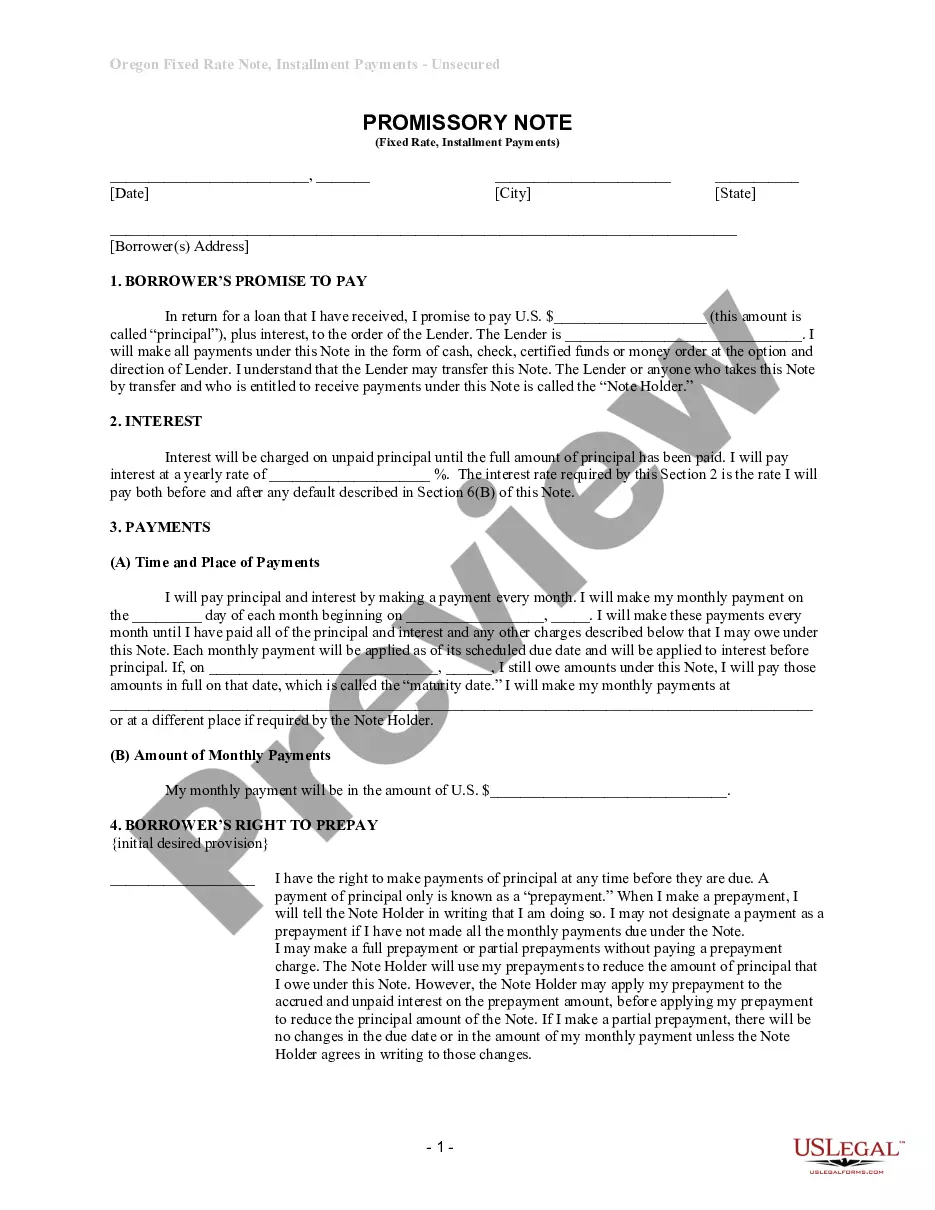

Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Oregon Unsecured Installment Payment Promissory Note For Fixed Rate?

Irrespective of social or occupational standing, filling out legal documents is a regrettable requirement in today’s work environment.

Frequently, it’s nearly impossible for someone lacking legal education to draft these types of documents from scratch, primarily due to the complicated language and legal intricacies they involve.

This is where US Legal Forms proves useful.

Ensure the template you have located is suitable for your jurisdiction, as the laws of one state or county do not apply to another.

Examine the form and review a brief description (if available) of the situations it can be utilized for.

- Our platform features an extensive collection of over 85,000 ready-to-use state-specific forms applicable for almost any legal situation.

- US Legal Forms is also an outstanding tool for associates or legal advisors looking to save time by using our DIY papers.

- Whether you require the Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate or any other document that is acceptable in your state or county, with US Legal Forms, everything is readily available.

- Here’s how to acquire the Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate swiftly by utilizing our dependable platform.

- If you are already a current customer, you can proceed and Log In to your account to obtain the suitable form.

- However, if you are new to our library, make sure to follow these steps prior to downloading the Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate.

Form popularity

FAQ

Obtaining a promissory note is straightforward. You can create one by drafting it yourself, using a template, or consulting a legal resource. For a tailored option, explore uslegalforms, where you can find a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate that meets your specific requirements. This can save time and ensure you're using a legally binding document.

Banks typically do not sell promissory notes directly. Instead, they may offer loans or financing options that involve secured or unsecured notes. If you are looking for a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, consider seeking out private lenders or legal platforms like uslegalforms. These sources often provide customized documents that fit your specific needs.

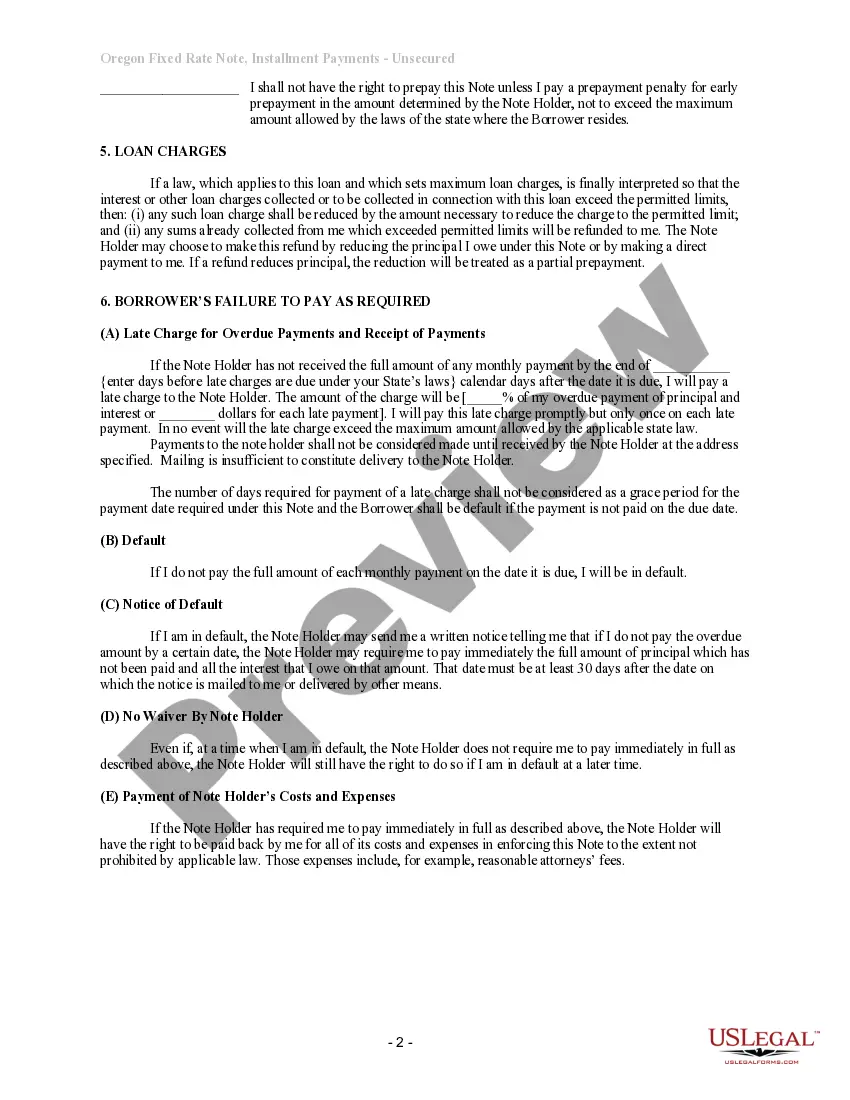

To report a promissory note on your taxes, you should track the interest income you earn from it. The interest from a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate is typically taxable, and you must report it in the year you receive payment. Additionally, if you sell the note, you may need to report capital gains or losses. Always consider seeking advice from a tax professional for clarity.

While you can create a promissory note without a lawyer, consulting one can ensure the document meets legal standards. Drafting a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate with legal guidance can safeguard your interests. Legal experts can clarify specific terms and conditions, making your note enforceable and clear. Using platforms like uslegalforms can also simplify this process.

The interest rate on a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate varies based on factors like market rates and borrower qualifications. Typically, lenders define this rate based on risk assessments and prevailing economic conditions. Understand that both state and federal laws may influence the maximum allowable interest rate. To navigate these complexities effectively, consider utilizing resources from uslegalforms for clear and comprehensive guidance.

A reasonable interest rate for a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate typically falls within the range set by state regulations and market conditions. Generally, lenders consider factors such as the borrower’s creditworthiness and current economic trends when determining rates. It’s important to evaluate these factors to ensure the rate is fair and within legal limits. Consulting with a financial advisor or legal professional can provide more tailored guidance on setting the rate.

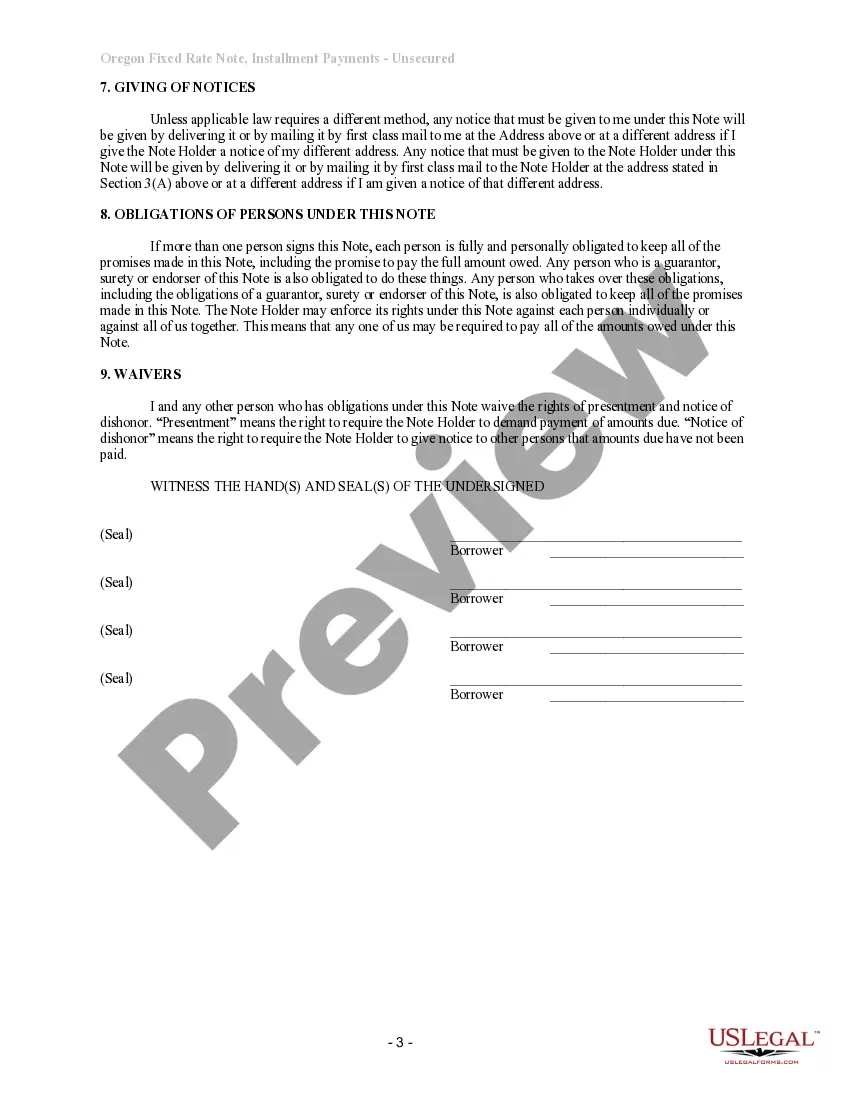

To fill out a promissory note, write down the title at the top, followed by the borrower and lender's names. Indicate the principal amount, interest rate, and specified repayment schedule. Make sure to include any additional terms and have both parties sign the document. For better clarity and format, consider using a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate template.

Filling out a promissory demand note involves specifying the amount due and the conditions under which repayment will be demanded. The document should state that the full balance is payable upon request. It is crucial to include both parties' information and a clear repayment clause. For support, the Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate can serve as a reliable resource.

To write a promissory note for payment, begin by clearly stating that it is a promissory note. Include key details such as the amount owed, the borrower’s promise to repay, and the terms of repayment. It’s beneficial to be precise about dates and interest to avoid misunderstandings. Utilizing a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate can guide you in composing a solid agreement.

To fill out a promissory note sample, you should include essential details such as the names of the borrower and lender, the principal amount, interest rate, and repayment schedule. Clearly state the terms and conditions to ensure that both parties understand their obligations. Using a template specifically designed for a Gresham Oregon Unsecured Installment Payment Promissory Note for Fixed Rate simplifies this process, providing you with a structured format to follow.