Home Affordable Modification Program Hardship Affidavit

Understanding this form

The Home Affordable Modification Program Hardship Affidavit is a crucial document that helps homeowners apply for a loan modification under the Home Affordable Modification Program (HAMP). This form specifically addresses the financial hardships that may prevent mortgage payments from being made. Unlike general loan applications or refinancing documents, this affidavit focuses on the unique circumstances affecting borrowersâ ability to meet their mortgage obligations.

Main sections of this form

- Borrower and co-borrower identification including names and dates of birth.

- Property address where the mortgage is secured.

- Servicer details and loan number for identification.

- Hardship declaration checkboxes to specify the reasons for the applicant's financial difficulties.

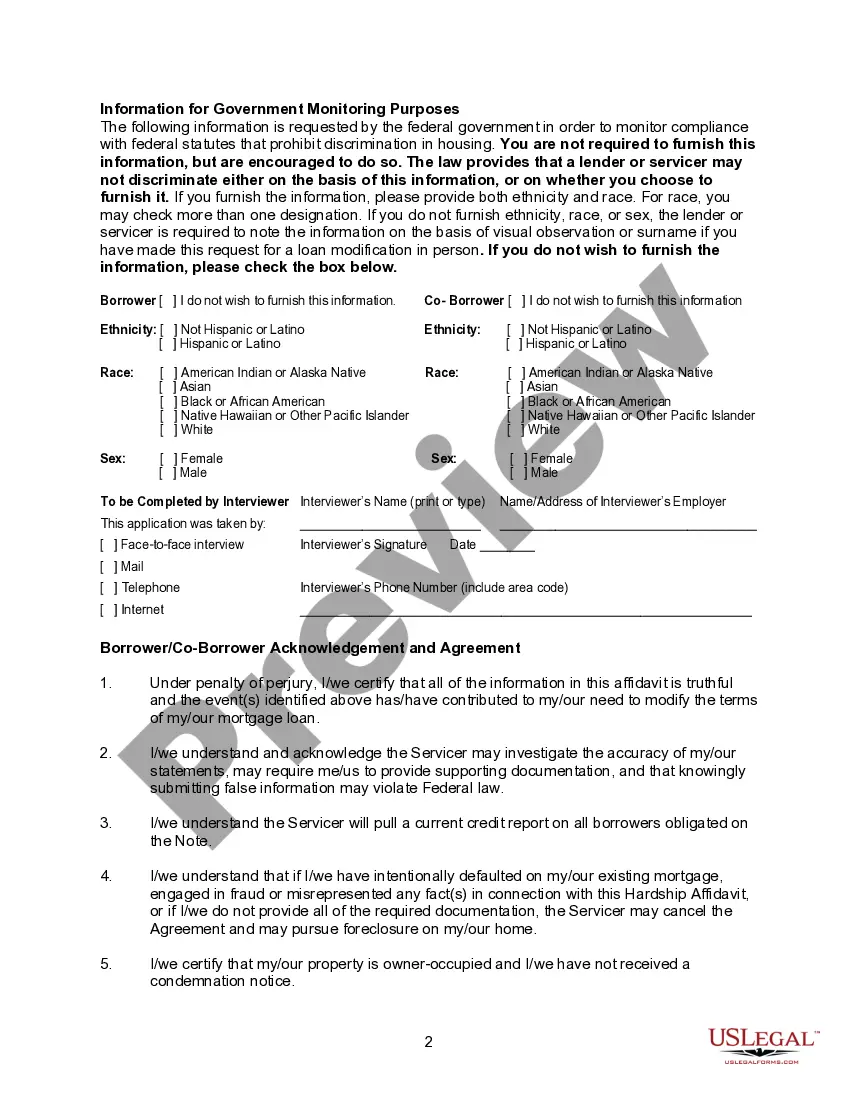

- Government monitoring information to ensure compliance.

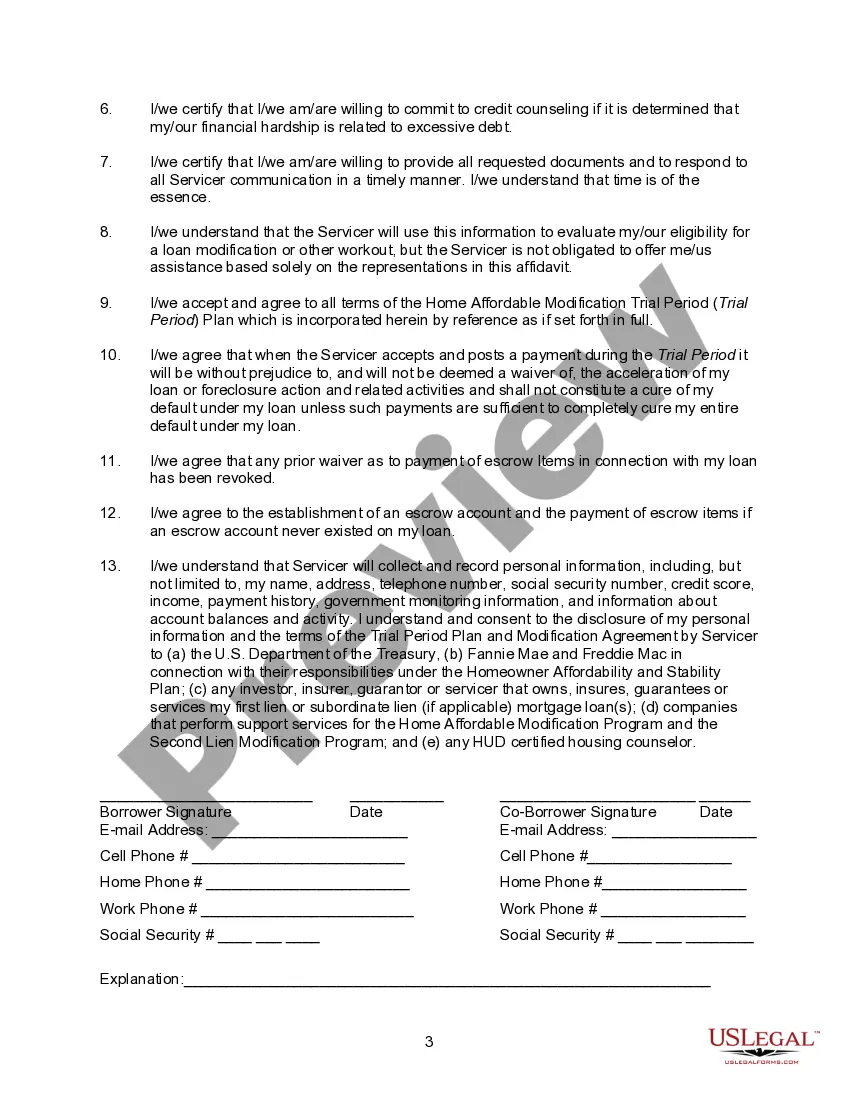

- A section for borrower acknowledgement and agreement to the affidavit's statements.

Situations where this form applies

This form should be used when a borrower is having difficulty making mortgage payments and wants to apply for a modification under HAMP. Situations that may necessitate its use include significant loss of income, unexpected medical expenses, or other financial hardships that may lead to imminent default or foreclosure.

Who can use this document

- Homeowners who have a first-lien mortgage owned or guaranteed by Freddie Mac or other eligible agencies.

- Borrowers who are 31 days or more delinquent on their mortgage payments.

- Those experiencing imminent financial hardship, even if current on payments.

- Individuals facing foreclosure or who are in pending litigation involving their mortgage.

- Borrowers currently working under another recovery plan seeking additional assistance.

How to prepare this document

- Identify the borrower and co-borrower by providing their names and dates of birth.

- Fill in the property street address along with the city, state, and zip code.

- Enter the servicer's information and the loan number associated with the mortgage.

- Select the applicable checkboxes to specify the financial hardships being faced.

- Complete the government monitoring section by providing optional ethnicity and race information.

- Sign and date the acknowledgement and agreement section, ensuring all provided information is accurate.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to accurately complete all sections, which may result in delays.

- Not providing sufficient detail in the hardship explanation section.

- Leaving out important signatures or dates, which may invalidate the affidavit.

- Not checking eligibility requirements before submission.

Why use this form online

- Immediate access to the form without needing to visit an office or print documents.

- Editable fields allow for accurate and complete information entry.

- Secure storage of sensitive personal information through a reliable platform.

- Quick submission options, speeding up the application process for loan modification.

Looking for another form?

Form popularity

FAQ

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.

Make the letter concise. Do not write pages explaining your hardship. State your response to the hardship. You need to describe the steps you have taken in response to the difficulty. Clearly state what you want. You can include enclosures. The conclusion.

A hardship affidavit can help distressed homeowners keep their homes or otherwise avoid a looming foreclosure.Hardship affidavits, sometimes known as hardship letters, should be completed with precision, as lenders may request supporting documents to verify your hardship.

Proof of income (pay stubs, offer letter, etc.) proof of other income (e.g., alimony, child support, disability benefits) an expense sheet laying out all your expenses. tax returns (two years worth of returns) profit and loss statement. current bank statements.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

Suspend past due amounts. Bring your account current. Adjust your interest rate. Lower your minimum payments. Modify your loan. Agree to a short sale of a home. Consider a settlement option.

The most common examples of hardship include: Illness or injury. Change of employment status. Loss of income.

Financial hardship typically refers to a situation in which a person cannot keep up with debt payments and bills or if the amount you need to pay each month is more than the amount you earn, due to a circumstance beyond your control.

Name, address, phone number, date, loan number. Short introduction asking for permission to sell your home in a short sale. Hardship details and neighborhood comparables. Assertion that the only other alternative is foreclosure.