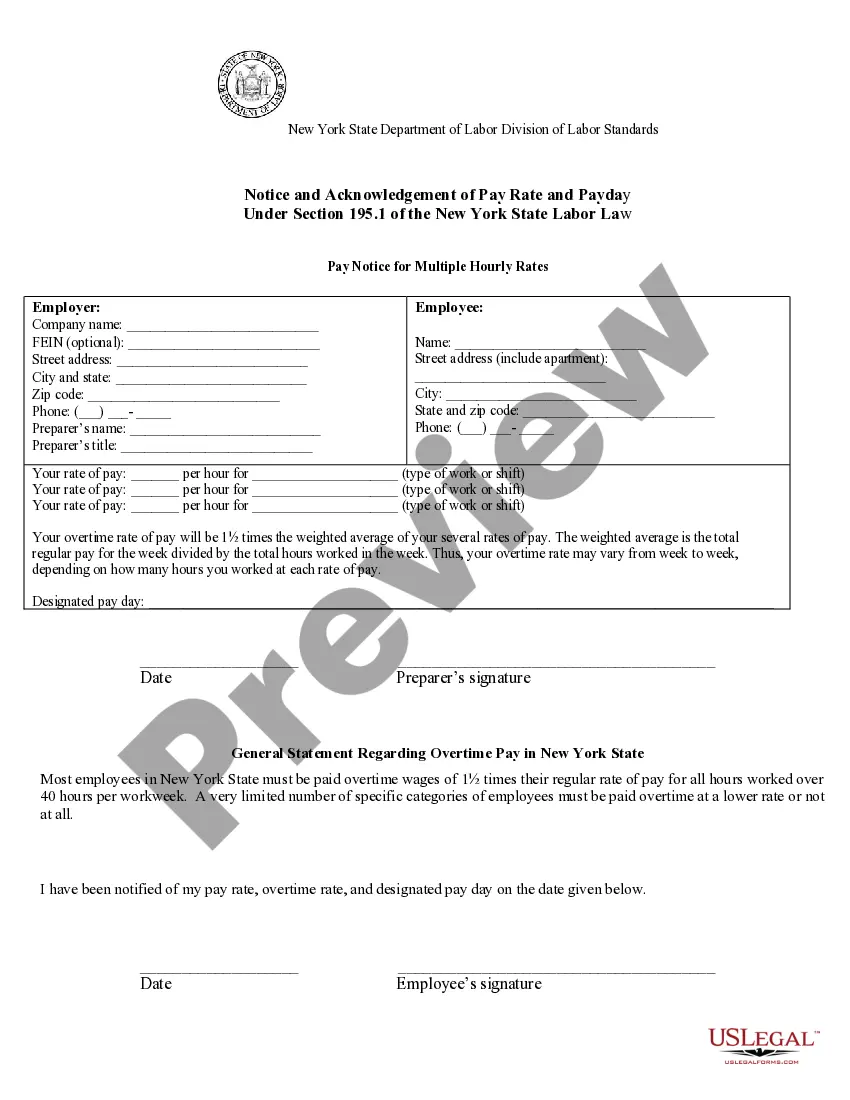

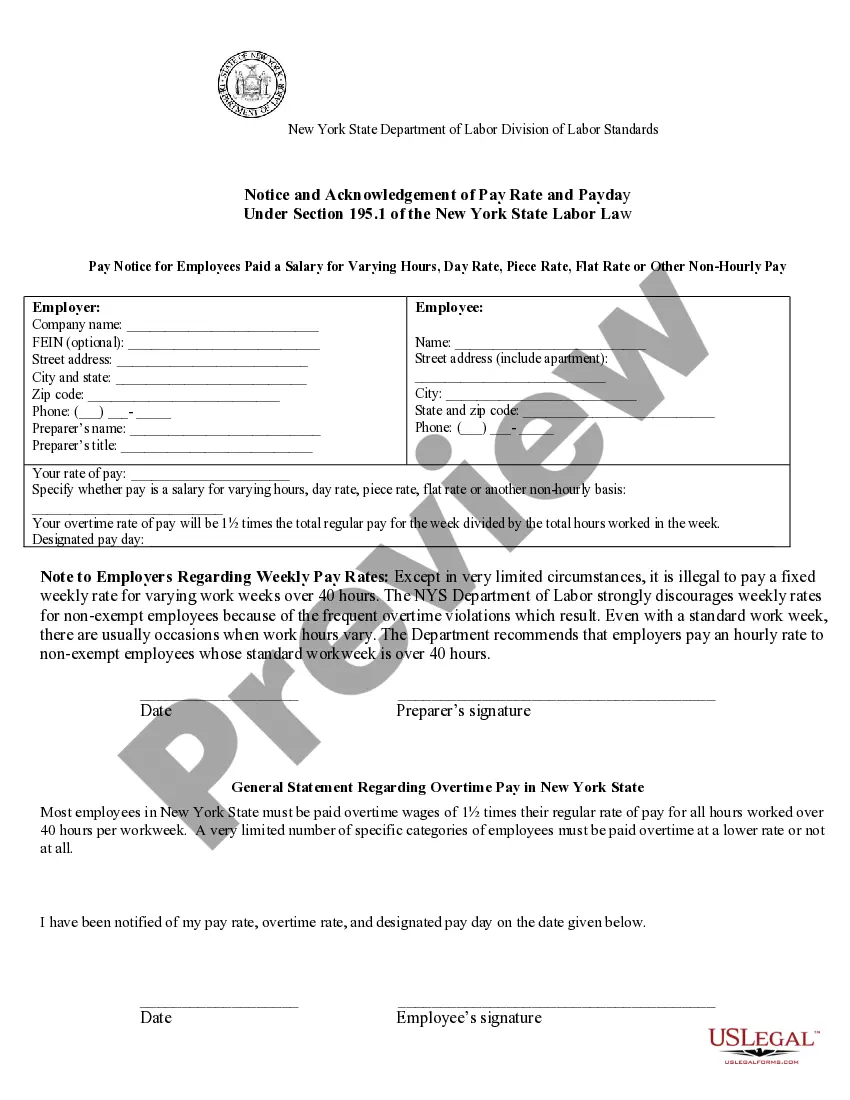

Rochester New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

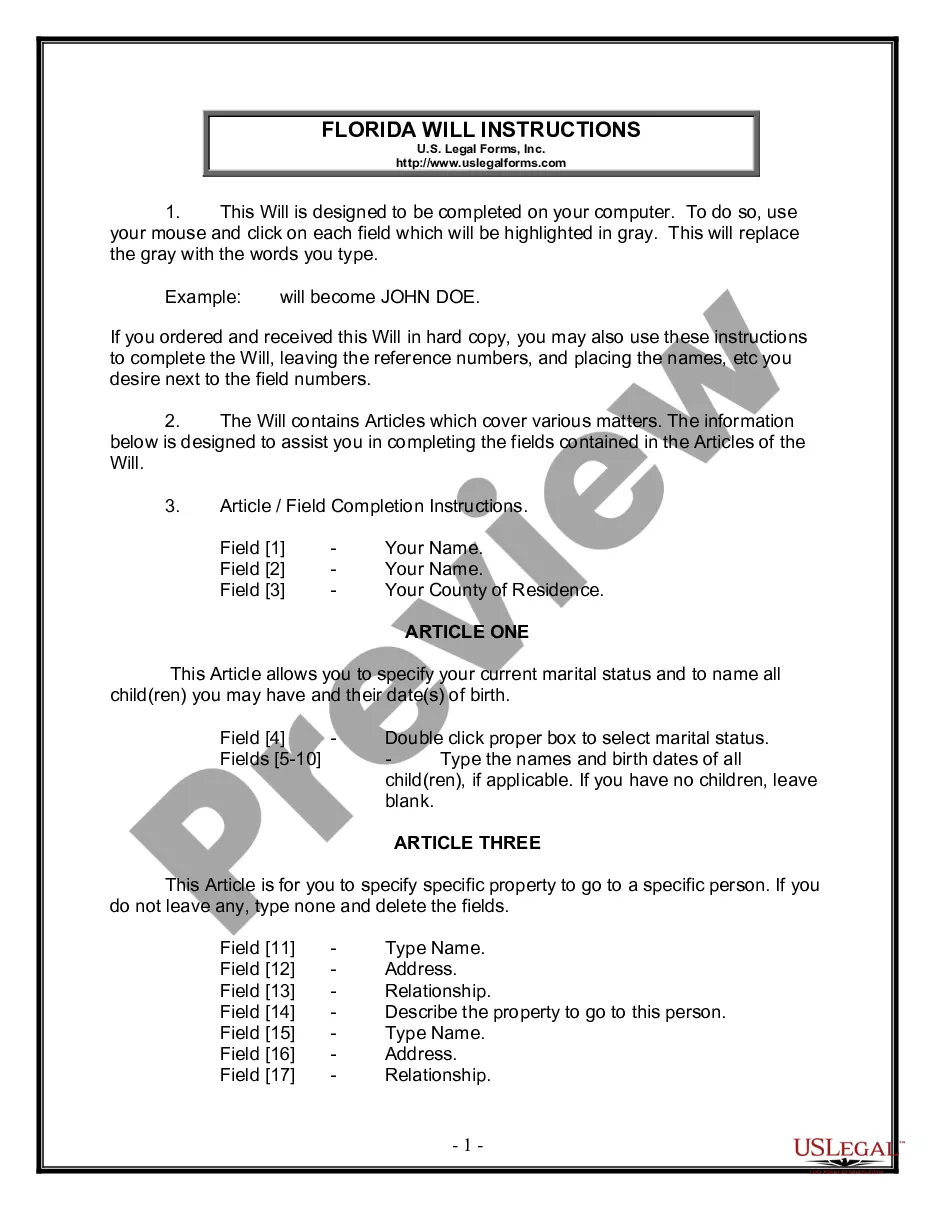

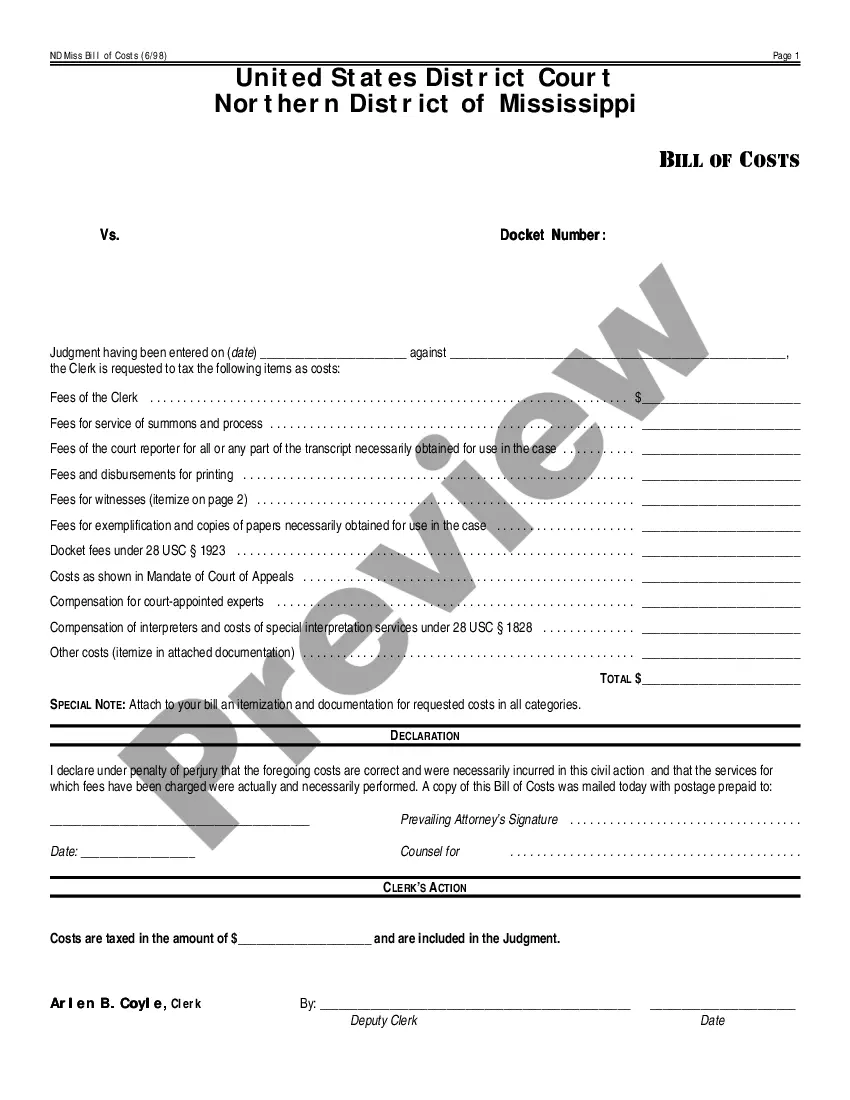

How to fill out New York Pay Notice For Hourly Rate Employees - Notice And Acknowledgement Of Pay Rate And Payday?

Finding authentic templates that align with your local regulations can be difficult, unless you utilize the US Legal Forms database.

This online resource comprises over 85,000 legal documents for various personal and professional requirements, catering to real-life situations.

All the papers are accurately categorized by area of application and jurisdictional domains, making the search for the Rochester New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday as simple as one, two, three.

Organizing paperwork accurately and adhering to legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates at your fingertips!

- Ensure you check the Preview mode and document description.

- Confirm that you have chosen the correct one that fulfills your needs and fully aligns with your local jurisdiction standards.

- If necessary, search for an alternative template.

- Upon noticing any discrepancies, utilize the Search tab above to identify the appropriate one.

- If it fits your criteria, proceed to the following step.

Form popularity

FAQ

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

Wage theft occurs when an employer does not fully pay an employee for the work the employee has performed. Unpaid wages can include not paying minimum wage, failing to pay overtime, or requiring off-the-clock work.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

Salespeople are entitled to all ?earned? commission pay, even after they quit or are terminated from their position. Regardless of which party ends the contract, salespeople must receive earned commission pay, which is legally considered wages under labor law and laws for commission pay.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

If you quit without 72 hours' notice, your employer has 72 hours to pay commissions that can be reasonably calculated. If you quit with 72 hours' notice, your employer must pay your commissions on your last day.

Workers who have collective bargaining agreements or individual employment contracts are shielded from pay cuts while those agreements are in effect. If you work under a contract or collective bargaining agreement, your employer is not allowed to reduce your pay or hours arbitrarily.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

Salespeople are entitled to all ?earned? commission pay, even after they quit or are terminated from their position. Regardless of which party ends the contract, salespeople must receive earned commission pay, which is legally considered wages under labor law and laws for commission pay.