This form is a Deed of Correction where the Grantor is an Individual and the Grantee is an Individual. Grantor conveys and warrants the described property to the Grantee. This Deed is used to correct a mutual mistake. This deed complies with all state statutory laws.

Houston Texas Correction Deed - Prior Deed from an Individual to an Individual

Description

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

If you have previously used our service, Log In to your account and download the Houston Texas Correction Deed - Prior Deed from an Individual to an Individual onto your device by selecting the Download button. Ensure that your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to all the documents you have purchased: you can find them in your profile under the My documents section whenever you need to use them again. Make use of the US Legal Forms service to easily find and download any template for your personal or professional requirements!

- Confirm you’ve located a suitable document. Review the details and utilize the Preview feature, if available, to verify if it aligns with your needs. If it doesn't suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Houston Texas Correction Deed - Prior Deed from an Individual to an Individual. Choose the file format for your document and save it to your device.

- Fill out your form. Print it or utilize professional online editors to complete and sign it digitally.

Form popularity

FAQ

When you gift property in Texas, such as through a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual, there are potential tax implications to consider. The IRS allows individuals to gift up to a certain amount each year without incurring gift tax liability. However, if the value exceeds this threshold, the donor may need to file a gift tax return, and this could affect their lifetime gift tax exemption as well. It's wise to consult a tax professional to fully understand how gifting property could impact your taxes.

To amend a deed, you usually need to create a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual. This amendment highlights the changes that need to be made while providing clarity on the property information. It is critical to gather all pertinent documentation and signatures required for the amendment. After preparing the amendment, file it with your county clerk to update the public records.

In Texas, anyone with an interest in the property can file a correction deed, including property owners and authorized representatives. If you have executed a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual, it is essential to file it with the county clerk where the property is located. This ensures that the corrections are recognized legally. However, it's wise to consult legal advice if unsure about the process.

Correcting a deed in Texas involves preparing a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual. This document serves to rectify any mistakes or inaccuracies in the original deed. You must include precise details about the property and any errors that need correction. Once you have completed the deed, file it with the appropriate county office and notify any relevant parties.

To remove someone from a deed in Texas, you typically need to execute a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual. This document effectively corrects the existing deed by removing the individual's name. Ensure you have the property’s legal description and the necessary signatures. After completing the correction deed, file it with the county clerk to make it official.

The most commonly used deed is the warranty deed, which guarantees that the seller has clear title to the property and the right to transfer it. Warranty deeds offer protection to the buyer against any future claims to the ownership of the property. However, quitclaim deeds are also frequently used, especially in informal transactions. Understanding the distinctions and applications of each deed type, including a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual, is crucial for making informed decisions.

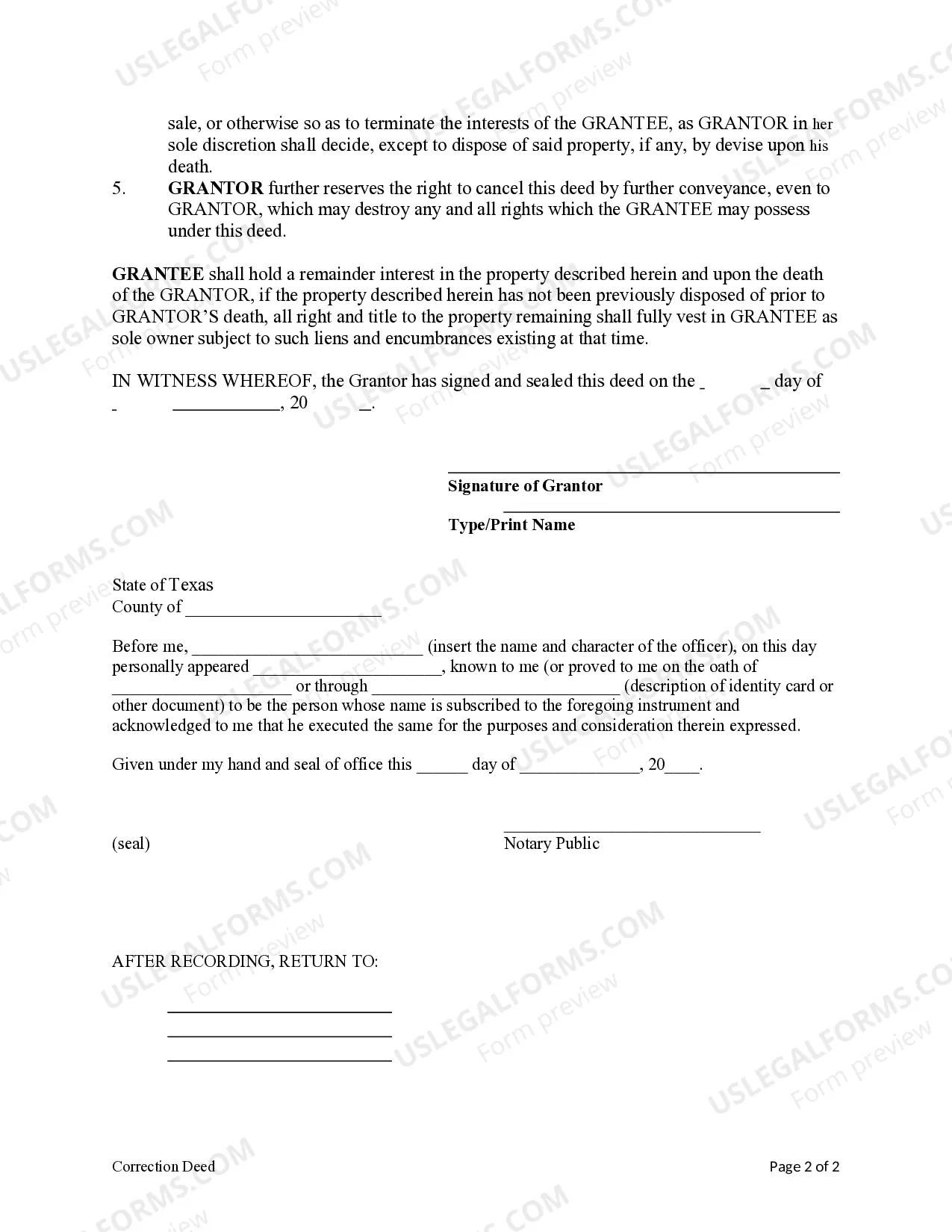

A corrective deed resembles a standard deed but contains specific language that details the corrections made. It will include information from the original deed along with the corrections clearly outlined. Critical elements like the names of the parties and the description of the property should be emphasized to avoid confusion. If you seek clarity in a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual, platforms like uslegalforms can provide structured templates for your needs.

A corrective deed is used to fix errors in a previously executed deed. For example, if a name was misspelled or if the property description was inaccurate, a corrective deed would articulate the proper details. It essentially acts as a legal fix, ensuring that the real estate records accurately reflect the intent of the parties involved. This is particularly useful when dealing with a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual.

To amend a deed, you typically need to create a new document that outlines the necessary changes. This new amendment should reference the original deed and state the corrections clearly. After drafting the amendment, ensure you sign and notarize it, then file it with your county's property records office. Utilizing platforms like uslegalforms can simplify the process of creating a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual for you.

A quitclaim deed primarily benefits individuals who want to transfer property ownership without providing a warranty of title. This type of deed is often used among family members or friends, simplifying the process and reducing costs associated with more formal transactions. For instance, if someone is transferring property to a spouse or a child, they may utilize the quitclaim deed. Understanding the specifics of a Houston Texas Correction Deed - Prior Deed from an Individual to an Individual can enhance your clarity.