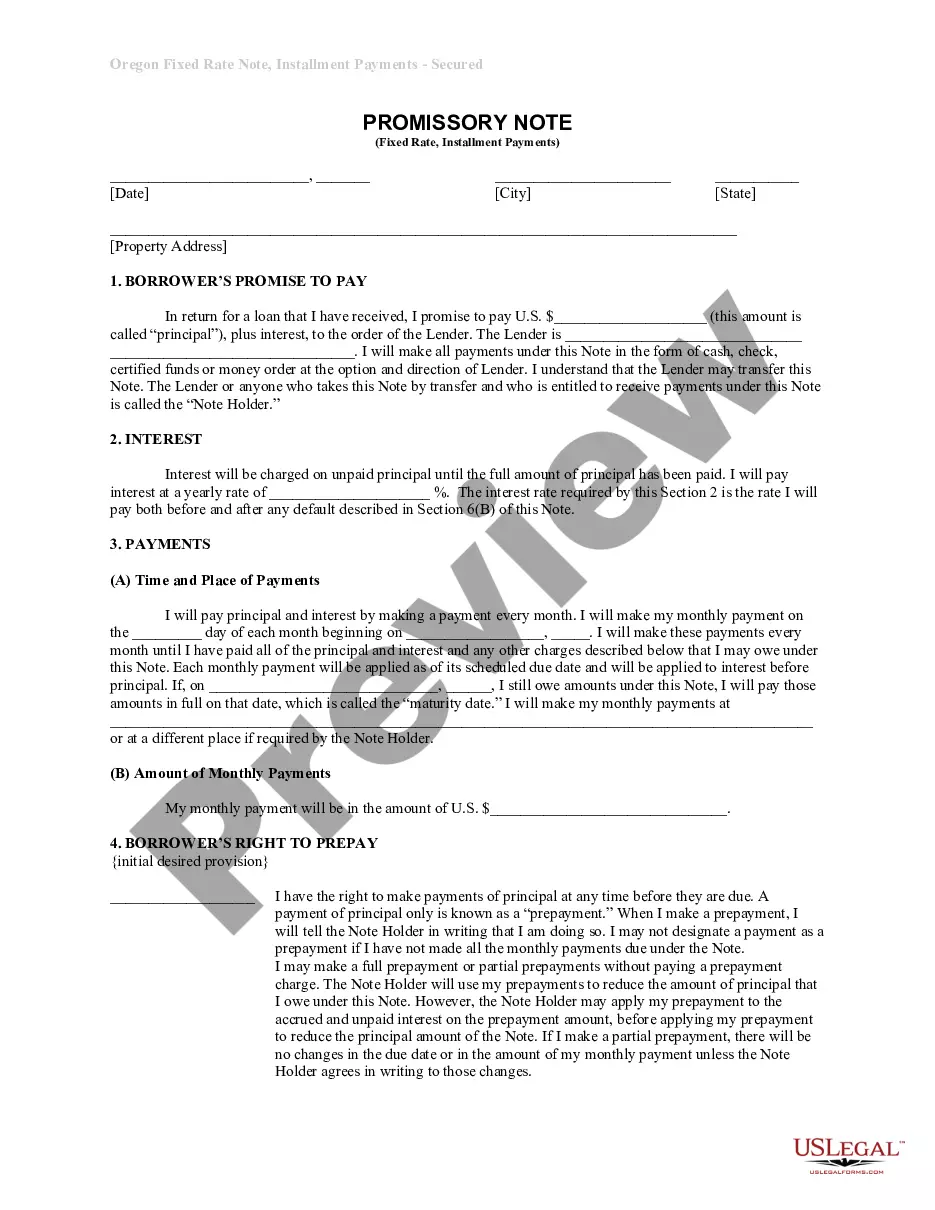

Portland Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Oregon Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We consistently aim to reduce or evade legal complications when navigating intricate law-related or financial issues.

To achieve this, we enlist attorney services that are typically quite expensive.

Nonetheless, not every legal situation is that complicated; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents that cover everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it from within the My documents tab.

- Our platform enables you to take control of your affairs without needing to consult a lawyer.

- We provide access to legal form templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which greatly simplifies the searching process.

- Make use of US Legal Forms whenever you need to easily and securely obtain and download the Portland Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other form.

Form popularity

FAQ

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan. If the payor does not have sufficient assets, the payee is out of luck.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.

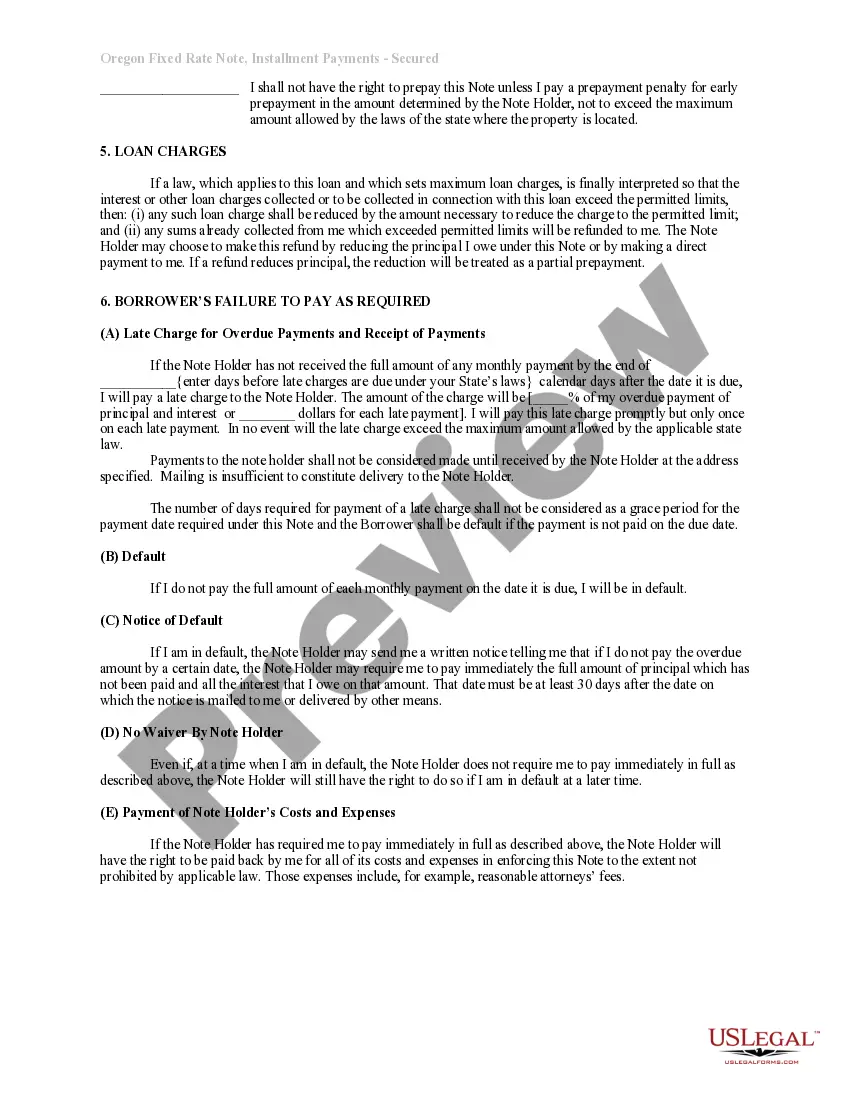

A secured promissory note should carefully outline its repayment, and default terms. For example, it should spell out the steps required for seizing collateral. It should also state if there are any grace periods for late payments, and name who shall pay for costs, and legal fees if there is a default.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

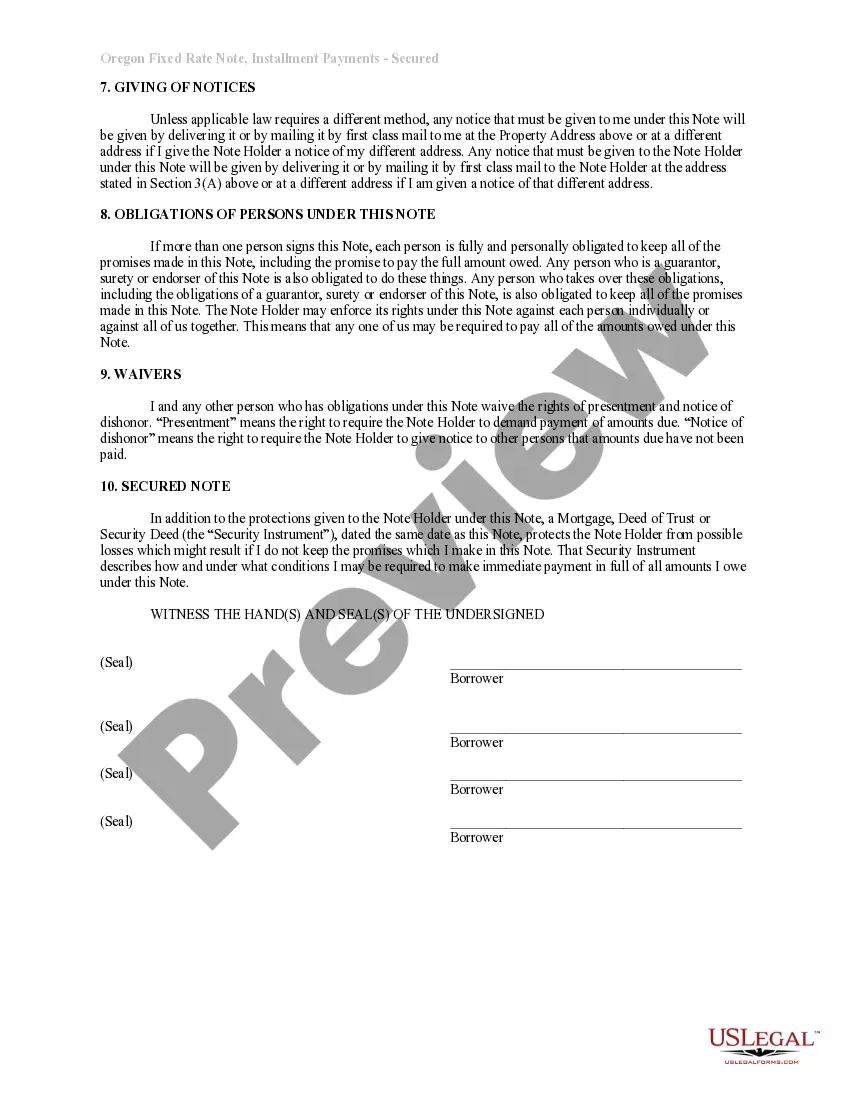

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.