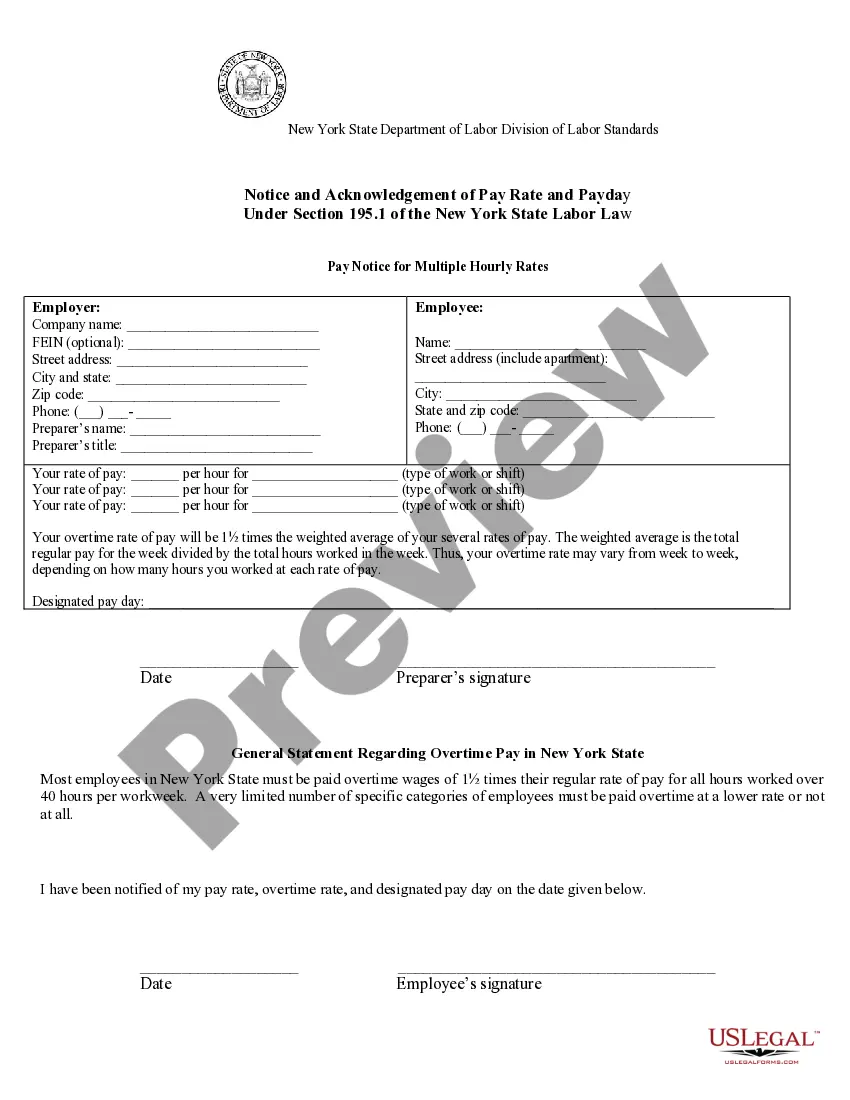

Bronx New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non-Hourly Pay - Notice And Acknowledgement Of Pay Rate And Payday?

We consistently strive to reduce or avert legal repercussions when managing intricate legal or financial matters.

To achieve this, we enlist legal services that are typically quite costly.

However, not all legal challenges are equally complicated. Many can be resolved independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you've lost the form, you can always re-download it from the My documents tab. The process is equally simple if you're not acquainted with the platform! You can set up your account in a matter of minutes.

- Our library empowers you to handle your matters autonomously without relying on legal advisors.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, simplifying the search process significantly.

- Leverage US Legal Forms whenever you need to acquire and download the Bronx New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday or other documents swiftly and securely.

Form popularity

FAQ

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Timely Payment The hiring party must pay you for all completed work. You must receive payment on or before the date that is in the contract. If the contract does not include a payment date, the hiring party must pay you within 30 days after you complete the work.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

Work any number of hours in a day: New York employers are not restricted in the number of hours they require employees to work each day. This means that an employer may legally ask an individual to work shifts of 8, 10, 12 or more hours each day.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies) How the employee is paid: by the hour, shift, day, week, commission, etc.

An overtime-eligible employee (paid a salary) who regularly works more than 40 hours per week, they are still entitled to overtime pay for hours worked over 40 hours. The number of hours included in the employee's regular workweek only affects the rate of overtime pay.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)