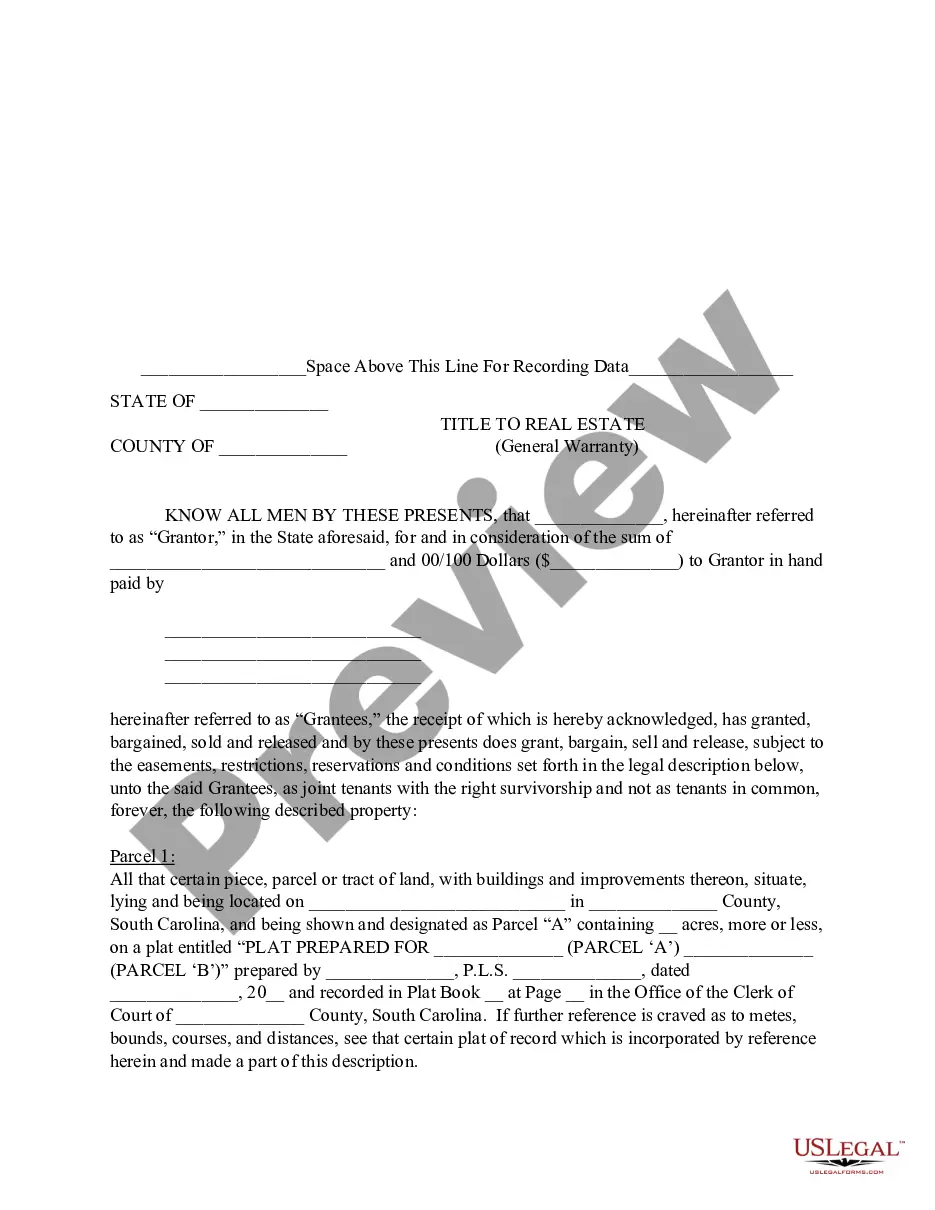

This form is an Executor's Deed where the Grantor is the executor of an estate and the Grantee is a Trust disgnated by will to receive the property. Grantor conveys and grants the described property to the Grantee. The Grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

Plano Texas Executors Deed of Distribution to a Trust

Description

How to fill out Texas Executors Deed Of Distribution To A Trust?

Utilize the US Legal Forms to gain instant access to any document you require.

Our beneficial platform, featuring a vast array of document templates, simplifies the process of locating and acquiring nearly any document sample you need.

You can download, complete, and authenticate the Plano Texas Executors Deed of Distribution to a Trust in mere minutes, instead of spending hours searching online for a suitable template.

Employing our collection is an excellent method to enhance the security of your document submission.

If you haven’t created an account yet, follow the guidelines outlined below.

Locate the template you require. Ensure that it is the document you were looking for: check its title and description, and utilize the Preview option if available. Alternatively, use the Search box to find the correct one.

- Our experienced attorneys frequently examine all documents to guarantee that the forms are appropriate for a specific area and conform to the latest laws and regulations.

- How can you acquire the Plano Texas Executors Deed of Distribution to a Trust? If you already possess a profile, simply Log In to your account.

- The Download button will be available on all forms you access. Additionally, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

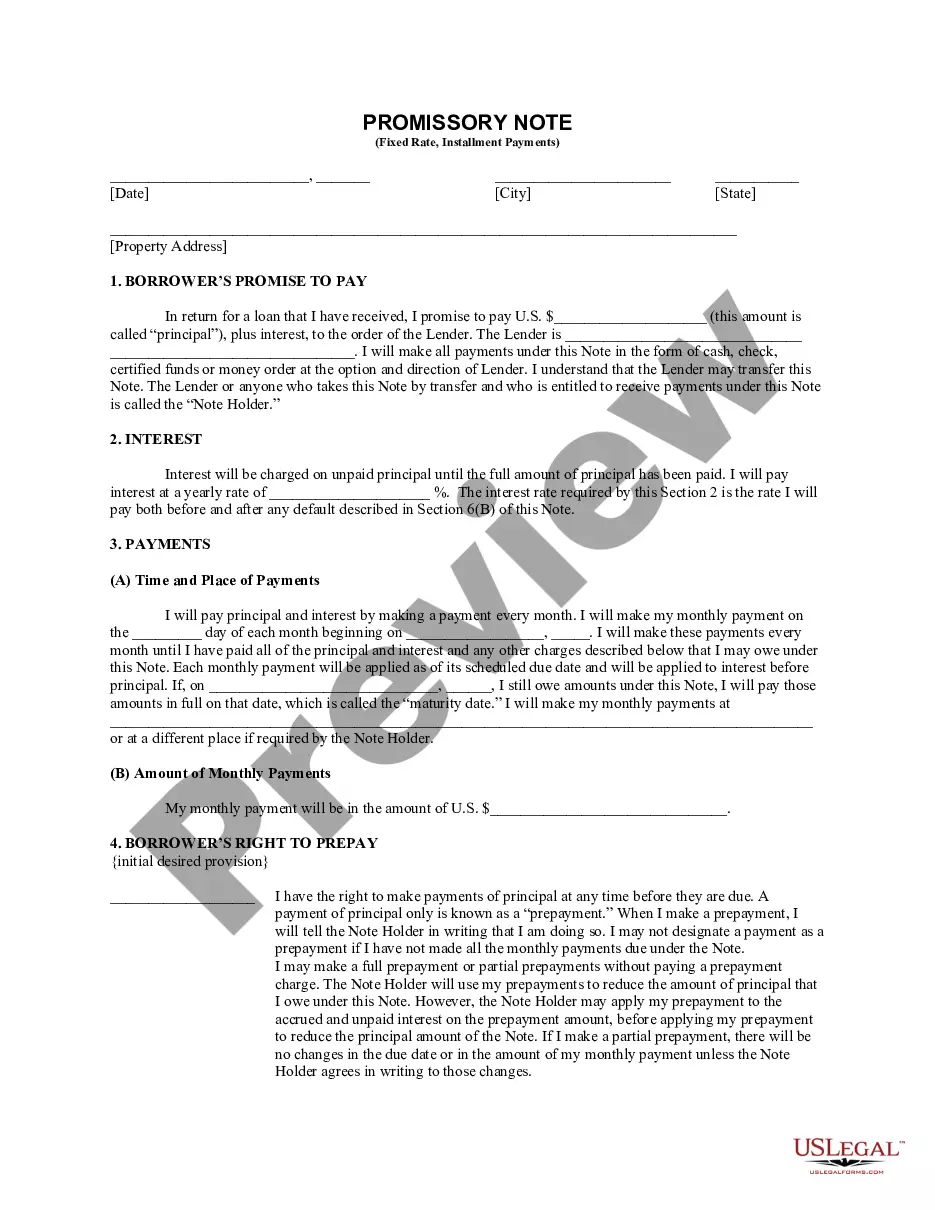

Typically, the borrower or the lender files a deed of trust. The borrower engages the lender to secure financing with the property as collateral, which requires the deed. However, in some cases, a representative, such as a trustee under a Plano Texas Executors Deed of Distribution to a Trust, may file on behalf of the involved parties. With US Legal, you can navigate these responsibilities smoothly, ensuring all procedures are followed correctly.

Filing a deed of trust in Texas requires you to complete the proper forms accurately. You will need to present your completed deed at the county clerk’s office, where the transaction will be officially recorded. It's important to ensure that all parties involved have signed the document where necessary. For ease and reliability, consider using US Legal to assist you with the specifics of the Plano Texas Executors Deed of Distribution to a Trust.

An executor transfers property in Texas by following specific legal procedures. First, the executor must gather all necessary documents, such as the will and the Plano Texas Executors Deed of Distribution to a Trust. This deed allows the executor to legally distribute assets to beneficiaries or a trust. By using a professional service like US Legal Forms, executors can ensure they complete this process correctly, ultimately preventing potential legal issues.

To transfer property to a trust in Texas, you must complete a deed that signifies the transfer of ownership. Typically, you would execute a new deed, such as a quitclaim deed or warranty deed, and make the trust the grantee. Afterward, it's crucial to record this deed in the county clerk's office. This process is often simplified by using a Plano Texas Executors Deed of Distribution to a Trust, ensuring a smooth transition of your property into the trust.

Placing your house in a trust can sometimes complicate your estate planning. One downside is the potential for higher upfront costs, such as legal fees for drafting trust documents. Additionally, if you need to refinance your property, the process can become more complex when a trust is involved. It’s essential to weigh these factors against the benefits of using a Plano Texas Executors Deed of Distribution to a Trust.

While Texas does not impose a strict time limit for settling an estate, the law encourages executors to act in a timely manner. Typically, estates should be settled within one year, but extensions may occur based on specific circumstances. Using the Plano Texas Executors Deed of Distribution to a Trust can help facilitate the process, ensuring quicker resolutions in managing and distributing estate assets.

In Texas, the time allowed for an executor to settle an estate can vary widely; it generally takes six months to a year or more, depending on the size and complexity of the estate. Factors such as debt settlements, tax considerations, and locating beneficiaries can extend this period. The Plano Texas Executors Deed of Distribution to a Trust can help streamline this process, minimizing delays and disputes.

An executor can sell property held in a trust if the trust document permits it and the sale aligns with the estate's best interests. The executor should follow any stipulated guidelines in the trust and consult with legal advice if needed. Utilizing the Plano Texas Executors Deed of Distribution to a Trust can ensure that these transactions are carried out smoothly and in compliance with Texas laws.

Yes, you can sue the executor of an estate in Texas if you believe they have acted improperly or failed to fulfill their duties. It's crucial to have substantial evidence to support your claims. You may find that the Plano Texas Executors Deed of Distribution to a Trust can be beneficial in addressing disputes related to asset distribution, offering transparency and clarity.

To transfer a deed to a trust in Texas, you must first create the trust and prepare a new deed that names the trust as the grantee. Then, execute the deed, ensuring it is signed and notarized appropriately. Finally, file the deed with the county clerk's office where the property is located, enabling the Plano Texas Executors Deed of Distribution to a Trust to effectively manage the property within the trust.