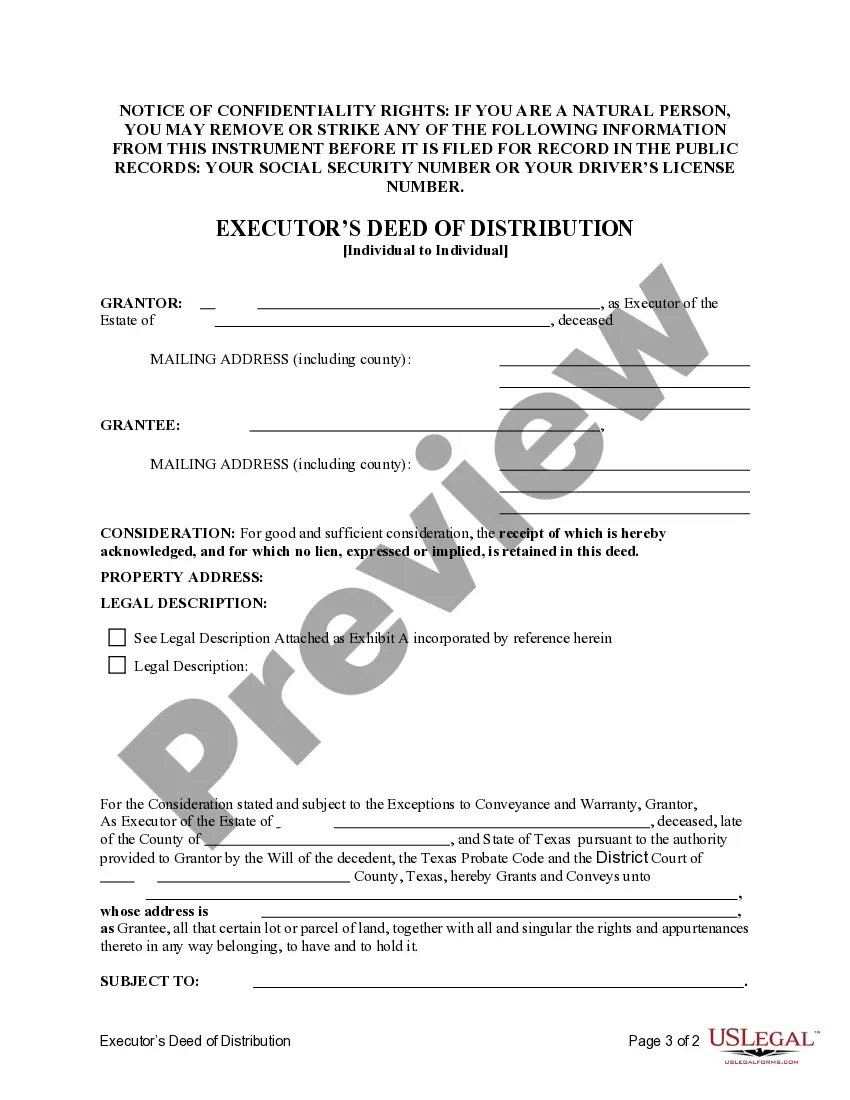

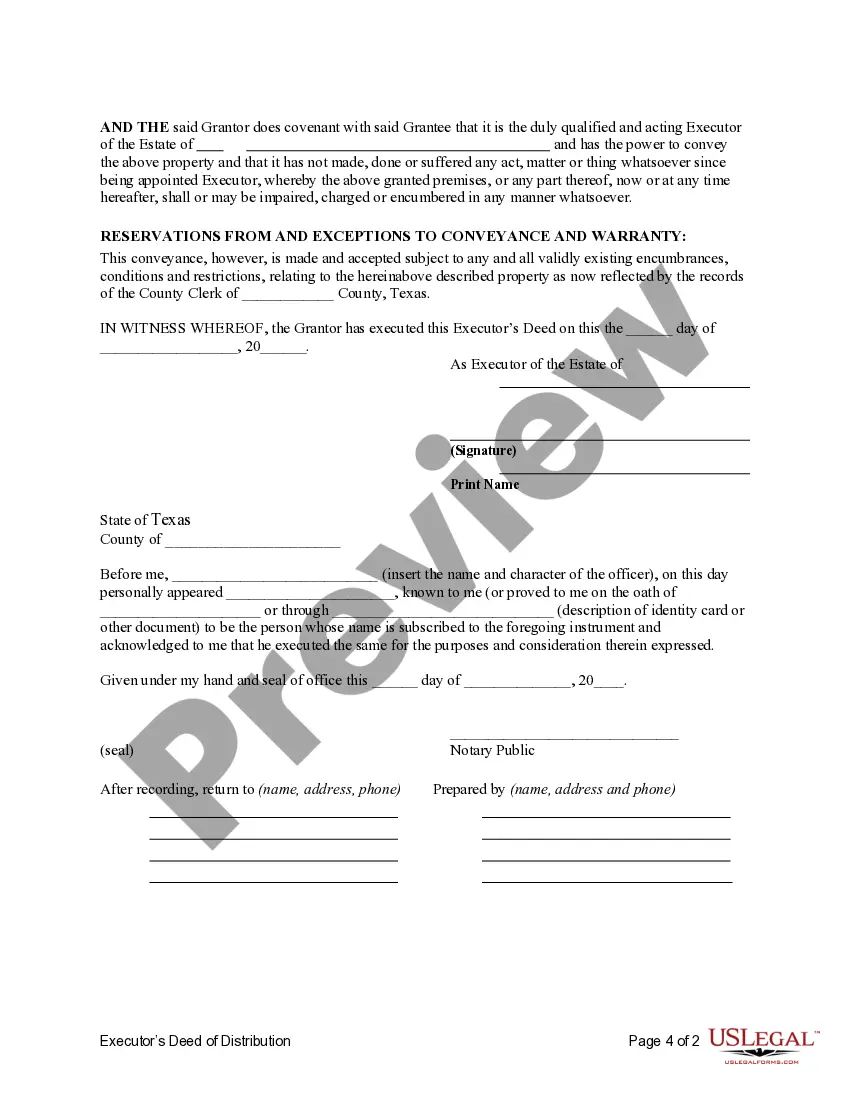

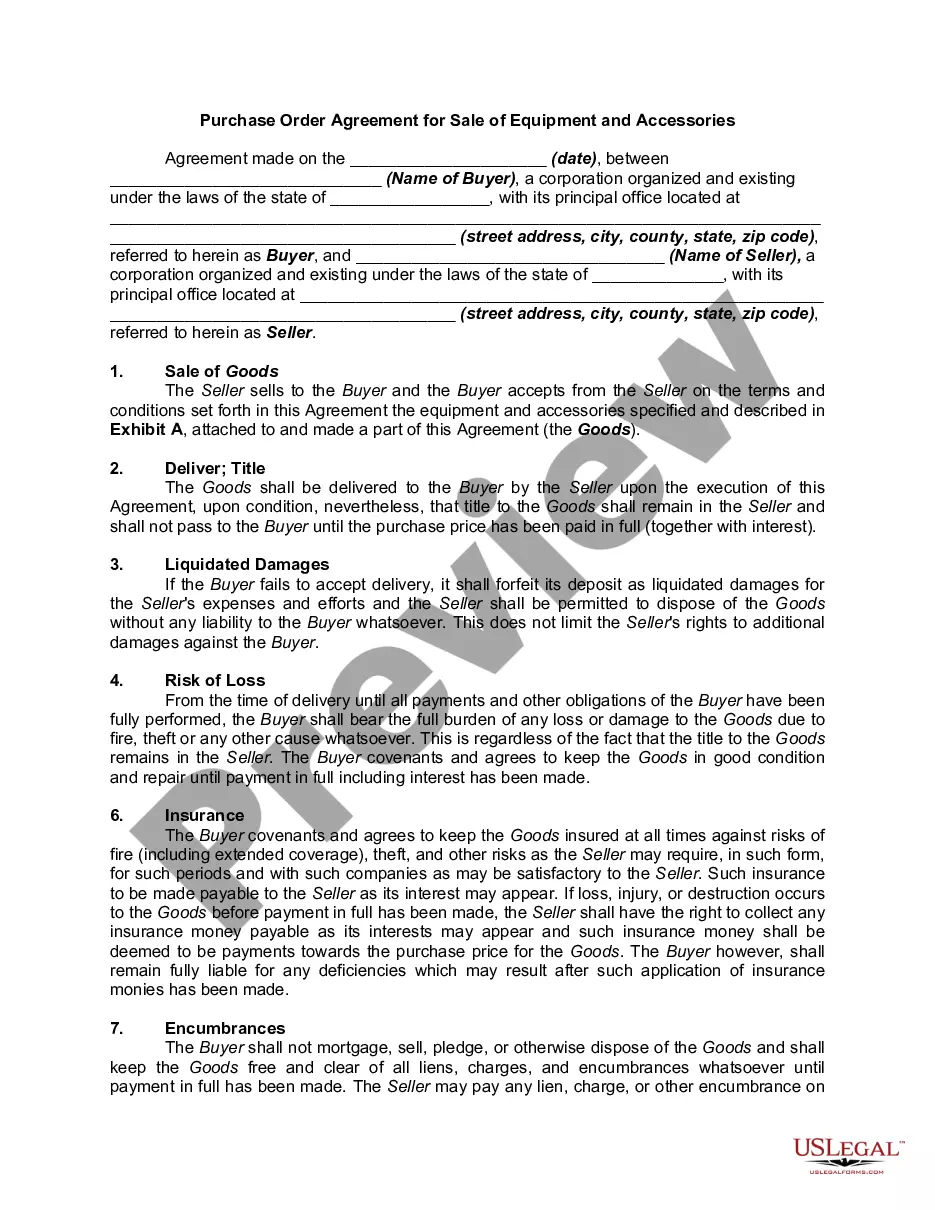

This form is an Executor's Deed of Distribution where the Grantor is the executor of an estate and the Grantee is the beneficiary entitled to the property according to the Will. Grantor conveys the described property to the Grantees. The grantor warrants the title only as to events and acts while the property is held by the Executor. This deed complies with all state statutory laws.

Carrollton Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary

Description

How to fill out Texas Executor's Deed Of Distribution - Individual Executor To Individual Beneficiary?

Regardless of social or occupational rank, completing legal paperwork is an unfortunate requirement in today’s workplace.

Quite frequently, it’s nearly impossible for someone lacking legal expertise to generate this type of documentation from scratch, primarily due to the complex language and legal subtleties involved.

This is where US Legal Forms steps in to help.

Ensure that the form you’ve selected is appropriate for your location as the laws of one state or county may not apply to another.

Review the form and read through any brief descriptions (if provided) about the cases for which the document can be utilized.

- Our platform provides an extensive collection of over 85,000 ready-to-use documents specific to each state that are applicable for nearly every legal situation.

- US Legal Forms also acts as an excellent tool for associates or legal advisors who aim to save time by utilizing our DIY papers.

- No matter if you need the Carrollton Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary or any other form that is recognized in your state or county, with US Legal Forms, everything is readily available.

- Here’s how to quickly obtain the Carrollton Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary using our reliable service.

- If you’re already a member, you can proceed to Log In to your account to download the required document.

- However, if you are a newcomer to our library, please follow these steps before downloading the Carrollton Texas Executor's Deed of Distribution - Individual Executor to Individual Beneficiary.

Form popularity

FAQ

As an executor, you will have a duty to ensure that you are selling the property for the best possible price, for the benefit of the estate. For example, you must not sell the property at an undervalue to yourself, a member of your family, or indeed to one of the beneficiaries in the will.

Yes, an executor can override a beneficiary's wishes as long as they are following the will or, alternative, any court orders. Executors have a fiduciary duty to the estate beneficiaries requiring them to distribute estate assets as stated in the will.

Beneficiaries are entitled to a copy of the will. If the executor fails to provide a copy, beneficiaries can obtain a copy from the appropriate probate court, since a decedent's will must be lodged with the court by the executor.

There is no obligation on an Executor to give a copy of the Will to anyone before it is admitted to Probate, or to inform a beneficiary of his interest. If required, an Executor must give any information to a beneficiary in relation to his interest in the Estate, and in the normal course he will do so in any event.

Can Beneficiaries Demand to See Deceased Bank Statements? No, generally, beneficiaries cannot demand to see the decedent's bank statements unless they are also a personal representative of the estate. However, it is within the executor's discretion to share bank statements with beneficiaries upon request.

Once the assets of the estate have been distributed, the personal representative must issue a final accounting with the court, which must also be sent to each beneficiary.

Technically speaking, there aren't any legal beneficiary rights, as such. What they do have is the ability to force the executor to perform their duties, and with that comes the understanding that beneficiaries can't act on behalf of the executor. They don't have the same authority.

The executor may also be a beneficiary of the Will, though he or she must treat all beneficiaries fairly and in accordance with the provisions of the Will. The duties of an independent executor are those of a trustee. He holds property interests, not his own, for the benefit of others.

The Will will also name beneficiaries who are to receive assets. An executor can override the wishes of these beneficiaries due to their legal duty. However, the beneficiary of a Will is very different than an individual named in a beneficiary designation of an asset held by a financial company.

The executor will notify all creditors about the person's death and validate any claims before paying them to ensure that they are legitimate debts. Other duties include: Filing tax returns for the decedent and the estate and paying any taxes due. Notifying the Social Security Administration regarding benefits payments.