Assignment of Judgment

About this form

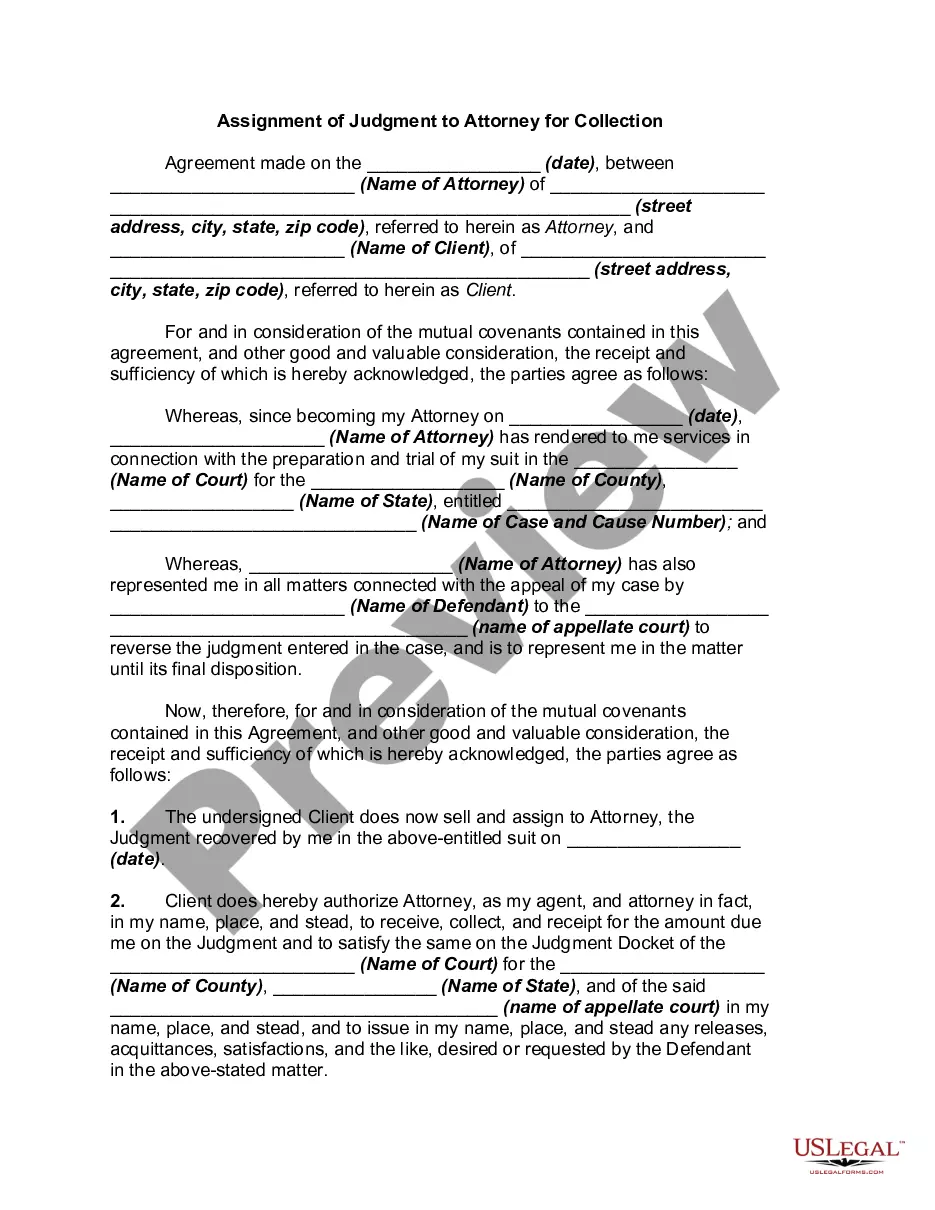

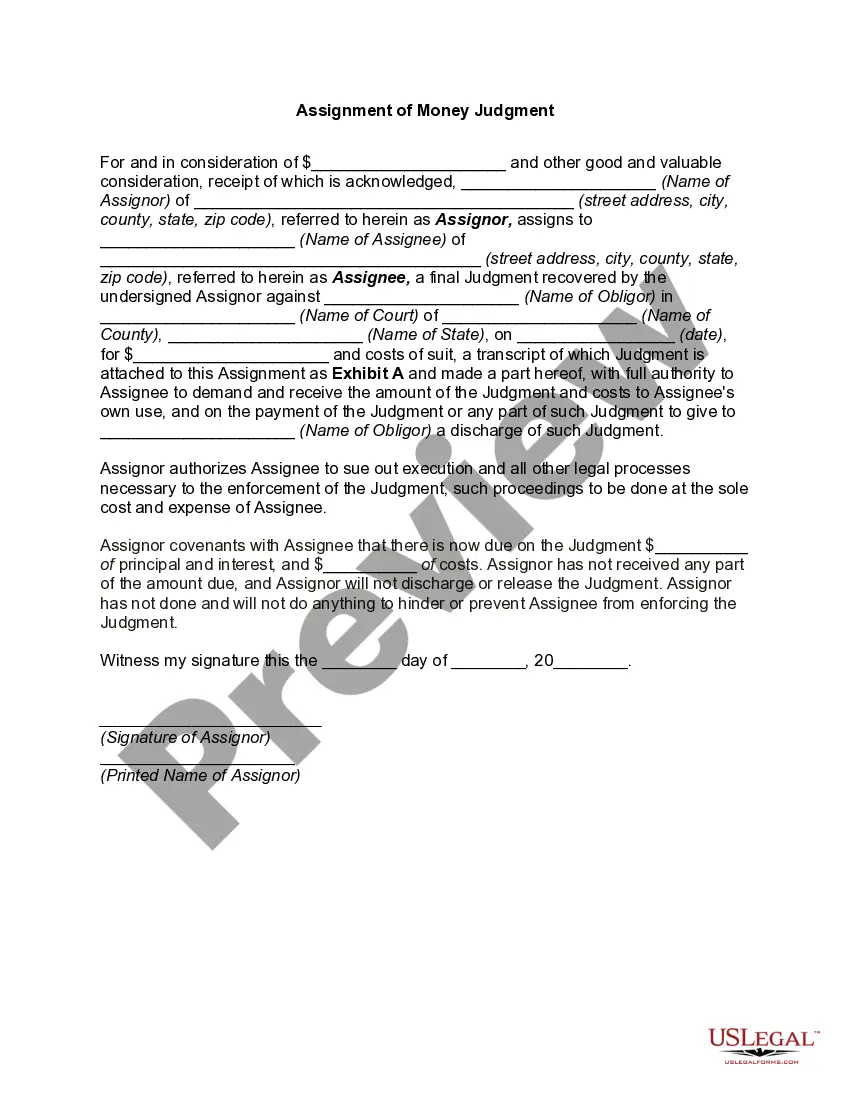

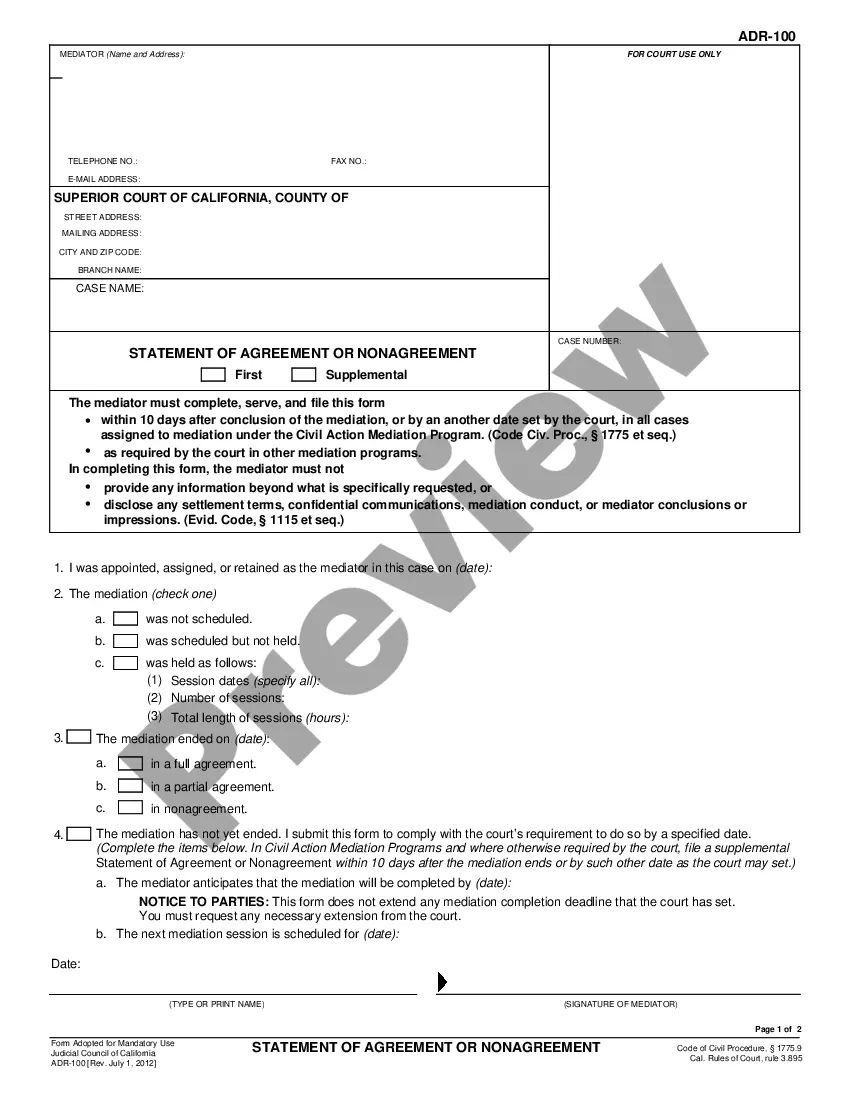

An Assignment of Judgment is a legal document that allows one party (the assignor) to transfer their rights to a judgment to another party (the assignee). This form is typically used for purposes such as debt collection or assignment of rights for payment. It ensures that the assignee can legally pursue the collection of the judgment under the terms outlined in the document.

Key parts of this document

- Name and address of the Assignor (the party assigning the judgment).

- Name and address of the Assignee (the party receiving the judgment rights).

- Consideration being exchanged for the assignment (the amount or value).

- Date of the original judgment.

- Name of the court that issued the judgment.

- Name of the judgment debtor.

- Amount of the judgment, including any court costs and fees.

- Signature of the Assignor and a notary acknowledgment (if required).

When to use this form

This form is used when an individual or business has a judgment in their favor but wants to transfer the right to collect that judgment to another party. For example, if a creditor has a judgment against a debtor and chooses to assign that judgment to a debt collection agency, this Assignment of Judgment would be the appropriate document to use. It can also be useful in situations where a judgment is being used as an asset in a business transaction.

Who this form is for

This form is intended for:

- CREDITORS who hold a judgment and wish to transfer their rights to another party.

- DEBT COLLECTION AGENCIES that need to formalize their right to collect a judgment on behalf of a creditor.

- BUSINESS OWNERS looking to assign judgment rights as part of a financial agreement.

How to prepare this document

- Identify the Assignor by entering their name and address.

- Identify the Assignee by entering their name and address.

- Specify the consideration amount that is being exchanged for the assignment.

- Fill in the date when the original judgment was recovered.

- Enter the name of the court that issued the judgment and the name of the judgment debtor.

- Sign the document and arrange for notarization if required by your state.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

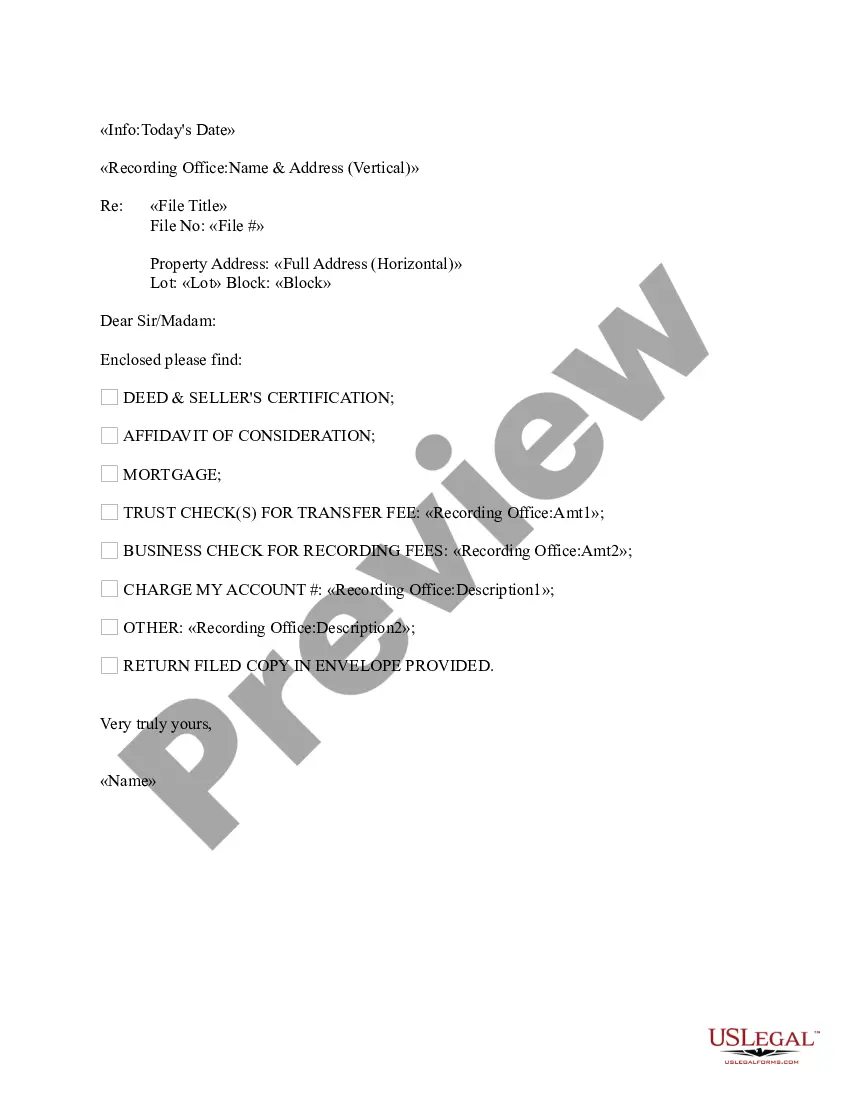

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide accurate names and addresses of all parties involved.

- Not specifying the consideration amount clearly.

- Omitting the date of the original judgment.

- Neglecting to have the document notarized if required by state law.

- Not keeping a copy of the completed form for personal records.

Benefits of using this form online

- Easy access to the form for quick preparation and submission.

- Convenience of completing the form at your own pace.

- Instant availability of downloadable templates, eliminating delays.

- Reliability of forms created based on professionally drafted templates.

Looking for another form?

Form popularity

FAQ

Assigning your judgment means that you forfeit ownership of your judgment permanently. It is a one-way sale that cannot be reversed except by finding and obtaining the cooperation of the person you assigned it to; or working and paying for a court order voiding the judgment assignment to them.

If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt. A judgment is an official result of a lawsuit in court. In debt collection lawsuits, the judge may award the creditor or debt collector a judgment against you.

Do not use illegal ways to collect your money. Encourage the debtor to pay you voluntarily. Be organized. Ask a lawyer or collection agency for help. Make sure you renew your judgment. Ask the court for help.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

Satisfied Judgments A satisfied judgment is the opposite of an unsatisfied judgment. It means that your debt is either paid or settled. While you may not have completely paid off your debt in full, you can satisfy a judgment by making a new payment plan and paying what you and the lender agreed on.

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

It is divided into five types unlike judgement which is final in itself. A decree may be final or preliminary. It is a formal declaration or adjudication and is conclusive in nature. A decree is of three kinds namely, preliminary decree, final decree and partly preliminary & partly final.

What Happens After a Judgment Is Entered Against You? The court enters a judgment against you if your creditor wins their claim or you fail to show up to court. You should receive a notice of the judgment entry in the mail. The judgment creditor can then use that court judgment to try to collect money from you.