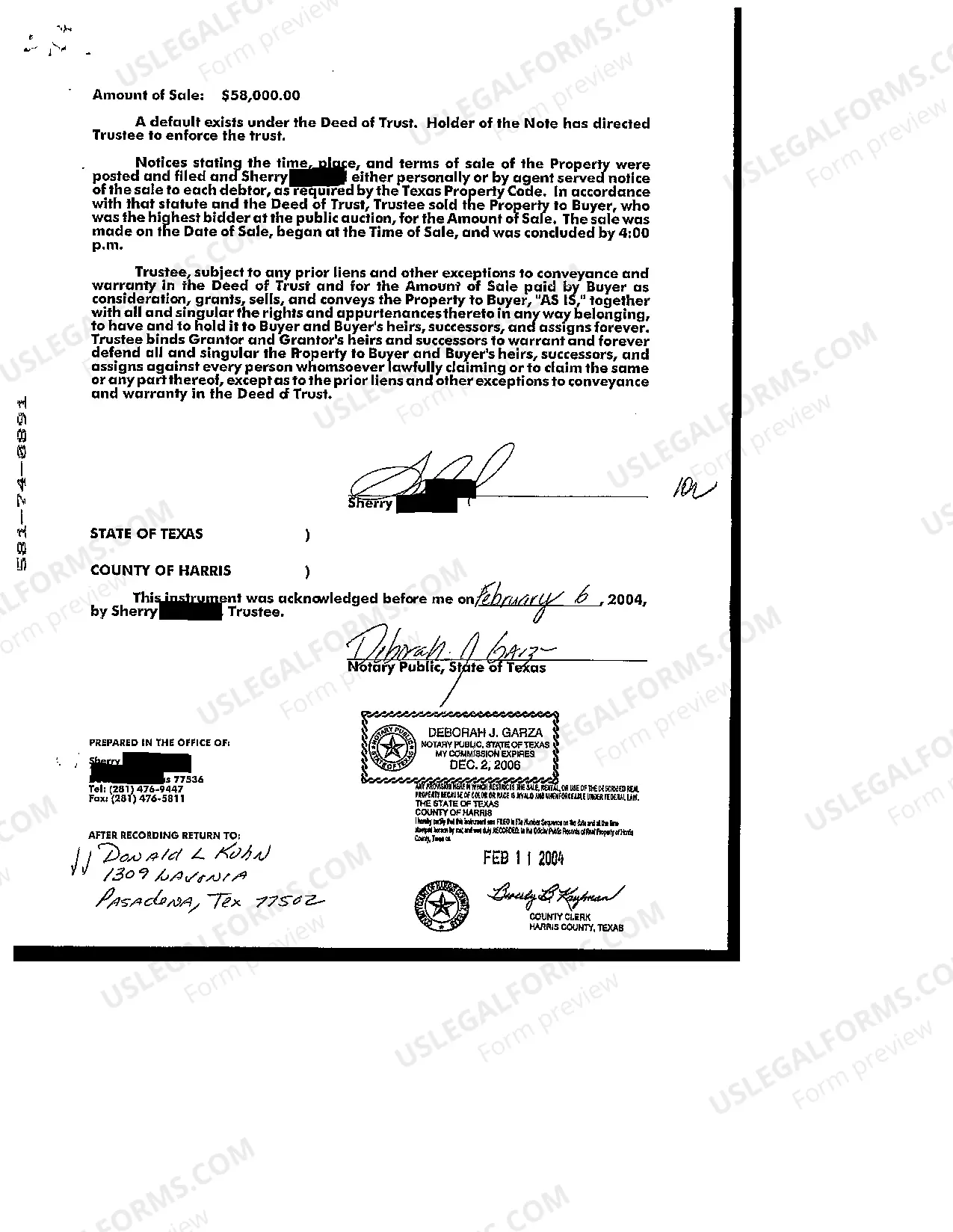

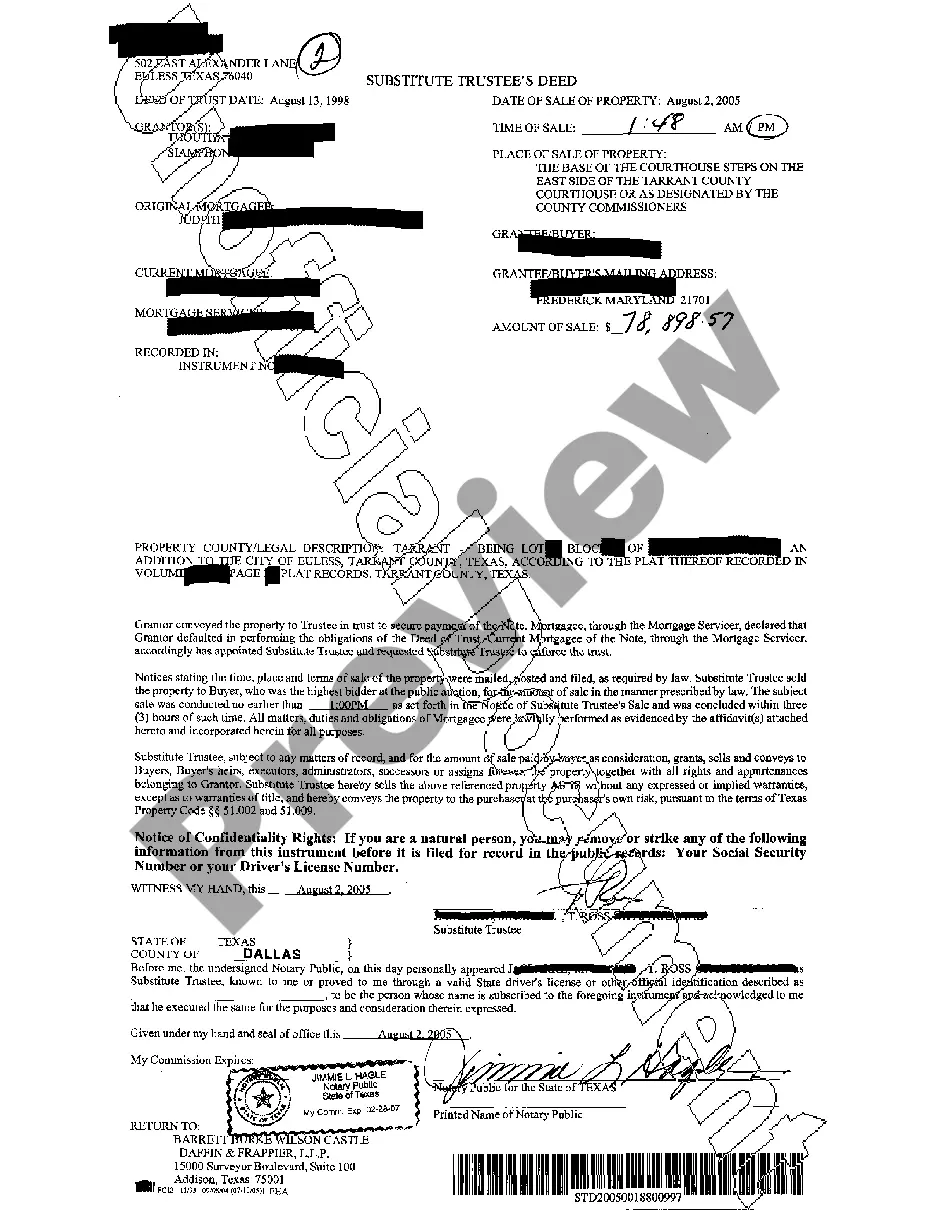

Carrollton Texas Trustee's Deed

Description

How to fill out Texas Trustee's Deed?

We consistently endeavor to reduce or avert legal complications when engaging with intricate legal or financial issues.

In order to achieve this, we enroll in attorney services that are typically quite costly.

However, not all legal challenges are equally intricate. Many of them can be addressed by ourselves.

US Legal Forms is an online repository of current DIY legal templates covering everything from wills and powers of attorney to articles of incorporation and petitions for annulment.

Simply Log In to your account and select the Get button adjacent to it. If you misplace the document, you can always retrieve it from the My documents section. The process is just as straightforward if you’re unfamiliar with the website! You can create your account in a matter of minutes. Ensure to verify if the Carrollton Texas Trustee's Deed complies with the laws and regulations of your state and region. Additionally, it’s important that you review the form’s outline (if available), and if you notice any inconsistencies with your original requirements, look for an alternative template. Once you’ve confirmed that the Carrollton Texas Trustee's Deed is suitable for you, you can select a subscription plan and proceed with the payment. Following that, you can download the document in any preferred format. For over 24 years in the market, we’ve assisted millions by providing customizable and up-to-date legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our collection empowers you to manage your affairs independently without needing to consult a lawyer.

- We offer access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, greatly easing the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Carrollton Texas Trustee's Deed or any other form quickly and securely.

Form popularity

FAQ

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

A trustee is somebody who manages property that is held in a trust. As a trustee, you're responsible for using the money or assets in a trust to benefit somebody else.

The trustee named in a Texas deed of trust can be any individual person who has the legal capacity to hold and transfer property. Under Texas law, if the named trustee is a corporation, the corporation must be authorized to act as a trustee in Texas.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

In simple terms, anyone who has the capacity to hold property can be a trustee. It is possible to be both a beneficiary and a trustee, although this may not always be appropriate. A trust may have just professional trustees, just lay trustees or a combination of the two.