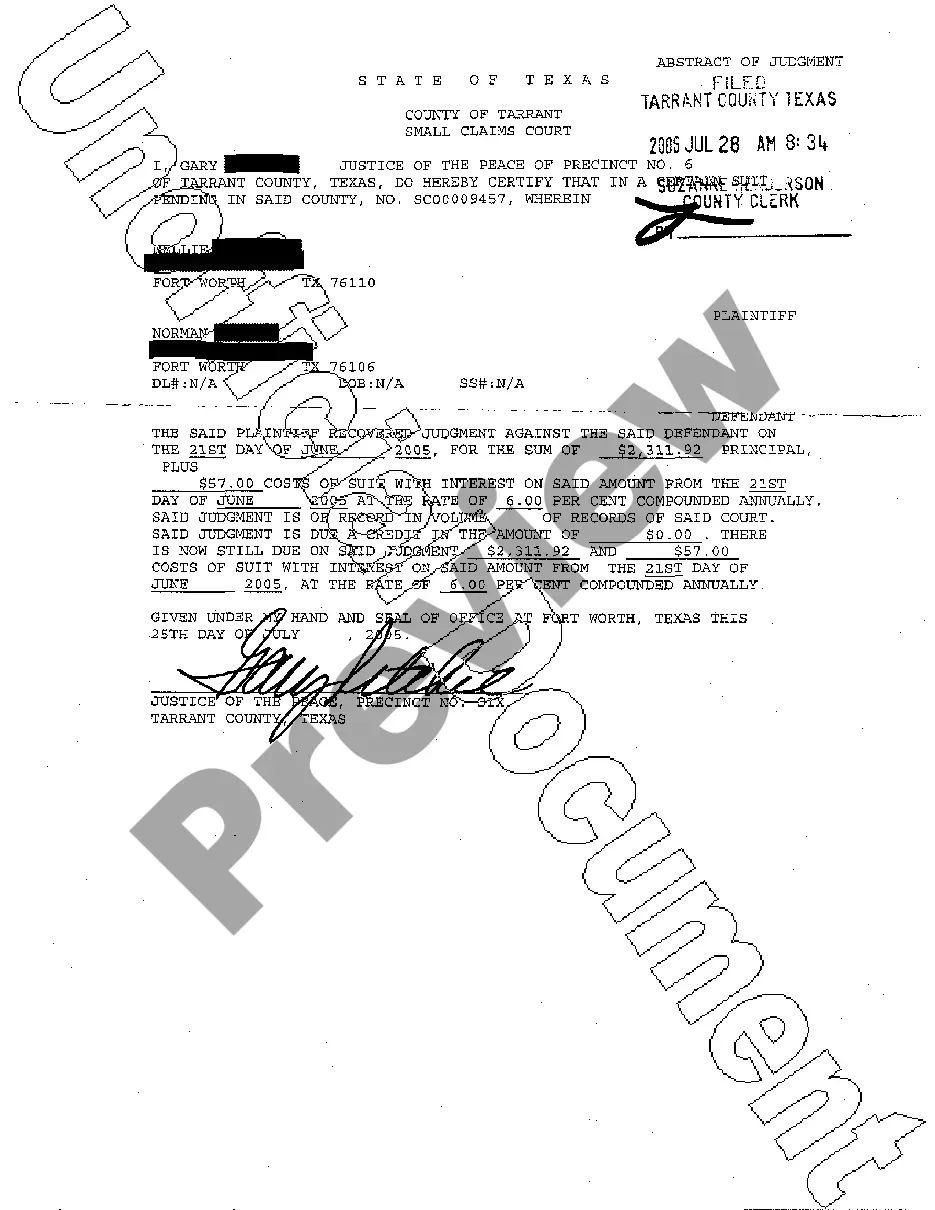

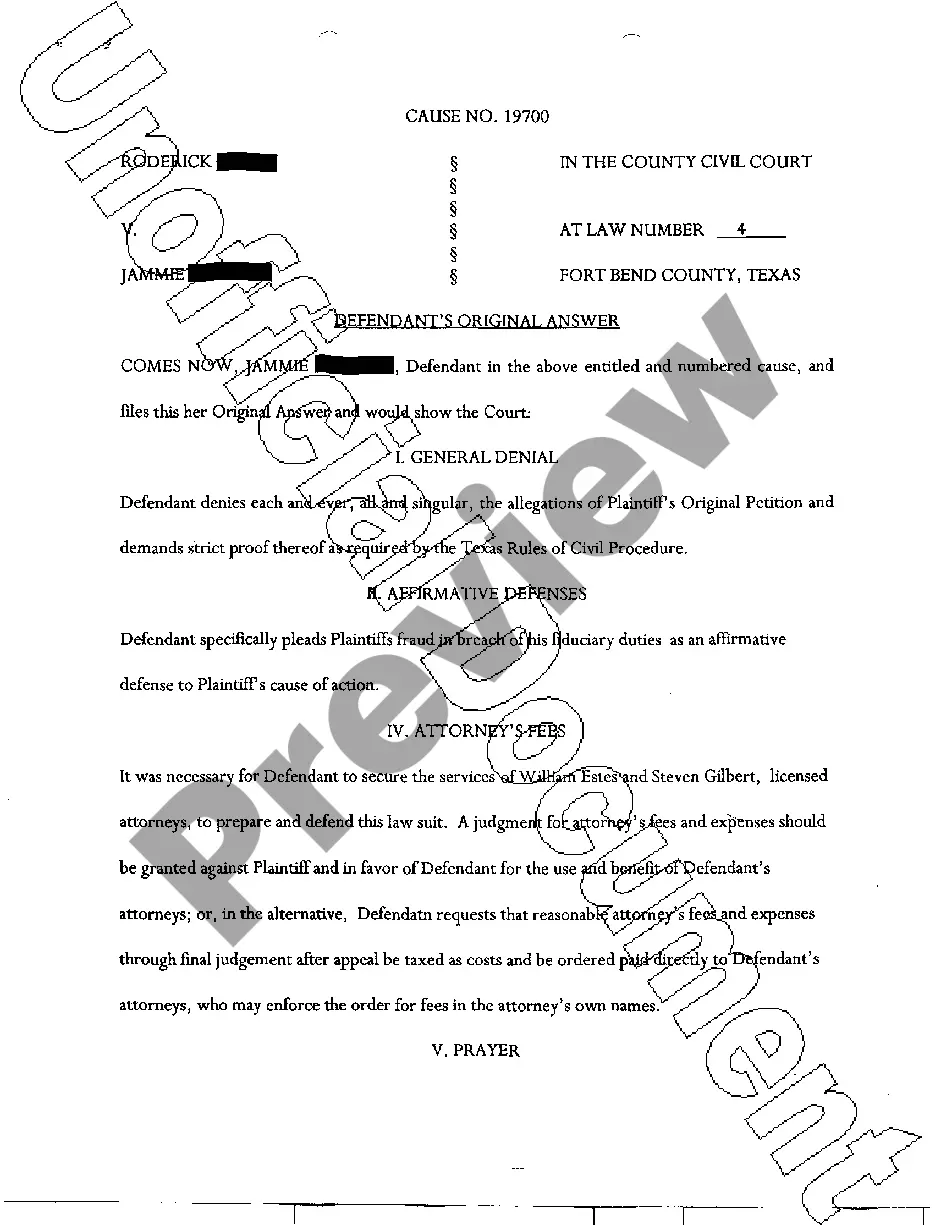

This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

Plano Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary

Description

How to fill out Texas Executor's Deed Of Distribution - Individual Executor To Individual Beneficiary?

We consistently aim to reduce or avert legal complications when engaging with intricate legal or financial issues.

To achieve this, we enroll in legal services that are generally quite expensive.

Nevertheless, not every legal matter is equally intricate.

Many can be managed independently.

Utilize US Legal Forms whenever you require to retrieve and download the Plano Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents, ranging from wills and power of attorney to incorporation articles and dissolution petitions.

- Our collection empowers you to handle your issues autonomously without needing to employ an attorney's expertise.

- We provide access to legal document templates that are not always available to the public.

- Our templates are specific to state and locality, significantly streamlining the search process.

Form popularity

FAQ

Technically speaking, there aren't any legal beneficiary rights, as such. What they do have is the ability to force the executor to perform their duties, and with that comes the understanding that beneficiaries can't act on behalf of the executor. They don't have the same authority.

No, generally, beneficiaries cannot demand to see the decedent's bank statements unless they are also a personal representative of the estate. However, it is within the executor's discretion to share bank statements with beneficiaries upon request.

Since the heirs own the real estate when the decedent dies, all the heirs must join in selling the property, including signing the real estate contract, deed of sale and other documents incidental to a sales transaction.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

There are certain kinds of information executors are generally required to provide to beneficiaries, including an inventory and appraisal of estate assets and an estate accounting, which should include such information as: An inventory of estate assets and their value at the time of the decedent's death.

When the Will is filed for probate, the person named as the Executor will need to sign the Executor's Deed to transfer the property from the deceased owners to the heirs named in the Will. If there is no Will, a probate judge may appoint an Administrator for the estate.

As an executor, you will have a duty to ensure that you are selling the property for the best possible price, for the benefit of the estate. For example, you must not sell the property at an undervalue to yourself, a member of your family, or indeed to one of the beneficiaries in the will.

Once the assets of the estate have been distributed, the personal representative must issue a final accounting with the court, which must also be sent to each beneficiary.

A beneficiary's right to information Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

However, if there is no stipulation, the PR, working with their attorney, submits paperwork to the court to get their okay to finalize the sale. All heirs must agree with the terms of the deal.