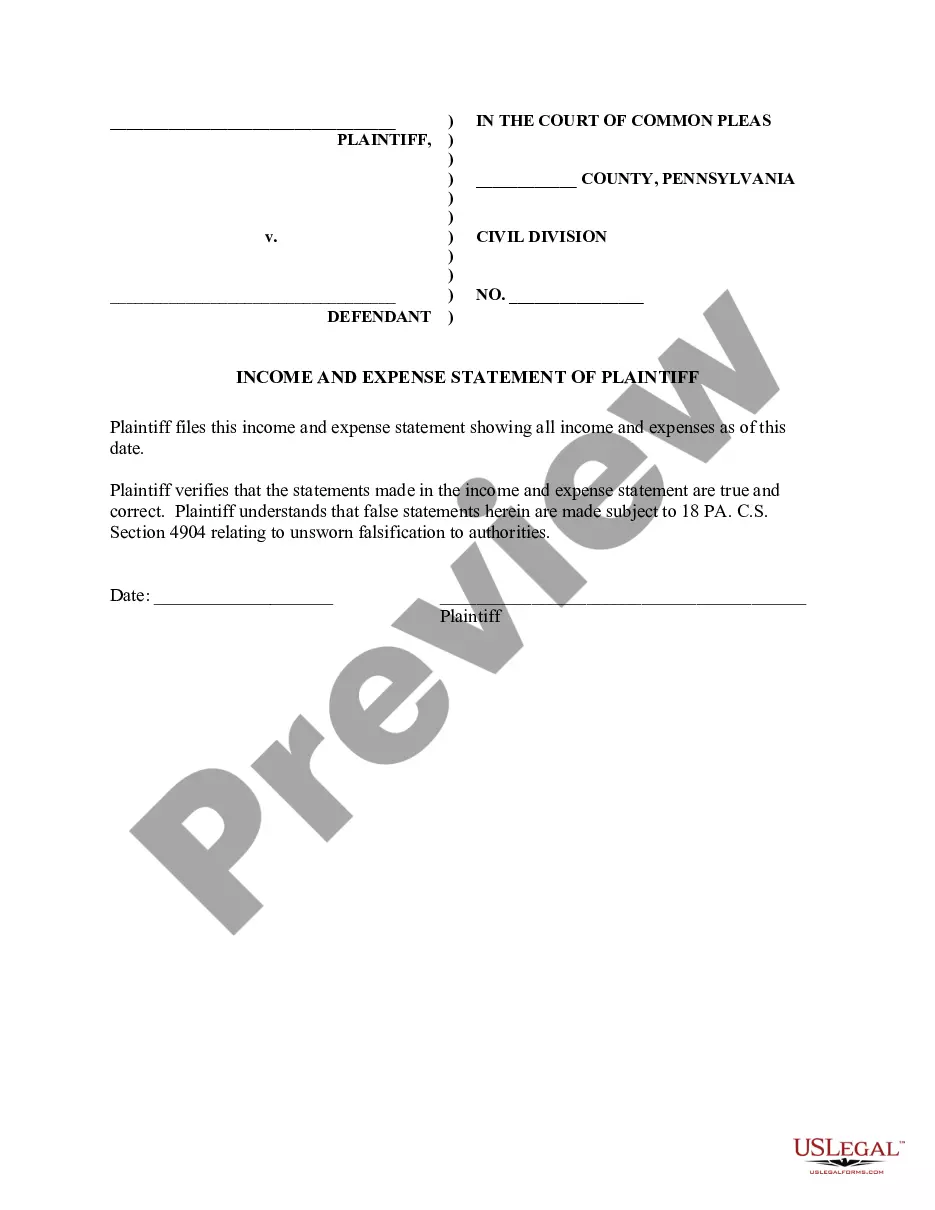

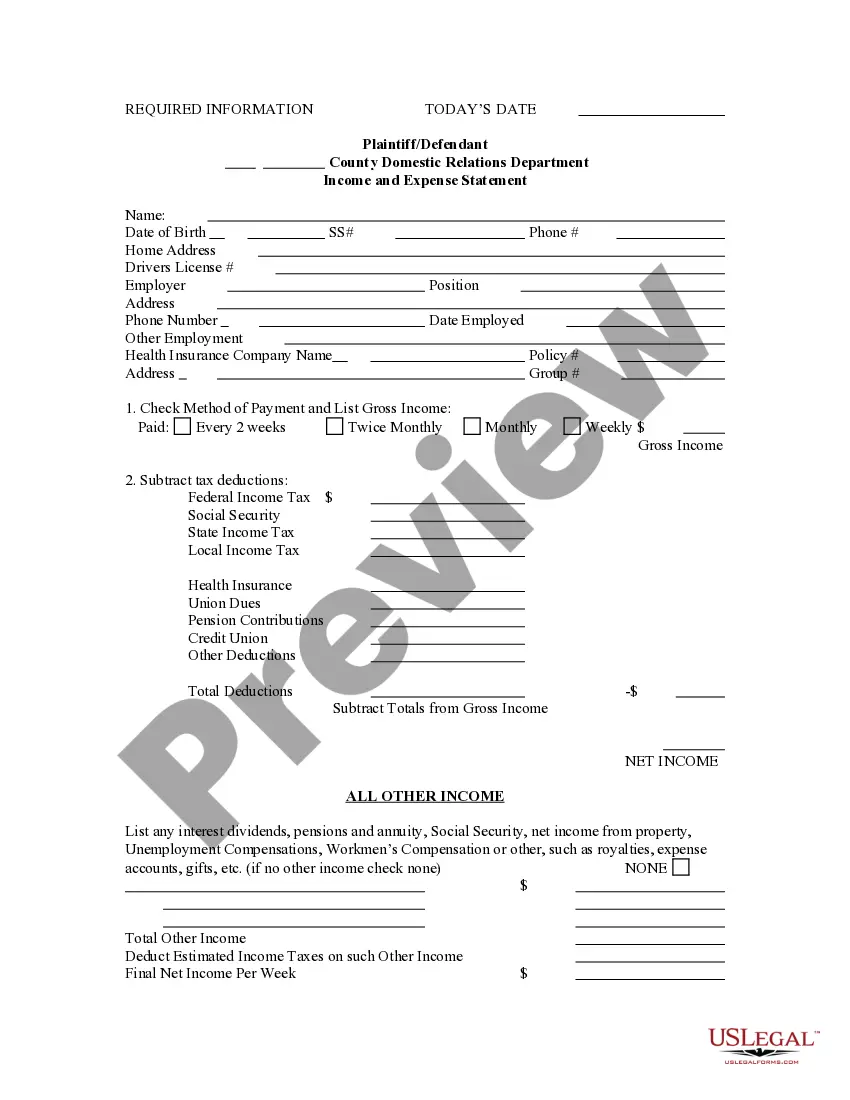

This is an Income and Expense Statement, to be used in causes of action where children are involved. This form provides the Court with basic information regarding employment, health insurance and the income and expenses of the parties.

Pittsburgh Pennsylvania Income and Expense Statement

Description

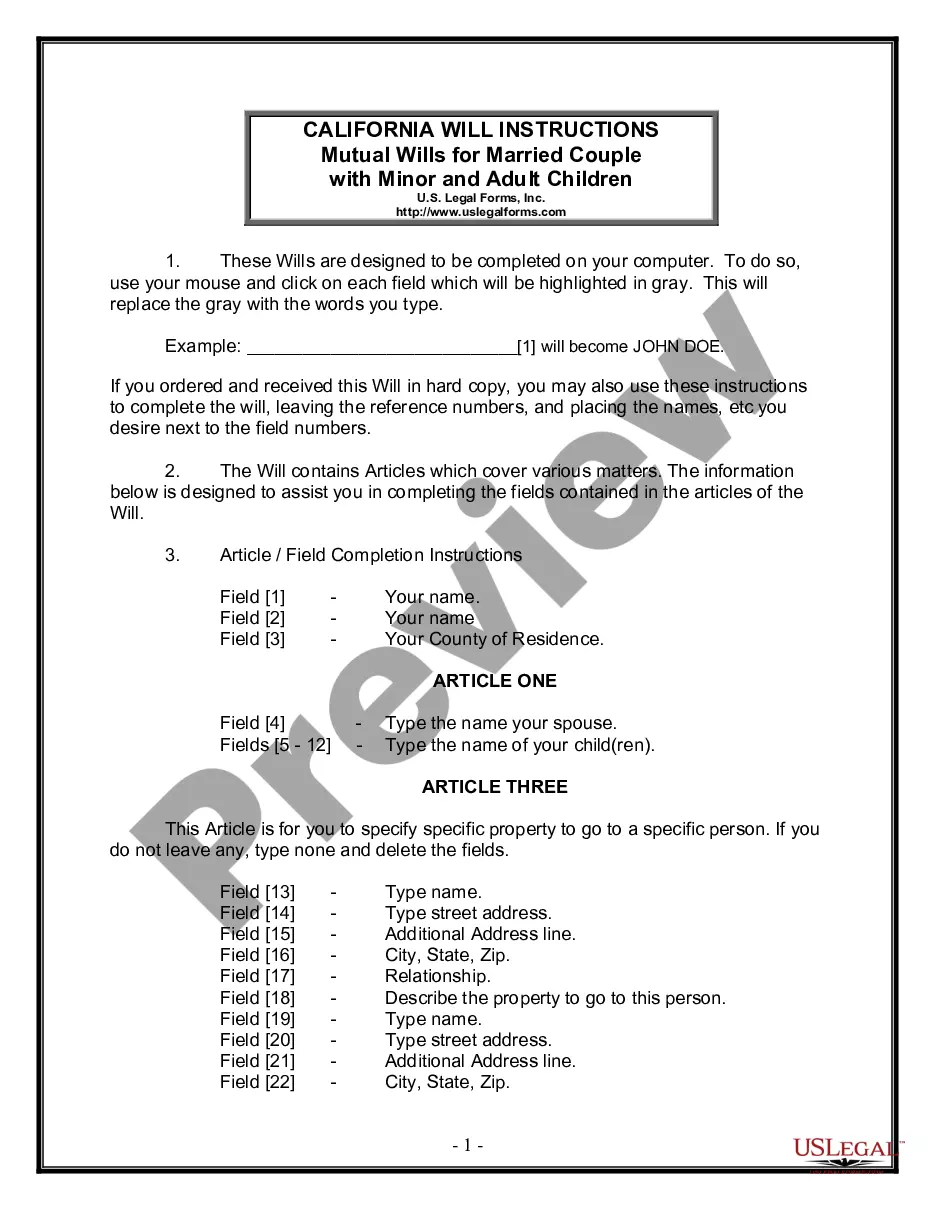

How to fill out Pennsylvania Income And Expense Statement?

If you have previously utilized our service, Log In to your account and retrieve the Pittsburgh Pennsylvania Income and Expense Statement on your device by selecting the Download button. Ensure your subscription is current. If not, renew it per your payment arrangement.

If this is your inaugural time using our service, follow these straightforward steps to obtain your document.

You have continual access to all the documents you have purchased: you can find it in your profile under the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business requirements!

- Make sure you've found the correct document. Review the description and utilize the Preview option, if available, to verify it fulfills your needs. If it doesn't suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the payment.

- Obtain your Pittsburgh Pennsylvania Income and Expense Statement. Select the file format for your document and save it to your device.

- Complete your document. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Yes, Pittsburgh has a city income tax that applies to residents and non-residents working within the city limits. This tax is essential for funding city services. Make sure to complete your tax filings accurately using the Pittsburgh Pennsylvania Income and Expense Statement to ensure compliance with local laws.

Most post offices do not carry tax forms like they used to, but some locations may provide limited access to certain documents. Instead, it's more reliable to check local government offices or download forms online. Be sure to include the Pittsburgh Pennsylvania Income and Expense Statement to cover local taxes on your income.

Physical copies of tax forms can be found at local government offices, including the city tax office, public libraries, and community centers in Pittsburgh. You may also inquire at office supply stores that may carry copies of local tax forms. This can include the Pittsburgh Pennsylvania Income and Expense Statement, which is essential for accurate reporting.

You can obtain Pennsylvania state income tax forms from the Pennsylvania Department of Revenue's website. Many local offices also provide physical copies of these forms. Don’t forget to fill out the Pittsburgh Pennsylvania Income and Expense Statement if you need to declare local income, ensuring you are fully compliant with city regulations.

In Pennsylvania, you can pick up tax forms at various designated distribution points, such as libraries and state government buildings. Many residents also prefer to access these forms online for easy download. Remember to include the Pittsburgh Pennsylvania Income and Expense Statement as part of your filings, especially if you reside or work in the city.

The Pittsburgh expense tax refers to the tax imposed on businesses generating income within the city. This tax is vital for funding essential city services. By filling out the Pittsburgh Pennsylvania Income and Expense Statement, you'll provide necessary details that affect your local tax obligations and compliance.

You can pick up tax forms at various locations in Pittsburgh, including local government offices and community centers. Additionally, you can find downloadable forms online for convenience. Utilizing the Pittsburgh Pennsylvania Income and Expense Statement will help streamline your tax filing process, making it easier for you to complete the necessary paperwork.

Yes, you need to file local taxes in Pittsburgh. Residents must report their income to the city as part of their local tax obligations. This includes completing the Pittsburgh Pennsylvania Income and Expense Statement for accurate reporting. Ensure you stay compliant by understanding your responsibilities as a Pittsburgh resident.

Individuals who reside in Pittsburgh and earn income must file a return. This includes both residents and non-residents who earn income within the city limits. Understanding how to prepare your Pittsburgh Pennsylvania Income and Expense Statement is essential for meeting local tax obligations. To simplify this process, consider using resources available on the uslegalforms platform to assist you in meeting your filing requirements.

Yes, seniors may need to file state income tax if their income exceeds a certain threshold in Pennsylvania. Even if you qualify for certain deductions, understanding your obligation related to the Pittsburgh Pennsylvania Income and Expense Statement is important. If your income falls within specific limits, you might not have to file. Always check the latest regulations to ensure compliance with state requirements.