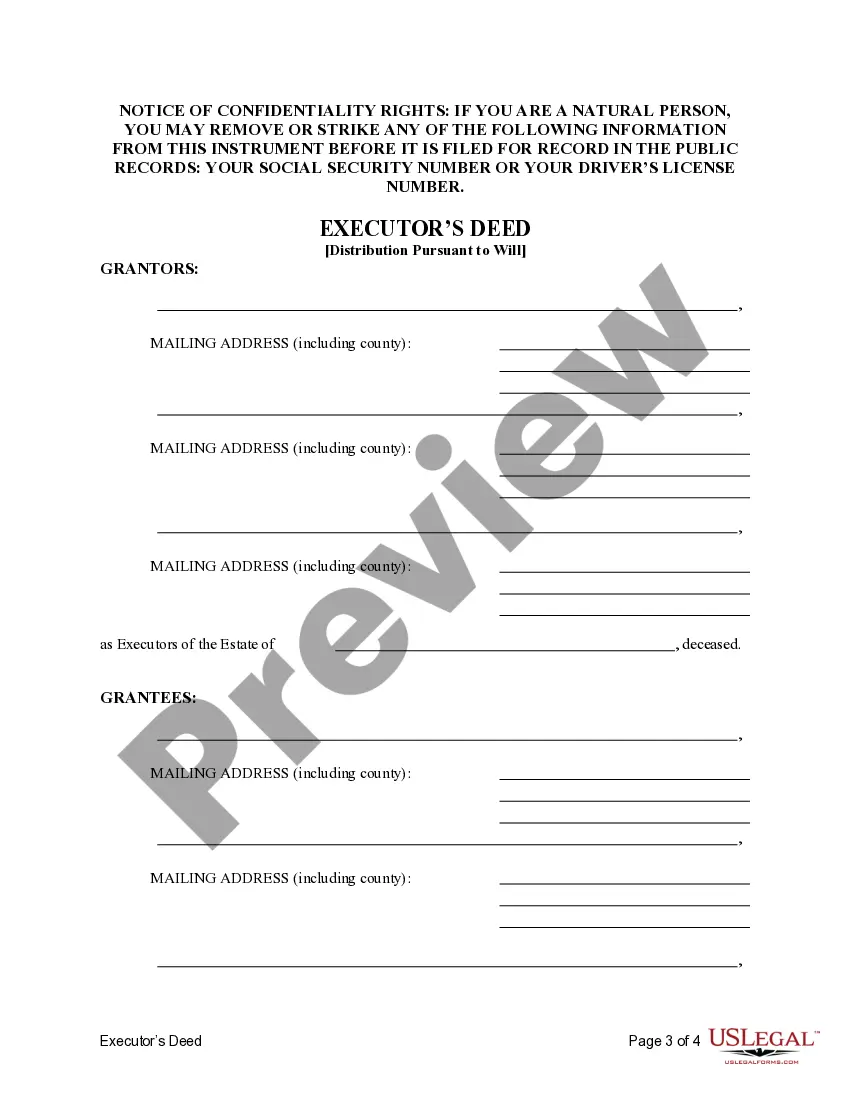

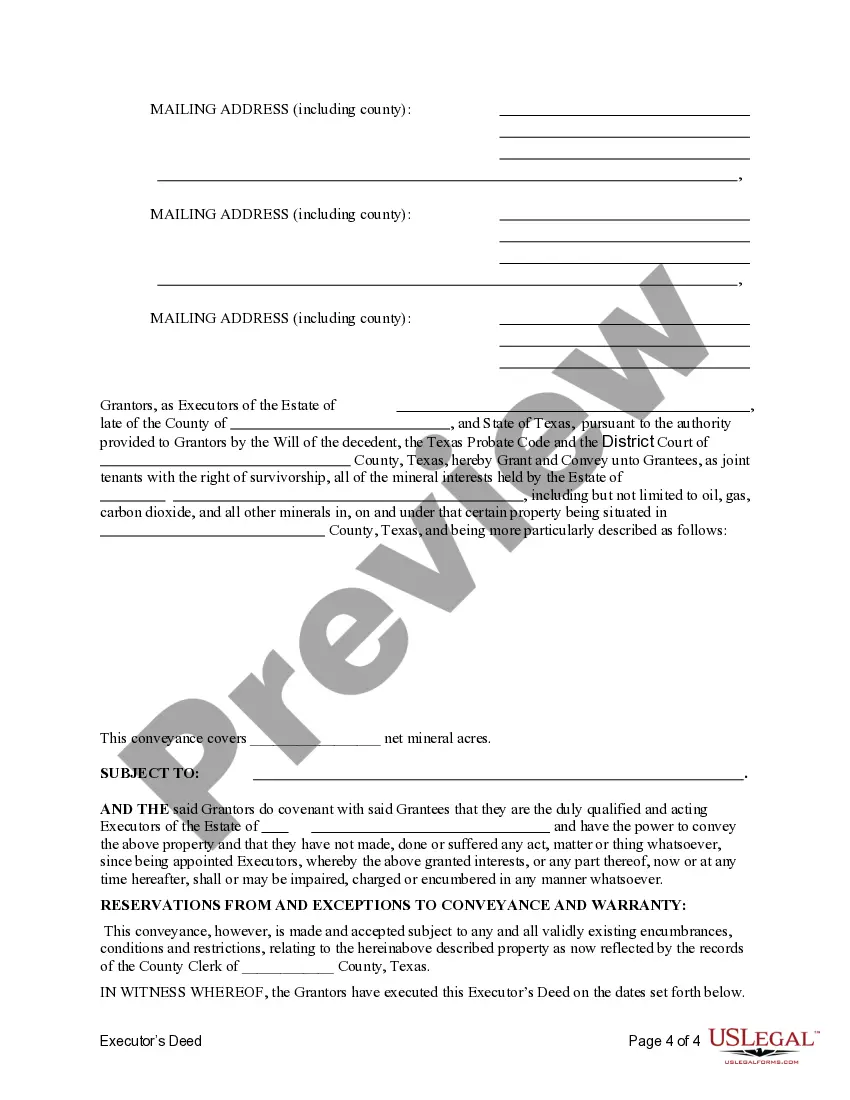

This form is an Executor's Deed where the Grantors are the executors of an estate and the Grantees are the beneficiaries of the estate. Grantors convey the described property to the Grantees. The Grantors warrants the title only as to events and acts while the property is held by the Executors. This deed complies with all state statutory laws.

Plano Texas Executor's Deed - Three Executors to Five Beneficiaries Pursuant to Terms of Will

Description

How to fill out Texas Executor's Deed - Three Executors To Five Beneficiaries Pursuant To Terms Of Will?

Are you in search of a dependable and cost-effective provider for legal documents to purchase the Plano Texas Executor's Deed - Three Executors to Five Beneficiaries as per the Will's stipulations.

US Legal Forms is your primary answer.

Whether you require a simple arrangement to establish rules for living with your partner or a collection of forms to facilitate your divorce proceedings, we have you covered.

Our site presents over 85,000 current legal document templates for personal and business applications. All the templates we provide are not universal and are tailored according to the stipulations of specific states and regions.

Examine the form's particulars (if available) to understand who and what the document serves.

If the template is not appropriate for your specific needs, restart your search.

- To acquire the document, you must Log In to your account, locate the needed template, and click the Download button adjacent to it.

- Keep in mind, you can download your previously acquired document templates at any time through the My documents section.

- Are you a newcomer to our platform? No trouble.

- You can create an account in just a few minutes, but first, ensure you do the following.

- Verify whether the Plano Texas Executor's Deed - Three Executors to Five Beneficiaries aligns with the regulations of your state and locality.

Form popularity

FAQ

An executor must be impartial. Neither he/she, nor his/her family, friends, may benefit unfairly (for example from the sale of an asset). He/She must carry out the instructions in the will, as well as reasonable instructions of the heirs. Quarrels with heirs should not interfere with his or her duties.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

Under the Texas Estates Code, the standard compensation is a five (5%) percent commission on (1) all amounts that the executor or administrator receives; or (2) pays out in cash in the administration of the estate (the Texas two-step on executor compensation).

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.

Therefore, an executor of a will can be a beneficiary, and in reality, the main beneficiary of the estate is often one of the executors. As a result, it is both perfectly legal and commonplace to name the same person as an executor and a beneficiary in a will.

The executor may also be a beneficiary of the Will, though he or she must treat all beneficiaries fairly and in accordance with the provisions of the Will. The duties of an independent executor are those of a trustee. He holds property interests, not his own, for the benefit of others.

Up to four executors can act at a time, but they all have to act jointly. So it might not be practical to appoint that many people. It's a good idea, though, to choose two executors in case one of them dies before you do or 'renounce probate' if they do not want the job.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

A: The best way to make this change to your will is to have a typed codicil that is properly witnessed and notarized in conformance with Texas law. If you do it this way, then probate will be quick and simple. You are allowed to make the change by signing a handwritten note.

Under the laws of Texas, some of the primary duties of an executor include: Locating the beneficiaries named in the will. Giving notice to creditors of decedent's death, paying all valid debts. Identifying, protecting and managing the decedent's assets.