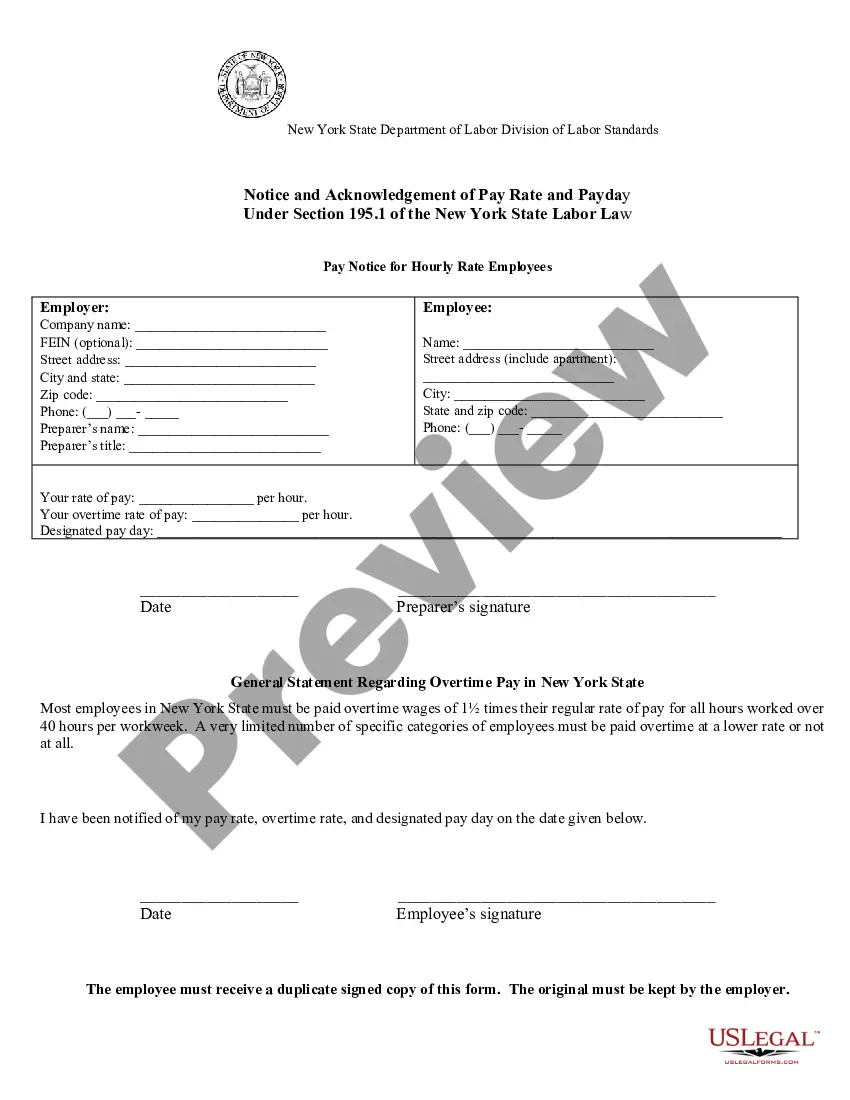

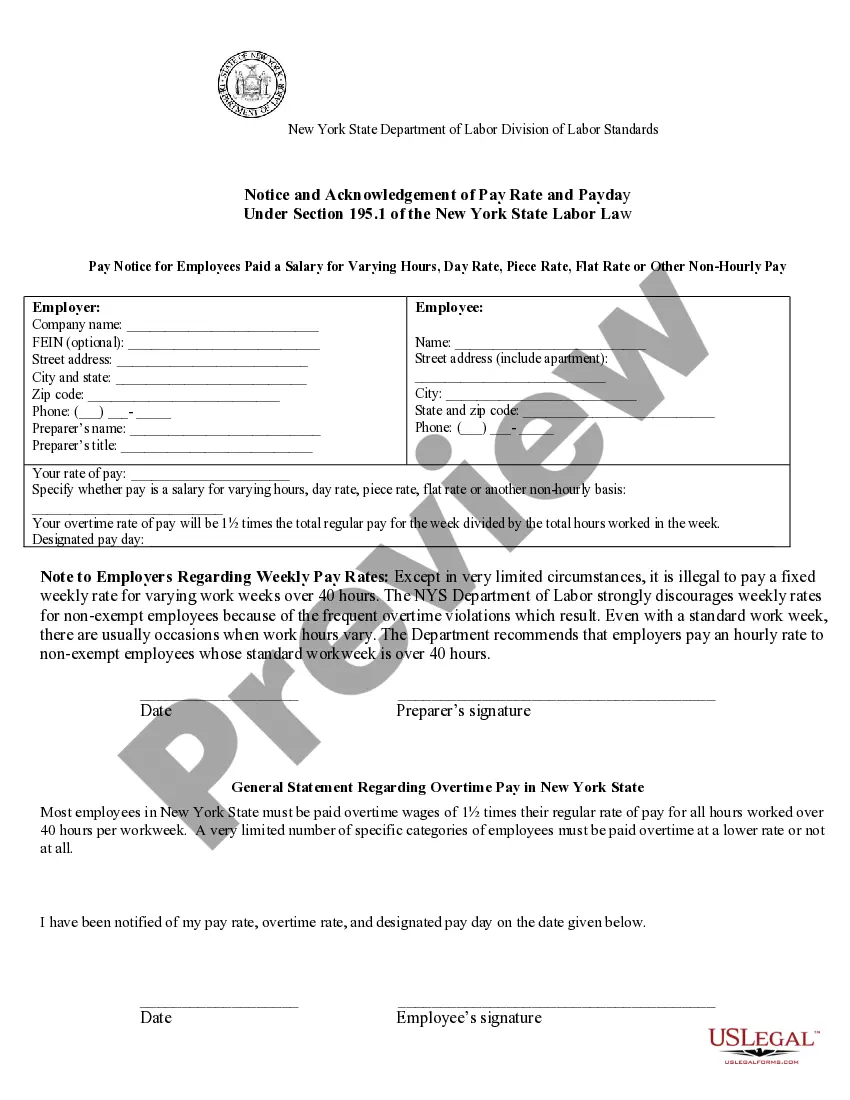

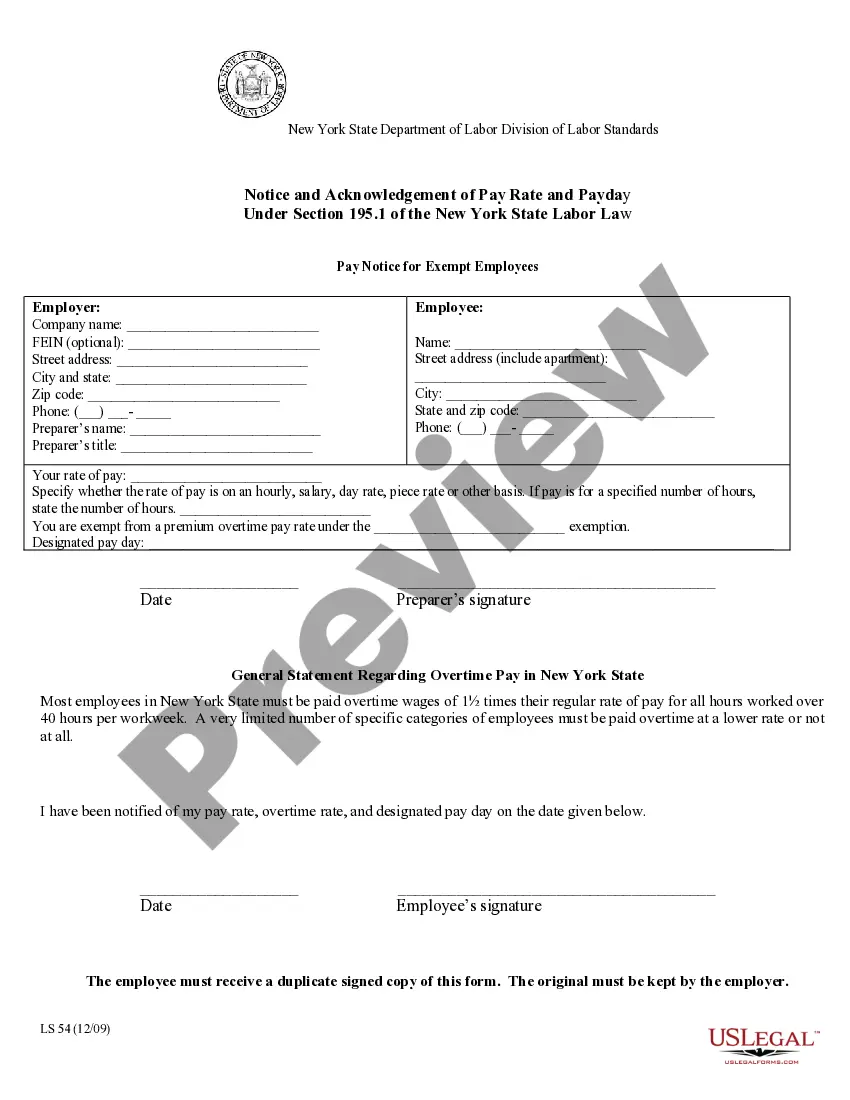

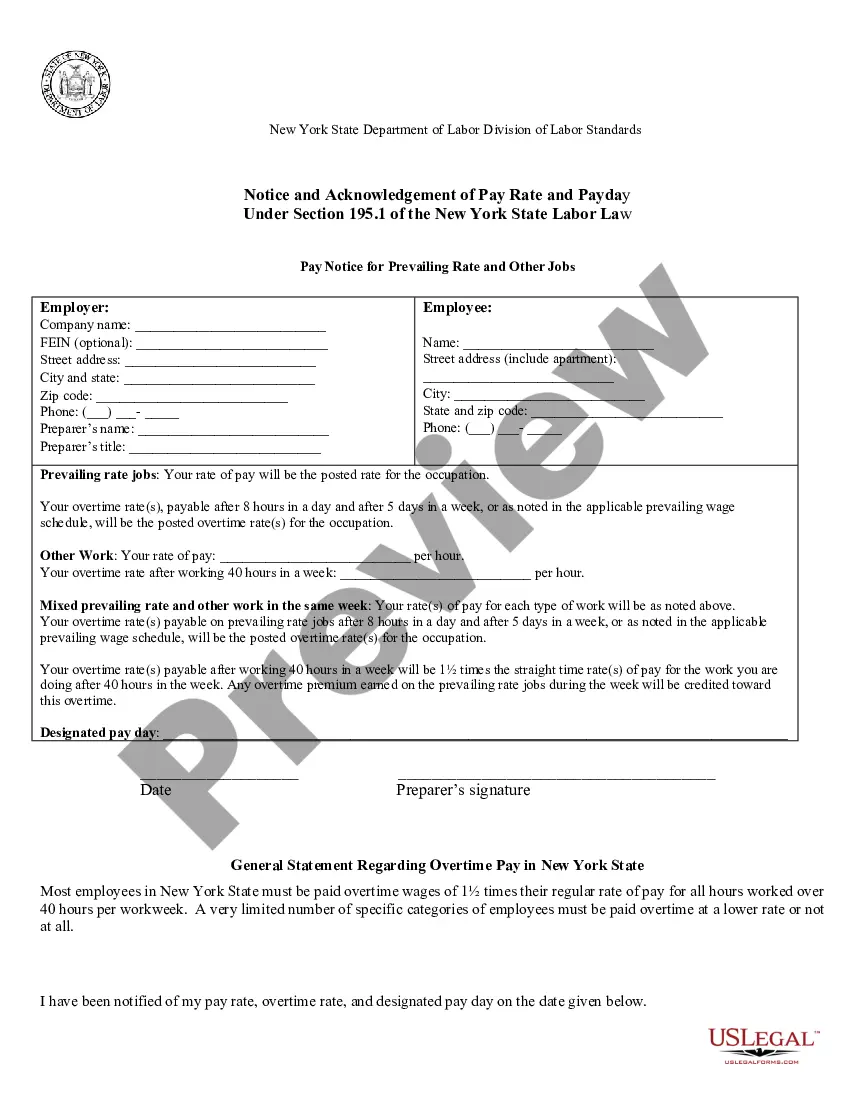

Bronx New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Multiple Hourly Rates- Notice And Acknowledgement Of Pay Rate And Payday?

Irrespective of social or occupational position, finalizing legal documents is a regrettable requirement in today’s society. Frequently, it’s nearly impossible for someone without any legal expertise to compose these types of documents from scratch, primarily because of the intricate terminology and legal subtleties they entail.

This is where US Legal Forms can come to the rescue. Our platform offers an extensive library with over 85,000 ready-to-use state-specific forms that are suitable for nearly any legal scenario. US Legal Forms also serves as an excellent tool for associates or legal advisors wishing to save time by utilizing our DIY templates.

Whether you need the Bronx New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday or any other documentation that will be applicable in your region, with US Legal Forms, everything is readily available. Here’s how to quickly obtain the Bronx New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday using our dependable service.

with your credentials or create one from scratch.

Select the payment method and proceed to download the Bronx New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday after the payment has been processed. You’re all set! Now you can either print the document or complete it online. If you encounter any difficulties accessing your purchased forms, you can easily retrieve them in the My documents section. No matter the case you are trying to resolve, US Legal Forms has you covered. Try it now and see for yourself.

- If you are already a registered user, you can proceed to Log In to your account to access the correct form.

- However, if you are new to our collection, be sure to follow these steps before acquiring the Bronx New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday.

- Make sure the form you found is applicable for your region since the regulations of one state or locality do not apply to another.

- Review the document and check a brief description (if available) of cases for which the form can be utilized.

- If the form you selected does not satisfy your requirements, you can start over and search for the necessary document.

- Click Buy now and choose the subscription plan that works best for you.

Form popularity

FAQ

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

Employers must pay their employees within seven days of their particular pay period, whether it is on a weekly or biweekly basis. While some exceptions exist, most employers cannot engage in untimely wage payments. Unfortunately, many New York employers do not pay their employees on time.

To file a claim, you will need to complete a form to claim unpaid wages, wage supplements, minimum wage/overtime and various non-wage items, if your situation meets the criteria below. Unpaid Wages: Your employer did not pay you for all hours worked (including on-the-job training).

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Timely Payment The hiring party must pay you for all completed work. You must receive payment on or before the date that is in the contract. If the contract does not include a payment date, the hiring party must pay you within 30 days after you complete the work.

An employee has two years to bring legal action against their employer for unpaid minimum wages and unpaid overtime compensation. In total, an employee has a six-year statute of limitations for any legal actions for recovering their wages, benefits, and wage supplements in New York.

If you are required or permitted to report to work, even if you are not assigned actual work, you may be entitled to ?call-in pay.? Usually, restaurant or hotel workers are entitled to three hours' pay at the applicable minimum rate, and employees in other private workplaces are entitled to four hours' pay at the

Under New York's late payment law, employers who fail to pay their manual workers on a weekly basis must repay them all amounts paid later than seven days after the end of the workweek as liquidated damages. In other words, the employee is owed all amounts paid late as liquidated damages.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.