Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

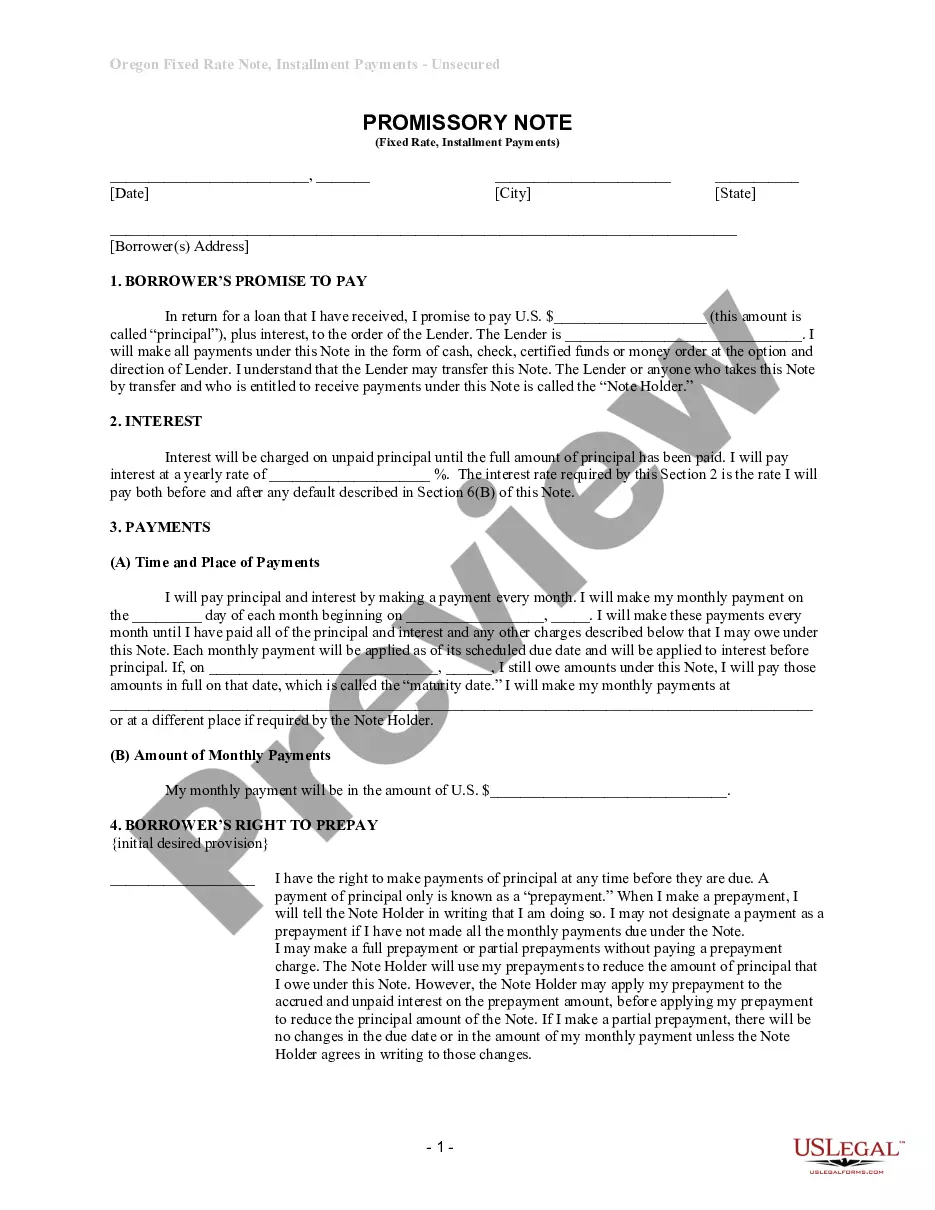

How to fill out Oregon Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you are looking for a pertinent form, it’s hard to find a better venue than the US Legal Forms website – likely the most extensive online collections.

With this repository, you can discover thousands of template examples for business and personal use categorized by types and states, or keywords.

With our top-notch search functionality, obtaining the latest Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the account registration process.

Acquire the form. Choose the format and download it to your device.

- Additionally, the authenticity of each document is validated by a group of experienced lawyers who frequently review the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our system and possess an account, all you need to do to access the Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have located the sample you need. Review its details and utilize the Preview feature (if available) to view its contents. If it doesn’t suit your requirements, use the Search box at the top of the page to find the necessary document.

- Confirm your choice. Click the Buy now button. Then, select your desired pricing plan and provide details to create an account.

Form popularity

FAQ

Yes, a Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is typically secured by collateral, which in this case is commercial real estate. This provides additional security for the lender, as they can reclaim the asset if the borrower does not fulfill their obligations. By using our platform, you can easily draft and manage such agreements, ensuring both parties are protected.

The interest rate on a promissory note can vary based on market conditions and the terms of the agreement. Typically, a Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate may offer a competitive fixed rate, which provides stability for borrowers over the life of the note. It's important to review the terms carefully to understand how the rate is set and any potential impacts on your payments.

To fill out a sample promissory note, follow the suggested format, including names, amounts, and repayment terms. For instance, if it involves a Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, ensure the sample reflects the property's details. Always double-check for clarity and completeness.

Filling out a promissory note requires specific information like the lender's and borrower's details, the amount borrowed, and repayment terms. If it is a Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, make sure to specify the property being used as collateral. Clear and complete information is key to avoiding misunderstandings.

To fill out a promissory demand note, start by clearly stating the borrower's name and the amount owed. Next, include the repayment terms and any relevant details about collateral, such as a Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Make sure to sign and date the document, ensuring both parties have a copy.

A promissory note generally does not appear on your personal credit report unless it goes into default. For a Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, failure to meet payment terms could lead to legal actions impacting your credit. It’s crucial to stay current on payments to maintain a good financial standing. If you have questions about your credit report, explore services that can guide you through understanding your financial obligations.

You typically file a promissory note in your personal records, but you can also file it with the county recorder if it’s secured by property. This is especially important for the Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, as it provides legal backing to claim your interests. Keep a copy in a safe place, as it is essential for future reference. Always confirm local recording requirements to ensure you're filing correctly.

To report a promissory note on your taxes, you should use IRS Form 1040, including the interest income on Schedule B. This applies to the Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Ensure that you keep accurate records of all transactions related to the note to simplify the reporting process. If you are unsure about the details, it may be prudent to seek advice from a tax professional.

Promissory note interest should be reported on Schedule B of your IRS tax return. It’s essential to report any interest accrued from your Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate as part of your taxable income. This ensures transparency and keeps you compliant with tax regulations. Consider using tax preparation software or consulting a tax advisor to assist with this process.

You can record a promissory note at your local county clerk's office. This is a vital step when dealing with Gresham Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Recording it provides public notice of the debt and protects your interests. Always consult with a legal professional to ensure proper compliance with local laws.