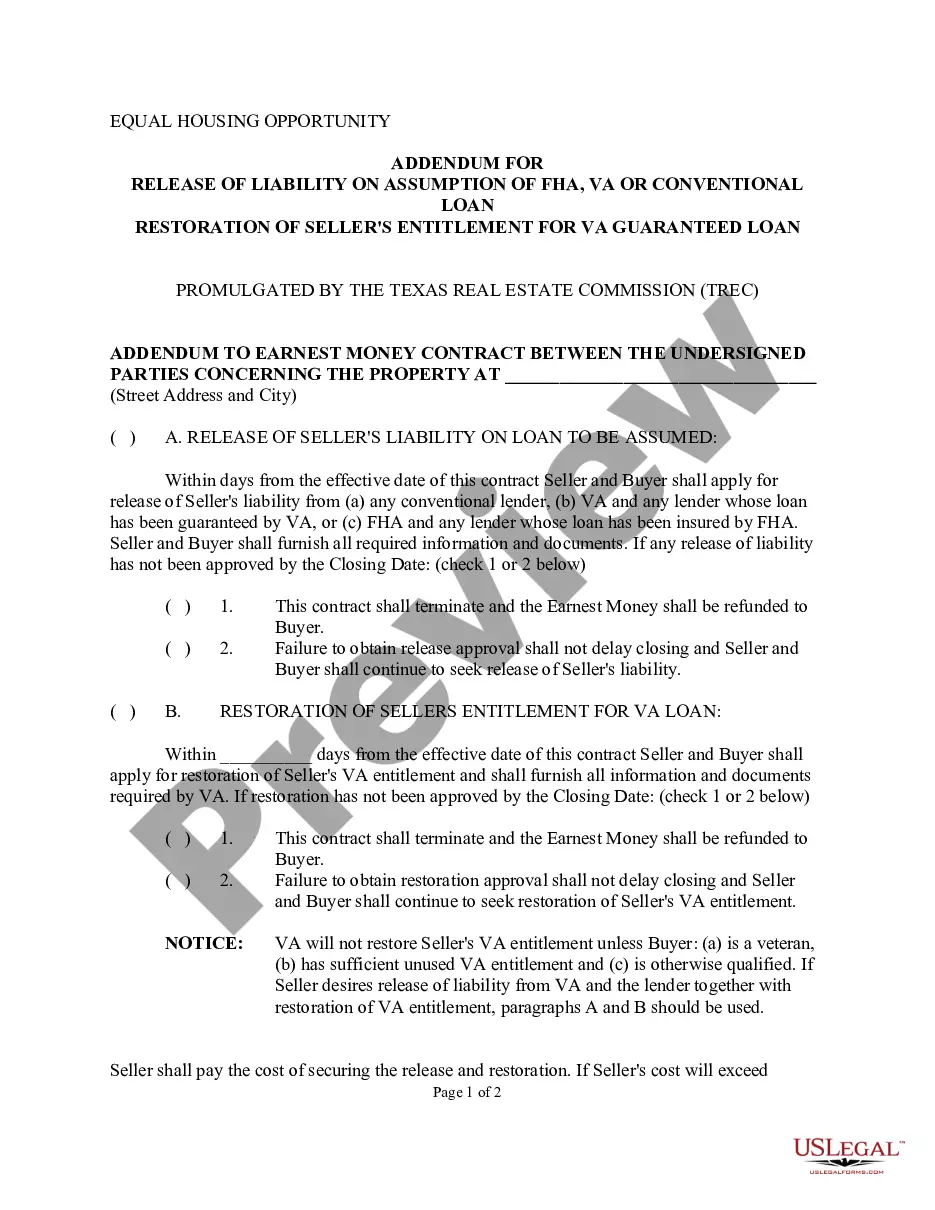

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

The Pasadena Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a legal document that outlines the terms and conditions related to assuming a loan or restoring the seller's entitlement for a VA guaranteed loan in Pasadena, Texas. This addendum protects the parties involved in the transaction and clarifies their rights and responsibilities. When assuming an FHA, VA, or conventional loan in Pasadena, Texas, both the buyer and seller must agree to release liability. This addendum ensures that the buyer assumes full responsibility for the loan and relieves the seller of any further obligations or liability. Furthermore, in the case of a VA guaranteed loan, if the seller wishes to have their entitlement restored, this addendum specifies the necessary steps and conditions for the restoration process. By restoring the seller's entitlement, they regain their eligibility for future VA loans. Different types of Pasadena Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan may include variations based on the specific loan type being assumed or the circumstances of the restoration of the seller's entitlement. These variations address the nuances associated with different loan programs and ensure compliance with relevant regulations. Pasadena Texas Addendum for Release of Liability on Assumption of FHA Loan: This specific addendum focuses on the release of liability when assuming a Federal Housing Administration (FHA) loan. It highlights the unique aspects and requirements associated with FHA loans, such as upfront mortgage insurance premiums or other FHA-specific conditions. Pasadena Texas Addendum for Release of Liability on Assumption of VA Loan: This addendum is tailored to assuming a loan backed by the Department of Veterans Affairs (VA). It outlines the specific responsibilities and considerations involved with assuming a VA loan, including meeting VA eligibility requirements and obtaining any necessary approvals from the VA. Pasadena Texas Addendum for Release of Liability on Assumption of Conventional Loan: This addendum deals with releasing liability when assuming a conventional loan, which is not insured or guaranteed by a government entity. It addresses the specific terms and conditions outlined in the original loan documents and highlights the buyer's responsibilities in assuming the loan. It is crucial to consult a qualified real estate attorney or professional when dealing with the Pasadena Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. They can provide accurate guidance and ensure compliance with relevant laws and regulations to protect all parties involved in the transaction.